Turnkey crypto exchange development

A cryptocurrency exchange is a platform that allows users to buy, sell, and trade digital assets. Similar to a traditional currency market, a crypto exchange helps coin sellers and buyers quickly connect and ensures secure transactions.

According to CoinMarketCap, the daily trading volume on popular cryptocurrency exchanges reaches $38.8 billion. These platforms charge a commission of 1% to 4% on each transaction, which, given their scale, sounds quite reasonable.

If you're looking to make money in the crypto industry, a cryptocurrency exchange is one of the fastest and most reliable ways to do so. Demand for digital currency exchange continues to grow, and by owning your own crypto exchange, you're free from exposure to exchange rate fluctuations and simply take a fixed percentage of each transaction. No risk involved.

What types of crypto exchanges are there?

Cryptocurrency exchanges can be roughly divided into several types:

- Centralized crypto exchanges. These are owned by specific companies that unilaterally set the "rules of the game." Most often, such platforms are licensed to trade and are subject to traditional financial regulators.

- Decentralized exchanges. These are unregulated platforms that simply facilitate P2P markets. They are prized by the cryptocurrency community for their ability to conduct anonymous transactions.

- Hybrid exchanges. These offer the high functionality and liquidity of centralized platforms, but at the same time provide the anonymity and security of decentralized ones. In other words, they're a cross between the first two options.

- Altcoin exchanges. They trade exclusively cryptocurrency pairs, without fiat.

- Cryptocurrency exchanges with fiat. On these platforms, you can trade cryptocurrency pairs or exchange digital assets for dollars, euros, or even national currencies.

Cryptocurrency exchange and crypto exchanger – what's the difference?

There are two popular types of digital currency exchange services on the market: crypto exchanges and crypto exchangers.

A crypto exchange acts as a regulator during trading. It acts as an intermediary between the buyer and seller of cryptocurrencies. At the same time, a crypto exchange is a third party and fully participates in the transaction: it sells or buys assets. Simply put, a crypto exchange operates like a regular currency exchange, which can be found anywhere in the world.

Development of a cryptocurrency exchange

Developing your own crypto exchange is a complex task that requires a professional development team and significant financial investment. However, with a good business plan and high-quality technical implementation, the investment will pay off fairly quickly.

Creating such a project from scratch can be roughly divided into several components. Let's look at each of them in more detail.

