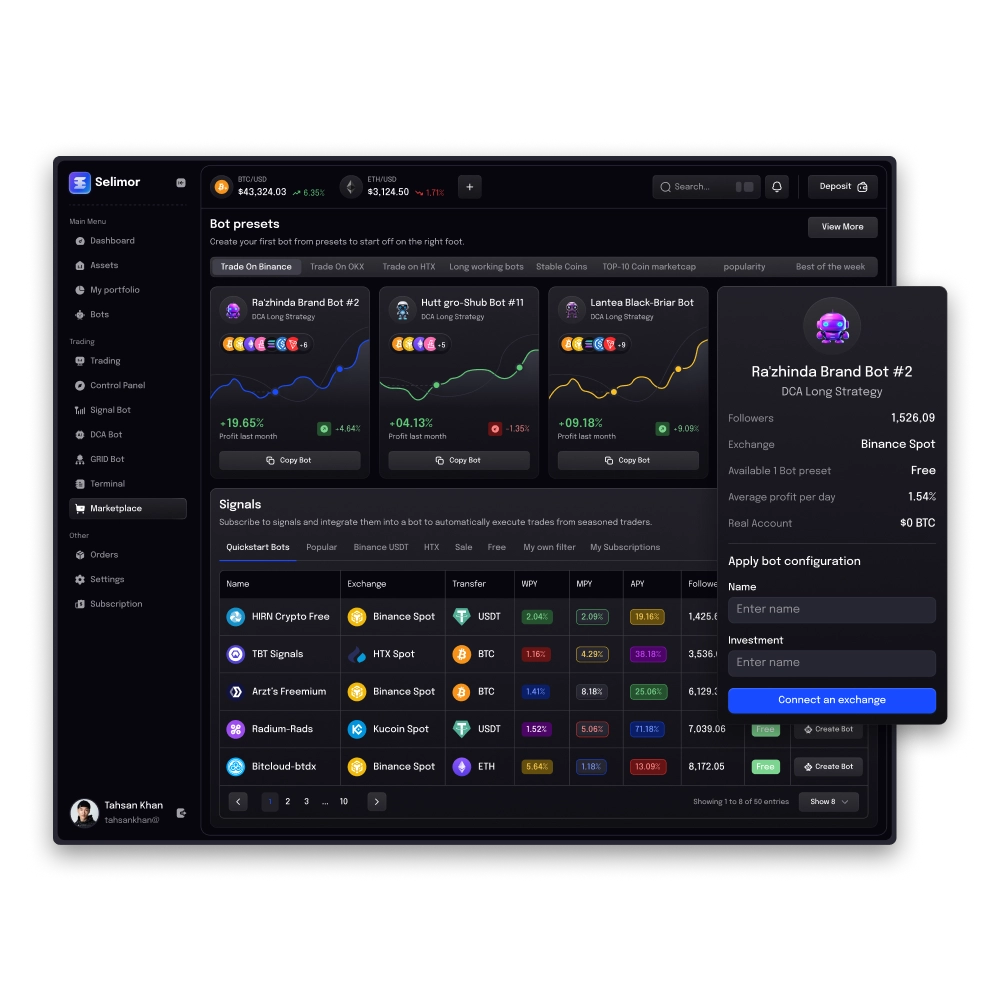

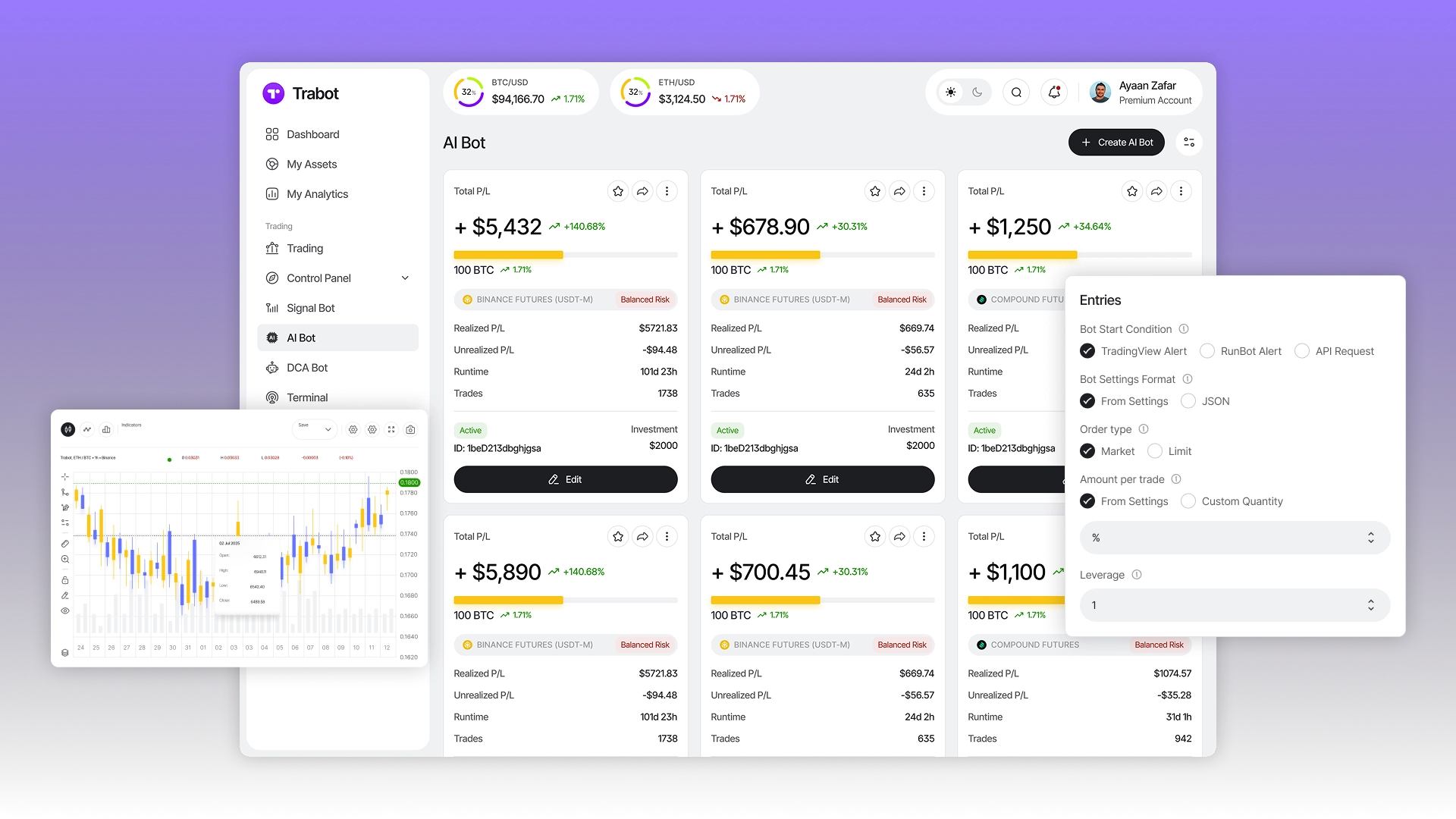

Trading bots

Services

For trading on the Binance

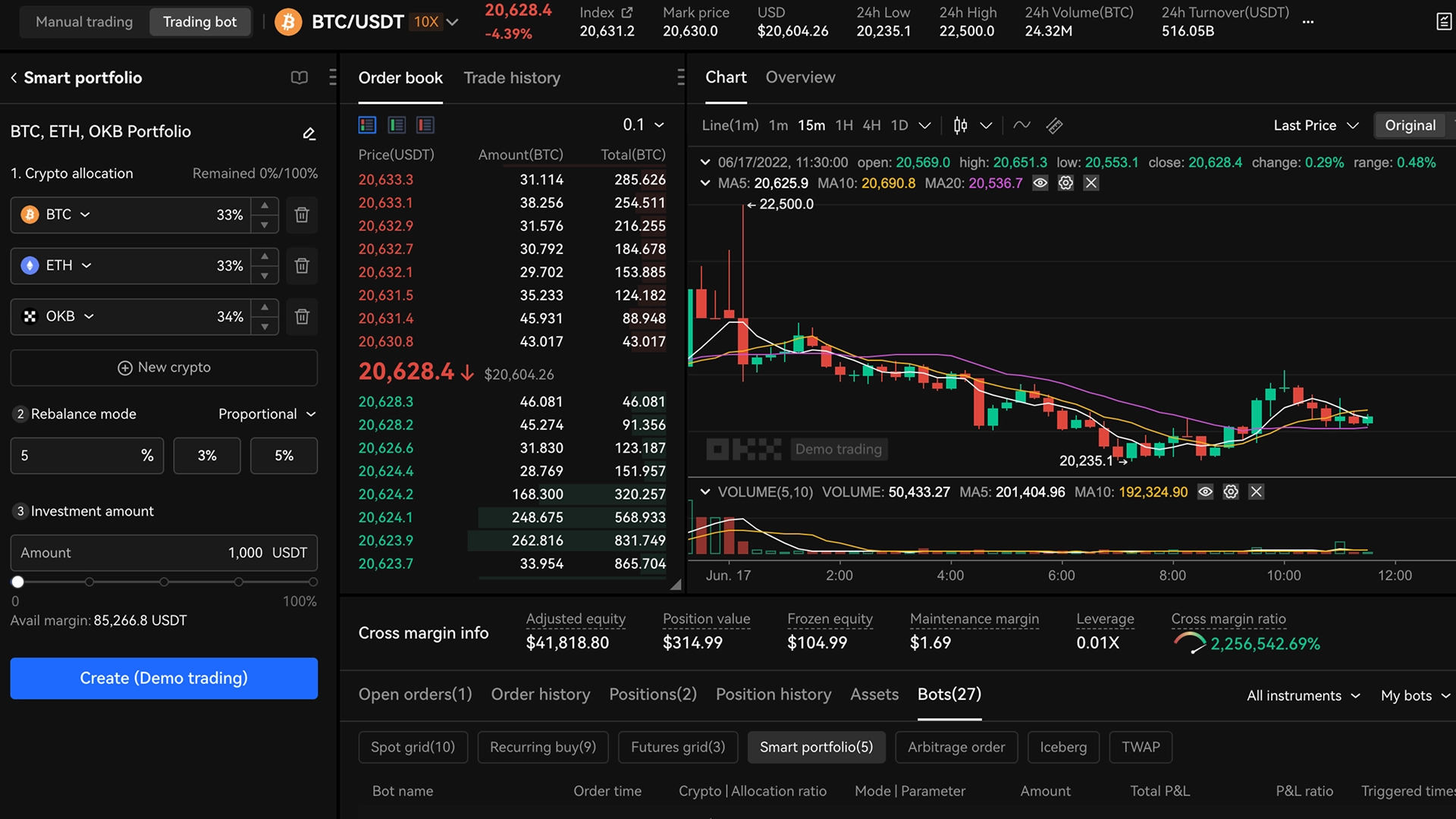

For trading on the OKX

For trading on Whitebit

Copy-Trading platforms and turnkey bots

Grid Trading Bot

Arbitrage bots for cryptocurrency exchanges

Trading Bot Development: Customized Solutions for Trading Stocks, Forex, and Cryptocurrency Markets

Manual trading on trading platforms requires constant monitoring, analyzing vast amounts of data, and meticulously following numerous rules. Mistakes caused by fatigue or emotion are costly.

A high-quality crypto bot automates all key processes: instant trade execution, a rigorous decision-making algorithm, and 24/7 operation without human intervention. It's a tool that transforms a strategy into a systematic and predictable source of profit.

Developing custom trading bots for crypto exchanges is a field CryptonisLabs has been working in for many years. We create custom IT solutions that operate using various algorithms, including 24/7 operations, and execute instant trades under the most favorable conditions through a multi-stage analysis of market dynamics across a variety of parameters. Our proven algorithms, product adaptability, and team's industry expertise are the key to the success of our clients' strategies and stable income.

Examples of our recent work in this and related areas are available in our Portfolio. You can ask any questions you may have, or learn how to scale your strategies, turning them into a 24/7 source of profit, and gain stress-free control over your results here.

What is a trading bot?

When trading on cryptocurrency trading platforms, some rely on the RSI (relative strength index), others on the on-balance volume indicator (OBV), and still others rely on their intuition. Whatever your method, cryptocurrency trading bots are a tool that will simplify your work, increase its efficiency, save time, and minimize human error risks.

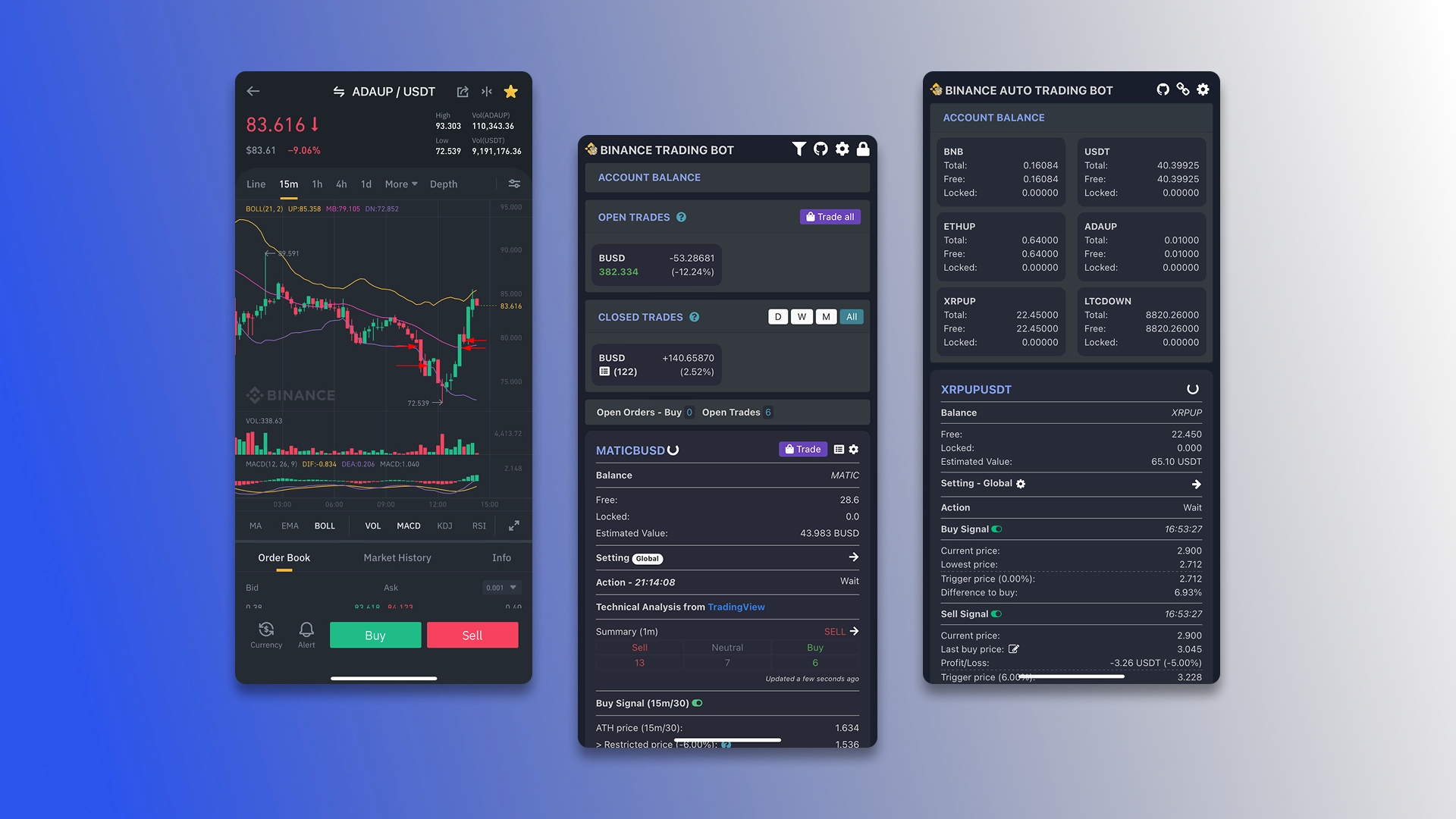

A crypto trading bot is a software solution that automates trading by executing trades according to preset algorithms. The software analyzes the market on target exchanges, monitors signals and indicators, instantly reacts to fluctuations, and manages capital according to predefined rules. The system makes decisions on asset buy and sell based on data including the number of orders, time, trading volumes, and prices. The bot is capable of quickly processing huge amounts of data.

