AI trading bots

CryptonisLabs creates smart trading bots that analyze the market, predict price movements, and automatically execute trades using machine learning and neural networks.

What is AI trading?

AI trading is automated trading where the algorithm doesn't simply follow predetermined rules, but rather learns and adapts to market changes based on data.

Unlike traditional trading bots, intelligent systems use machine learning models and neural networks to identify patterns and make decisions in real time. The result is a machine-learning crypto bot that adapts to the market and reacts to changes instantly.

AI trading bots can:

- analyze historical and streaming market data;

- recognize trends, patterns and trading signals;

- predict the direction of price movement;

- automatically optimize strategy parameters;

- adapt to the high volatility of the crypto market.

Conventional trading algorithms operate according to strict rules, while AI bots learn, predict, and evolve with the market, creating trading systems based on neural networks with adaptive decision-making logic.

Key technologies in AI trading

At CryptonisLabs, we build intelligent trading systems based on a modern AI stack that enables the creation of sustainable, scalable, and highly accurate automated trading solutions.

- Machine learning (ML) is used to train models on historical data, determine current market conditions, and build price movement forecasts taking into account a variety of factors.

- Deep learning (DL) is used to analyze time series of quotes and identify complex nonlinear relationships, which makes it possible to create deep learning crypto bots capable of working with large amounts of market data.

- Reinforcement learning (RL) allows the creation of self-learning trading agents, implementing reinforcement trading , in which the strategy is optimized based on interaction with the market environment.

- Natural Language Processing (NLP) is used to analyze news, social media, and information flows, forming the basis for predictive analytics of cryptocurrencies and assessing the impact of news factors on asset prices.

- Statistical & Predictive Modeling forms the mathematical basis of trading strategies through regression models, ARIMA, LSTM, and Random Forest, increasing the accuracy of signals and the stability of algorithms.

- AI Strategy Optimization allows you to automatically select parameters for grid bots (Grid), adapt scalping strategies (Scalping), and optimize arbitrage algorithms (Arbitrage) without the need for manual configuration.

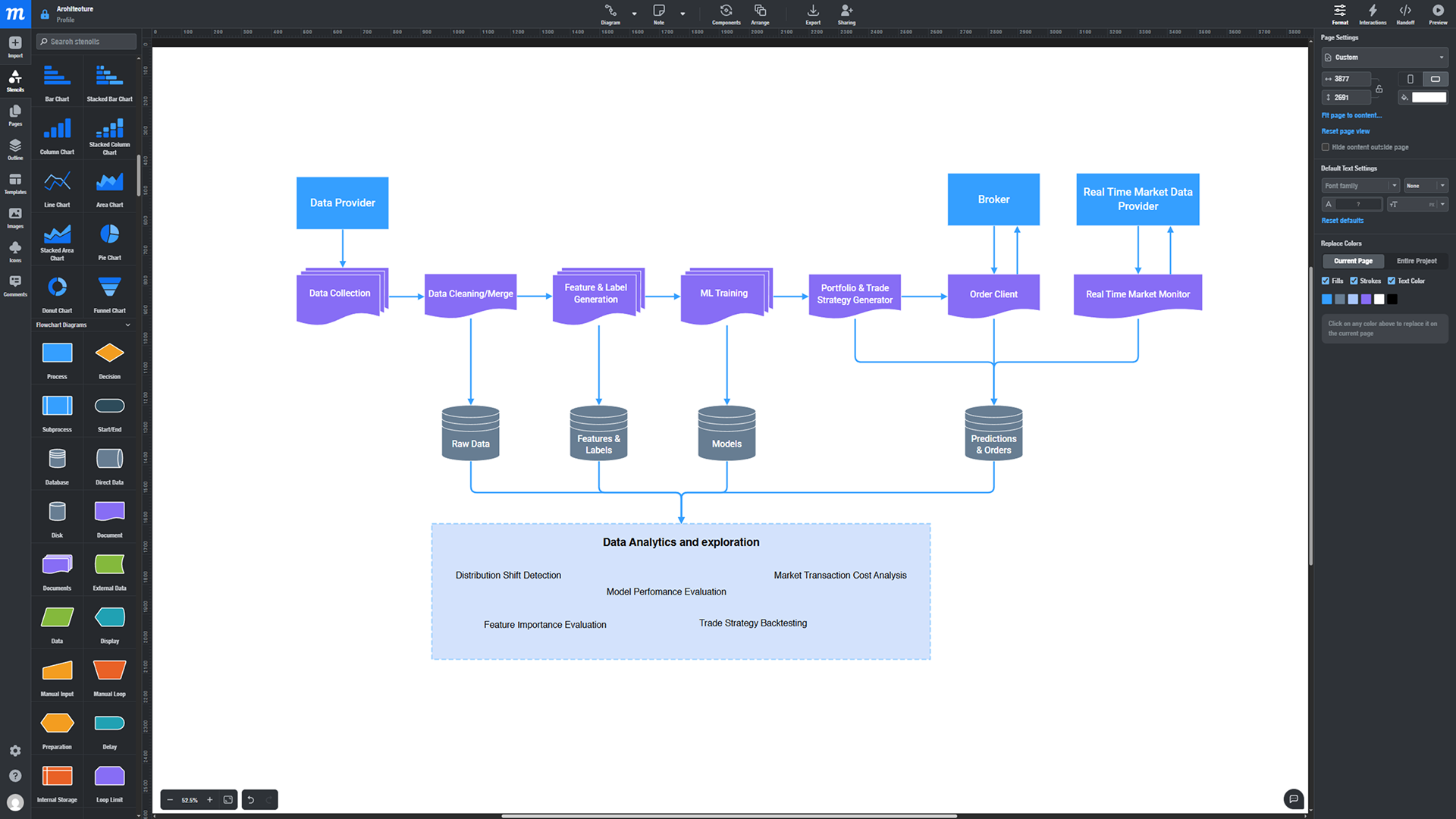

AI trading system architecture

An AI trading bot is more than just a trading algorithm, but a fully-fledged intelligent system that integrates market data management, information processing, machine learning, trading signal generation, risk management, and trade execution. To ensure stable and accurate operation, such solutions require a well-thought-out architecture, where each module is responsible for a specific stage of the trading process and interacts with other components in real time.