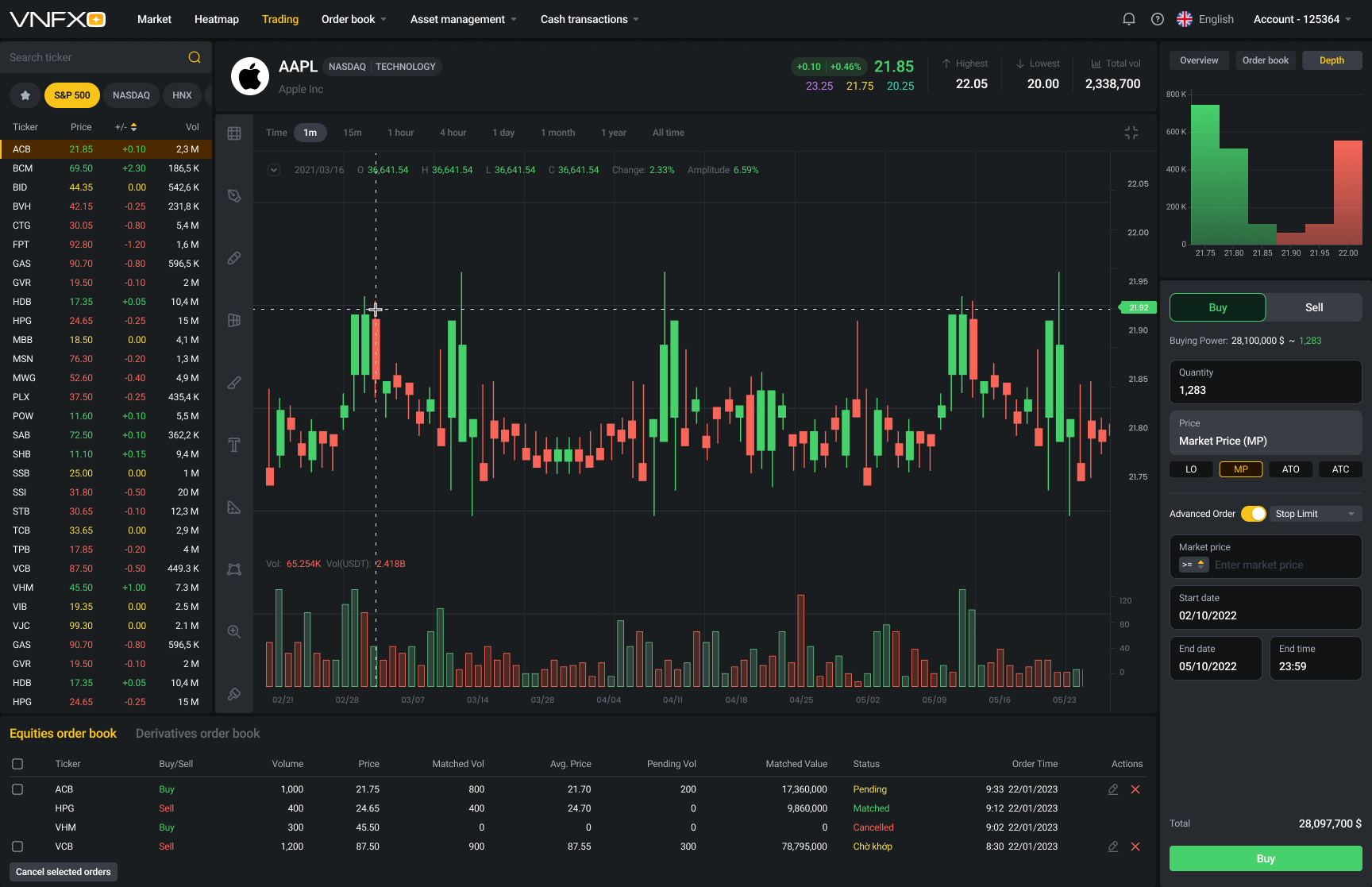

Development of a trading engine

The trading engine is the brain of the future cryptocurrency exchange. It is an electronic system that collects and compares all open orders in the system. When the algorithms find two matching offers, they automatically execute the trade.

Various algorithms can be used for matching. Most commonly, a FIFO system operates on the principle of "first in, first out." This means that if there are two similar offers, the system will choose the one submitted first.

The correctness and efficiency of the entire exchange depends on the engine's performance.