How does a trading bot work?

The software utilizes various algorithms: technical analysis (RSI, MACD, moving averages, etc.), arbitrage strategies, grid orders, and so on, depending on the results you're interested in and the trading methods you employ. There are two types of these tools.

1. Software for autonomous trading without human intervention

A cryptocurrency bot can fully automate trading. For example, it "sees" that the price of a target asset has risen above a moving average, and if this is a buy signal according to its settings, it automatically places an order on the exchange, locks in profits if the price rises, and sets a stop-loss to protect capital.

2. Bots for data collection and evaluation

There are also types of software that assist in decision making. The following functions can be performed by the system:

- Real-time market analysis. The software informs traders about key events, monitoring charts, indicators, and news. It then sends signals to traders when the price breaks a resistance level, the RSI indicator indicates an asset is overbought/oversold, trading volume increases sharply, etc.

- Data filtering. The crypto bot can filter out information noise, making it easier to spot significant changes, compare various indicators, and alert you to matches (for example, if the RSI and MACD simultaneously indicate a buy signal, etc.).

- Strategy testing. We develop products that can test a strategy on historical data—reporting its performance over the past months/years, displaying statistics on returns, risks, drawdowns, and more.

- Scenario modeling. Our cryptocurrency trading bots are capable of forecasting future events. This means that traders receive not just a summary of the facts, but ready-made scenarios and probabilities. For example, if the price falls by 5%, strategy "X" yields a potential upside of XX%; if a support level is broken, a downtrend is possible with a YY% probability, and so on.

All these options allow traders to see the picture more clearly, relying on objective data rather than emotion, react faster, and test hypotheses without risk. Unlike fully automated algorithms, this software leaves the final decision up to you rather than making it itself. It can send signals to Telegram, Discord, and other services.

