Smart contracts for ICO, IDO, and DAO projects

CryptonisLabs develops smart contracts for ICO, IDO, and DAO projects that help securely attract investments and conduct token sales. We automate fundraising, token distribution, and voting so that projects can be managed transparently and gain the trust of investors.

What ICO, IEO, IDO, and DAO Are in Simple Terms

ICO (Initial Coin Offering) is a way to raise investments in which a project sells its tokens directly to investors. For this purpose, an ICO smart contract is used, which automatically accepts funds and distributes tokens among participants.

IEO (Initial Exchange Offering) is a token sale format conducted through a centralized crypto exchange. The exchange acts as an intermediary between the project and investors, and the sale process itself is also based on a token sale smart contract.

IDO (Initial DEX Offering) is a token sale conducted through decentralized exchanges or specialized launchpad platforms. This format requires the development of smart contracts and IDO infrastructure that ensure proper token launch, investor access control, and subsequent liquidity on DEXs.

DAO (Decentralized Autonomous Organization) is a project governance model in which decisions are made by the community. Participants vote on the project’s development, and all governance and voting processes are implemented through smart contracts.

Why Reliable Smart Contracts Are Important for Attracting Investments

During token sales, DAO launches, and the development of launchpad platforms, smart contracts are responsible for fundraising, token distribution, and voting. Errors or vulnerabilities in the code can lead to the loss of investments and a decrease in trust in the project. Therefore, a reliable token sale contract and audited smart contracts are the foundation of secure fundraising and the successful development of a crypto project.

Smart Contracts for ICO / IDO / IEO

Token Sale Contracts (Crowdsale Contracts)

We develop smart contract solutions for launching ICO, IEO, and IDO token sales, providing clear and automated token sale logic. These contracts allow projects to securely collect investments, distribute tokens, and launch sales stages while taking into account all project parameters.

Configuration of All Key Parameters

- Price, limits, and sales stages. Smart contracts allow flexible configuration of token prices, minimum and maximum purchase amounts, and the logic of the token sale. The sale can take place in several stages: Private Sale – a closed round for early investors with special conditions and more favorable pricing, and Public Sale – an open stage available to all participants under predefined conditions.

- Whitelist and access management. CryptonisLabs implements a whitelist system that allows investors to be registered and verified in advance before participating in a token sale. This makes it possible to control access to token purchases, comply with sale requirements, and restrict participation to approved users only.

Support for Multiple Tokens and Currencies

Our solutions support working with various assets: ETH, BNB, USDT, and other tokens – you can easily configure sales in multiple cryptocurrencies simultaneously.

Integrations with Launchpads, DEXs, and KYC/AML Modules

We create smart contracts with integrations to launchpad platforms and DEXs, as well as trusted KYC/AML solutions, which increases security and regulatory compliance.

Additional Security Features

The contracts include important risk management mechanisms:

📌 refund and cancellation functions,

📌 emergency stop functionality,

📌 pausable modes for rapid response to threats.

Vesting, Staking, and Distribution Contracts

CryptonisLabs creates smart contracts for reliable token distribution, ensuring transparency and security for all transactions. We automate phased token unlocking (vesting), reward accrual for token locking (staking), and bonus token distribution (airdrop) so that investors, the team, and project participants receive tokens strictly according to predefined rules.

Token Distribution Contracts

CryptonisLabs develops smart contracts for secure and transparent distribution of tokens among investors, the team, and project partners. All distribution rules are embedded in the code in advance, eliminating manual management and increasing user trust.

Vesting – Phased Token Unlocking

We create vesting smart contracts that automatically manage token unlock schedules for investors and founders. This helps protect the project from sudden token sell-offs and ensures long-term commitment from all participants to the ecosystem’s development.

Staking – Rewards for Token Locking

CryptonisLabs implements staking smart contracts that allow users to lock their tokens and receive rewards for participating in the project ecosystem. Reward conditions, lock-up periods, and interest rates are fully configurable according to the project’s business logic.

