What is a native coin

By definition, a native coin is a digital currency that is an integral part of its blockchain and is inextricably linked to it. It is also called a "native token", "protocol token", "internal token" or "embedded token". For example, in the Bitcoin blockchain, the native coin is BTC, and in the Ethereum network, ETH.

At the same time, smart contract platforms such as Ethereum also allow the issuance and creation of tokens, which are essentially derivatives of the main blockchain.

Native coins can be used in the following ways:

- for forwarding between different addresses;

- to pay for transactions – each blockchain sets the amount of payment in accordance with the prescribed algorithm.

Let's make a brief overview of the blockchains of the most popular native tokens.

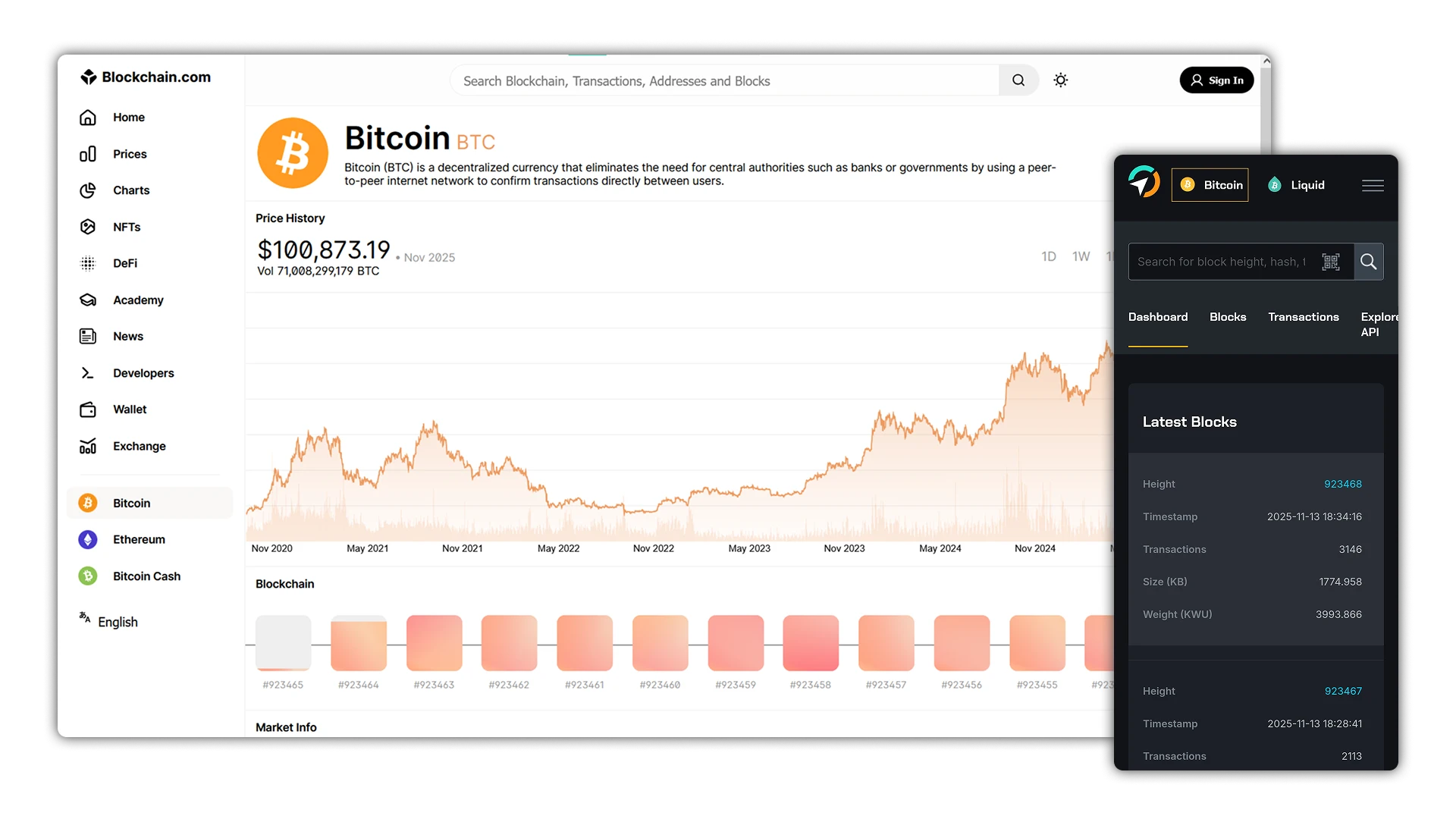

Bitcoin

The native coin of the Bitcoin network is BTC. This is the largest cryptocurrency by capitalization, which is in first place in the Coinmarketcap list.

