The market for cryptocurrency bots is growing rapidly and is already estimated to be worth $52 billion by the end of 2024. As interest in DeFi and cryptocurrencies grows, the number of applications and platforms for automated trading continues to increase. However, launching your own trading bot is not an easy task. It requires deep knowledge in programming, trading and an understanding of complex trading strategies such as DCA, arbitrage or GRID.

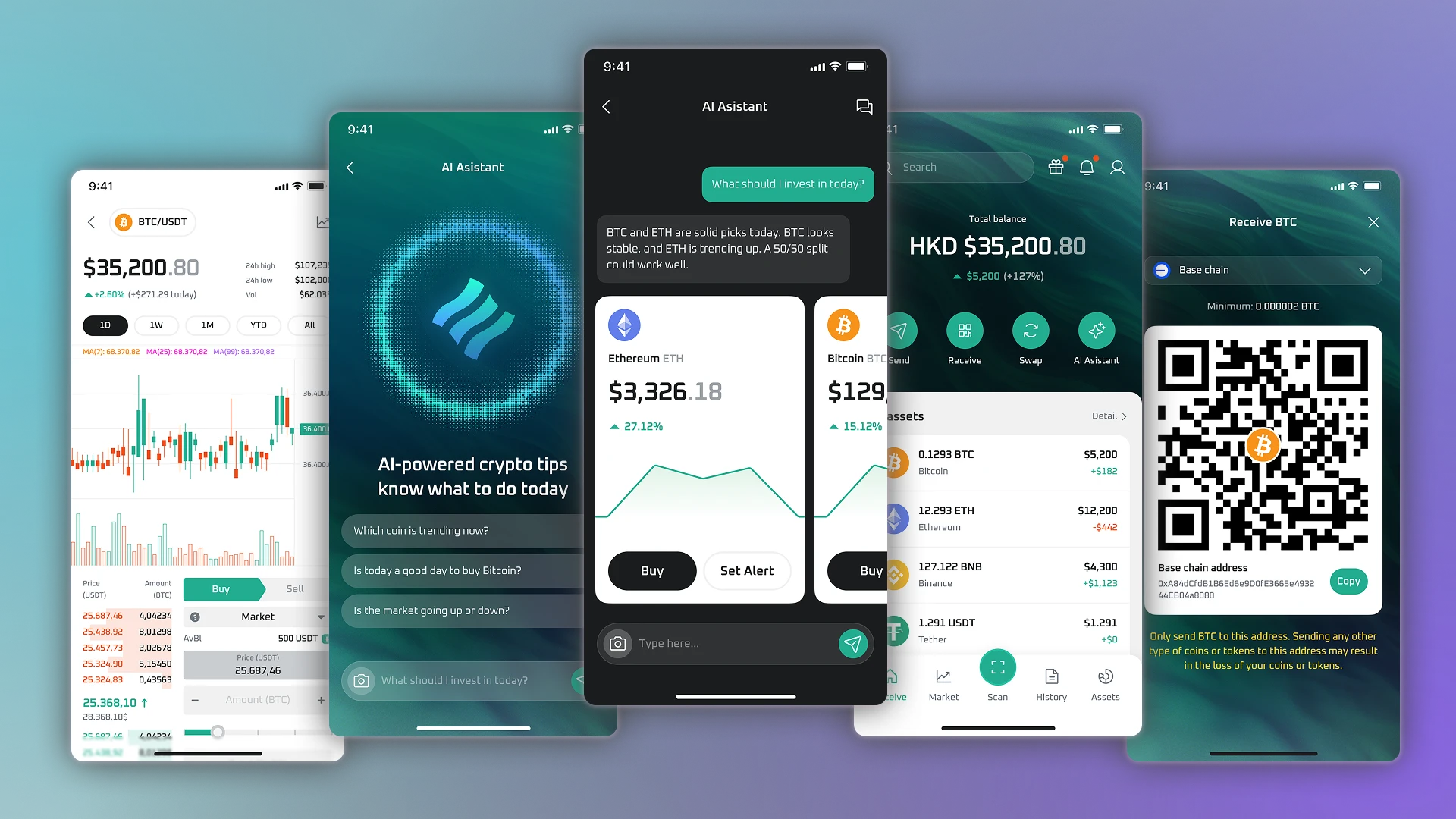

In addition, users are increasingly interested in innovative solutions based on artificial intelligence (AI) that utilize machine learning (ML) algorithms and allow trading on exchanges even more successfully. In such circumstances, White Label's acquisition of a crypto-bot looks like an attractive alternative to in-house development. In this article, we analyze how such a solution can help save time and reduce implementation costs.

White Label software – what is it?

White Label translates as “clean slate”, and in the context of software, it means ready-made software that can be customized to meet the needs of a particular brand. When implementing it, any company requirements are taken into account. These can be:

- User Interface (UI) changes – adding corporate colors, logos and other design elements.

- Technical adaptation – adding new features, improving algorithms and finalizing strategies.

- Platform integration – ensuring compatibility with the company's existing services and external platforms it uses in its work.

- Legal adaptation – customizing the software in accordance with the company's policies and regulations, as well as local legislation.