- At the first level, the system connects to market data sources—centralized and decentralized exchanges, as well as quote aggregators. Price, volume, and order book feeds are fed to a preprocessing module, where data is cleaned, normalized, noise filtered, and features are generated for model training.

- The prepared data is then fed into the system's intelligent core—machine learning models and neural network architectures such as LSTM, CNN, Random Forest, and Transformer. These models analyze the market situation, identify patterns, and generate probabilistic forecasts of future price movements.

- The model output is used by a trading signal generator, which converts forecasts into specific actions: buy, sell, hold, or skip. The order execution module then interacts with the exchange APIs, ensuring accurate, fast, and secure execution of trades.

- The final layer of the architecture is the risk management module and analytics dashboard. It controls loss limits, position sizes, and asset correlations, and also provides visualization of trading results, strategy statistics, and model performance indicators.

This architecture ensures system scalability, stable operation under high load, accurate and timely trading decisions, as well as transparent analytics and complete control over the automated trading process.

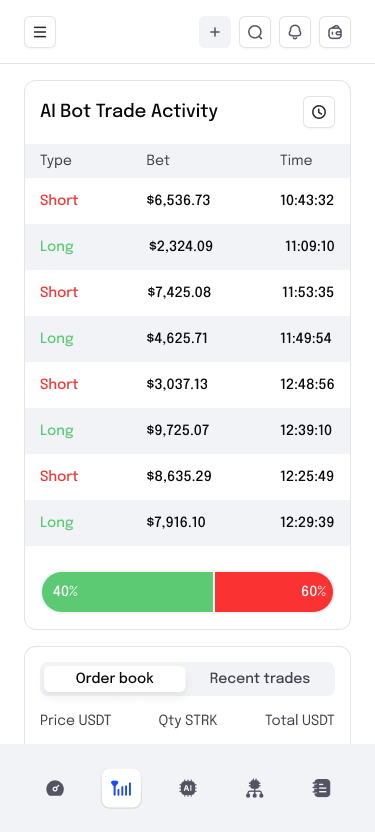

AI trading bot capabilities

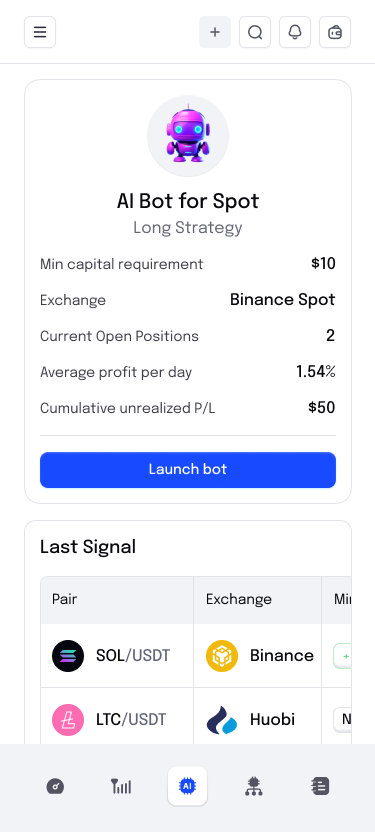

Intelligent trading bots powered by artificial intelligence automate not only trade execution but also the entire cycle of analysis, decision-making, and risk management. These systems continuously process large volumes of data and adapt to changing market conditions.

- Forecasting – analyzing historical data and creating short-term price movement forecasts on timeframes from 1 minute to 1 hour, which allows for more accurate entry and exit points.

- Volatility analysis – automatically detects periods of high and low market activity to select optimal trading conditions and adjust position sizes.

- Automatic strategy tuning (Auto-tuning) is the dynamic optimization of trading bot parameters without manual intervention, which increases efficiency in different market phases.

- Sentiment Analysis – processing news, Twitter/X, Reddit, and Telegram posts to identify market expectations and potential momentum price movements.

- Risk Management – control of loss levels, transaction limits, correlation between assets and the overall deposit load to protect capital.

- Portfolio Balancing is the intelligent redistribution of assets depending on market conditions and investment goals.

- Adaptive Learning is the regular updating of models based on new data, allowing the trading system to remain relevant and effective in a changing environment.

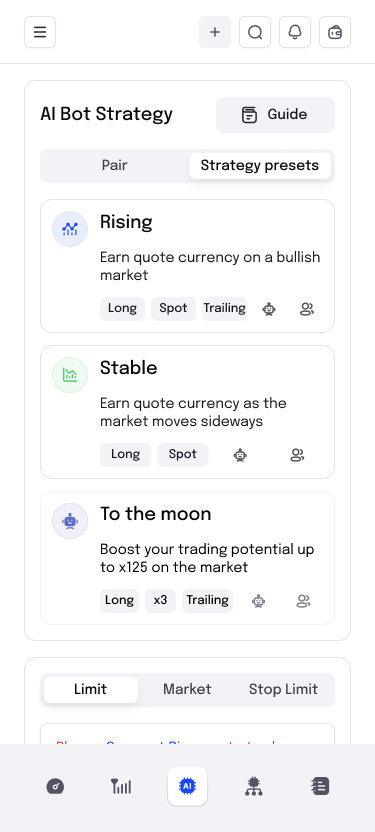

Examples of AI strategies

We develop intelligent trading strategies that utilize different approaches to market analysis and trading automation, depending on the client's objectives and asset type.

- AI-Scalping — the algorithm is trained to identify short-term price impulses and quickly enter and exit positions, maximizing profits on high-frequency movements.

- AI-Arbitrage — the system identifies price anomalies and discrepancies between exchanges, automatically executing trades to profit from price differences.

- AI-Grid is an AI grid trading bot that dynamically optimizes ranges, grid spacing, and order levels.

- AI-Trend-Following — a neural network model predicts trend direction on short timeframes and automatically opens positions in the direction of the dominant market movement.

- AI-Sentiment Bot is a trading strategy based on the analysis of news feeds and market sentiment, allowing you to react to news events faster than traditional indicators.