The most famous and widely used network token is Tether USDT, a stablecoin based on the Omni protocol.

All wallets compatible with BTC are automatically compatible with Tether Omni. To complete a successful transaction, the sender must pay a fee in BTC.

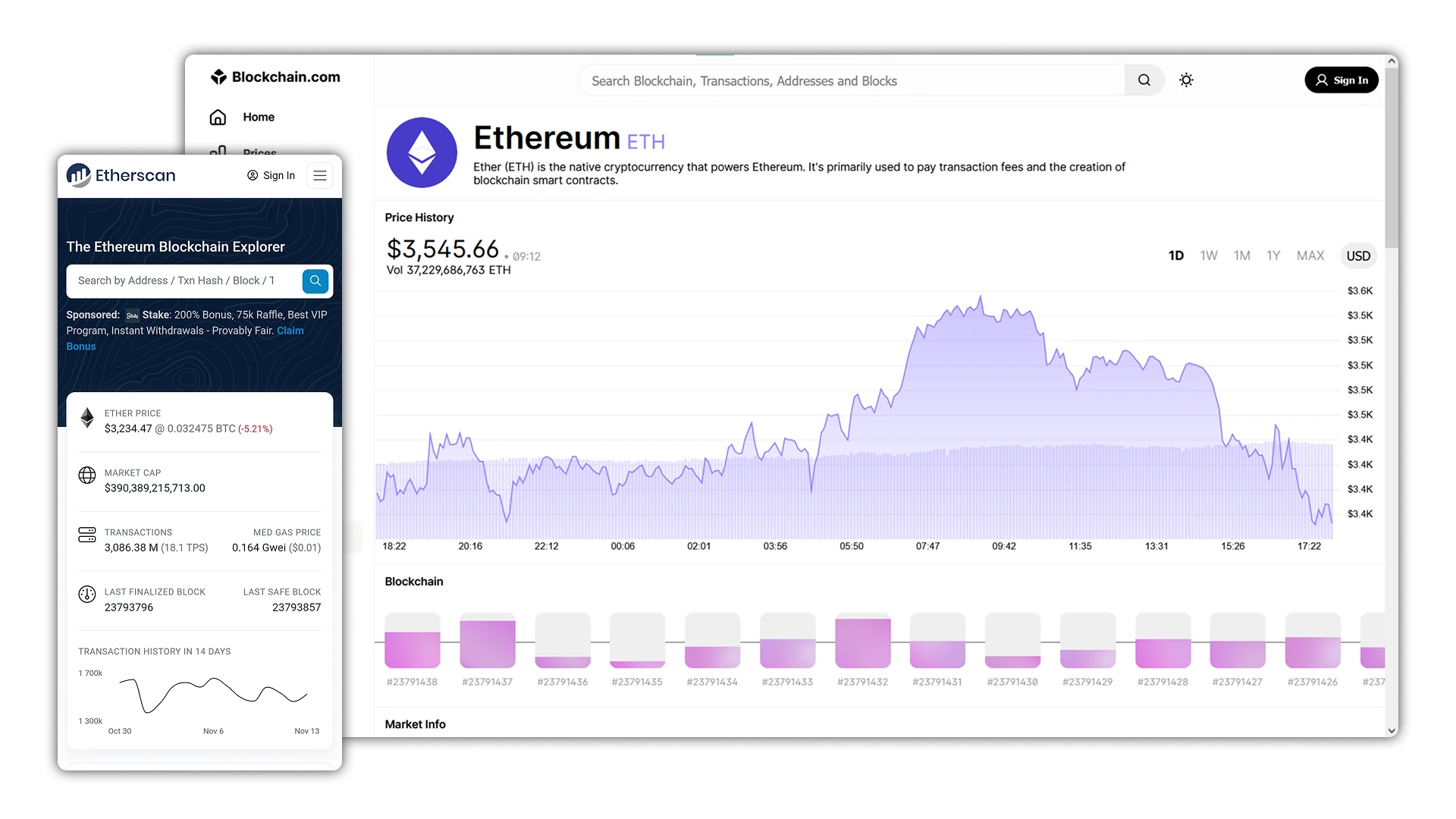

Ethereum

The native coin of the Ethereum network is ETH. Ethereum is the second largest cryptocurrency by capitalization on the Coinmarketcap list. The blockchain serves a large number of popular, highly liquid tokens, the most famous of which is Tether ERC20 (USDT). To send a token to any ERC20 compliant address, the sender also pays a network fee in ETH.

The same rules apply to the rest of the Ethereum blockchain tokens, including Polygon (MATIC), Dai Stablecoin (DAI), Aave Token (AAVE), Chainlink (LINK), USD Coin (USDC), Uniswap (UNI), Paxos Standard (PAX) , Maker (MKR), KyberNetwork (KNC), Shiba Inu (SHIB), Wrapped BTC (WBTC), OMG Network (OMG), Compound (COMP), Balancer (BAL), yearn.finance (YFI), Axie Infinity (AXS ), 1inch (1INCH) and others. The capitalization of some of these projects exceeds a billion dollars.