How does buying a White Label crypto bot work

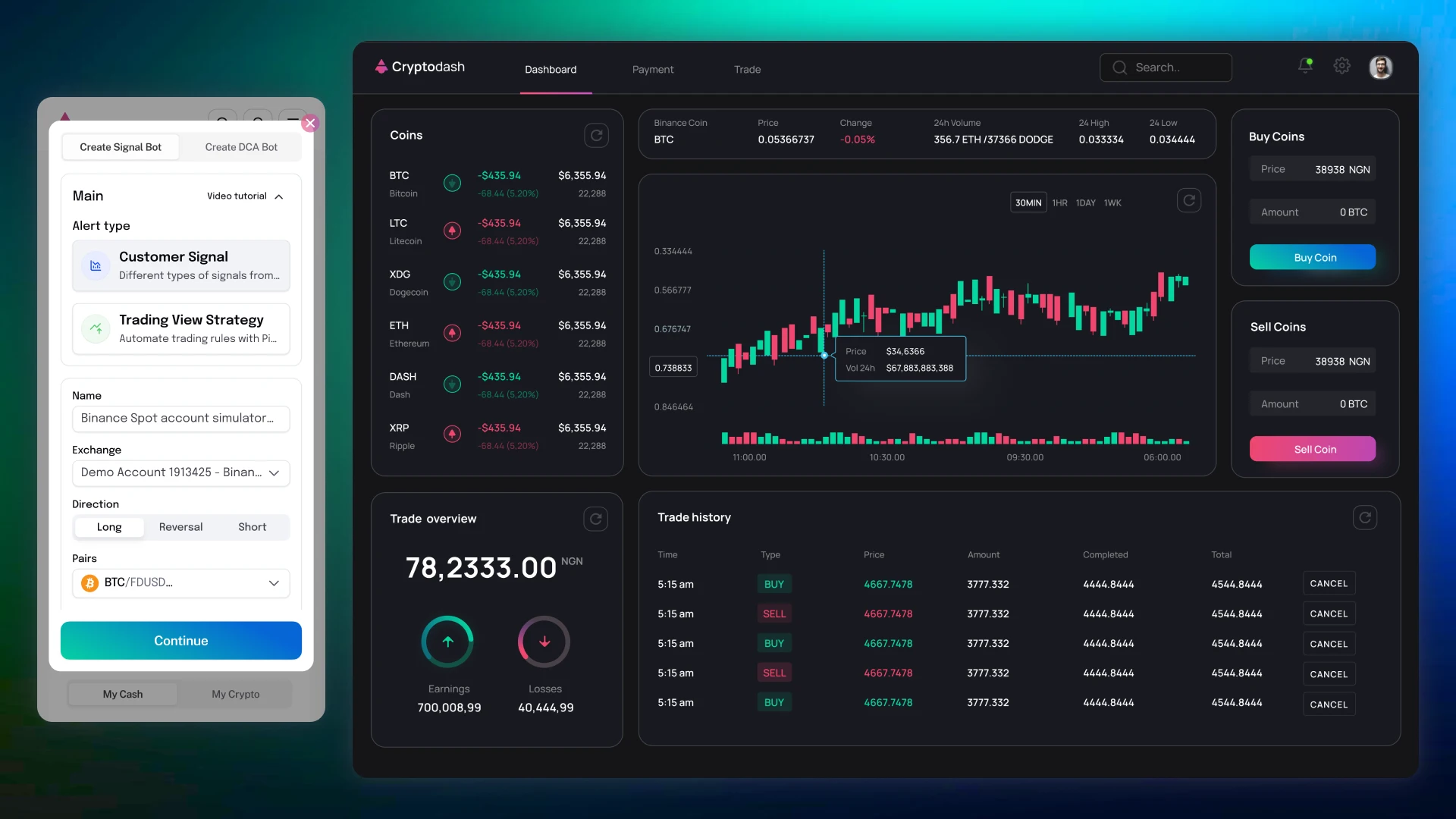

According to statistics, White Label bots for cryptocurrency trading are one of the most popular solutions for trade automation. Such programs connect to centralized (CEX) and decentralized (DEX) exchanges using APIs or smart contracts. They analyze the market around the clock and execute trades based on pre-programmed algorithms or using artificial intelligence, and their key goal is to extract maximum benefit from market opportunities with minimum risks for the trader.

Cryptonis Labs is engaged in the development of innovative products in the field of blockchain. Our portfolio includes projects related to the creation of cryptocurrency exchanges, exchangers, DeFi platforms and other products that help companies to work effectively on the digital currency market. A special place among our solutions is occupied by White Label trading bots – tools that allow to automate trading and provide clients with a ready platform to enter the market.

Our company employs established teams of highly qualified specialists with extensive experience in the development of crypto-bots for trading. Using best practices and advanced technologies, we develop White Label solutions customized to the specific tasks and needs of our clients. This approach allows us not only to speed up the development process, but also to guarantee the high quality of the final product. Let's look at how the process of acquiring and implementing such software works in practice:

- We discuss in detail with the customer the regulatory, technical and other requirements for the software. For example, this may include support for various strategies such as arbitrage, trend analysis or AI-based automated trading, as well as integration with specific CEX and DEX exchanges.

- Once the requirements are agreed upon, we adapt the bot architecture to the client's requirements: we implement missing functionality, refine algorithms and perform maximum customization, including changes in UI/UX.

- Before the bot is handed over to the customer, we thoroughly test it. We check the security, stability and efficiency of the algorithms. We also fix bugs and customize the system to work in real market conditions.

- We integrate the cryptocurrency trading bot into the client's platform. We customize it, train employees and provide technical support to make the transition to operation smooth.

The result – the client receives a ready crypto-bot with individually selected and customized functions, design and logo. The customer is a full-fledged owner of such a solution and can use it at his discretion and without restrictions. This approach is especially attractive for startups and small companies that want to get a high-tech and effective trading tool as quickly as possible and with relatively small investments.

Advantages of White Label crypto-bots Cryptonis Labs

Modern companies, startups and private traders are increasingly choosing custom White Label solutions with the possibility to personalize them in order to avoid the complexities of independent development. Let's look at how this approach is better:

- Saving budget for analysis and production. Designing, developing architecture, testing and maintaining your own trading bot requires significant investments. By choosing to purchase a White Label program, you can save up to 80% of resources and redirect them to marketing and development of your business.

- Reliable technological base. Our trading bots are developed by experienced and qualified teams of programmers who have in-depth knowledge of blockchain, smart contracts and crypto exchanges. To improve the efficiency of our solutions, we also implement artificial intelligence and machine learning technologies, which allows our bots to use various strategies – from scalping to dollar cost averaging (DCA), quickly analyze large amounts of data and instantly conclude transactions.

- Removing the technical burden. With Cryptonis Labs you don't have to delve into the subtleties of programming or learn the nuances of trading. Our team takes care of all technical tasks – from algorithm customization to integration with exchanges. We also help our clients find the best features, exchanges and trading strategies for their needs, allowing them to focus on developing and promoting their brand.

- Fast time to market. Developing software from scratch can take 6 to 12 months, which is unacceptable in the rapidly changing cryptocurrency market. White Label solution allows you to reduce this time to a few weeks or months, depending on the level of customization and complexity of the project.

- Support and maintenance. After the purchase, you get not only ready-made software, but also assistance in its operation. We can provide professional technical support, timely bug fixing and release of updates. This will minimize maintenance costs and guarantee stable bot operation in the rapidly changing crypto-industry.