Airdrop and Claim Mechanisms

We also develop airdrop smart contracts that automatically distribute tokens to users. In addition, claim functions are implemented through a convenient interface, allowing participants to independently receive their tokens without administrator involvement.

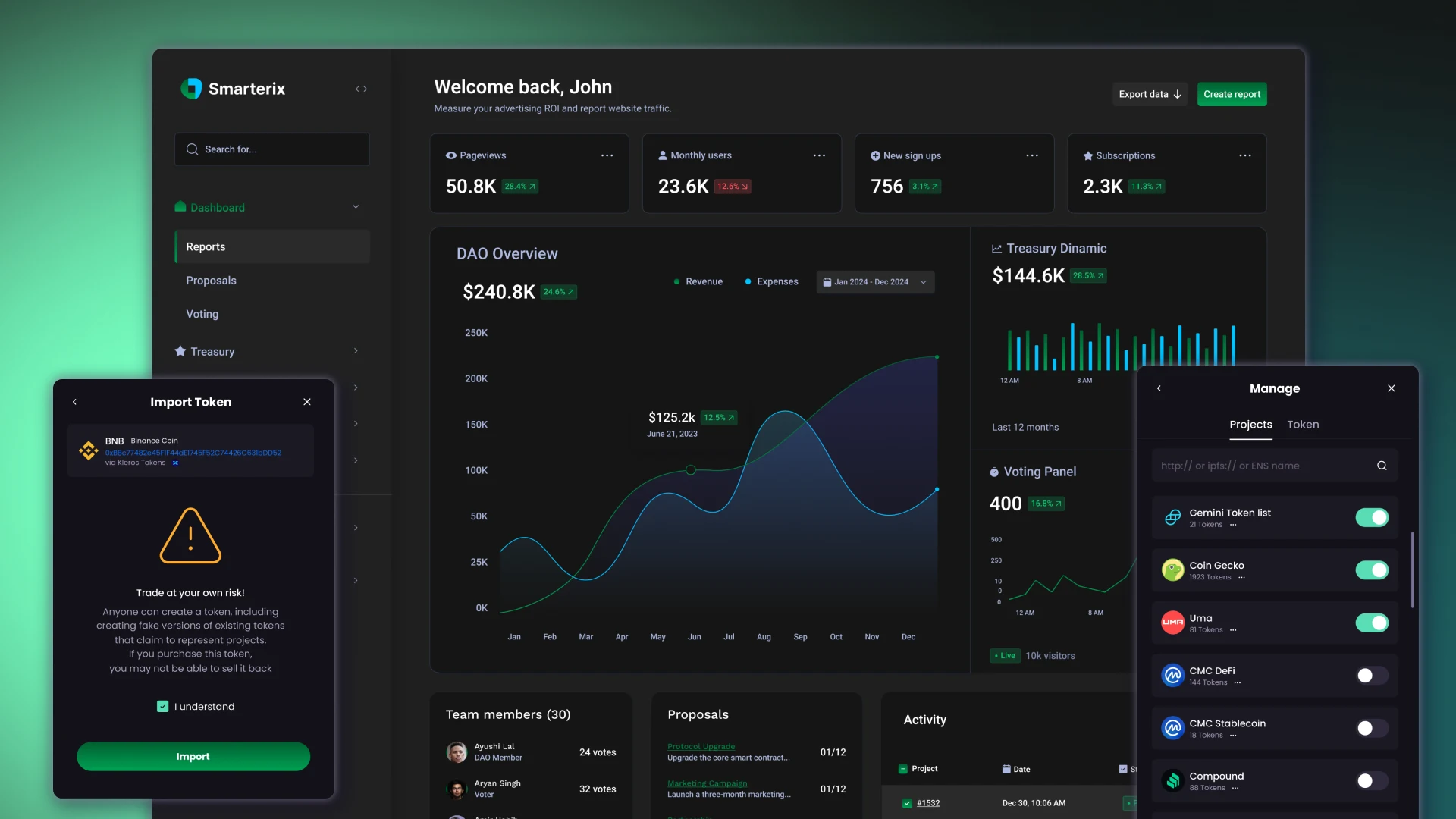

DAO and Governance Contracts

CryptonisLabs develops smart contracts for creating secure and transparent decentralized autonomous organizations (DAOs), enabling communities to make decisions without intermediaries. Our smart contracts ensure DAO operational stability, fund protection, and convenient process control for both the team and participants.

DAO Automation

We develop DAO smart contracts that structure project governance: proposal processing, quorum calculation, resource allocation, and treasury management are all executed automatically without manual intervention.

Voting and Token Governance

With voting smart contracts and governance token integration, participants can easily take part in decision-making. Every vote is counted fairly and transparently, and the project gains a reliable mechanism for controlling each participant’s influence.

Delegation and Shared Governance

We implement vote delegation features and multi-signature decision approval, allowing responsibility to be distributed, decision-making processes to be accelerated, and the risk of management errors in DAO operations to be reduced.

Governance Tokens

CryptonisLabs implements support for governance tokens, which give participants the ability to influence project decisions. Using these tokens, holders can vote on proposals, participate in resource allocation, and manage DAO development, with all processes fully automated through smart contracts.

Application in DeFi and Launchpad Projects

In today’s crypto world, a project’s success depends on flexibility and integration with the DeFi ecosystem – decentralized financial protocols that enable token management, exchanges, and liquidity without intermediaries. CryptonisLabs helps companies organize fundraising through DeFi by integrating smart contracts with decentralized exchanges, liquidity pools, and staking mechanics.

- Integrations with DeFi Protocols

We create smart contracts for working with decentralized exchanges (DEXs) and liquidity pools, enabling projects to securely perform token swaps and manage capital.