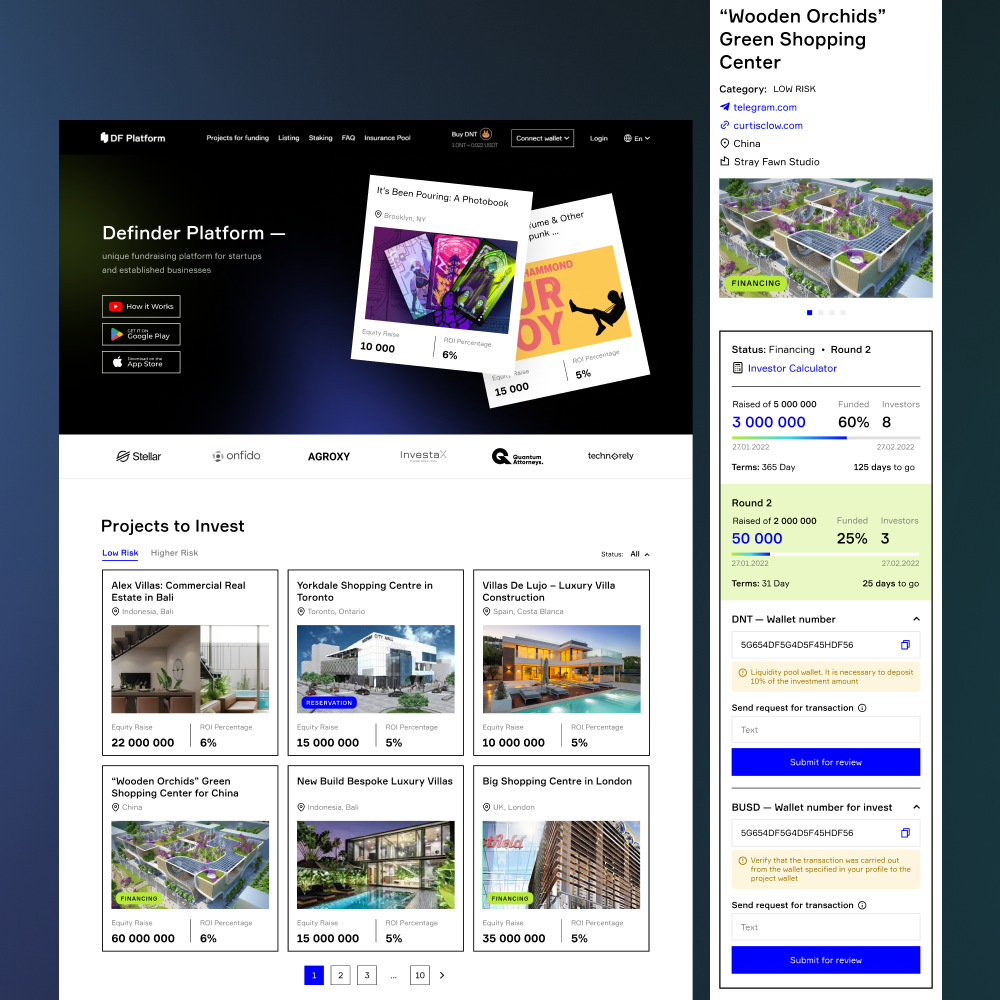

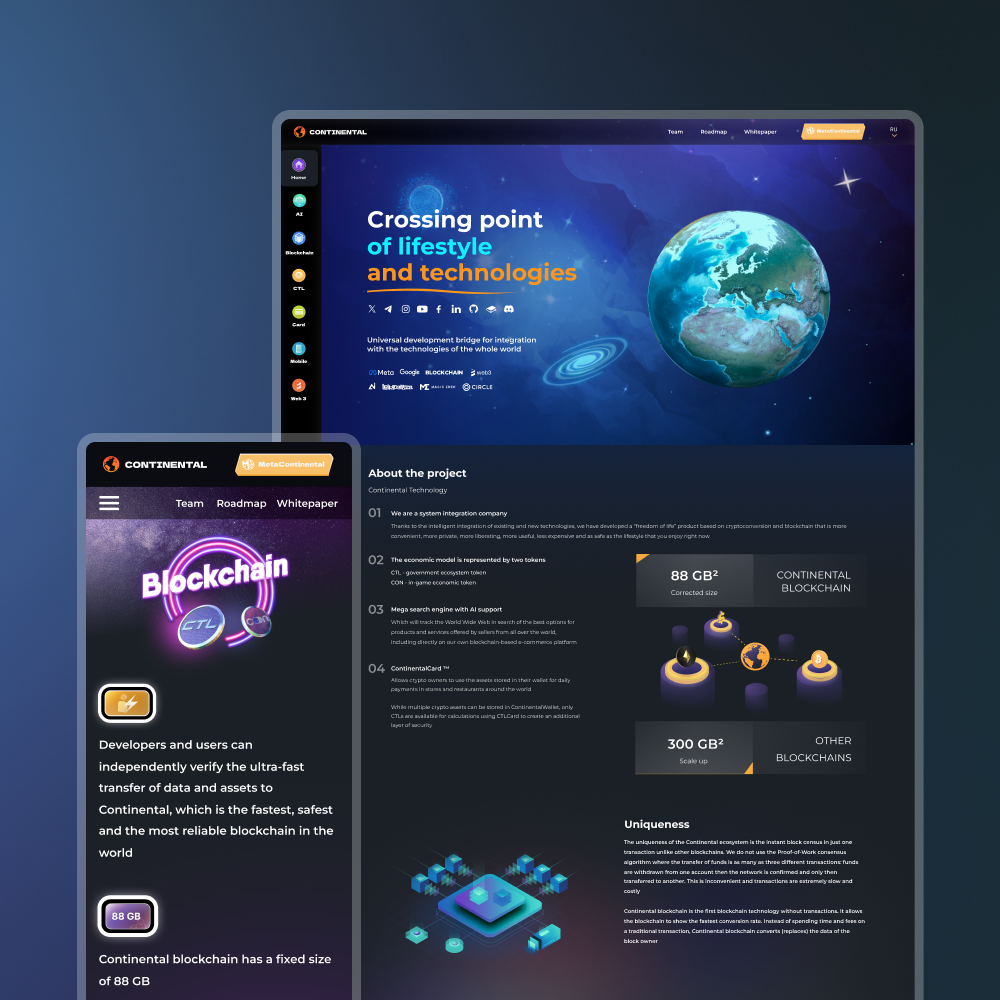

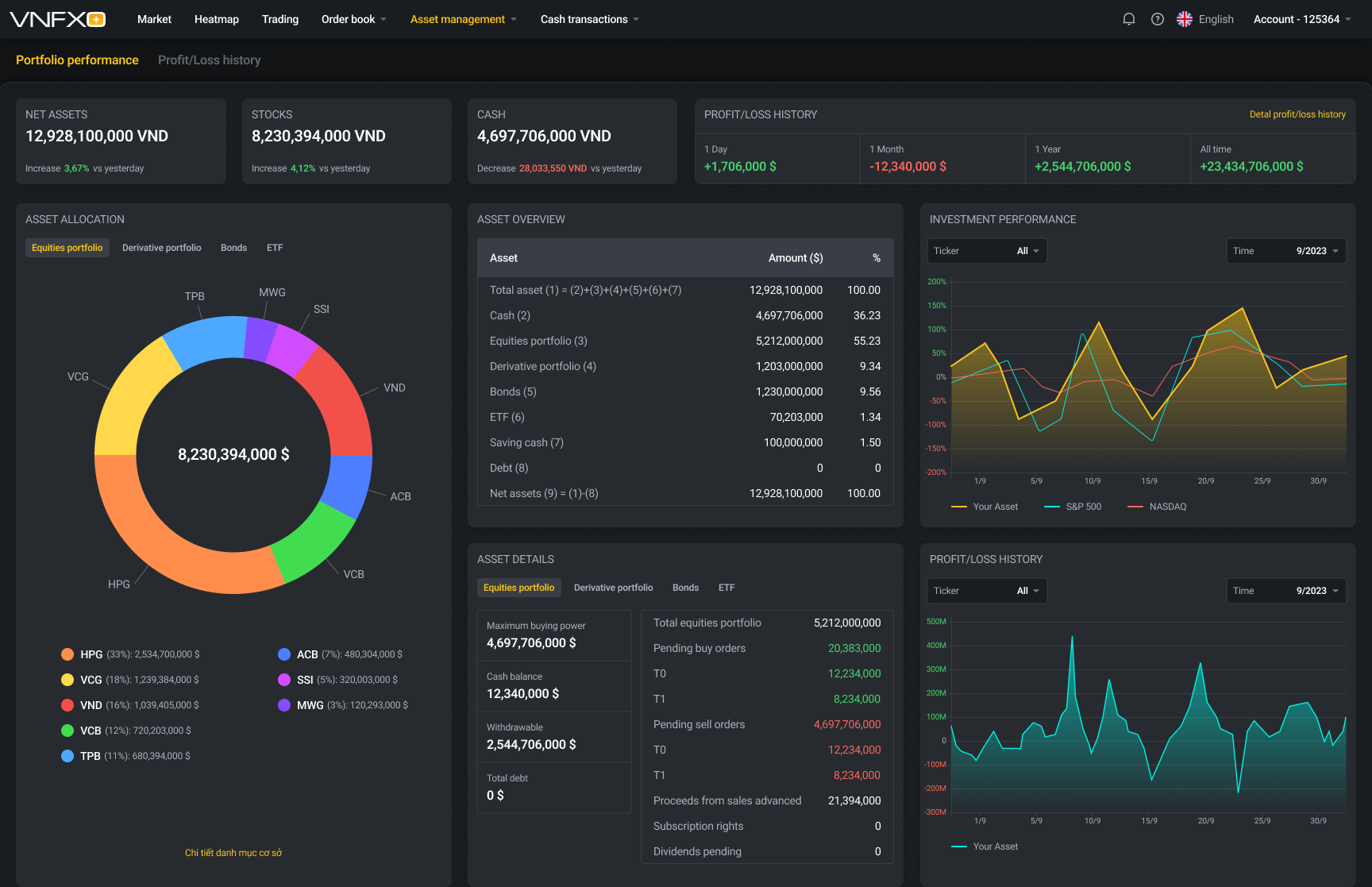

In addition to trading droids and bots, we also develop related tools. For example, our portfolio includes a mobile non-custodial crypto wallet and a web-based cryptocurrency investment platform. We can also implement other functionality that will be useful for both individual traders and corporate organizations.

Why is ordering a trading bot development profitable?

Modern financial platforms place high demands on traders – successful trading requires quick reactions, in-depth analysis of dozens of parameters, and emotional stability. With an automated trading system, you don't need to constantly monitor the market, stress over missed opportunities, independently assess the significance of news, or compare indicators and price fluctuations.