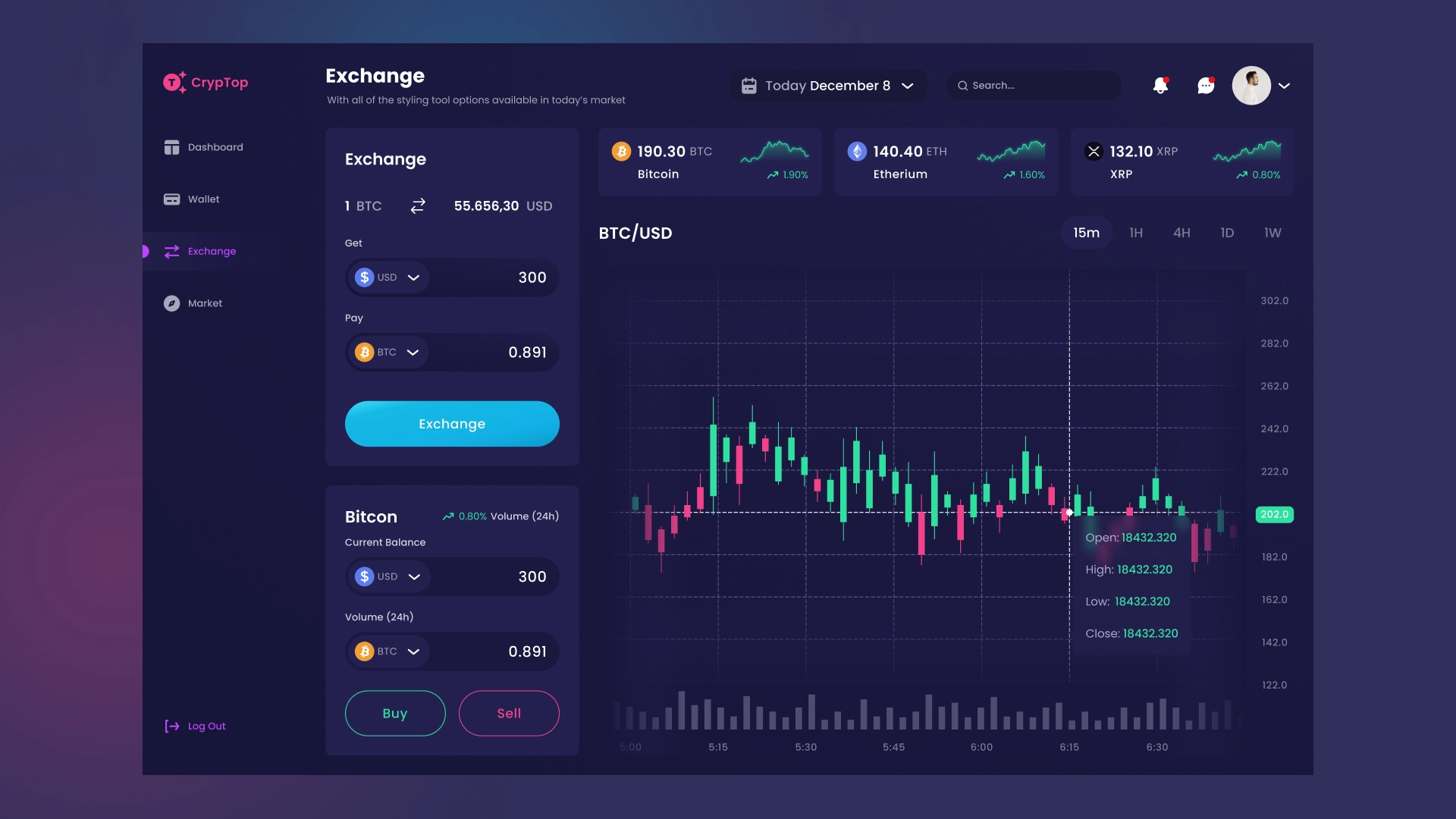

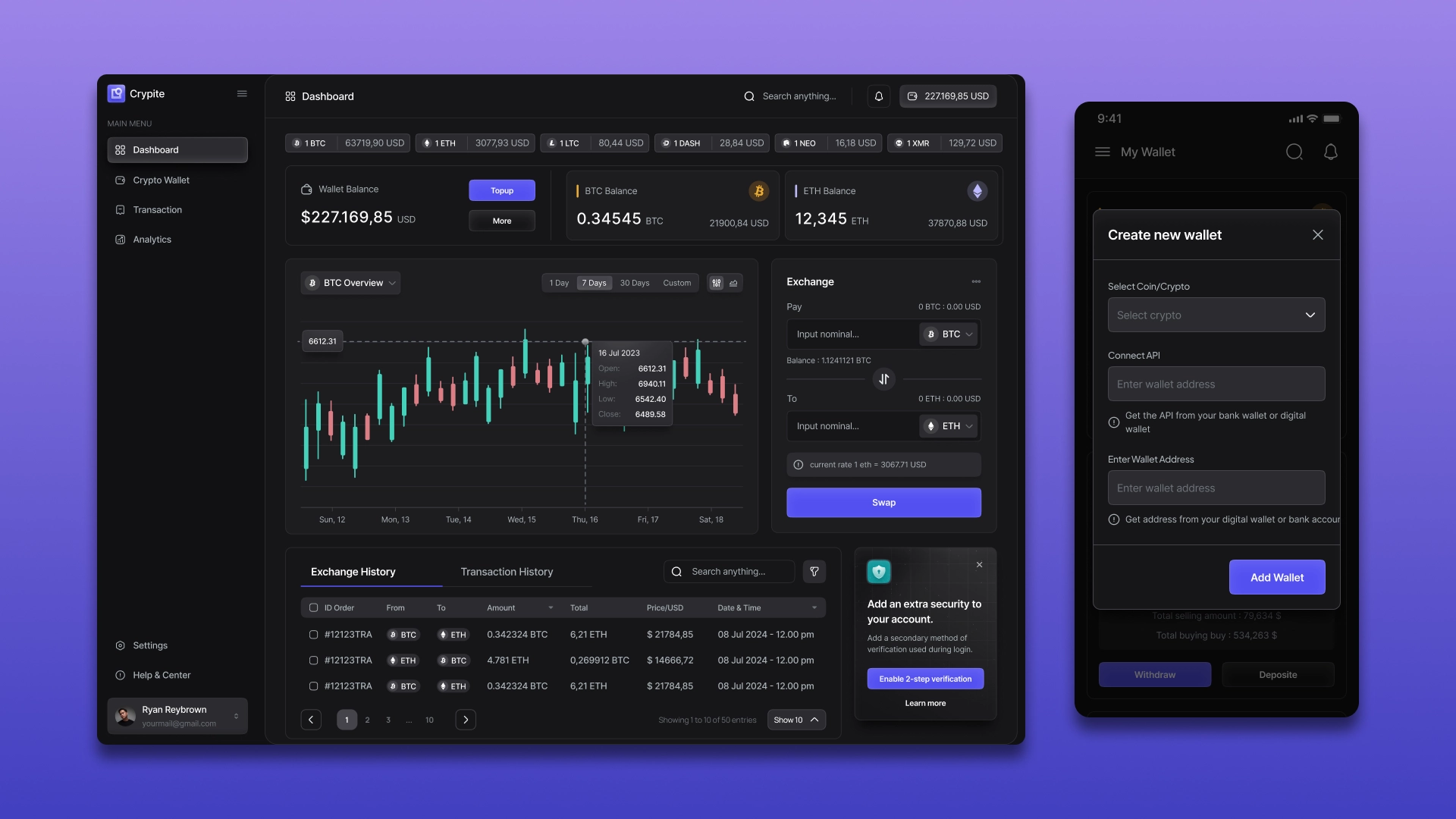

Development of a trading platform

This is software that allows traders to manage their own accounts and open orders.

Such a platform consists of several mandatory parts that are interconnected:

- server part with a trading engine;

- trading terminals;

- Various services, APIs, and integrations that provide user convenience and open up new opportunities for using the exchange.

The more convenient and functional the trading platform, the greater the chances of successful promotion of the crypto exchange.