- Contracts for Launchpads and IDO Platforms

Smart contracts for launchpad platforms (token sale services), IDO projects, and investment portals automate token sales, fund distribution, and participant access control, making the process transparent and secure.

- Multi-Blockchain Support

Our solutions operate across multiple networks – Ethereum, BNB Smart Chain, Polygon, Solana, and TON – allowing projects to scale and attract investors on all popular platforms.

Audit and Security

In the crypto world, a single smart contract error can cost millions. CryptonisLabs builds reliable solutions that protect tokens and investments by combining advanced auditing methods, testing, and automated security mechanisms.

- Security Mechanisms

We implement proven solutions that prevent token reselling, replay attacks, and other common threats. This allows investors to be confident in the safety of their funds, while projects can securely manage their tokens.

- Pre-Launch Audit

For each project, CryptonisLabs offers a detailed smart contract audit before launching a token sale. We check the code for vulnerabilities, compliance with business logic, and security standards to minimize risks for both investors and the team.

- Testing and Development Tools

CryptonisLabs uses unit testing and professional frameworks such as Hardhat and Foundry for comprehensive contract verification. This ensures stable operation and helps identify issues at early development stages, ensuring the reliability of the entire project.

Implementation Examples

Crypto projects of any size can effectively use smart contracts to attract investments and manage communities without being global DeFi giants.

1) IDO Platform Example: Polkastarter

What it is:

Polkastarter is one of the leading decentralized IDO platforms, operating across multiple blockchains, including Ethereum and Binance Smart Chain. It allows projects to conduct initial token sales through pool-based mechanisms, ensuring fair distribution.

Technical implementation:

The platform uses pool contracts for organized token distribution: participants connect a wallet (for example, MetaMask), deposit funds into the IDO contract, and receive tokens proportionally to their participation. Polkastarter smart contracts provide automated sale logic, including whitelist checks, participation limits, and instant distribution after the round ends.