- Reinforcement Learning Bot is a self-learning trading agent that adapts its strategy to changing market conditions, constantly improving the quality of its decisions based on accumulated experience.

Contact CryptonisLabs for a consultation. We will analyze your objectives, trading goals, and infrastructure, select the optimal approach to using artificial intelligence, and develop an AI trading bot tailored to your profitability, risk, and system scalability requirements.

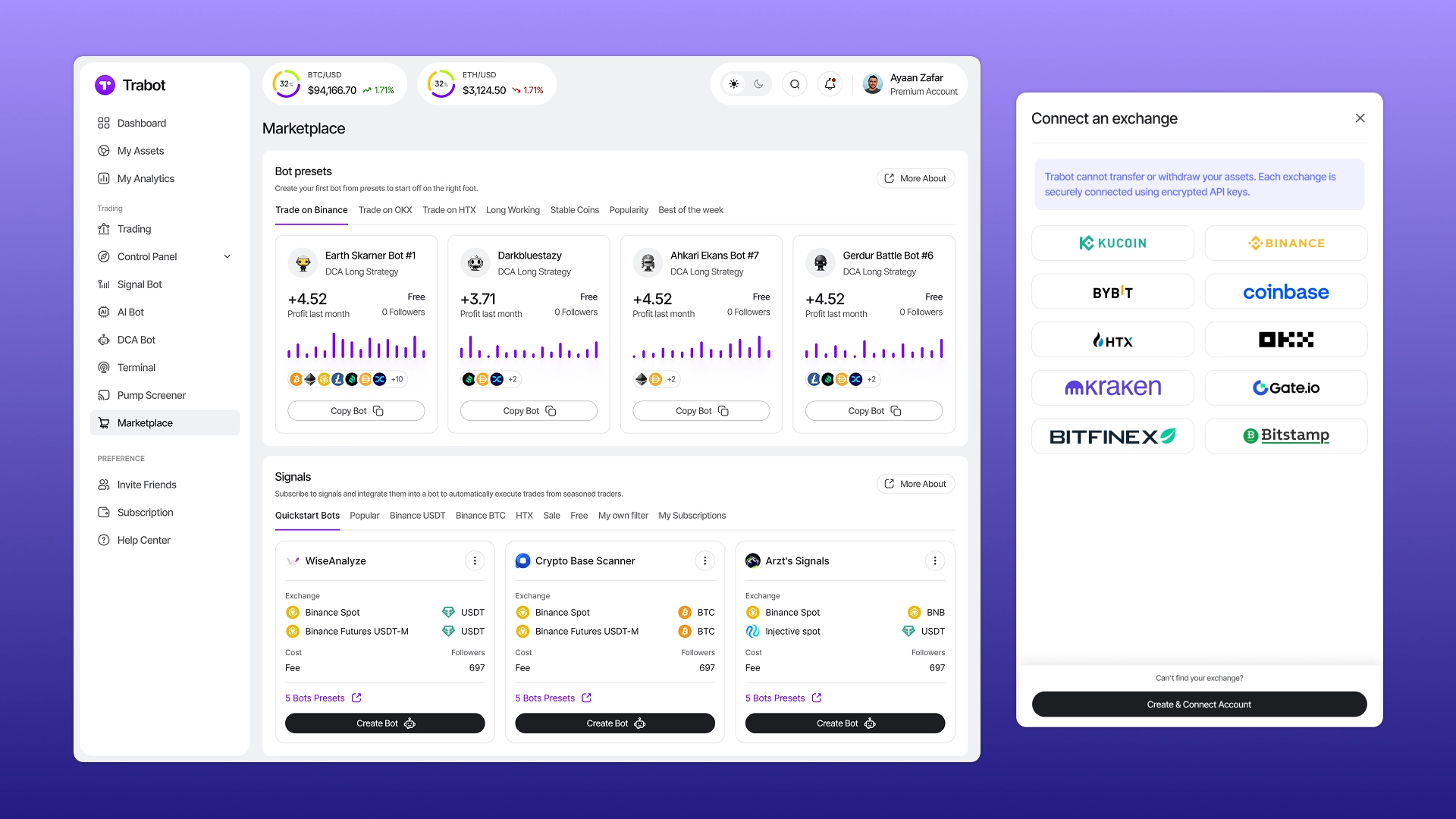

Integrations

We design AI trading systems with speed, reliability, and scalability in mind, ensuring deep integration with key trading platforms, data sources and cloud infrastructure.

Centralized Exchanges (CEX)

Integration with centralized exchanges provides high liquidity, access to futures markets, and expanded trading tools:

- Binance is the largest platform by trading volume, supporting Spot, Futures, and algorithmic trading APIs.

- OKX is a professional trading ecosystem with advanced derivatives and a high-performance API.

- WhiteBIT is a popular European exchange with high liquidity and stable infrastructure.

- KuCoin is a platform with a wide selection of trading pairs and flexible API capabilities.

- Bybit is an exchange focused on futures and margin trading with high-speed order execution.

Decentralized exchanges (DEX)

DEX support allows for the implementation of AI strategies without custodial risks and with direct interaction with smart contracts:

- Uniswap is the leading AMM protocol for token trading on the Ethereum network.

- PancakeSwap is a popular DEX platform in the BNB Chain ecosystem.

- 1inch is a liquidity aggregator with optimized trade routes.

- Jupiter is the primary liquidity aggregator in the Solana ecosystem.

Market data providers

To accurately train models and generate forecasts, we leverage professional market and on-chain analytics:

- CoinGecko is an aggregator of cryptocurrency market data and metrics.

- Kaiko is an institutional provider of highly accurate trading data.

- Glassnode is a platform for analyzing on-chain metrics and investor behavior.

- TradingView is a visualization and technical analysis tool with support for custom indicators.

AI stack and machine learning tools

We use proven libraries and frameworks to build, train, and optimize models:

- TensorFlow is a scalable framework for training neural networks.

- PyTorch is a flexible platform for developing and experimenting with deep learning models.

- Scikit-Learn is a library for classic machine learning and data processing algorithms.

- XGBoost is a highly efficient tool for gradient boosting and tabular data.