Missed signals, fatigue, and the inability to stay in front of a monitor 24/7 lead to stress and lost profits. With a quality tool, all these problems are eliminated.

What are the benefits of using bots for trading on exchanges?

- Automate your routine. The software runs 24/7, without errors, emotions, or interruptions, allowing you to fully exploit the market's potential, even while you're sleeping or busy.

- Speed and accuracy. The algorithm reacts to market changes in seconds, which is especially valuable when trading on volatile exchanges.

- Eliminate human error. Your income isn't dependent on emotions, hasty decisions, or poor information—the program operates according to a precise algorithm, strictly adhering to the chosen strategy and taking into account the current market situation.

- Analytics and accountability. The bot records results and maintains reports, allowing you to adjust your strategy and increase revenue based on real, up-to-date data. This software provides up to 90% accuracy thanks to various options, including approximation of collected data and price forecasting.

With the right approach and high-quality technical execution, a cryptocurrency trading bot can pay for itself within 1-3 months, significantly increasing competitiveness in this market.

The CryptonisLabs team develops cryptocurrency trading bots, adapting these tools and their functionality to each client's individual strategies, platforms, and trading style. These range from simple scalping algorithms to complex arbitrage and trend analysis systems.

Who is the custom trading bot development service suitable for?

The creation of custom software for trading on crypto exchanges is relevant for all financial market participants:

- Investors seeking to achieve a stable passive income – proven algorithms allow you to make a profit without having to monitor the market 24/7;

- private traders who want to scale their strategies – automation of routine operations frees up time for strategy optimization;

- Hedge funds and financial companies – customized solutions simplify the integration of successful strategies into corporate processes, minimizing risks and increasing trading accuracy;

- For cryptocurrency asset owners, trading bots provide 24/7 control and rapid response to market volatility.

A couple of decades ago, programs for trading on stock and other markets were available exclusively to hedge funds due to the high cost of creating and maintaining such software.

Today, such solutions are available to all participants, including private traders and brokers. Moreover, such systems can be implemented with a unique set of options tailored to specific strategies, trading styles, and target platforms. Monetization is also possible through SaaS platforms, commissions, marketplace formats, and more.

Custom trading bot development from CryptonisLabs addresses each client's individual needs, from optimizing personal methods to comprehensive solutions for professional companies and efficient trading scalability. These IT solutions save time, increase profitability, and help effectively manage risks.

Important. Trading bot settings can be highly precise and customized, their reactions are faster and more accurate than those of humans, they are not susceptible to fear or panic, and they can operate simultaneously on multiple markets and platforms. However, it's important to understand that an incorrectly set strategy, a lack of control and updates (the market is very dynamic), as well as gaps in the software itself or the connection to the exchange you're interested in, all carry the risk of losses. This is why it's crucial to entrust the creation of crypto trading systems only to qualified specialists.

Stages of trading bot development

We customize each trading bot to best suit the client's strategy and goals. The process involves several key stages:

1. Data collection and analysis

We define the client's trading goals and strategies. The functionality, scale, and cost of the trading bot depend on the specific tasks the system will perform (arbitrage, scalping, etc.). We also examine the client's focus markets and platforms (their APIs, limitations, fees, response times, etc.).

We develop a list of necessary solutions – order support, risk management, working with different pairs, etc. We create a specification reflecting the technical and other requirements for the future product, including deadlines, stack, and budget.