Liquidity aggregator

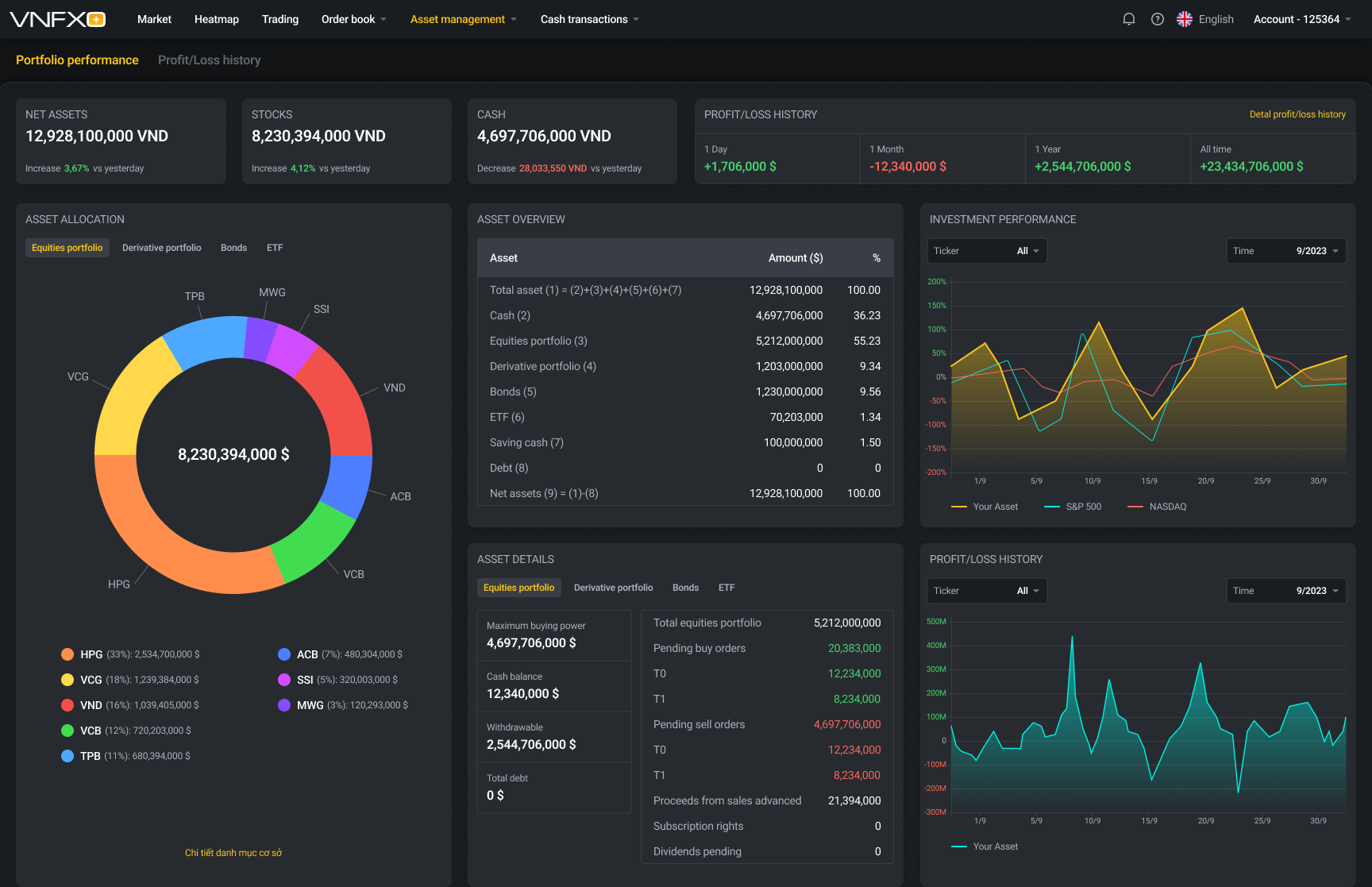

Liquidity is one of the key metrics of a crypto exchange. It shows how quickly a user's asset can be converted into the desired currency.

For example, a user wants to buy 3 BTC, and at the time the order was placed, the price per coin was $54,000. If the liquidity indicator is low, they could buy the first BTC for the same $54,000, and the remaining two for $54,300.

For comparison, on a highly liquid exchange, he could have bought BTC at $54,100 and would have lost $200 instead of $600.

Obviously, the second time a person will prefer to make transactions on a more liquid platform, which will lead to the loss of a client.

The liquidity aggregator is designed to prevent such situations. It allows you to add external providers and market-making algorithms to the system, which will shoulder the risks, thereby increasing your exchange's liquidity.

Development of wallets

Wallets allow users to store, deposit, and withdraw funds. This functionality requires a high level of security to prevent fraudulent activity.

If you want to work not only with cryptocurrency pairs but also with fiat, you will also need to develop fiat gateways and integrate them with payment systems.