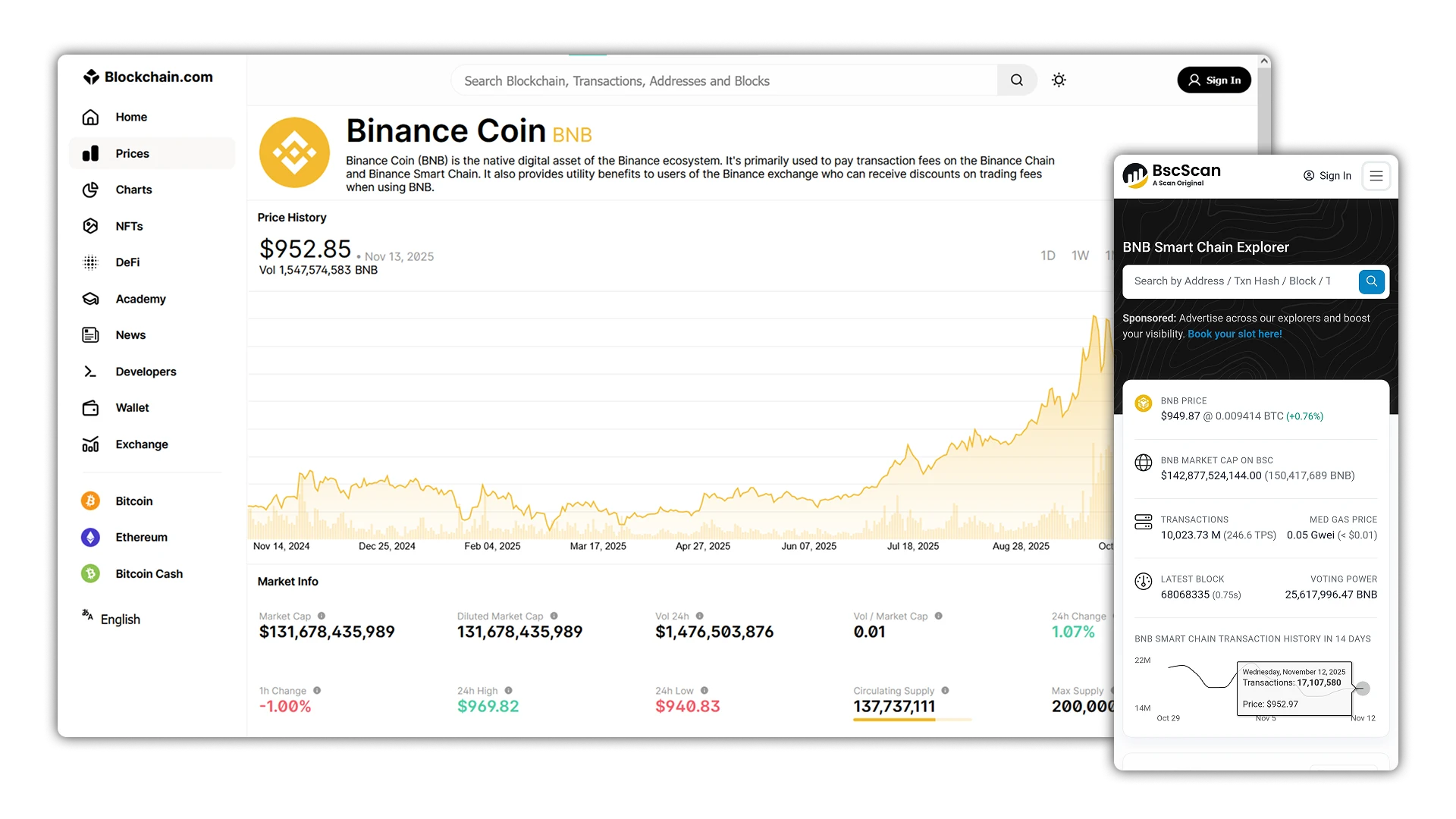

Binance Smart Chain

BNB is the native coin of the Binance Smart Chain (BSC). Blockchain is created and maintained by one of the most reputable businessmen, a crypto enthusiast from China, Changpeng Zhao. Currently, the total capitalization of BNB exceeds $51 billion and it is in fifth place on the Coinmarketcap list. The network fee for transferring any tokens on the BSC network is made in BNB tokens.

Such well-known crypto tokens as Ethereum BEP20 (ETH), Binance USD (BUSD), Tether BEP20 (USDT), Litecoin BEP20 (LTC), Pancake Swap Token (CAKE), Cardano BEP20 (ADA), Alpha Finance BEP20 ( ALPHA), etc.