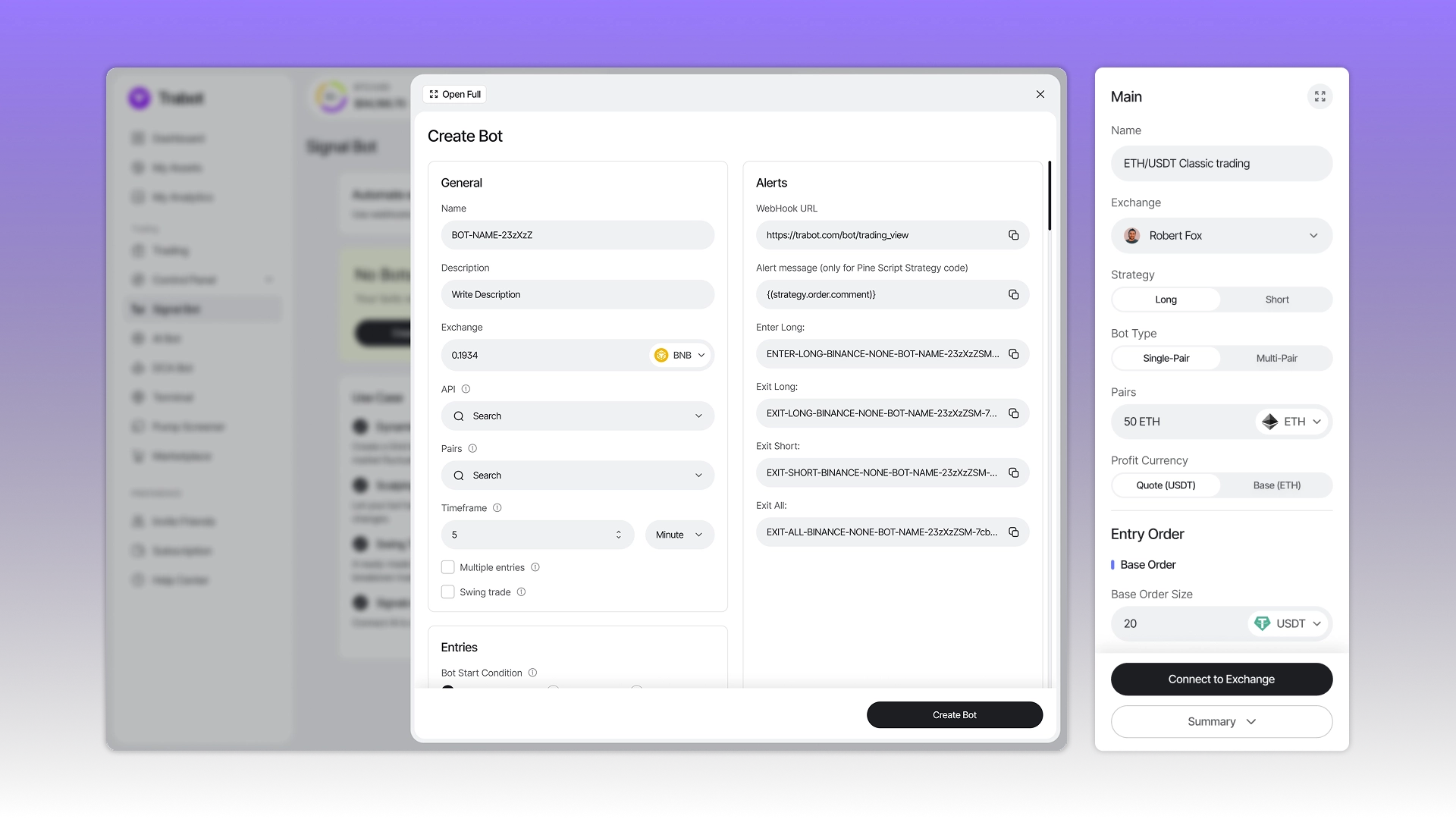

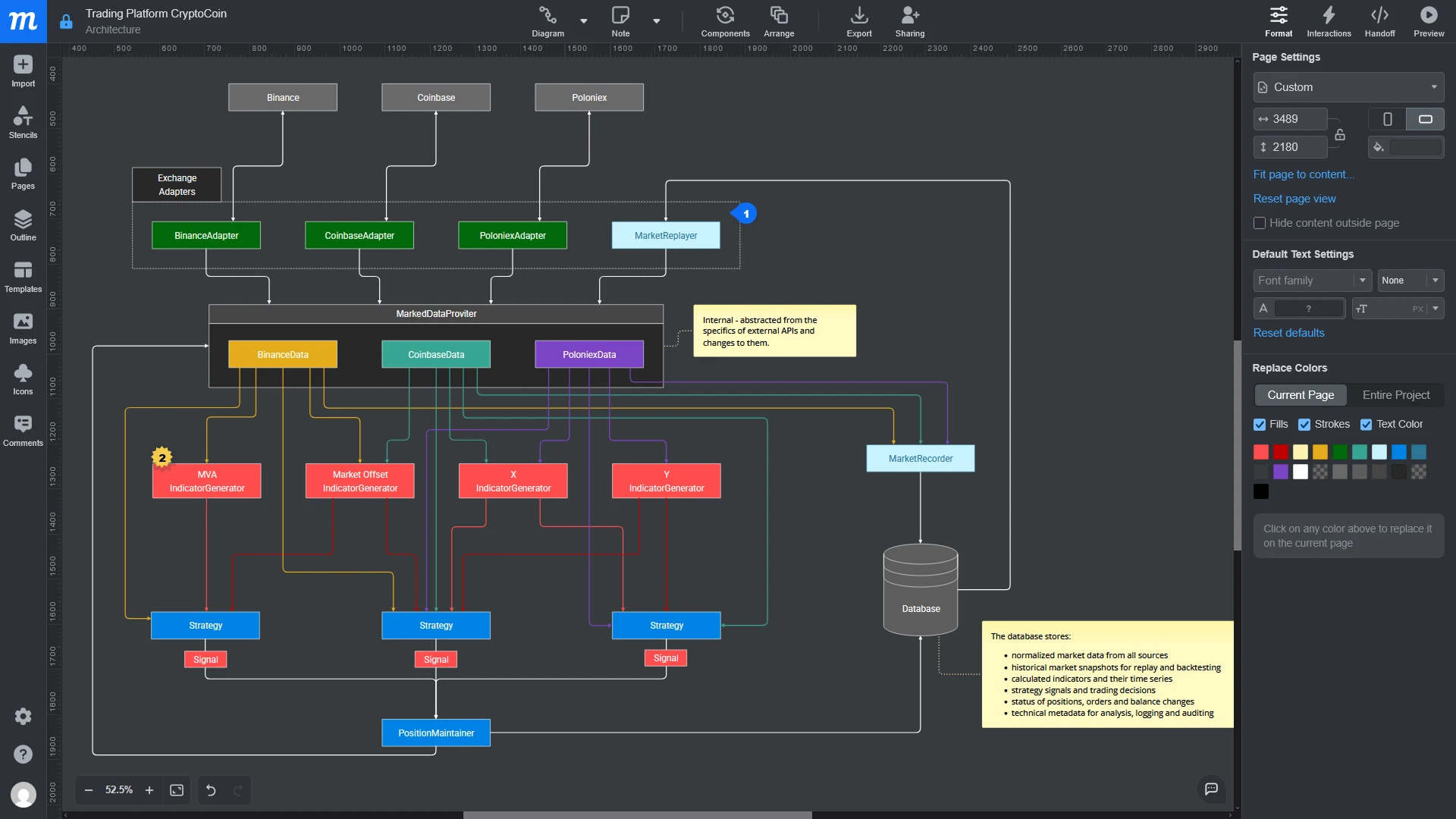

2. Architectural design

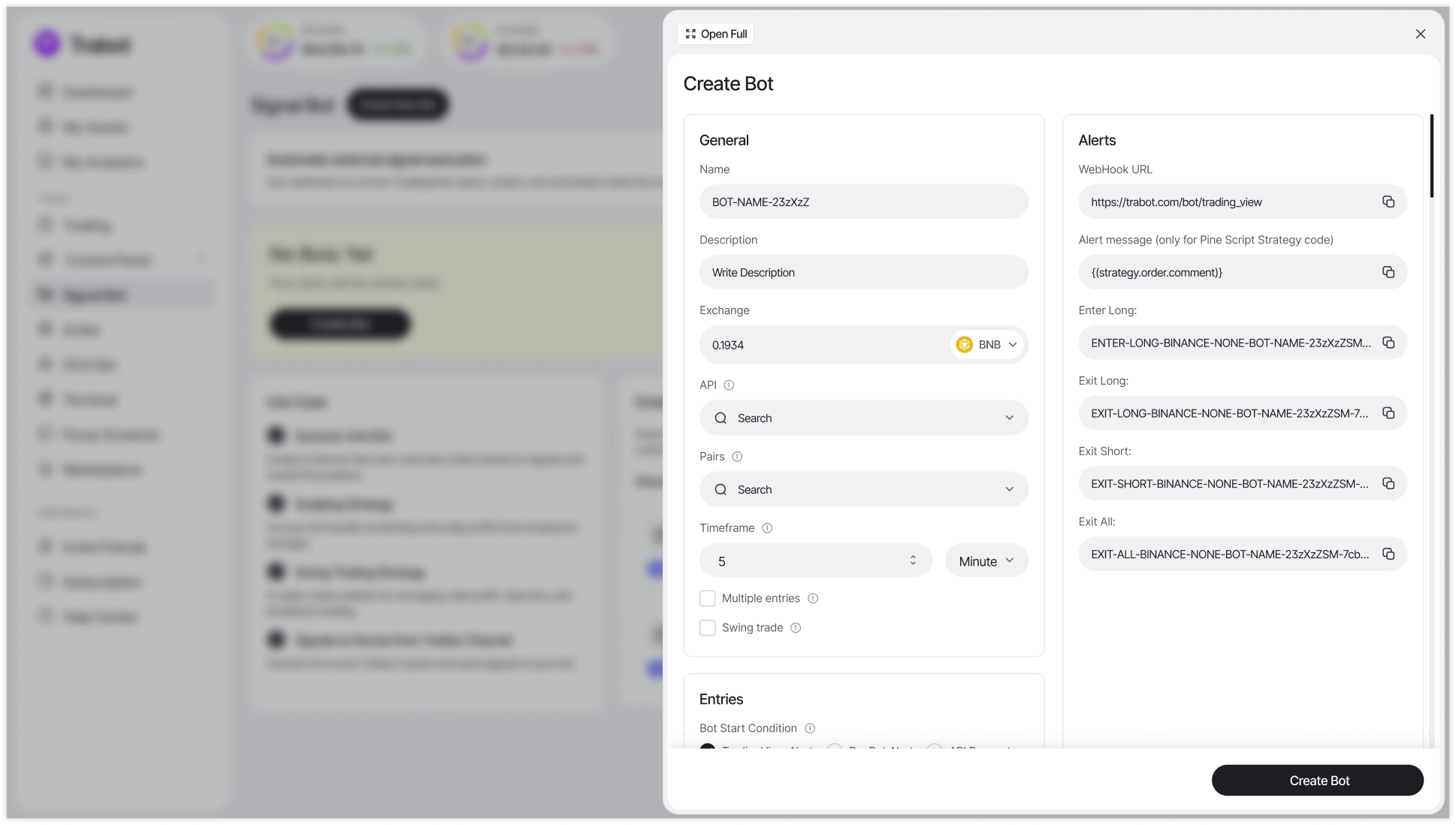

At this stage of trading bot development, the foundation of the future system is implemented, ensuring its accuracy and efficiency. The studio's programmers define the tool's structure - modules for data collection, decision making, signal processing, and order placement. They then select programming languages and frameworks and design databases for storing logs, quotes, and trade history.

3. Development and testing on historical data

The next step is to create a trading algorithm based on the selected indicators, signals, and risk management rules. The system is implemented and tested on historical data to assess its performance and effectiveness, identifying and mitigating risks before trading with real capital.

At this stage, the trading logic is implemented and the crypto bot's strategies are programmed (technical analysis, indicators, machine learning, etc.), and risk management is configured (loss limit, take profit, stop loss). Specialists also implement monitoring and logging systems to record transactions in a journal, generate event notifications (successful trades, errors, connection failures, etc.), and visualize statistics through a dashboard or interface.

4. Integration with crypto exchanges

After successful testing on historical data, the bot is connected to the real trading platforms or exchanges specified in the terms of reference. It is implemented via an API, and authentication, key protection, and market and limit order processing are configured.

5. Testing and optimization

After successfully connecting to target platforms, the crypto bot is tested on real markets without any investment. The developers then fine-tune its functionality in real-world conditions with small volumes, optimizing response speed, algorithm performance, support for specified trading pairs, adding modules with advanced strategies, connecting to the client's internal/corporate systems (e.g., CRM), and more.

6. Launch and post-release support

Once the system is up and running as intended, the cryptocurrency trading/exchange bot is launched into full operation on the server or cloud. CryptonisLabs developers provide instructions to the client and/or their team, providing technical documentation and access rights. After the release, our team can also support the project, adjusting its operation to changing market conditions or the client's strategies and expanding its functionality. This ensures an effective long-term solution, taking into account industry dynamics and/or crypto exchange regulations.

A phased, iterative approach to developing crypto trading bots, along with regular algorithm optimization, ensures the reliability, stability, and security of a system that best suits the client's strategies and goals.

Technologies and tools

Creating an effective trading bot requires professionalism, as well as the use of proven tools and cutting-edge technologies. The speed, accuracy, and performance of the product depend on the choice and combination of software and IT solutions.

What stack do we use:

- Programming languages – we can create a trading bot in Python, C++ and C#, JavaScript / Node.js, Java.

- Libraries and frameworks – Pandas, NumPy, TA-Lib, Tulip Indicators, Scikit-learn, TensorFlow, PyTorch, Backtrader, Zipline.

- API and exchange integrations – REST and WebSocket API, FIX protocol.

- IDEs and editors: PyCharm, Visual Studio, VS Code.

- Testing, monitoring and logging – Backtesting, Paper trading, Prometheus, Grafana.

- Version control systems: Git, GitHub, GitLab.

- Containerization and virtualization: Docker, Kubernetes.

- Security – encryption of API keys and tokens, two-factor authentication, protection systems against failures and force majeure on exchanges (stop-loss algorithms, transaction limits).

The right combination of programming languages, libraries, and integration systems ensures customization, scalability, and seamless integration of the trading system into your processes, increasing their efficiency, security, and profitability.

Popular types of trading bots for crypto exchanges that can be ordered

A crypto bot can be developed to solve a variety of problems. This software increases portfolio control thanks to its flexibility—it can adapt to the conditions and specifics of any market and operate autonomously. Depending on your needs, the system can analyze market data, track signals and indicators, quickly execute trades, and manage capital according to specified conditions.

There are many varieties of such software:

- Cryptocurrency arbitrage bots. They profit from price differences between exchanges. This approach is virtually risk-free, but requires speed and liquidity.

- Trend-following. These follow the main market trends (a classic example is buying when the price rises and selling when it falls). They rely on moving average indicators (MA), MACD, and ADX, which can be very profitable during clear trends, but are ineffective during flat markets (when the market moves sideways).

- Cryptocurrency scalping bots. They allow you to quickly profit from micro-movements in intraday prices. With super-fast response and low fees, they can produce very good results. The main advantage is low risk per trade, but a large volume is required.

- Grid software. Places a "grid" of orders above and below the current price, buying on declines and selling on rises, generating profit from fluctuations. It performs well in flat markets, but is ineffective during pronounced trends.