Types of White Label Crypto Trading Bots

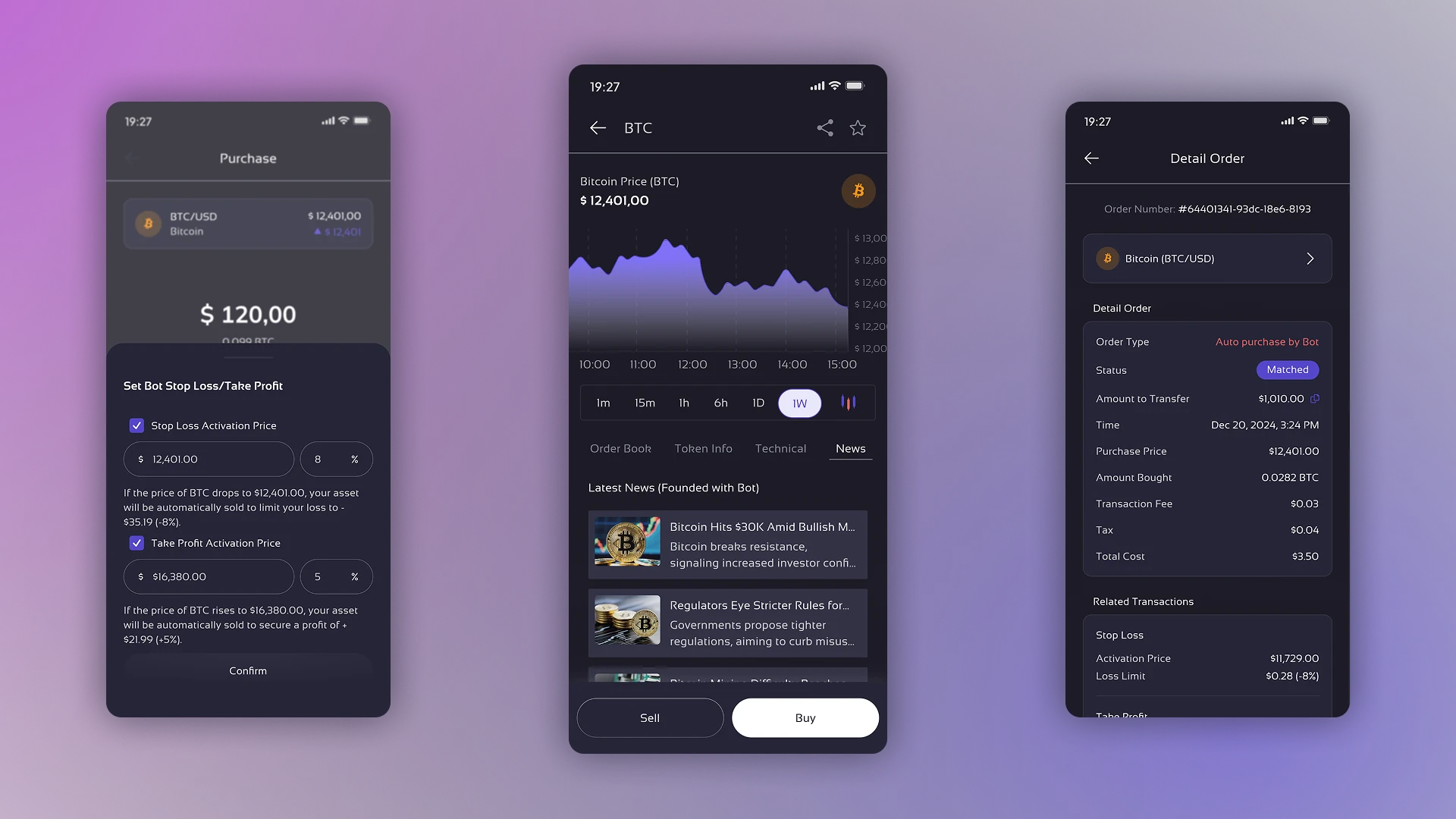

Automated cryptocurrency trading software can utilize different approaches and strategies. Such bots provide access to trading indicators such as MACD, VWAP and RSI, analytics and risk management tools, making them a versatile solution for traders. Bots can also be integrated into various platforms, including specialized apps or popular messengers such as Telegram, where trading bots have gained particular popularity in 2024.

However, the main criterion for categorizing crypto bots remains the trading strategy used. Let's take a look at the main types of strategies that can utilize White Label solutions:

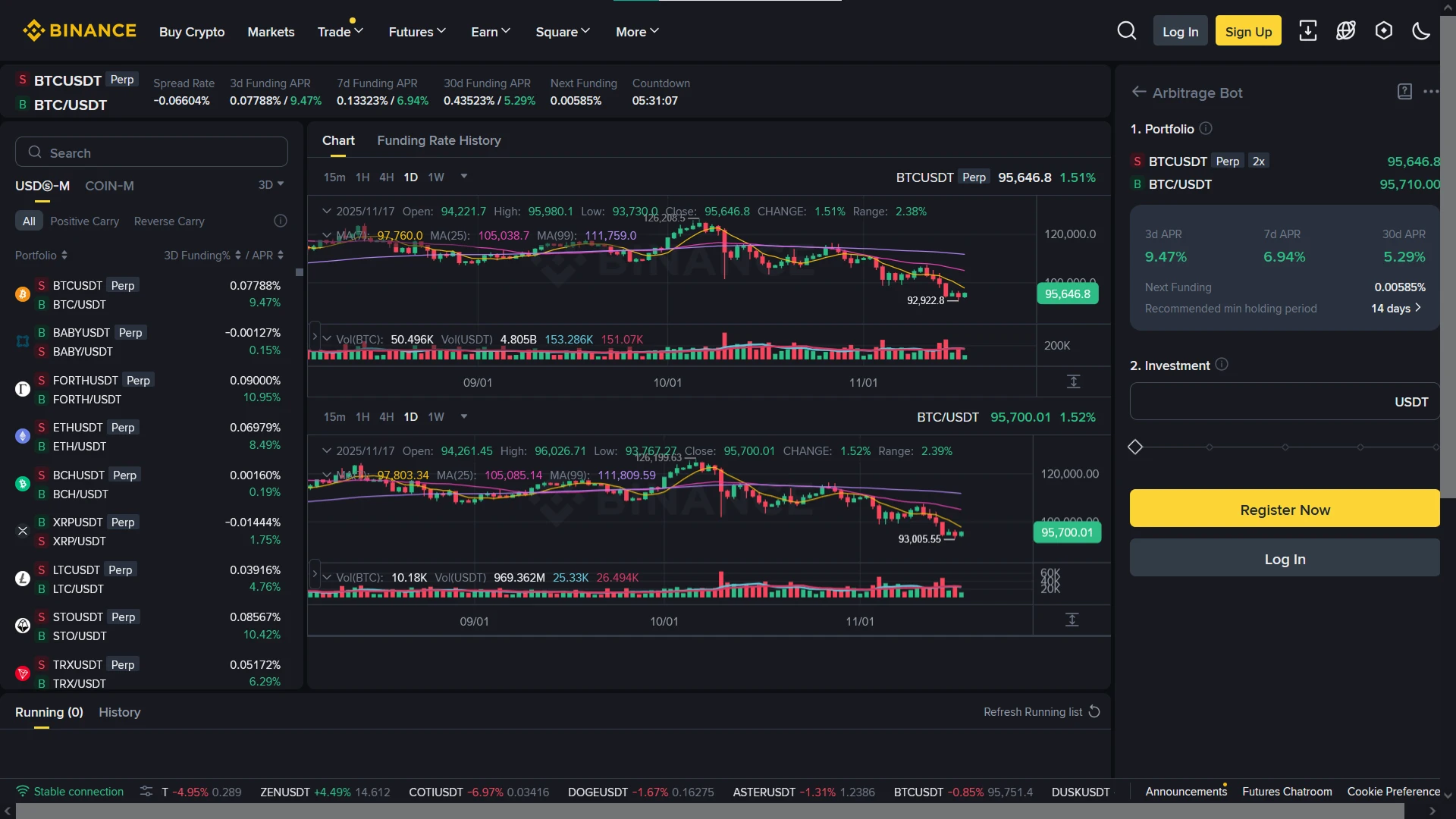

- Arbitrage bots. They bring profit due to timely buying/selling of assets during the period of price divergence. For example, in inter-exchange arbitrage bot can buy cryptocurrency on one platform, where the price is lower, and sell on another, where it is higher, which allows the trader to get a stable income even in conditions of low market volatility.

- Scalping Bots. Focused on capitalizing on small price fluctuations. They make many transactions within a short time, instantly buying and selling assets. This strategy requires high transaction speed and minimal delays.

- AI bots. Artificial intelligence-based bots are capable of applying a wide variety of strategies, including balancing a crypto portfolio and analyzing large amounts of data. They use machine learning algorithms to predict market movements, adapt to market changes and make decisions based on historical data and the current situation.

