Arbitrage bots for cryptocurrency exchanges

What Is Arbitrage in Cryptocurrency

In cryptocurrency, arbitrage is considered a trading strategy in which a bot buys an asset where it is cheaper and sells it where it is more expensive, earning profit from temporary or inter-market price discrepancies. This difference can arise between centralized exchanges (CEX), decentralized platforms (DEX), between multiple trading pairs within a single exchange, or between different types of markets and networks, for example, between spot and futures.

While conventional trading is usually based on market direction forecasts, arbitrage does not rely on them. In this case, technological capability, speed, and calculation accuracy are critical. Until the market price stabilizes, the system must respond quickly to imbalances, correctly calculate profit taking fees into account, and automatically execute orders.

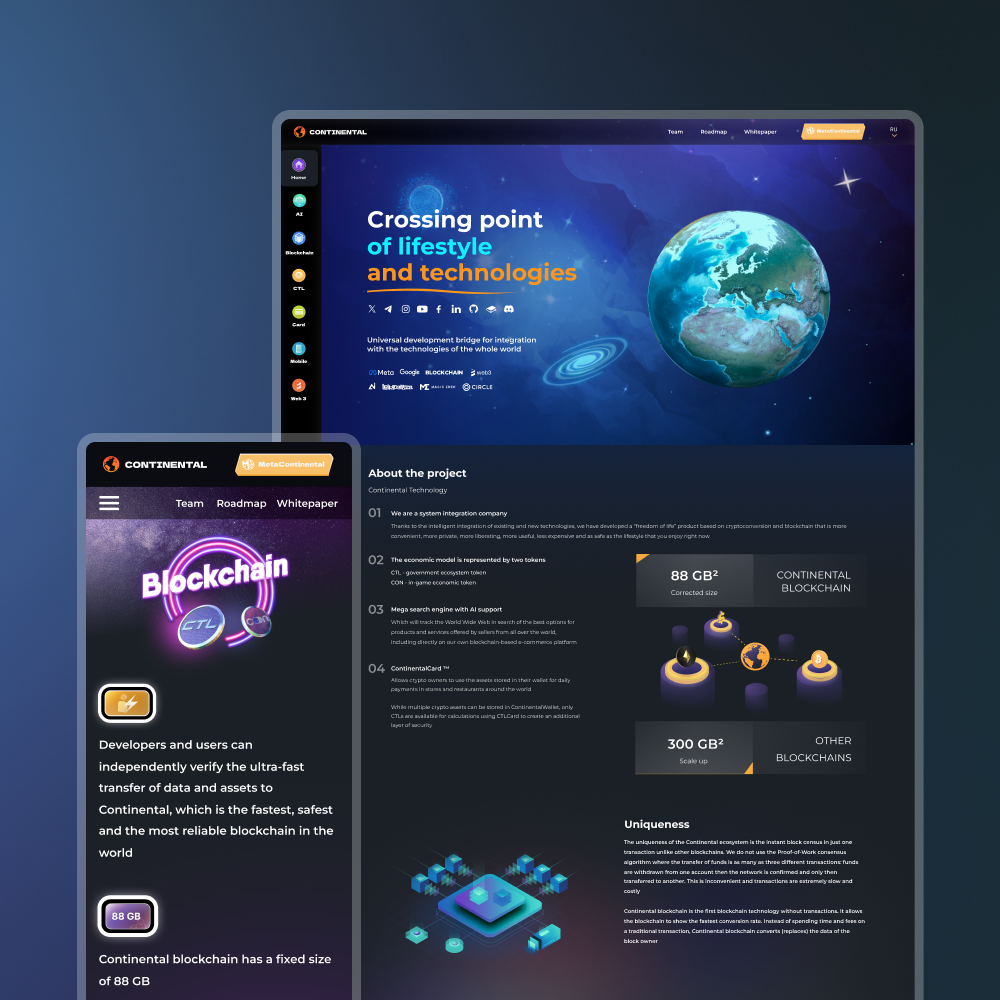

CryptonisLabs develops high-performance arbitrage engines that operate on CEX, DEX, and hybrid platforms, ensuring response times under 100 ms and flexible strategy configuration.

Types of Arbitrage Strategies

Inter-exchange

An inter-exchange arbitrage system involves purchasing cryptocurrency on one exchange and selling it on another at a higher price. For example, Binance ↔ OKX, KuCoin ↔ WhiteBIT. Key features of this method include: easier monitoring than intra-exchange arbitrage; asset transfers become unprofitable if the price difference is small; it requires more capital than intra-exchange arbitrage, since in addition to trading fees there are withdrawal fees. Inter-exchange arbitrage also allows returning the proceeds to the first exchange and, if desired, completing another cycle. It is important to consider withdrawal times from one exchange and deposit times to another. We build systems so that you can distribute balances across exchanges in advance. This minimizes delays and avoids on-chain transfers during a trade.