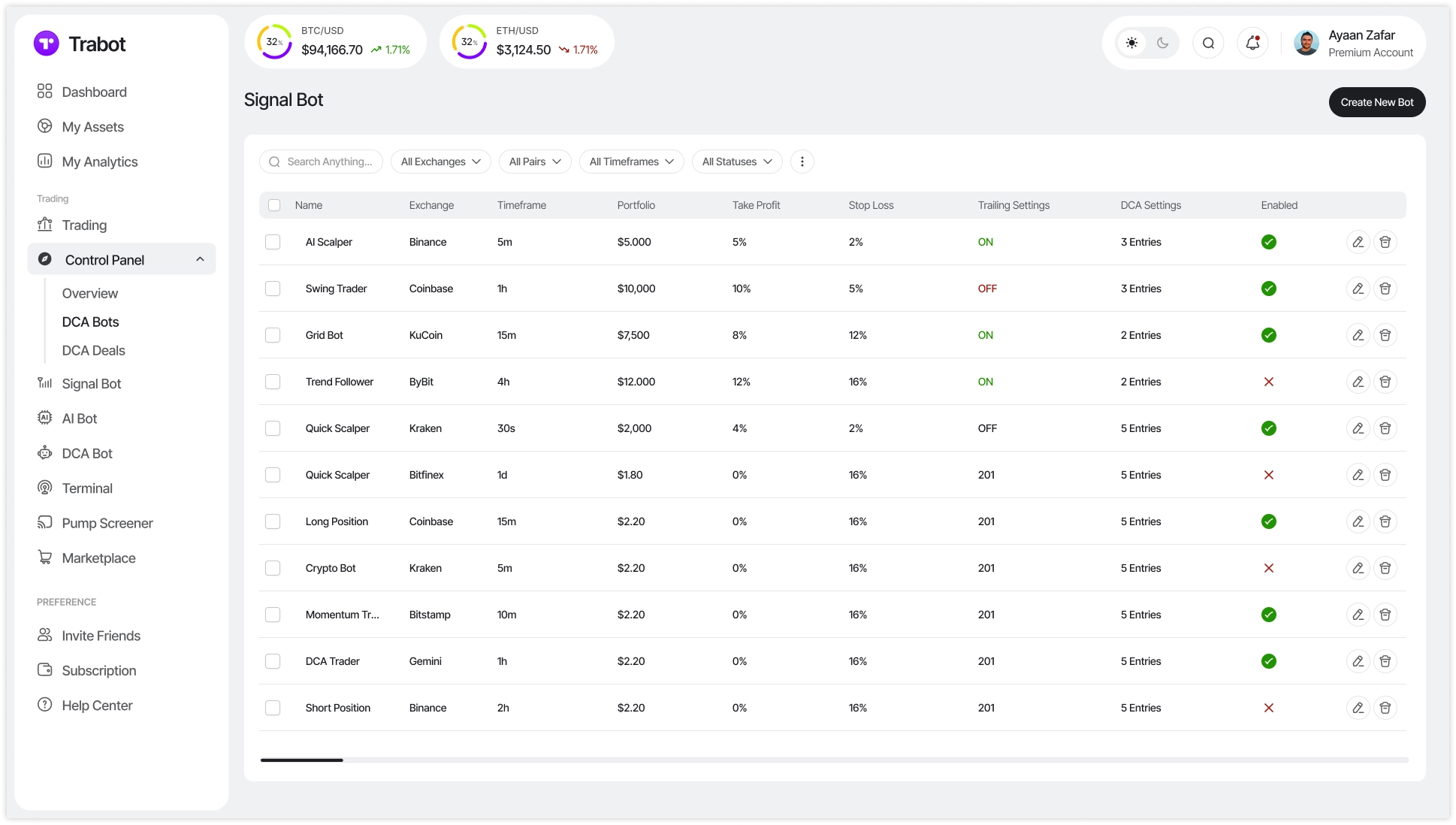

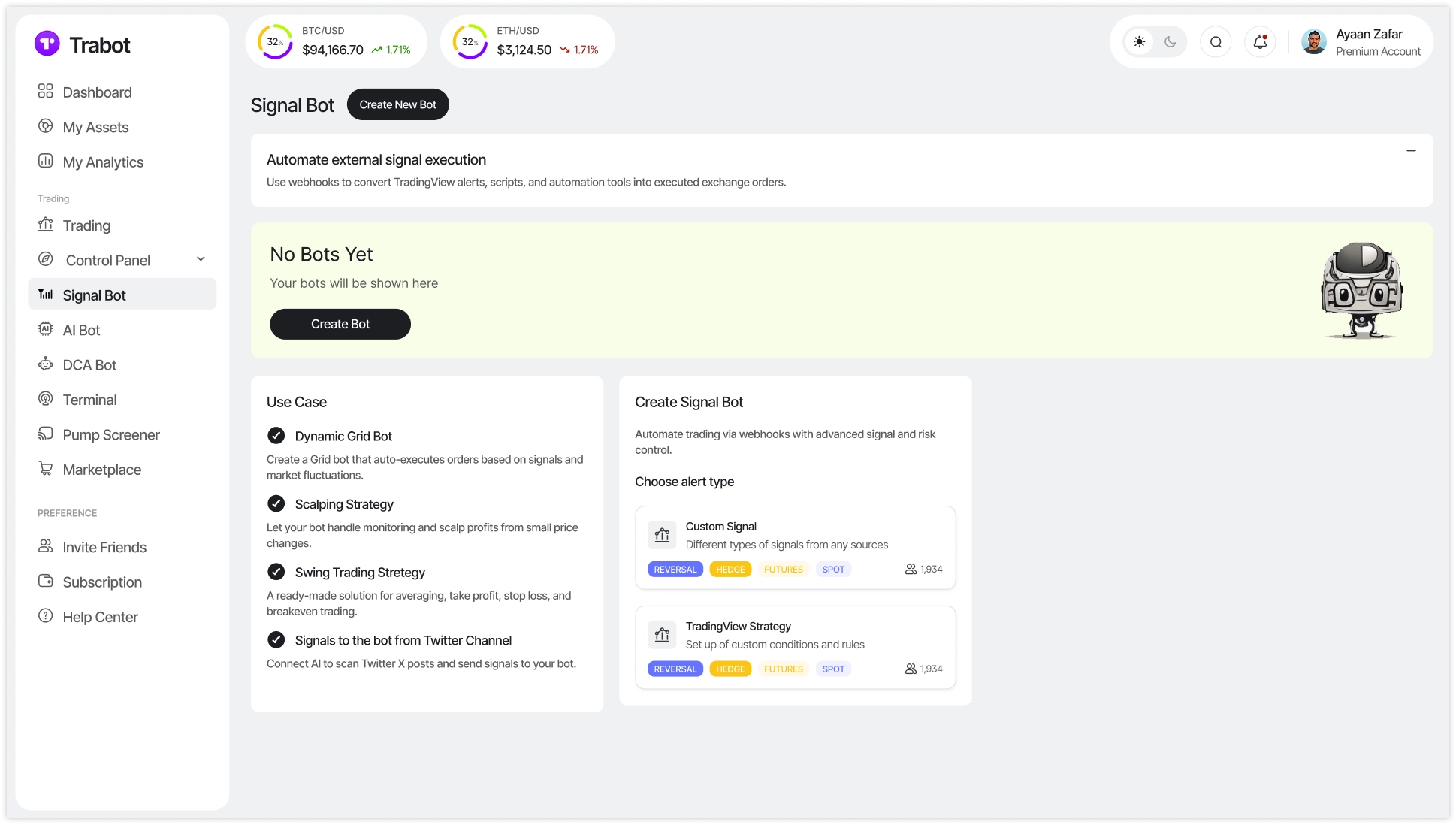

- Cryptocurrency signal bots (algorithmic). They work using RSI, Bollinger Bands, OBV, and other indicators. They open trades when specified conditions are met (e.g., RSI < 30 → buy). They are easily customized to the trader's strategy.

- Market-making software. It creates simultaneous buy and sell orders for an asset around its current price, profiting from spreads. This provides liquidity, allowing for profits on small and frequent trades. The only vulnerability is potential sharp price fluctuations.