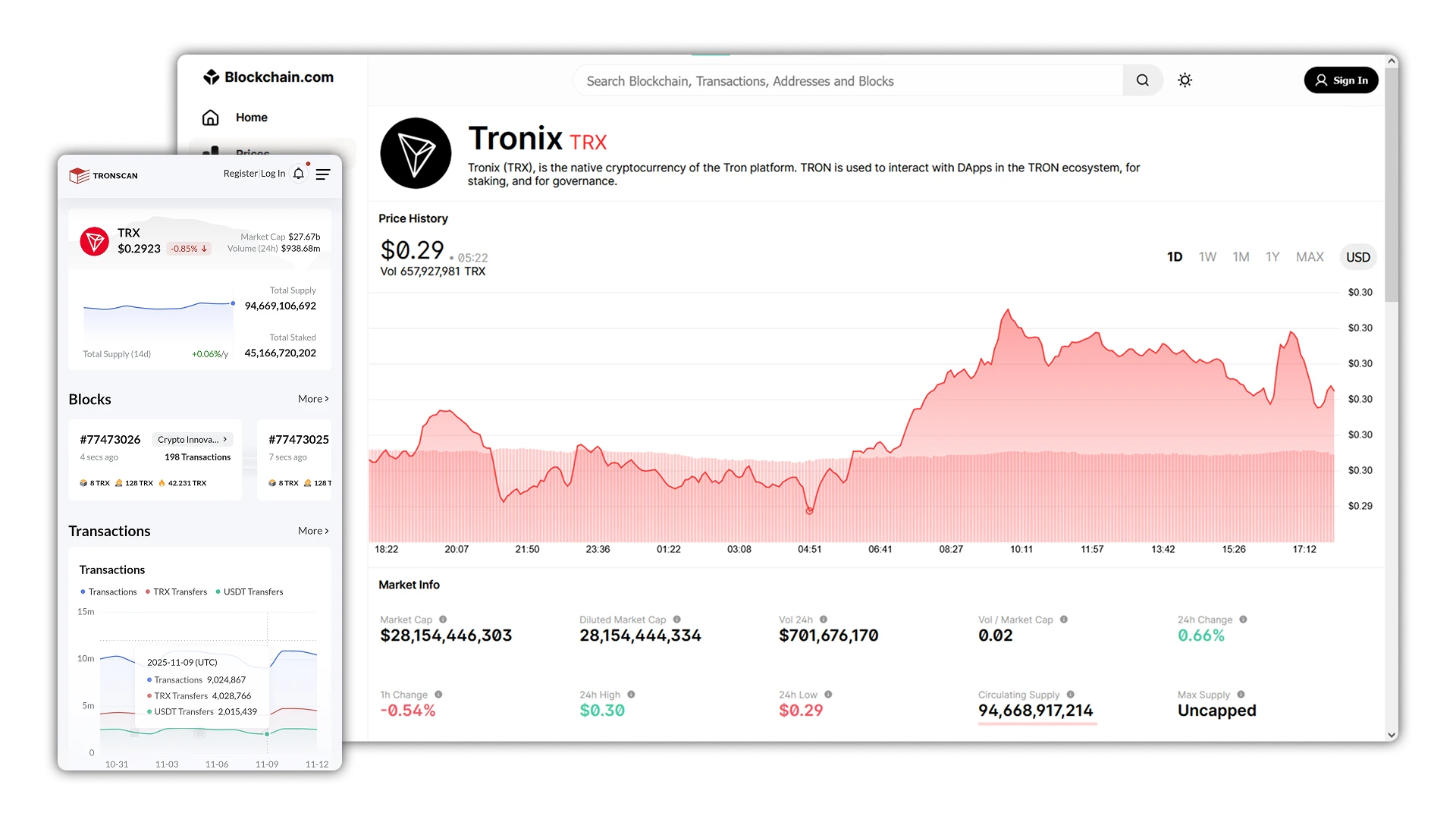

Tron

The native coin of the Tron network is TRX. The total capitalization of Tron (TRX) currently exceeds $6 billion. The coin is in 16th place on the Coinmarketcap list. The most famous and widely used token of the Tron network is Tether TRC20 (USDT). Energy and bandwidth are used as payment for transactions on the network. Both resources are renewable and are credited for staking TRX. In the absence of energy and bandwidth on the account, payment for transactions is made in the TRX cryptocurrency.

Notable tokens operating on the Tron network also include BitTorrent (BTT), Dogecoin TRC20 (DOGE), SUN (SUN), Wink (WIN), ApeNFT (NFT), Just (JST) and others.