Notifications and Communications (Messaging)

For operational monitoring of trading systems and team collaboration, we use modern messaging platforms:

- Telegram — instant notifications about transactions, signals, and events in the system.

- Discord — manage trading teams, log processes, and monitor in real time.

- Slack — corporate communication and integration with internal services and DevOps tools.

This connection ensures fast data exchange and transparency of all trading processes.

Cloud infrastructure (Hosting & Cloud)

To ensure stable operation, scalability, and training of AI models, we use proven cloud and hardware solutions:

- Amazon Web Services is a scalable infrastructure for high-load trading systems.

- Google Cloud Platform — computing resources for training and deploying ML models.

- Microsoft Azure - enterprise cloud solutions with high fault tolerance.

- NVIDIA is a GPU infrastructure for accelerated neural network training and complex computations.

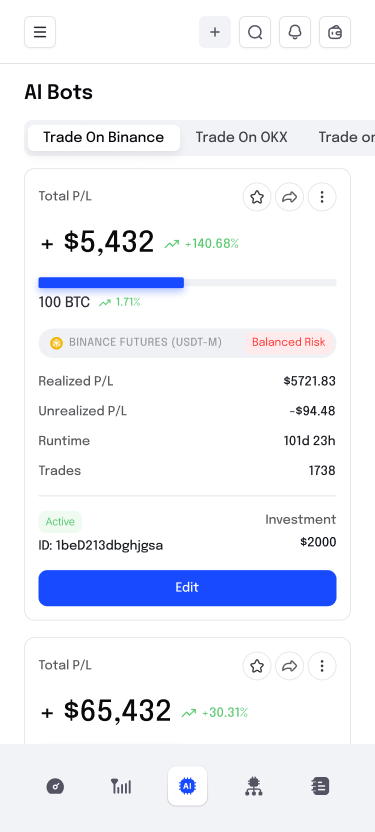

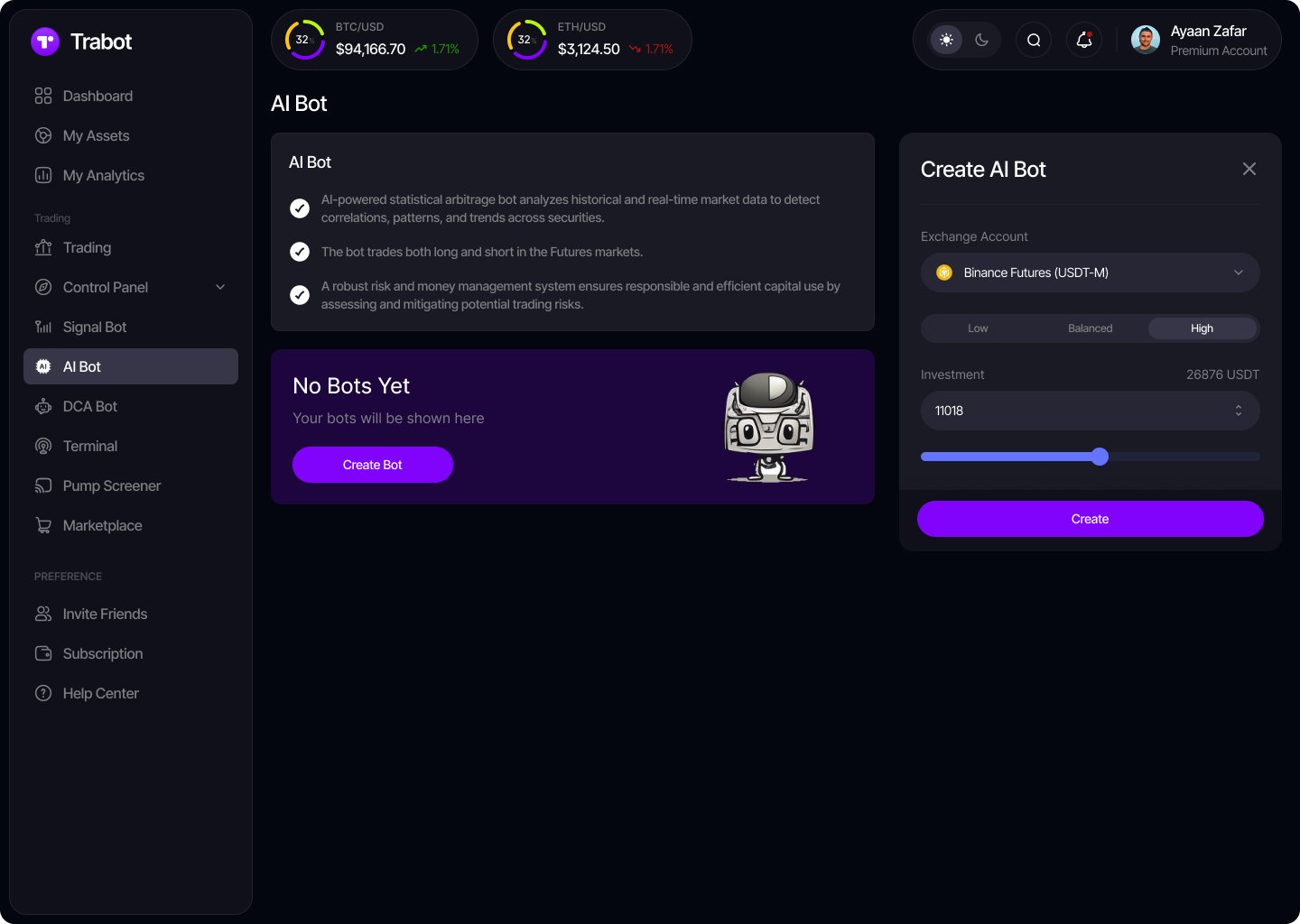

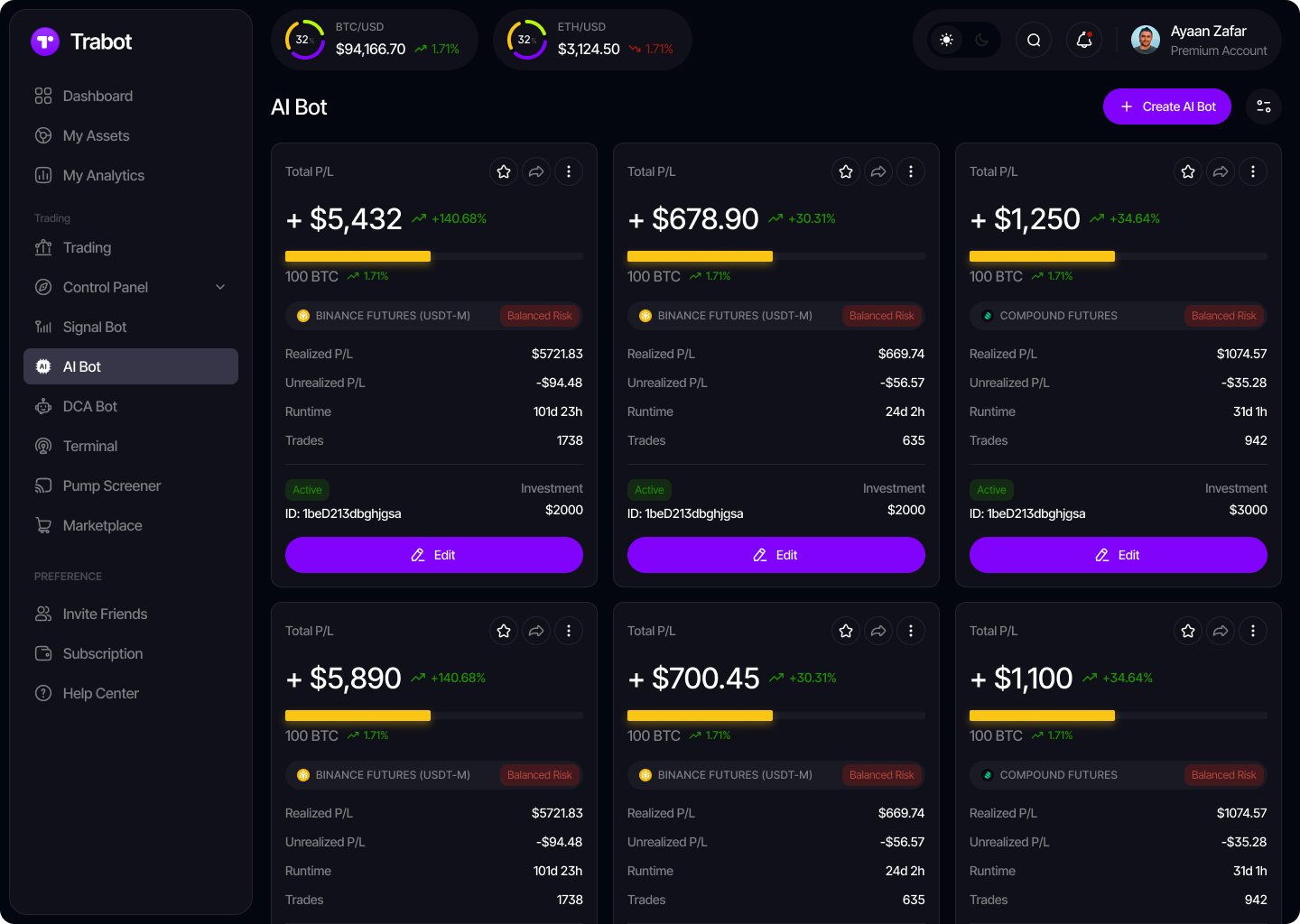

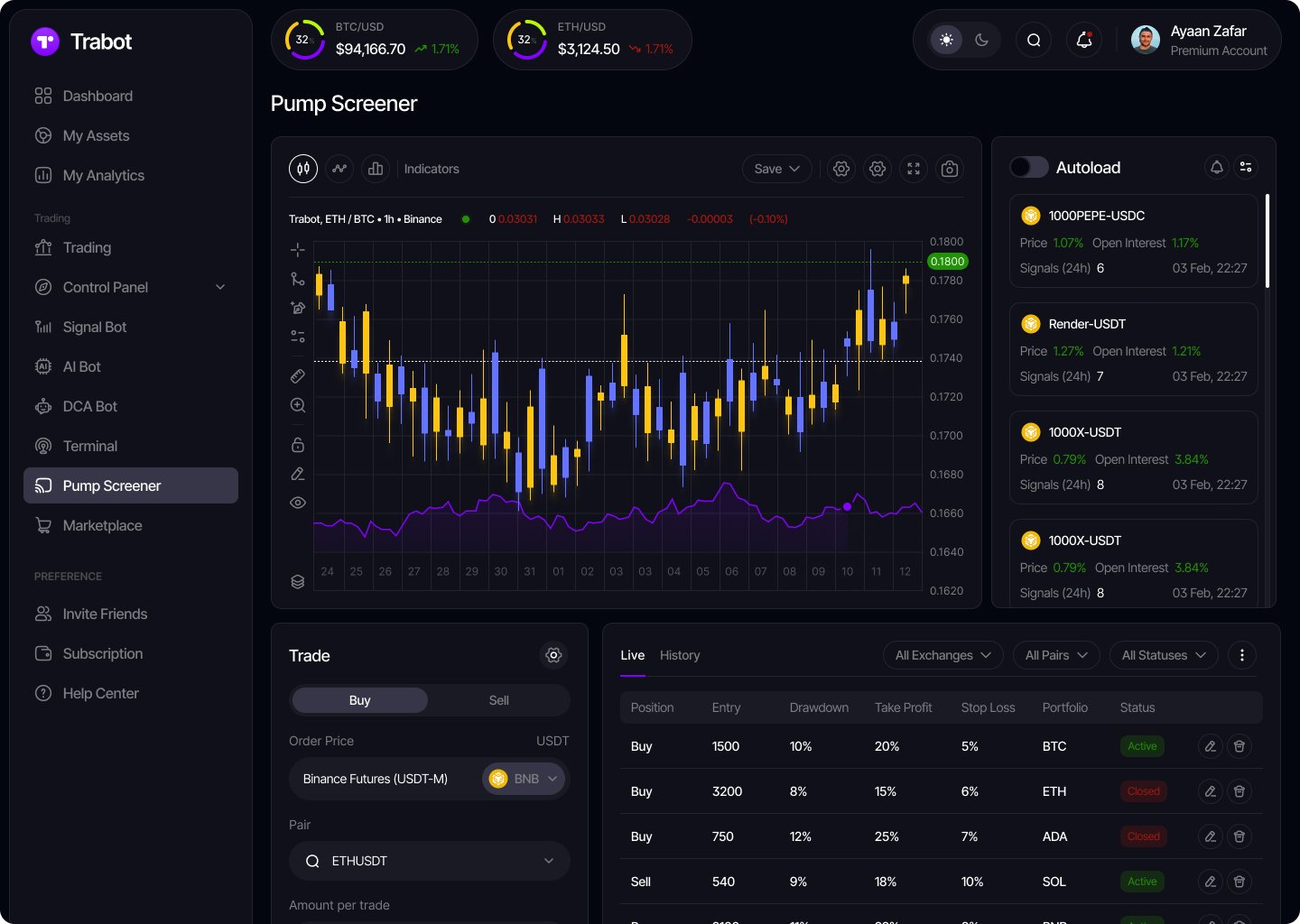