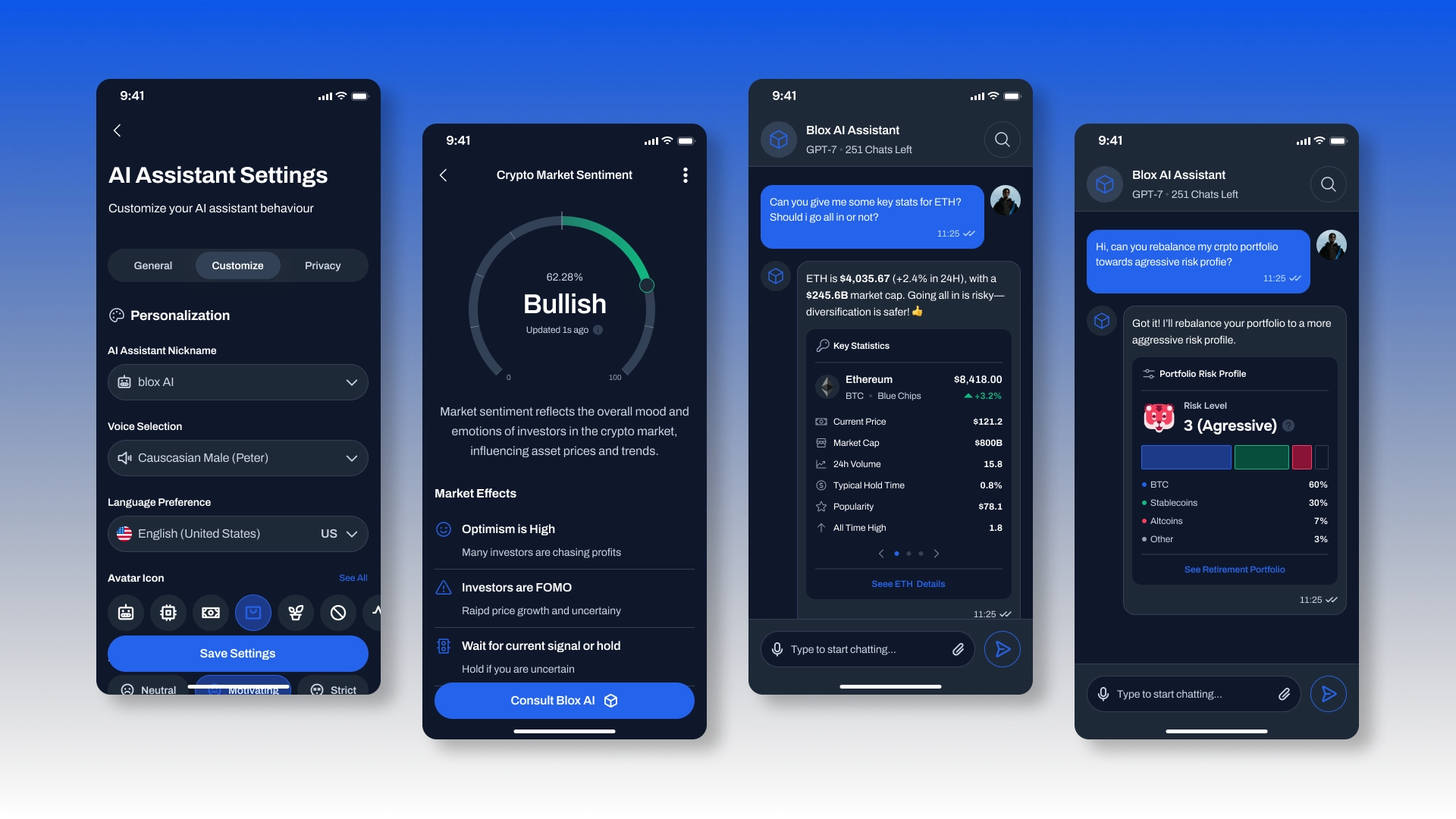

- Crypto trading bots powered by artificial intelligence (AI). They predict market movements using AI and machine learning. They analyze vast amounts of data, including news and social media posts. They are more expensive and complex to develop, but offer greater profit potential.

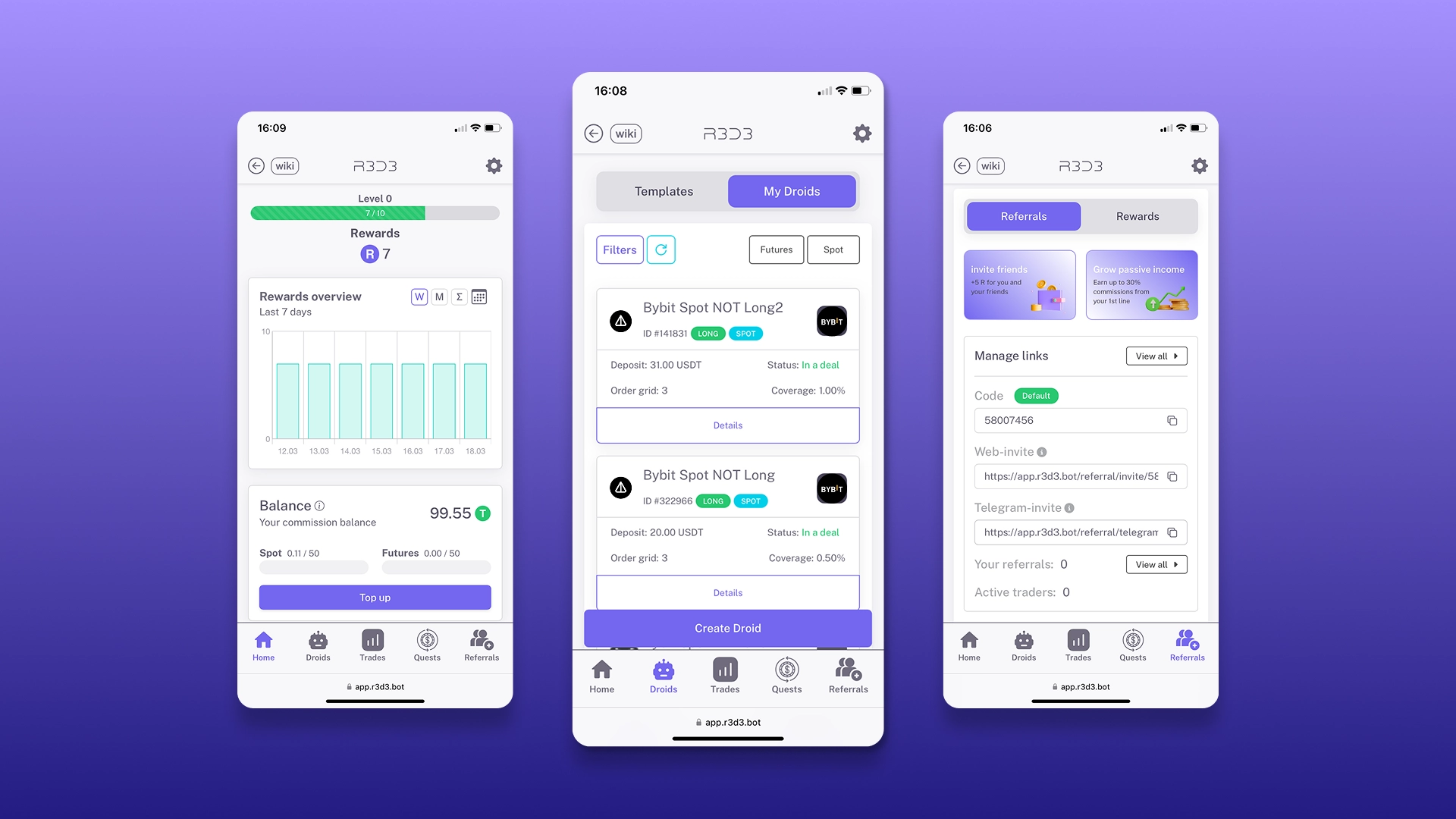

- Copy trading bots. They replicate the strategies and trades of successful traders. Essentially, they're an automated "subscription" to the trading of experienced market players.

- HODLing and rebalancing algorithms. These are designed not for trading, but for portfolio management. They maintain a predetermined asset ratio (e.g., 50% USDT, 30% BTC, 20% ETH), rebalancing during significant price fluctuations.

- Custom bots. Developed to meet unique needs and implement specific strategies/objectives for clients. They are capable of finding the most profitable trades even during low volatility, when reversing a trend is difficult or impossible. With a trading bot, a trader exploits the full potential of a situation, which may not be apparent to a human due to a lack of a complete picture, inexperience, or emotion.

As you can see, automated trading offers a wide range of optimization options, encompassing an entire ecosystem of strategies, from simple scalping to large-scale AI analytics. There's no single, 100% successful solution. The CryptonisLabs team, with its extensive web development experience, can help you select the right trading bot strategies for your specific markets, exchanges, and trading style.

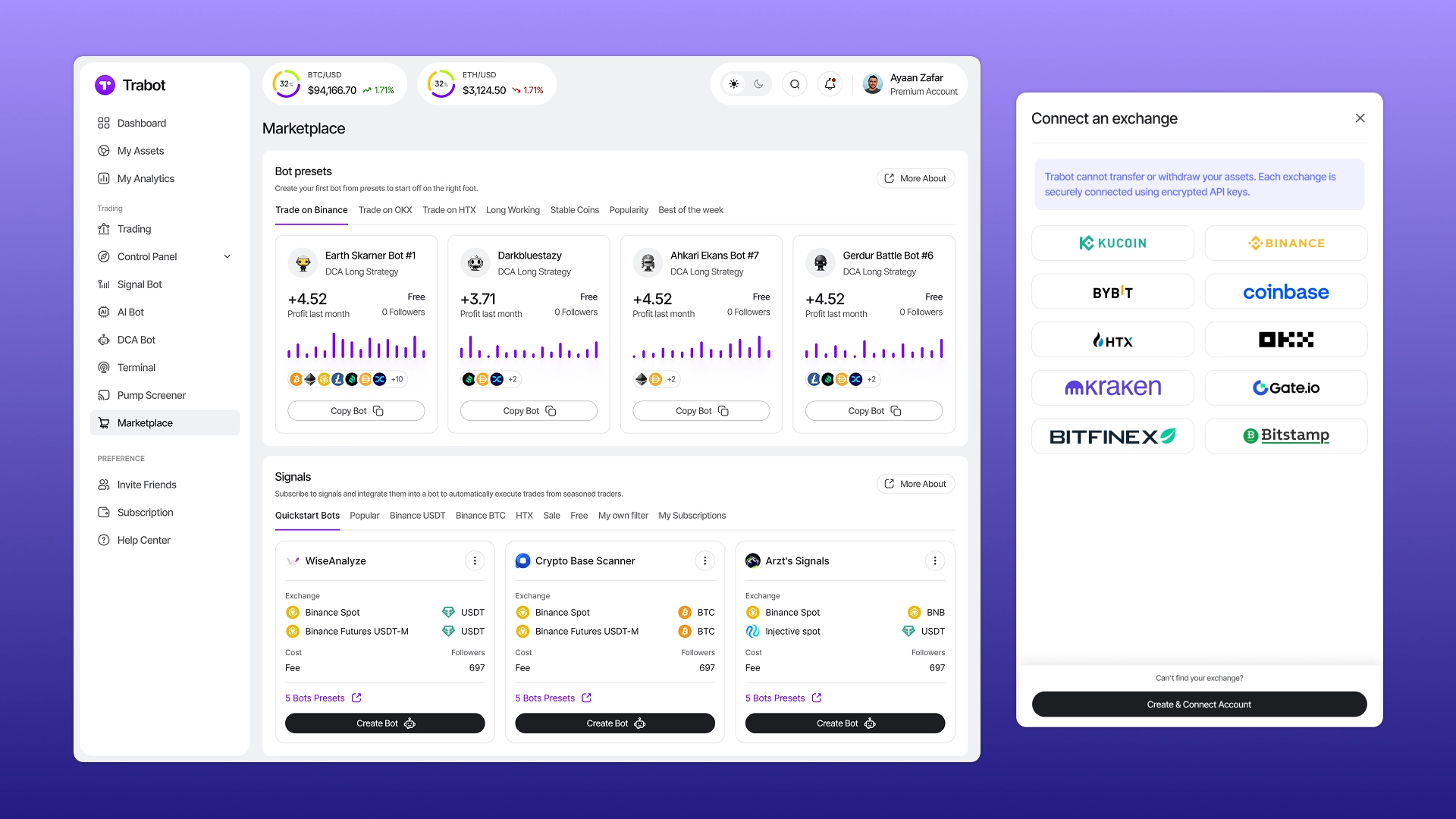

What trading bots do we develop for popular crypto exchanges?