- Trend bots. Their work is based on analyzing trends in the cryptocurrency market. They buy coins on the rise, and then resell at the moment when prices begin to fall.

- Mid-reversion bots. Bring profit by analyzing the price movement of assets and their deviation from the average value. The main idea of the strategy is based on the principle that the value of an asset eventually returns to its average level. Such bots buy cryptocurrency when it falls below the average value and sell it as soon as it returns to this level. To work, they also use trend indicators that help to capture the moments of price deviation.

- Machine Learning (ML) enabled bots. Just like AI bots, such solutions can use different strategies, but their distinguishing feature is their ability to learn from new data. They analyze market trends, identify patterns and adapt their algorithms, improving trading efficiency with each cycle.

- Market Bots. The strategy of such bots is to buy assets at the current market value. Their main advantages are low risk level and the ability to work in periods of “stagnation” in the markets.

- News analysis bots. Such bots make decisions based on the analysis of information background: articles, summaries, posts in social networks and financial reports found on the web. Given that news is one of the key factors of price changes in the crypto market, this strategy is often profitable.

What are the nuances to consider when buying a White Label bot?

White Label trading bot is not a ready-made tool, but a solution that is customized to meet the needs of a particular client. Its functionality and design are adapted to business tasks on the basis of already existing infrastructure, which allows you to save budget and bring the product to market faster.

And although you don't need to be a professional programmer to buy White Label software, understanding the basic stages of development can help you clearly formulate your requirements for functionality. Let's break down the key points that are discussed before starting software customization.

1. Choice of cryptocurrency exchanges

Trading bots can be configured to work with two main types of exchanges: centralized (CEX) and decentralized (DEX). Both approaches have their own peculiarities that should be taken into account when selecting and developing a White Label solution.

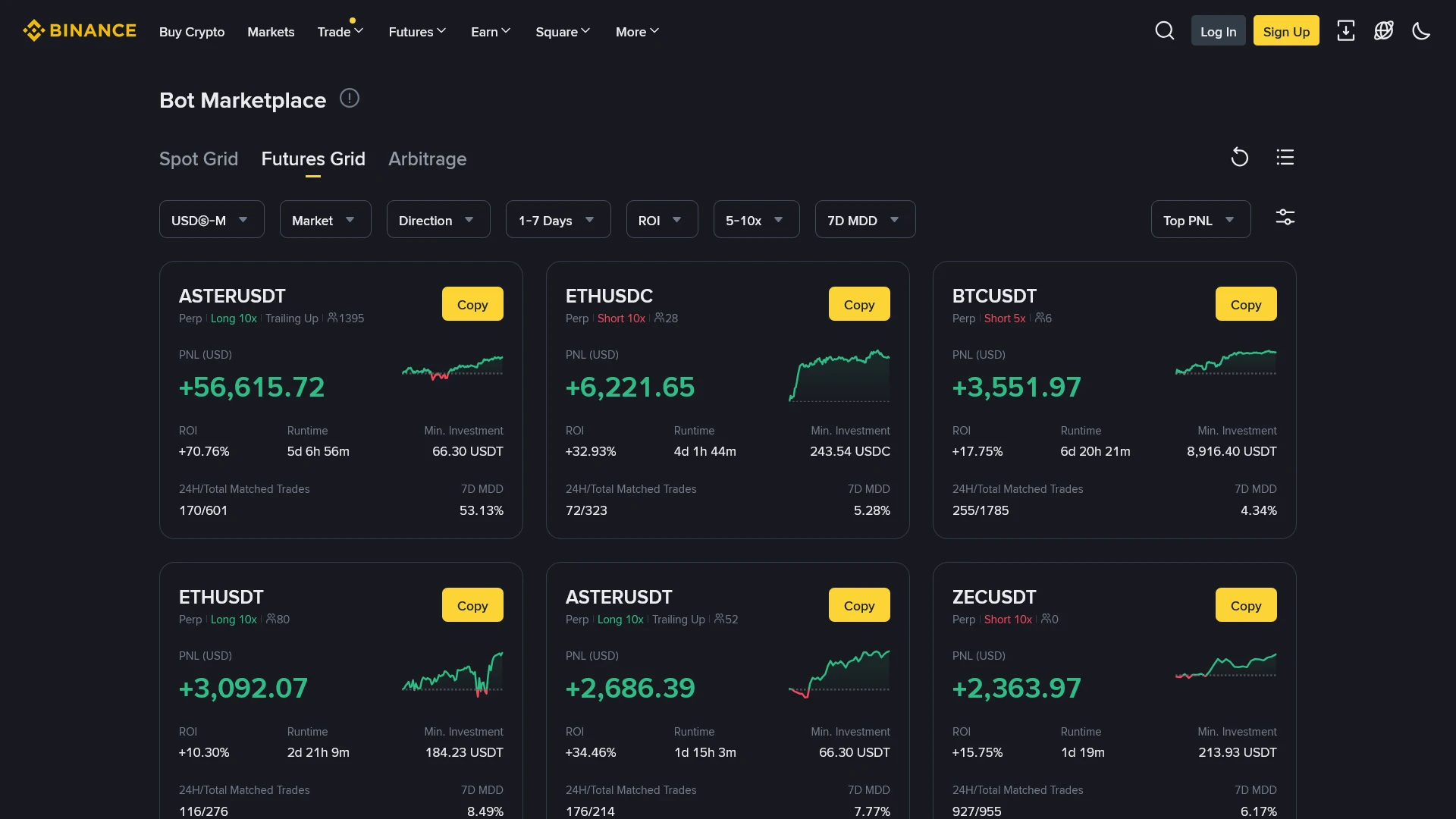

Working with CEX. Centralized exchanges such as Binance, Kraken, and Coinbase offer high liquidity and stability, making them the primary choice for trading bots. APIs are used to connect to such platforms, which simplifies development and allows for a variety of trading strategies.

Working with DEX. Decentralized exchanges such as Uniswap, PancakeSwap, and Jupiter operate based on smart contracts. This makes them more difficult to integrate, as they need to take into account the peculiarities of blockchain networks.

Additionally, DEX have lower liquidity than CEX, which can limit the choice of strategies and reduce the effectiveness of risk management. Some trading bots can be configured to work with both types of exchanges – CEX and DEX. These are universal solutions that provide traders with maximum flexibility and options. However, their customization and refinement require more time and effort, as you need to take into account the specifics of each type of platform.