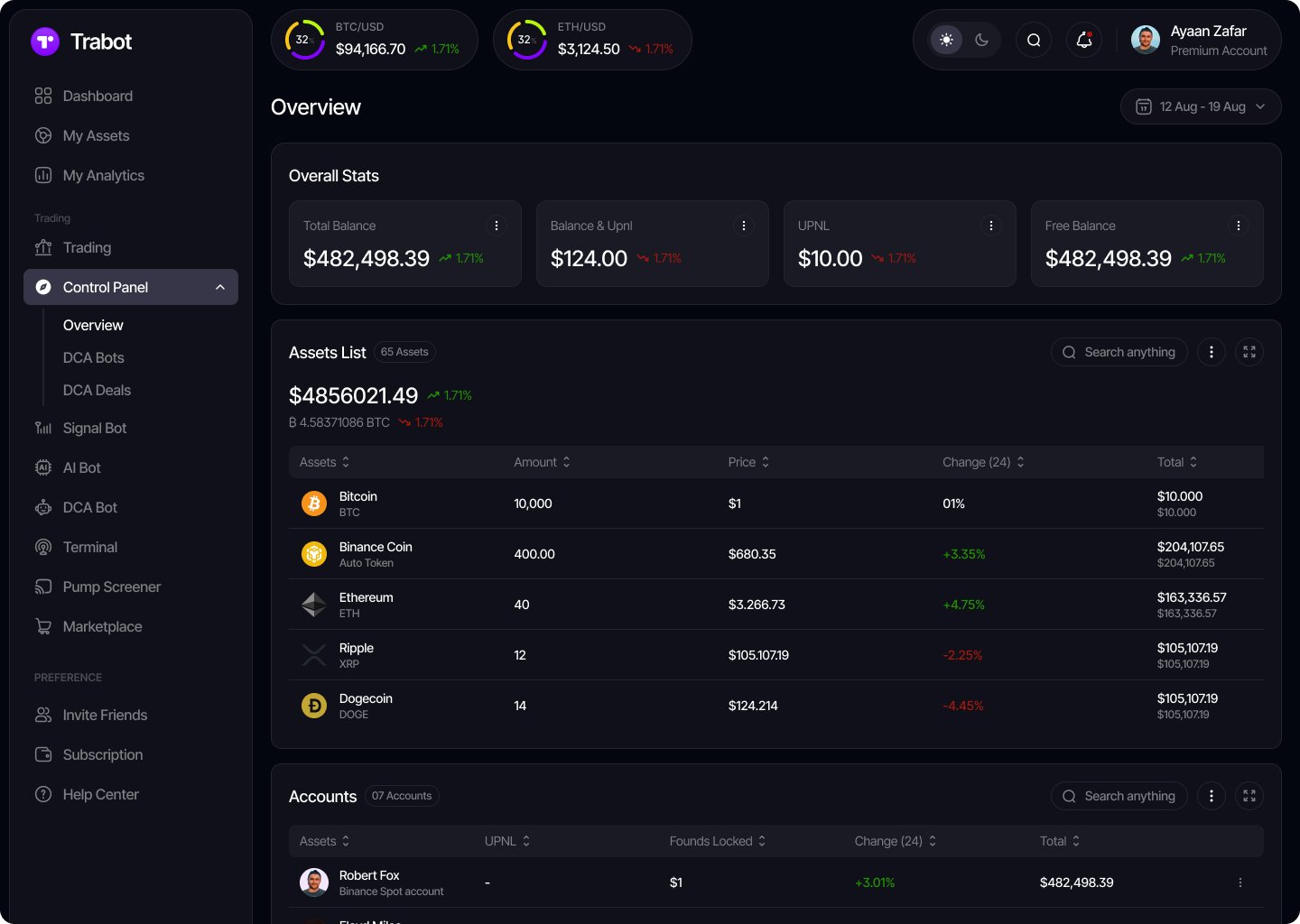

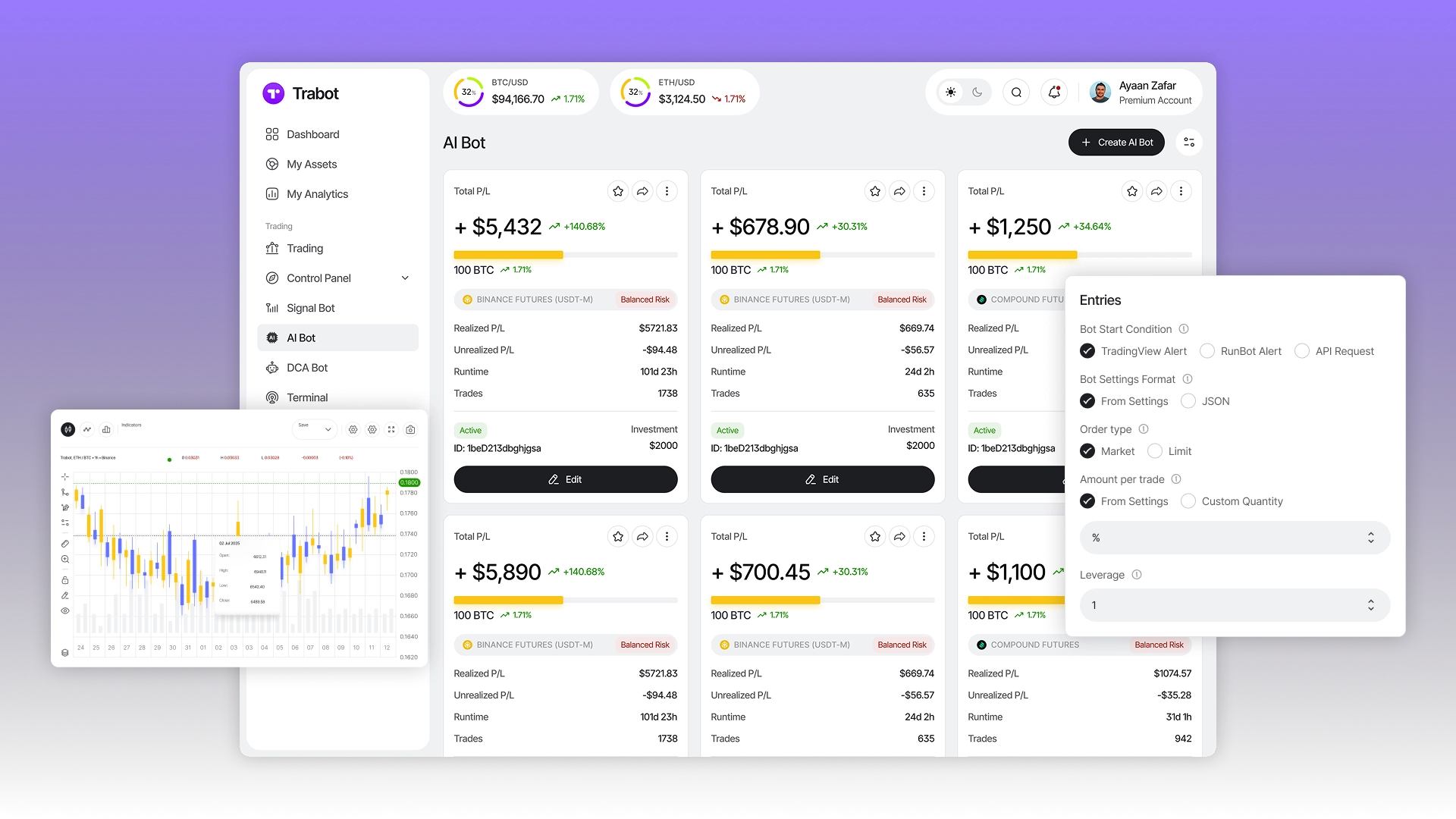

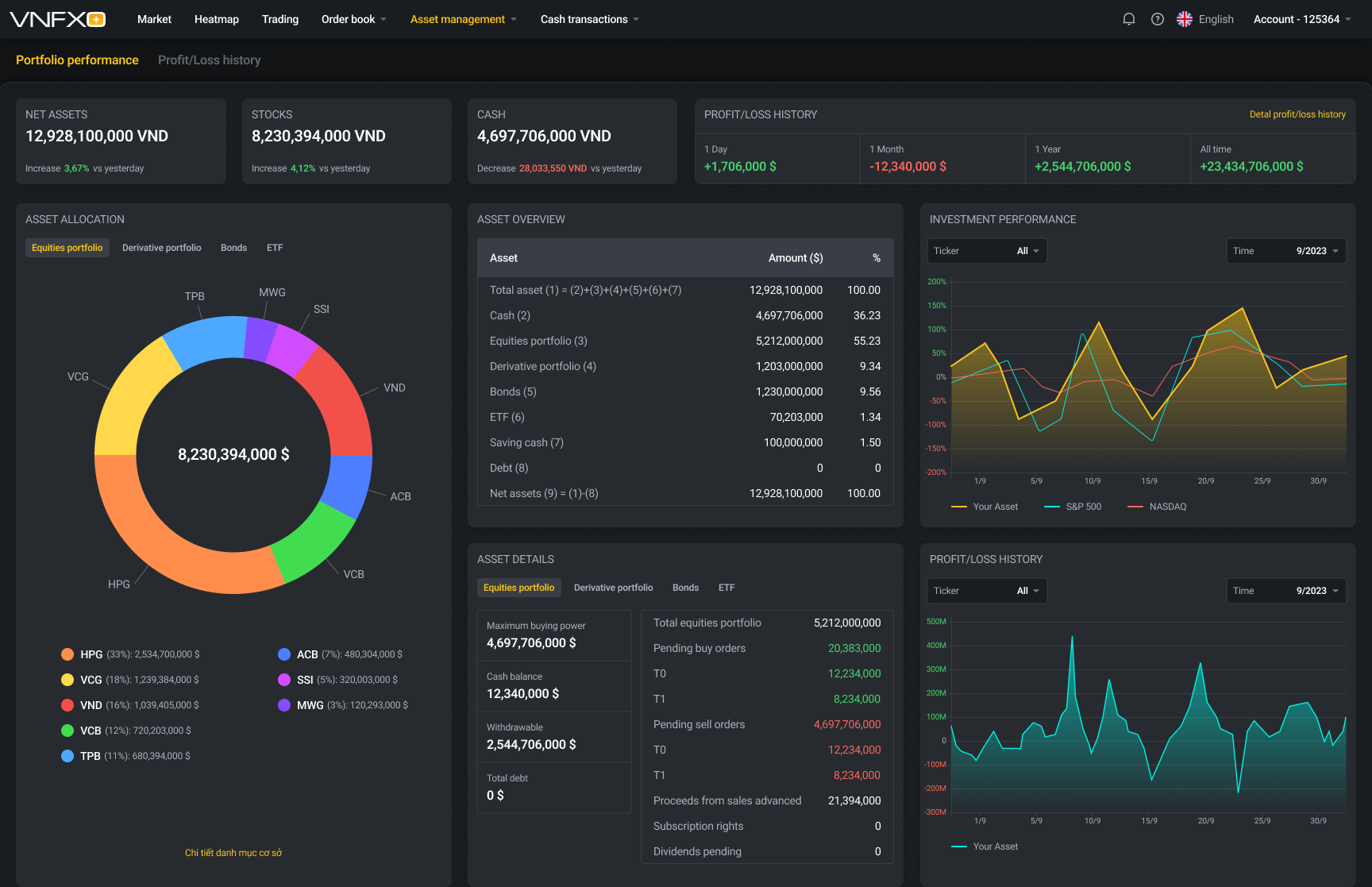

Interfaces and analytics

Professional interfaces and analytical tools provide complete control over the trading bot, transparency of all operations, and convenient strategy management in real time. A high-quality AI trading solution will feature:

- Dashboards with trading signals and forecasts display AI model recommendations, open position status, key market indicators, and trading dynamics in real time.

- TradingView charts with Buy/Sell/Skip markers allow you to visually compare trading signals with price movements and quickly analyze the effectiveness of market entries and exits.

- Model accuracy reports (Precision, Recall, Sharpe Ratio) provide objective metrics on forecasting quality and help evaluate the risk-reward ratio.

- Return analytics for each strategy shows the performance of individual bots and trading approaches, simplifying portfolio comparison and optimization.

- A web-based dashboard for managing models and hyperparameters allows you to update AI models, run retraining, adjust parameters, and manage trading algorithms without interrupting the system.

Safety

We are implementing a multi-layered approach to security that covers infrastructure, trading logic, and the operation of artificial intelligence models.

- We use restricted API keys with "Trade Only" permissions, which eliminates the possibility of withdrawals and minimizes the risk of account compromise. All trading bot actions and AI module decisions are thoroughly logged, ensuring system transparency, transaction auditing, and the ability to quickly analyze incidents.

- To improve forecast stability, we employ protection against model overfitting, as well as regular validation and multi-level testing on historical and streaming data. This prevents signal quality degradation as market conditions change.

- The infrastructure includes automatic failover mechanisms for API failures, connection delays, or forecast errors, ensuring uninterrupted trading. If necessary, we also implement a manual trade confirmation mode, allowing for additional control over critical transactions and mitigating operational risks.

Examples of use cases

AI trading solutions can be tailored to a variety of trading models and business needs, from active trading to investment platforms and SaaS services. Here are some examples of how AI trading might work in practice:

- An AI bot for futures trading with volatility adaptation automatically adjusts position sizes, leverage, and entry parameters based on current market activity, mitigating risks during sharp price movements. This scenario is particularly suitable for prop trading firms and professional trading teams working with high-frequency strategies.

- Sentiment bot for trading using Telegram and Twitter/X signals analyzes news feeds and social media posts, identifies market sentiment, and uses it to generate trading signals. This solution is effective for funds and media platforms that want to be the first to respond to market information impulses.

- The Reinforcement Learning bot for minute timeframes is a self-learning trading agent that optimizes strategies on short timeframes, continually improving its decisions based on accumulated experience. This approach is suitable for tech startups and trading labs focused on developing innovative trading models.

- The AI Trading Signals analytical dashboard is a web interface for displaying forecasts, trading recommendations, and model performance statistics in real time. This format is popular among brokers and investment platforms that provide users with ready-made trading signals and analytics.

- The Auto-Tuning module for grid bot optimization automatically adjusts grid spacing, ranges, and order parameters to current market conditions without manual adjustments. This solution is convenient for exchange services and SaaS platforms offering users automated trading tools.

- A copy-trading system with automatic strategy selection is an intelligent mechanism that analyzes the performance of traders and bots, selecting the best strategies for automatic copying. This scenario is well suited for social trading platforms and strategy marketplaces targeting the mass market.

Cost of developing AI trading bots

The cost of developing an intelligent trading bot depends on the strategy's complexity, the AI models used, the number of integrations, and infrastructure requirements. Below are sample packages to help you understand the project's budget.

| Plastic bag | Description | Deadlines | Price |

|---|---|---|---|

| AI Bot Starter | A basic AI bot with machine learning, one strategy, connection to 1-2 exchanges, backtesting, and basic analytics. | 2–3 months | From $15,000 |

| Advanced AI Trading System | A multi-strategy bot with neural networks, parameter auto-tuning, risk management, dashboard and Spot/Futures support. | 5–7 months | from $20,000 |

| Enterprise AI Platform | A full-fledged AI trading platform: RL models, sentiment analysis, copy trading, white labeling and scalable architecture | 10–12 months | from $50,000 |

| Custom AI Solution | Individual solutions for business needs, custom architecture, integrations, SaaS or proprietary platform | According to the technical specifications | Upon request |

The prices listed are approximate and depend on the project's complexity, feature set, technologies used, and infrastructure requirements. The final price is determined after a technical consultation and approval of the technical specifications.

Why choose CryptonisLabs

CryptonisLabs brings together experts in fintech, algorithmic trading, and AI, developing solutions for crypto trading and investment platforms. We design scalable AI systems focused on real-world business challenges.

Our key advantages:

- We understand the specifics of the crypto market , taking into account the high volatility, liquidity, and infrastructure limitations of the blockchain ecosystem to ensure our solutions work in real-world trading conditions.

- Forecasting and analytics modules – we use proven approaches to data processing and modeling to accelerate development and improve signal quality without losing flexibility.

- Spot, Futures, DEX, and Copy-Trading support — we design systems for classic trading, derivatives, decentralized protocols, and social mechanics.

- Integration with exchange APIs ensures stable interaction with platforms, accurate order execution, and reliable operation under load.

- AI-based price and news analysis – we combine market data and information flows into a single decision-making model.

- White-label SaaS solutions — we develop platforms tailored to your brand with the ability to scale, monetize, and grow your product.

Want to launch an AI bot that can analyze the market and make trades on its own?

Contact us and we'll create a turnkey intelligent trading system for you — complete with model training, analytics, automated order execution, and exchange integration.