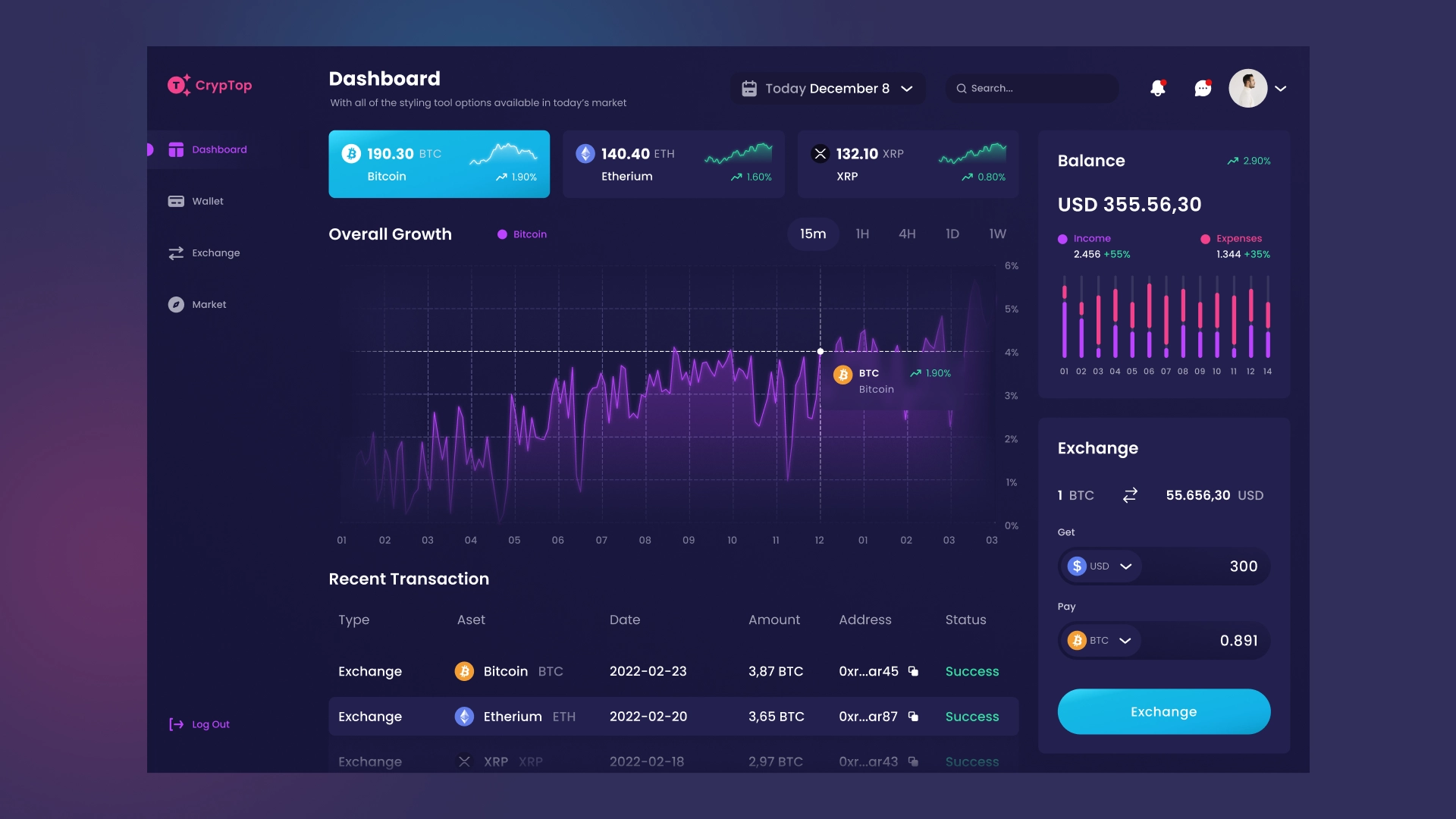

Development of a user personal account

The user account is a platform where traders can track and manage all their financial flows.

Website and application development

One of the key components of a crypto exchange is its website, with a user-friendly interface and attractive design. It should load quickly and function correctly on various devices: PCs, tablets, and phones.

Additionally, a mobile app can be developed to simplify user interaction with your exchange and help you popularize the platform.

Where to develop a cryptocurrency exchange?

Creating a crypto exchange is a complex project that requires a team of developers with experience and a sufficient level of technical training.

The CryptonisLabs team utilizes a cutting-edge technology stack and specializes in creating high-load IT solutions. We will develop and provide ongoing technical support for crypto exchanges of any scale.