The CryptonisLabs team creates a variety of software for stock market trading, from crypto signal bots for Telegram to complex systems with machine learning and extensive functionality. Below is a list of popular trading platforms for which we develop such IT solutions.

A trading bot for the OKX crypto exchange

The international OKX platform offers a wide range of instruments, from spot, futures, and options to perpetual swap contracts. It supports sub-accounts and has a comprehensive API. However, the platform limits request frequency, which is important to consider when implementing high-frequency trading strategies, and has its own derivatives features (margin, leverage, cross/isolated modes).

The bot must be able to automatically close trades if there's a risk of liquidation, recover, and reconnect if the connection is lost. Logs and alerts are critical; the exchange requires accurate timestamps and signed requests.

Whitebit Cryptocurrency Exchange Trading Bot

The European platform WhiteBIT imposes strict regulations and security requirements. The platform focuses on spot and margin trading, and perpetual futures are also offered, but the derivatives offering is more limited than on other exchanges.

The API is well-developed and supports HMAC-SHA512 authentication. If speed limits are exceeded, bots may be temporarily blocked, which is critical when using certain strategies. Therefore, it's important to carefully integrate risk management into the system. The platform does not offer a full-fledged testnet. Compared to OKX and Binance, there are fewer advanced orders – bots for WhiteBIT are easier to implement but less flexible when setting up trading strategies.

A trading bot for the Binance crypto exchange

Binance is the largest international crypto platform by trading volume, boasting high liquidity across virtually all pairs. The platform offers a wide range of instruments, including spot, futures, options, staking, P2P, and DeFi instruments. It features a sophisticated, advanced API for pricing, accounts, and orders, as well as a separate Binance Futures API, providing access not only to trading but also to market depth, liquidity, candlesticks, and indicators. It supports a wide variety of order types (market, limit, OCO, etc.), with request limits and strict API authorization.

When creating a trading bot for Binance, it's important to consider various speed limits, and the system must clearly distinguish between spot and futures trading methods. Due to high liquidity and leverage of up to 125x, detailed configuration of stop-losses and limits is essential, as well as protection against price spikes. A retry option is also essential, as under heavy loads, the service may return an HTTP 429 error.

The main advantage of custom trading bot development for crypto exchanges is its tailoring to the client's strategy and the specifics of the target platforms - their architecture, the variety of instruments, technical limitations, and security requirements. As a result, you receive the most effective IT solution for specific tasks and platforms.

Bot for trading on the Kucoin crypto exchange

This is one of the top platforms, offering more than 700 trading pairs, including spot, futures, margin, P2P, and Earn products. In addition to REST and WebSocket, the resource supports public data (order book, candles, transactions), as well as private operations (orders, balance, account), plus built-in Kucoin trading bots from the platform itself are available. When creating your automated solutions, it is important to consider the limitations on the number of requests and the separation of the API for futures.

There are many illiquid altcoins on the platform, so the software must check the volume before entering a trade. Due to the volatility of small pairs, it is important to implement stop-loss, trailing, and slippage protection features. In case of connection instability, the system needs a function for repeated requests and backup strategies.

Bot for trading on the Crypto.com crypto exchange

In addition to the exchange, the Crypto.com ecosystem includes DeFi wallets, Visa cards, and Earn programs. You can trade here using spot, margin, and derivatives. In addition to REST and WebSocket, the platform supports market data and private methods. When developing software for it, it is important to consider that it has licenses in various jurisdictions and uses the CRO token for staking, discounts, and commissions.

The trading software architecture must also provide for separate endpoints for spot and futures. And if you plan to use private methods, you will need HMAC signatures with a secret key. Liquidity varies, so the bot must check the volume and spread. At the same time, volatility is high, API delays are possible – it is important to consider options for repeat requests, stop orders, and fail-safe logic. We create Crypto.com bots for Telegram and mobile devices and implement cloud solutions.

Bot for trading on the Poloniex crypto exchange

This is one of the oldest platforms. It offers spot, margin trading, and derivatives. The selection of altcoins is quite large, but liquidity is uneven – the bot needs to check volumes. REST and WebSocket are used for market data, as well as balance and order management. WebSocket is preferable for obtaining quotes and transactions, as there are speed limitations in the REST API.

When using private methods, an HMAC-SHA256 signature is required. API key permissions can be restricted, for example, to trading without withdrawal. In the architecture of a trading bot for the Poloniex exchange, you need to take into account the difference between API endpoints for spot and futures. The platform does not offer a separate sandbox environment for testing, which is also important to keep in mind. The software must automatically reconnect and restore its state in case of failures.

The main advantage of custom development of trading bots for trading on crypto exchanges is that they can be tailored to the client's strategies and take into account the specifics of the target platforms – their architecture, variety of tools, technical limitations, and security requirements. As a result, you get the most effective IT solution for specific tasks and platforms.

Benefits of contacting CryptonisLabs

The CryptonisLabs team has been professionally developing custom digital solutions and creating custom crypto trading bots for many years. We are among the top blockchain developers in Ukraine. With us, you have a reliable partner.

Benefits of ordering crypto trading software from CryptonisLabs:

- Custom development – the bot is developed to solve specific problems, platform specifics, your strategies, and trading style.

- Specialized expertise – we have extensive experience working with APIs from major exchanges and trading platforms, understanding current trends in web development and the crypto market, and the nuances of algorithmic trading.

- Software stability and reliability – we integrate built-in risk management and capital protection systems and use proven technologies.

- Transparency of collaboration and bot operation – we test the software on historical data and demonstrate results before implementation. We collaborate iteratively, ensuring full control of the production process.

- Product support and optimization after launch ensures you receive an effective, scalable product that meets the current market situation.

If you're looking for a high-quality solution to automate your work with crypto exchanges, submit a request or contact us directly to discuss the details. Using cutting-edge technology and deep industry expertise, we'll help you transform your trading strategy into an effective, reliable source of profit.

FAQ

-

How much does it cost to develop a trading bot?

The project budget depends on the tasks the system must solve and its scale. The cost of creating a trading bot is influenced by the logic and architecture of the product - whether it requires implementing an arbitrage tool or a trading tool with stop-limits, specifically for cryptocurrencies or forex quotes, and which exchanges or brokerage platforms will be connected. If a SaaS product is required, the cost will be higher.

-

What's better: a standard solution or custom development of your own bot?

Custom software is fully tailored to your strategies and target exchanges, requiring no commissions to third-party services. It allows you to scale your income and optimize functionality for market dynamics, and even license the system for use by other traders, generating additional income.

Ready-made bots often don't fully meet all needs. Using functional, off-the-shelf systems can ultimately be more expensive than custom development, and using cheap alternatives carries a number of risks. Creating your own bot eliminates these risks, ensuring comprehensive asset protection. There's also an intermediate, hybrid solution, which you can learn more about on the White Label Crypto Trading Bot page.

-

Do I need to monitor the bot constantly?

Constant 24/7 monitoring by the trader is indeed unnecessary if the bot operates according to algorithms, but there are some nuances. The solution can be fully or partially automated (for example, signal bots only report data, while the trader makes the decision). You can order software that will monitor the market 24/7 and execute trades according to preset algorithms without your intervention.

But it's important to remember: the crypto industry is very dynamic. For maximum efficiency, it's essential to monitor software performance and adjust strategies as needed. This is accessible through the analytics dashboard and reports.

-

How long does it take to develop a trading bot?

The turnaround time depends on the complexity of the strategy and the functionality to be implemented. Simple software can be ready in 2-6 weeks. Large-scale SaaS solutions with architectural elements and custom logic require 4-6 months.

-

Which exchanges will my bot support?

It depends on your goals and strategy. We develop trading bots for many popular crypto exchanges, including Binance, KuCoin, OKX, Whitebit, Crypto.com, and Poloniex. If you're interested in automated trading on other platforms, please contact us to discuss your needs.

-

How does the bot manage risks?

Cryptocurrency trading bots manage risks using built-in strategies and control tools. Key mechanisms, implemented in various combinations depending on the architecture and software specifics, include:

- stop-loss – automatic closing of a position at a specified loss level;

- take profit – fixing profit at a certain level;

- diversification – distribution of capital between several coins and strategies;

- volatility risk management – reducing the transaction volume during large price fluctuations;

- trade size limitation – using only a certain percentage of the deposit for trading (for example, 1-2%);

- Hedging – opening opposite positions or pair trading.

This means that a trading bot manages risks in the same way as an experienced trader, but automatically and without emotion.

-

Is it possible to test the strategy before real trades?

Yes, we conduct backtesting (testing on historical data), paper trading (demo trading), and live trading with a small deposit (depending on the project). The availability of these types of testing also depends on the policies of the exchange for which the system is being developed.

-

How will I receive reports and see the bot's results?

The products we develop provide detailed reports on all trades, strategy performance, and capital management. This helps you make informed decisions, optimizing your trading and increasing profitability, predictability, and security.