What it delivered to clients:

Projects on Polkastarter gained fast access to an investor community and raised significant funds for launch. Investors were able to participate in token sales without complex centralized procedures and trust contracts that perform distribution automatically.

2) DAO Platform Example: MakerDAO

What it is:

MakerDAO is one of the most well-known decentralized autonomous organizations (DAOs) in the DeFi world. It manages the issuance of the DAI stablecoin and makes decisions on its parameters through governance token holder voting.

Technical implementation:

MakerDAO is built on Ethereum and uses a complex system of smart contracts that manage DAI creation (via overcollateralized loans), risk parameter systems, and protocol governance. MKR token holders participate in on-chain voting, where decisions are implemented automatically through DAO smart contracts.

What it delivered to clients:

MakerDAO became a resilient DeFi ecosystem where automated governance enabled the creation of the DAI stablecoin with a market capitalization of billions of dollars while maintaining decentralized decision-making. This strengthened participant trust and laid the foundation for further growth of DeFi protocols.

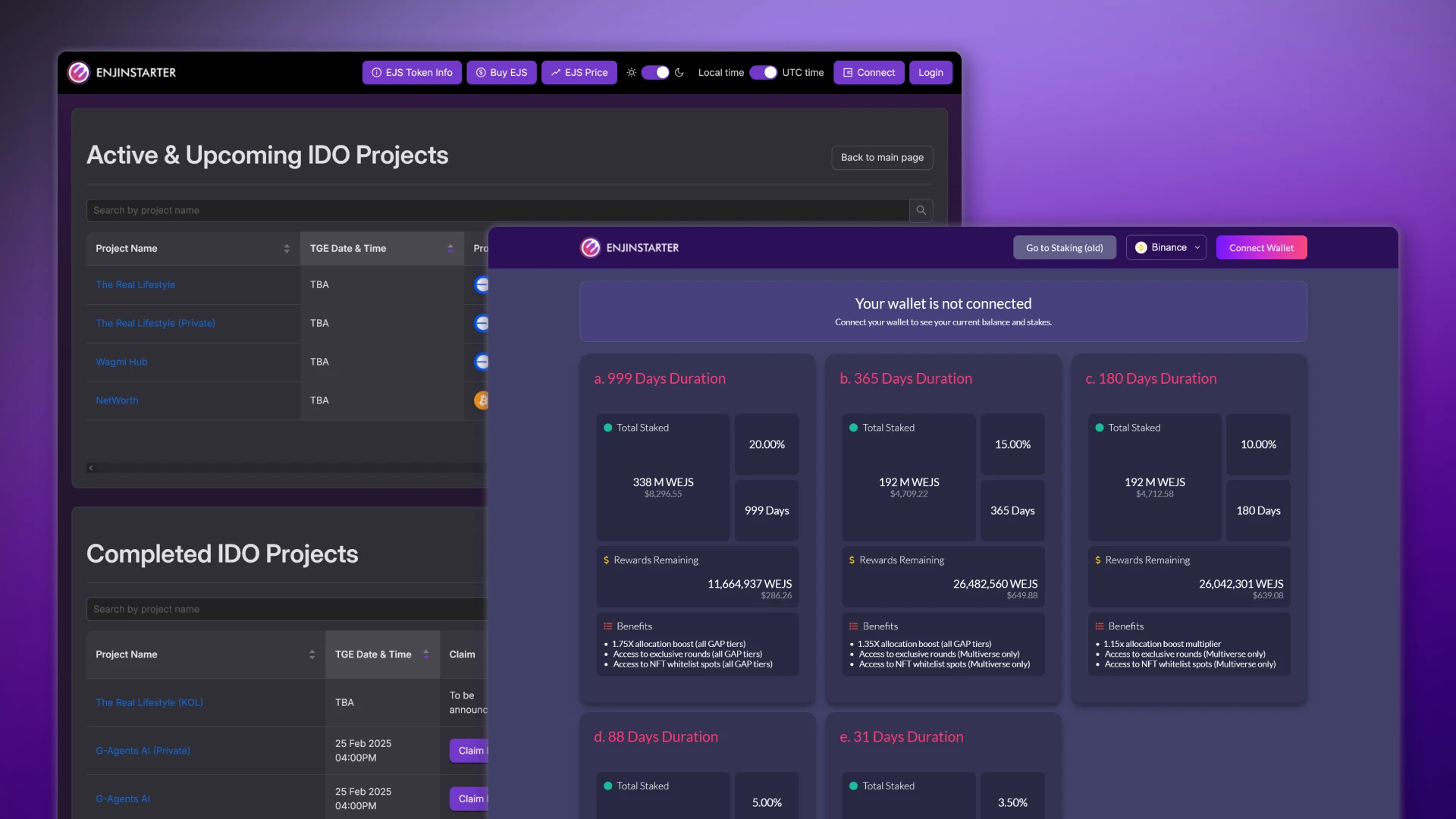

3) IDO Platform Example: Enjinstarter

What it is:

Enjinstarter is a multichain IDO launchpad focused on Web3, GameFi, and NFT projects, supporting multiple networks and offering flexible conditions for startups.

Technical implementation:

The platform developed smart contracts that manage investor participation (staking EJS tokens to gain access), token distribution, manipulation protection, and automatic execution of logic after the round ends. This mechanism ensures equal access to IDOs and automated distribution without intermediaries.

What it delivered to clients:

Enjinstarter helped many projects raise early-stage funding by providing structured access to capital and strengthening investor communities. Multichain support expanded the pool of potential participants, increasing audience reach.

CryptonisLabs Expertise

CryptonisLabs is a technical partner for Web3 projects that value predictability, security, and controllability of blockchain solutions. We do not limit ourselves to developing individual smart contracts but design holistic architectures for IDO and DAO platforms, taking into account business logic, scalability, and security requirements.