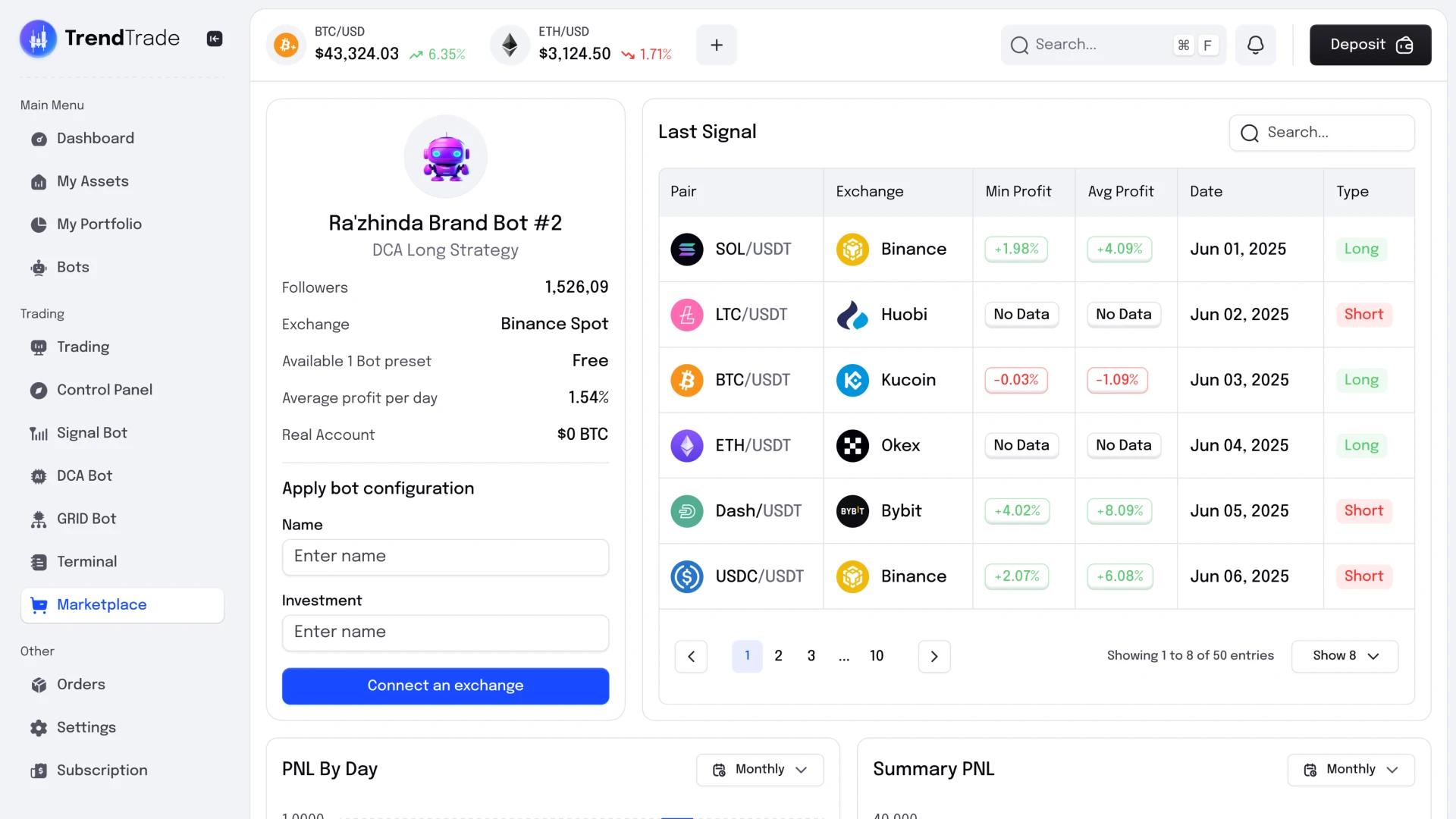

Large platforms with trading bots often give access to 5+ exchanges. The more the better. This list usually includes the most popular and liquid ones such as Binance, OKX, KuCoin, Uniswap, and PancakeSwap. This allows traders to make the most of the available market opportunities and make the most profit from their transactions.

2. Access to trading indicators and signals

The trading bot is based on various indicators and signals that it uses to make decisions about making deals. Which indicators to use depends on the trader's (client's) choice, but the strategies of the crypto-bot itself should also be taken into account. Here are the most popular options:

- Volume – analyzes trading volumes to determine the strength of the trend. High volumes confirm the relevance of the trend, while low volumes can signal its end.

- RSI – shows the rate of change in a trend and gives an indication of how overvalued or undervalued an asset is in a particular time period.

- MACD – helps to determine the direction of the trend and generates signals to buy or sell assets.

- Fibonacci Retracement – helps to identify support and resistance levels where the price may slow down or reverse.

- MA – represented by three types: SMA, EMA and WMA. All of them are used for calculating long-term trends and “smoothing” short-term price fluctuations.

- Stochastic Oscillator – detects overbought or oversold assets, which helps to determine when a price reversal is possible.

- Ichimoku Cloud – a comprehensive indicator consisting of five lines that analyzes trends, support and resistance levels, and provides signals for trading.

The bot can also provide various signals, which helps the trader to react quickly to any market changes. These can be:

- Crossing of overbought or oversold levels (RSI).

- Breakout of the upper or lower boundary of the Bollinger Bands.

- MACD line crossing, indicating a possible trend reversal.

- Publication of major news that may affect market trends.