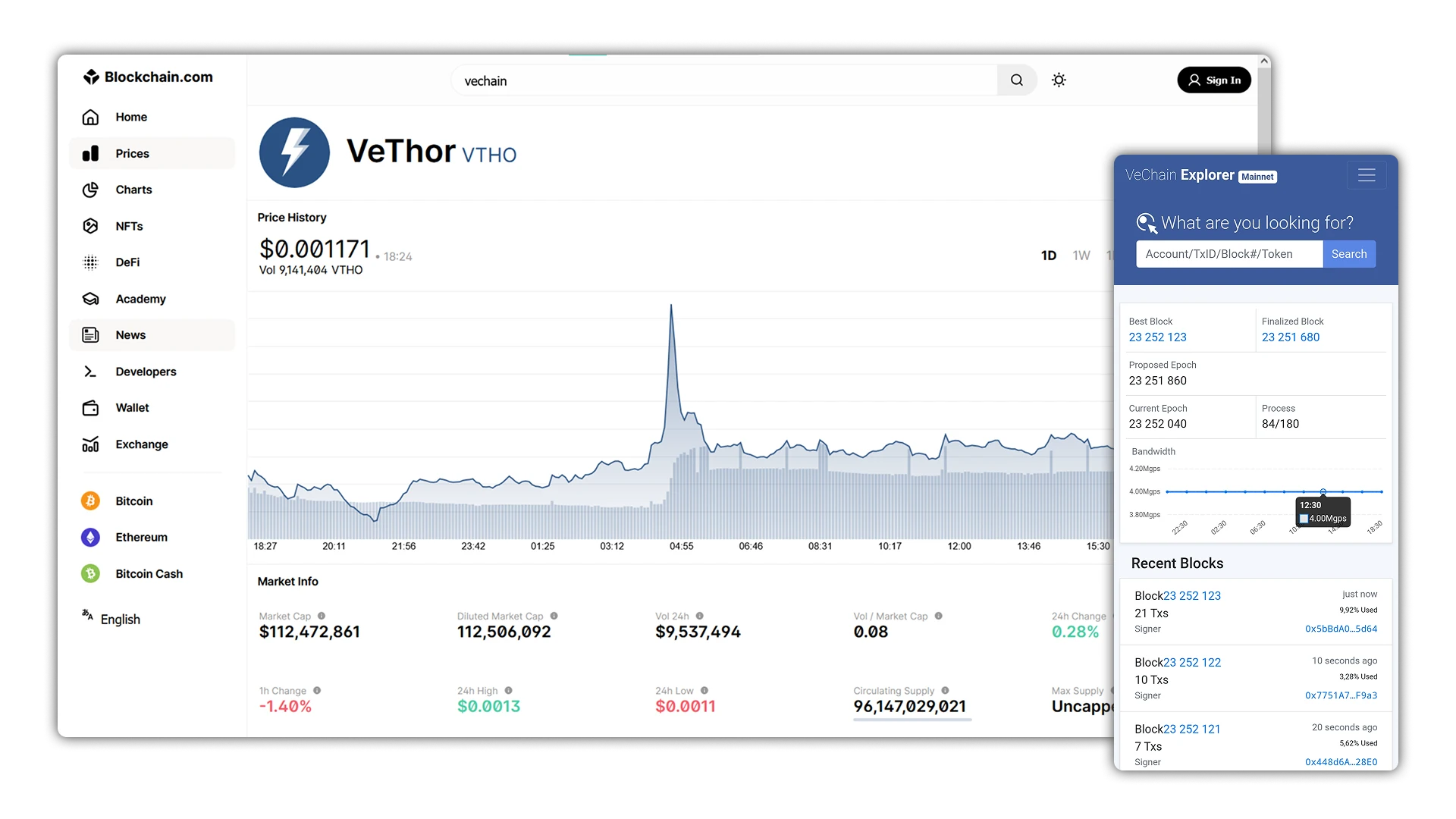

VeChain

Although the native coin of the VeChain network is VET (ranked 34th on the Coinmarketcap list with a market capitalization of over $2 billion), network fees are paid by the native token, VeChainThor Token (VTHO).

You can earn VTHO by staking a certain amount of VET. The coin and token are freely traded and convertible on some major crypto exchanges.

Conclusion

Understanding what native coins are, what they are for and how to use them are the basics that everyone who uses cryptocurrencies needs to know.

Even if you prefer to use tokens, make sure that you have enough corresponding coins in your crypto wallet, which will be required to pay transaction fees.

FAQ

-

Why is it important to have native coins, even if I use tokens?

Even if you use tokens (for example, ERC-20 on Ethereum), transactions are often paid for with native coins (ETH in the case of Ethereum), and therefore, if there are not enough native coins in your wallet, you may encounter problems paying network fees.

-

Can native coins be used for purposes other than fees?

Yes. In many blockchains, native coins are also used for staking, where users “stake” their coins to support the network and receive rewards. They can also be used for voting (as part of the governance system) or as an economic asset.

-

Does changing the number of native coins affect the blockchain economy?

Yes, changing the number of native coins directly affects the blockchain economy, since the rules of issuance – the volume and rate of issuance – are determined by the protocol and create a shortage or, conversely, a surplus of coins. Limited issuance usually increases the value of an asset, while active issuance reduces scarcity and can put pressure on market value. In addition, distribution mechanisms, such as staking rewards, create additional incentives for users to support the network and participate in its security.

-

How can a business benefit from introducing its own native coin?

Introducing its own native coin can be a strategic advantage for a business, as it not only allows it to create a unique economic model, but also increases user and investor engagement in the project's development. Possible advantages include:

- Creating an internal economy: the coin can be used as a means of exchange within the ecosystem, for example, to pay for services or for mutual settlements between users.

- Attracting investors and encouraging them to participate in the network, in particular through staking or other reward mechanisms.

- Increased decentralization: the native coin can serve as a management tool, for example, in DAO systems.

- Potential for coin value growth if the ecosystem is actively developing, which can bring additional benefits to both the business and its users.

-

When should you NOT use native coins for your business model?

Native coins are not suitable for every business model, and in certain cases, their use can create more difficulties than advantages:

- If your business does not require significant decentralization or blockchain transactions, ready-made tokens or third-party tools may be a simpler solution.

- If you are not ready to deal with volatility, as the price of a coin can fluctuate significantly and complicate financial planning.

- If your goal is a quick launch, because developing your own blockchain and its native asset often requires significant resources and time.