Our team has practical experience with token sales, DAO governance, and DeFi integrations, allowing us to anticipate risks, bottlenecks, and growth scenarios in advance. This enables us to deliver solutions ready for real-world use rather than experimental prototypes.

We support projects at all stages – from selecting a fundraising format and designing smart contracts to implementation, testing, and further platform development. This approach reduces technical and operational risks and allows teams to focus on the product and community rather than blockchain infrastructure complexity.

Discuss your project’s architecture and objectives with CryptonisLabs experts during a free consultation.

FAQ

-

Is launching an ICO, IDO, or DAO suitable for small and medium-sized businesses?

Yes, these solutions are suitable not only for large DeFi projects. Small and medium-sized businesses can use smart contracts to raise investments, launch tokens, and manage communities without complex infrastructure or large teams. CryptonisLabs adapts the architecture to the scale and goals of each specific project.

-

How does IDO differ from ICO, and which format should be chosen?

ICO is a direct token sale to investors, while IDO is conducted through decentralized exchanges or launchpad platforms. IDOs usually provide faster token launches and access to an existing investor audience. We help select the appropriate format and develop smart contracts for the chosen fundraising model.

-

Can investor access be restricted and token sales controlled?

Yes. We implement whitelists, purchase limits, Private Sale and Public Sale stages, as well as KYC/AML support when required. This allows projects to control who participates in the token sale and under what conditions, reducing risks and ensuring compliance.

-

How secure are smart contracts, and what do you do to protect funds?

Security is our top development priority. We implement protection against replay attacks, emergency contract stops, refund functions, and conduct audits and testing before launch. This helps minimize the risk of fund loss and increases investor confidence.

-

Can a project be scaled and operate across multiple blockchains?

Yes. CryptonisLabs develops solutions with support for popular networks – Ethereum, BNB Smart Chain, Polygon, Solana, and TON. This enables projects to scale, attract investors from different ecosystems, and flexibly evolve as the business grows.