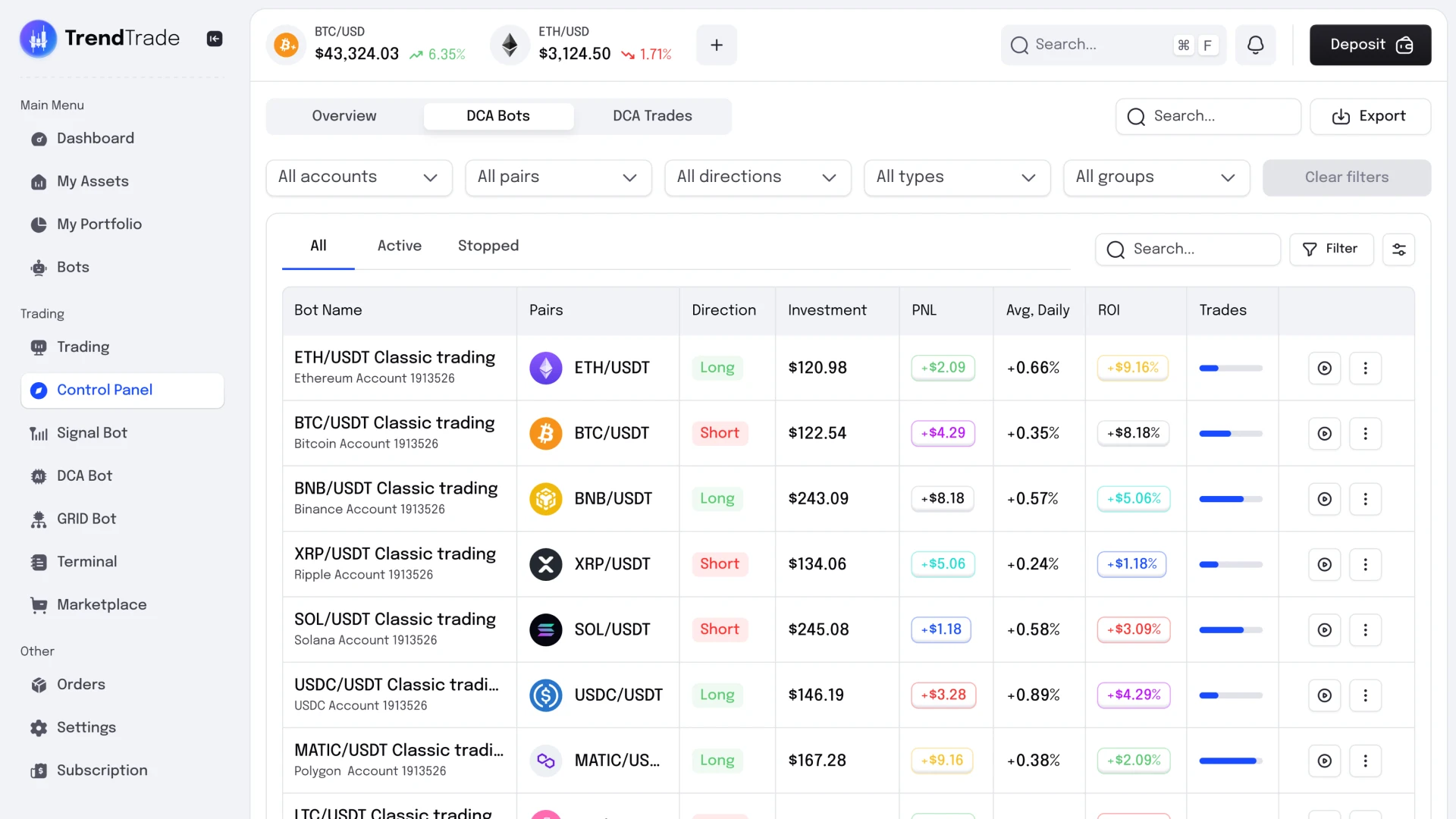

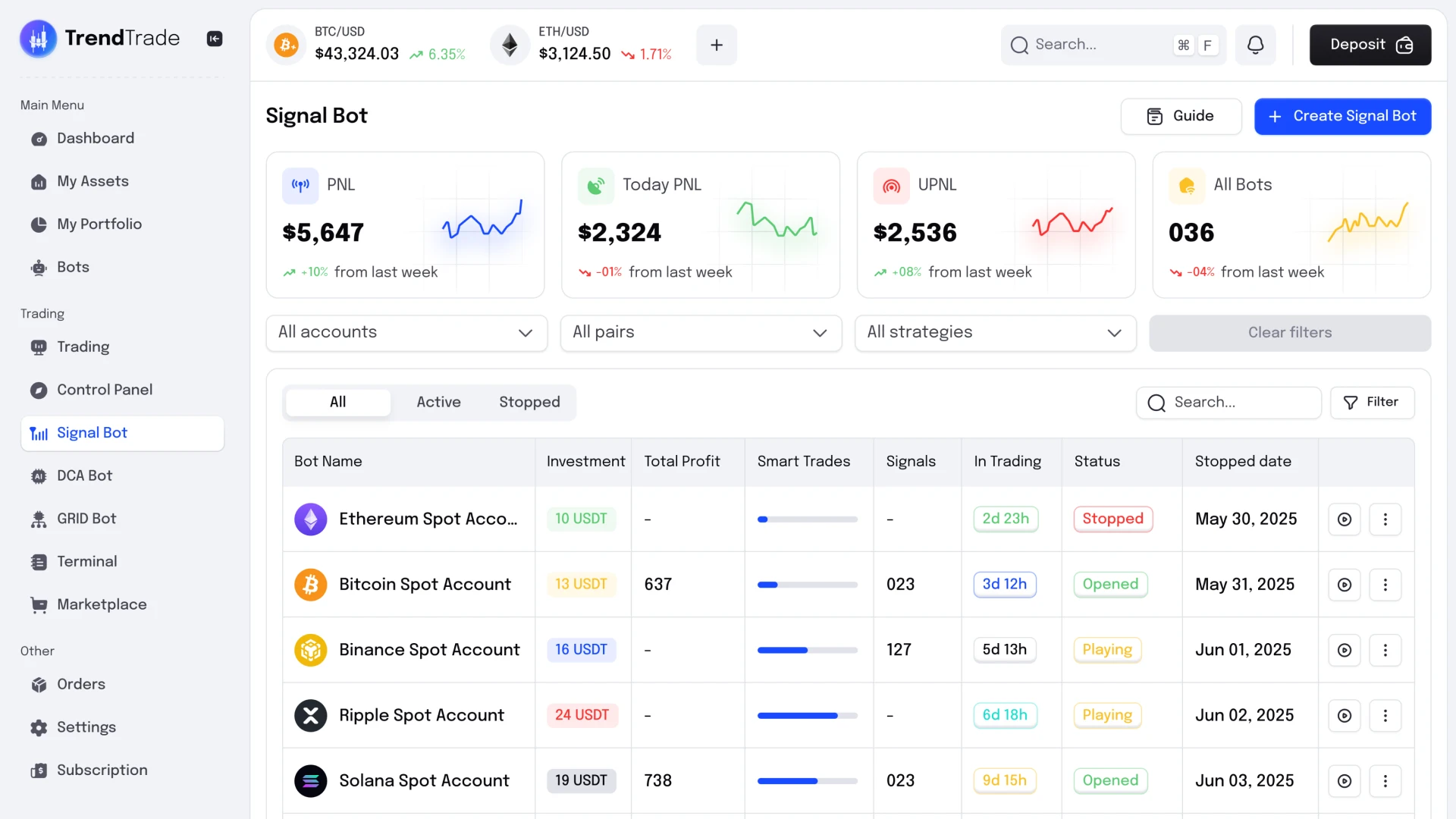

3. UI/UX design customization

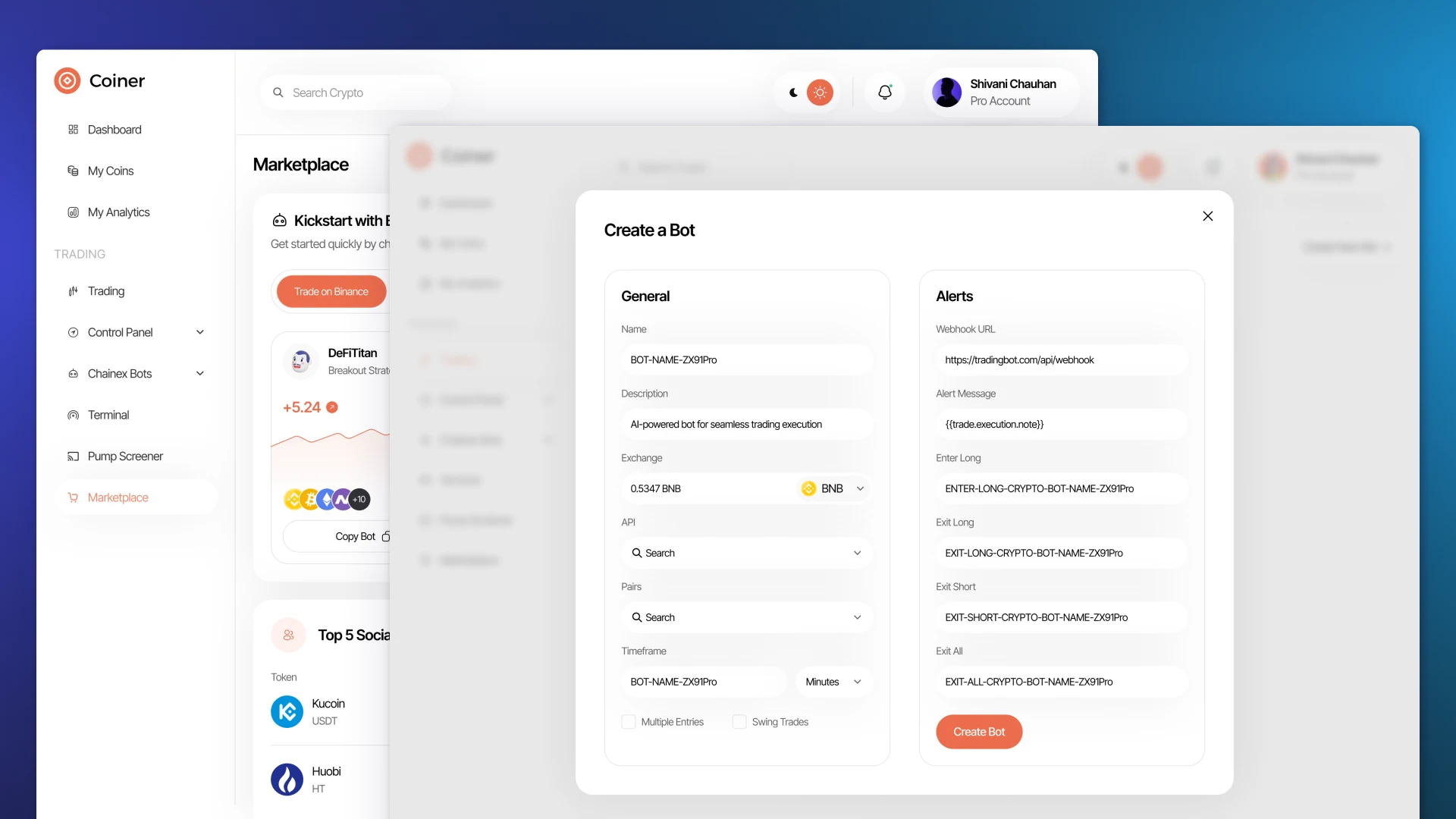

Design and user interface development is the most important step in customizing a trading bot, because the convenience and aesthetics of the interface directly affect the popularity of the product among traders. This is relevant both for complex platforms that provide access to several bots, and for simpler ones, such as those integrated into messengers.

When purchasing a White Label solution, the choice of interface style is always left to the customer, but the development team can also give their recommendations. At Cryptonis Labs we continuously analyze UX/UI trends in the crypto-industry and perfectly understand the expectations and needs of users, so we recommend our clients to adhere to a few basic principles:

- Simple operation. The bot interface should be intuitive, not only for experienced traders, but also for industry newbies. Easy navigation, consistency, logical arrangement of elements – all this makes the product convenient and comfortable.

- AI and ML integration. Personalized hints and recommendations based on artificial intelligence (AI) data can help users adapt to working with the bot faster.

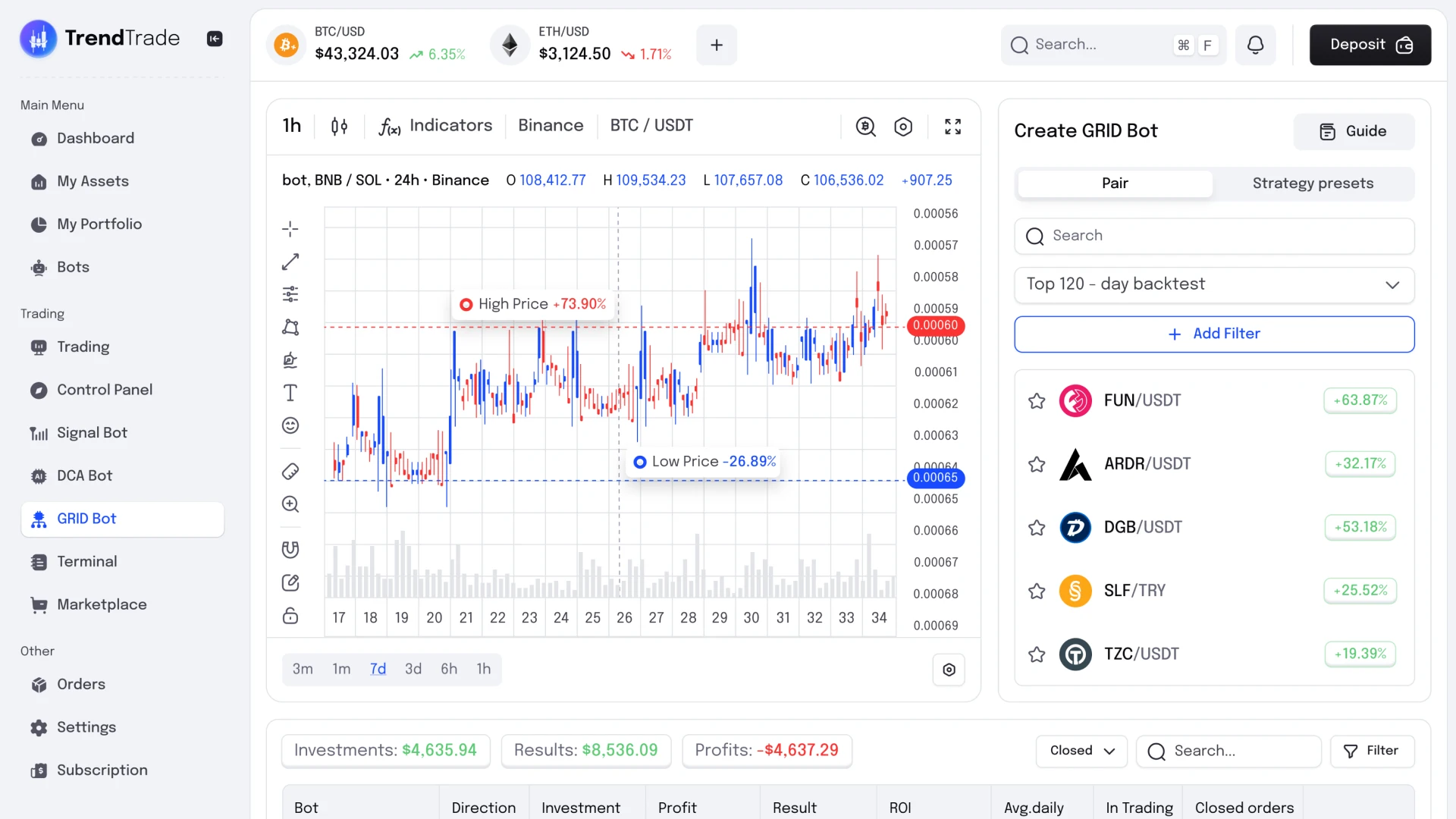

- Data visualization. Charts and graphs help traders better analyze data, which affects their trading performance and therefore increases the value of the bot.

- Support for personalization. Users should be able to customize the interface for their unique needs: choose a theme, change/disable display of some elements, etc.

- Minimalistic design. The trend for minimalism will continue in the coming years, as it reduces cognitive load and helps users to perceive information more easily.

- Notification system. To promptly inform users about important events and changes in the market, we recommend implementing push notifications.

- Design adaptability. The interface should be correctly displayed on all devices: from desktops to cell phones.

Since White Label bot is a software solution, logos, corporate colors and other visual elements emphasizing the identity of the client's brand are added to the design.

4. Trader Reporting

A detailed study of the leading crypto-bots on the market reveals that traders are interested in charts, diagrams and reports that visualize the performance of their work, such as gains and losses on specific types of transactions for the reporting period. Such tools help them analyze their successes, identify mistakes and optimize strategies. In addition, the bot can provide access to such important statistics:

- The state of the overall balance on different exchanges.

- Distribution of assets in the portfolio.

- The number and volume of transactions for a specific period.

- Problems in the work of the trading bot.

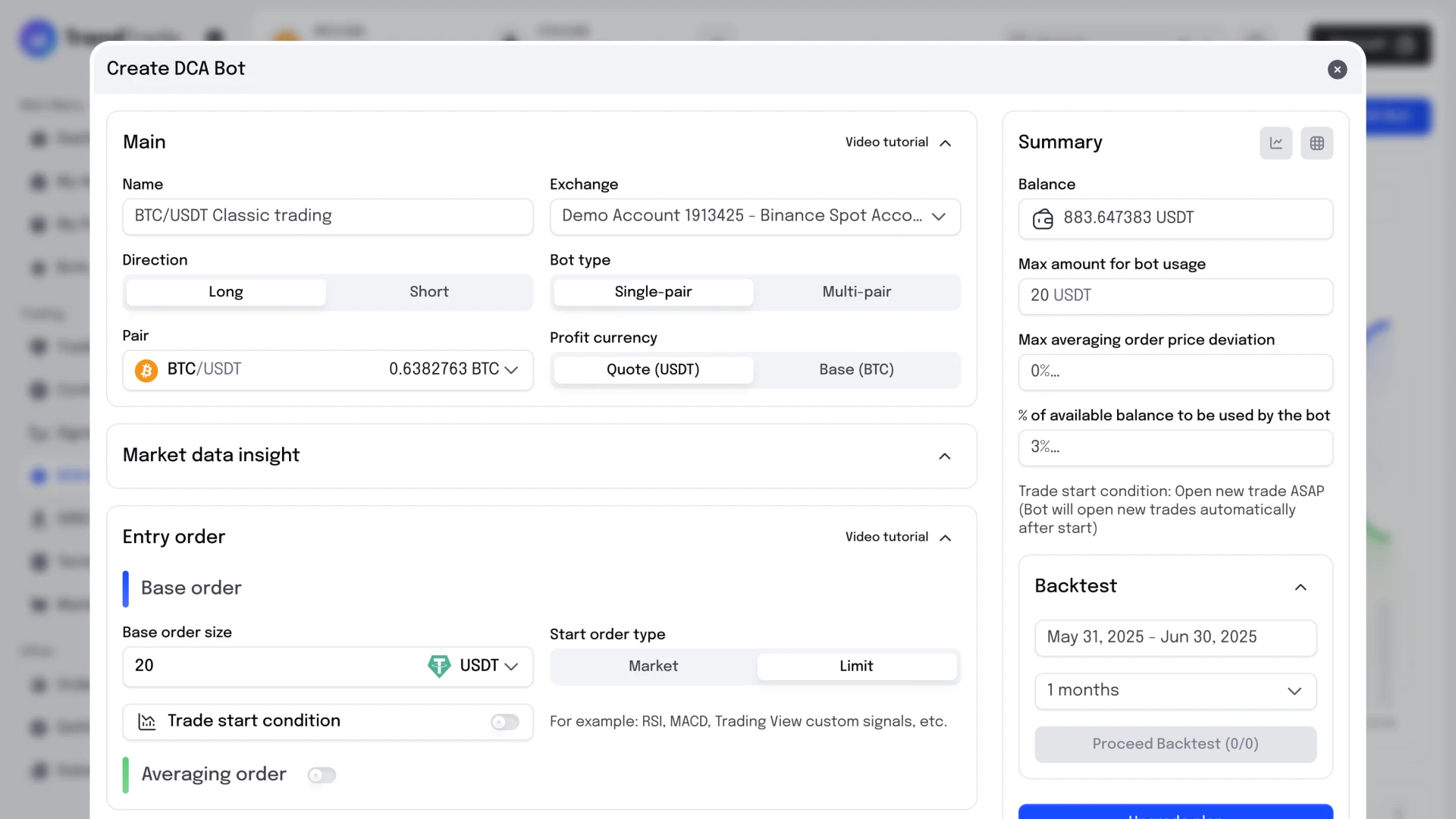

Also, popular bots often offer traders the possibility of risk-free backtesting of trading strategies – simulation of trading based on historical data. This allows you to evaluate the effectiveness of selected approaches, identify weaknesses and optimally adjust software parameters to maximize profits on real markets.

Conclusion

Buying a White Label trading bot is a great choice for those who want to bring a high-tech and efficient trading bot to the market while saving resources and time for its development. At Cryptonis Labs we offer software of different complexity: from simple bots integrated into messengers to complex platforms with access to several strategies and integration with popular exchanges.

In addition, our solutions can include AI and ML integration to improve trading efficiency and personalize bot performance.

If you still have questions, or want to clarify the cost and time of White Label bot development tailored to your needs – contact us via the contact form!

FAQ

-

Why choose a white label solution instead of creating a trading bot yourself?

With white label, you can save up to ~80% of your budget compared to full development. In addition, the development team takes on all the technical burden: integration with exchanges, testing, strategy configuration, leaving you more time to focus on your business strategy.

-

How safe is it to use a white-label crypto bot for trading?

Security depends on the quality of the solution's implementation: secure API keys, encryption, two-factor authentication, and activity monitoring are used. A reliable white-label bot provider provides regular security updates, as well as a reporting panel that shows errors or suspicious transactions.

-

How long does it take to implement a white-label crypto bot in my business?

The duration depends on the complexity of your requirements: for a basic white-label solution, it can take several weeks, and for customized features or a large-scale SaaS option, it can take several months.

-

Can the bot support different trading strategies (e.g., arbitrage, scalping, trend trading)?

Yes, modern white-label bots usually support a wide range of strategies: arbitrage, scalping, trend algorithms, portfolio rebalancing, DCA, etc. This allows you to tailor the solution to your target audience.

-

How do users see the bot's performance results? Is there a reporting panel?

Usually, yes. White-label bots have an interface for traders with graphs, charts, detailed statistics on transactions, portfolio distribution, profits and losses for the period, as well as other analytics.

-

Can I restrict the bot's access to my funds to minimize risks?

Yes, when connecting the bot to exchanges, you can configure API rights: for example, give permission only to trade, but prohibit the withdrawal of funds.

-

What business model can be built around a white-label crypto bot?

There are several options: you can sell subscriptions to users, charge a commission on profits, license the bot to other traders, or launch a branded SaaS platform. Our team can help you adapt the technical platform to your chosen business model and ensure its correct implementation at all stages.