Triangular Arbitrage

A triangular arbitrage bot exploits price discrepancies between three assets. A trader exchanges one asset for a second, the second for a third, and the third back into the first, earning from the price difference. Consider the chain BTC/USDT → ETH/BTC → ETH/USDT. It can generate profit even when the direct BTC/ETH market appears balanced. The success of this type of arbitrage requires careful market monitoring, detailed research, and effective risk management. Traders must remain vigilant and act quickly to avoid missing profitable opportunities.

Cross-market

Uses differences between spot and futures markets. For example, the price of an asset on the spot market may differ from the price of a futures contract with a near expiration date.

An arbitrage bot opens opposing positions in different markets, locks in the difference, and minimizes market risk. An example application is Binance Spot ↔ Binance Futures. This type of arbitrage is popular among professional traders and funds because it requires responsible and precise margin and liquidation management.

DEX Arbitrage

A decentralized exchange (DEX) operates on blockchain and smart contracts and has no owner or company that can influence its operations. It is based on price differences between AMM pools. Trades on these platforms occur as follows: two parties exchange cryptocurrency directly, without intermediaries, and the exchange itself is verified via multisignature mechanisms.

Due to the characteristics of pricing formulas and update delays, prices on Uniswap, PancakeSwap, or 1inch can differ significantly. CryptonisLabs develops DEX arbitrage bots using Web3 integrations and smart contracts that account for gas fees, slippage, and transaction confirmation speed. We embed protection mechanisms against MEV attacks and front-running.

Cross-chain Arbitrage

Cross-chain arbitrage is based on purchasing an asset on one network and selling it on another to profit from price differences. It leverages cost differences between networks such as Ethereum, BNB, and Solana. These price differences can arise due to variations in liquidity, trading volumes, or quotation update speeds between networks.

Such systems require integration with bridge APIs, regular monitoring of transfer statuses, and complex risk management logic. We help create solutions capable of analyzing multiple networks and selecting the optimal route for executing a trade.

Statistical Arbitrage

Statistical arbitrage is a trading strategy that allows profit from price differences between correlated assets or the same asset across different platforms. It uses correlation models and AI forecasts.

This approach is based on the idea that markets occasionally misprice assets and trading instruments, and these discrepancies can be exploited using statistical methods. Traders engaged in statistical arbitrage analyze historical data and use advanced algorithms to identify market patterns that indicate price divergences.

Latency Arbitrage

Latency arbitrage exploits delays in APIs and price updates between cryptocurrency exchanges. Because exchanges update prices at different speeds, these delays lead to price discrepancies that can be used to generate profit. It is often applied in HFT strategies.

This strategy requires fast reaction but low starting capital. You can start with a small amount but achieve solid profits if actions are precise and timely. Latency arbitrage is characterized by high technological complexity and requires optimized infrastructure, server placement close to exchanges, and reduced network latency.

How an Arbitrage Bot Works

Consider the following scenario:

- Exchange A (ETH/USDT) = 3,000

- Exchange B (ETH/USDT) = 3,050

The bot buys ETH on Exchange A and sells it on Exchange B. It earns a profit of USD 50 per ETH after deducting trading and infrastructure fees.

An arbitrage bot tracks hundreds of trading pairs and platforms, analyzing their APIs in real time. When discrepancies are detected, it automatically executes trades – taking into account fees, limits, and execution speed.

Core Modules of an Arbitrage System

- Data Feed & Market Scanner

This module is responsible for collecting market data from dozens of CEX and DEX via API or WebSocket. It monitors 1,000+ trading pairs in real time and supports market depth (order book snapshots). Using the Data Feed & Market Scanner, you can calculate fees, spreads, and potential profit. Filters and entry thresholds can be configured here.

- Arbitrage Engine (Core)

The core of the arbitrage system independently analyzes price discrepancies. When a trigger is reached, trades are executed instantly. This module also allows management of balances across different exchanges.

It contains a risk limit system that enables control over maximum trade volumes and loss calculation.

- Execution Layer

The module supports REST, WebSocket, and FIX integrations with CEX (Binance, OKX, KuCoin, WhiteBIT) and DEX (Uniswap, PancakeSwap, 1inch, Jupiter).

Orders can be executed in parallel. There is also smart order routing to reduce fees. The system verifies transaction confirmations (DeFi Layer).

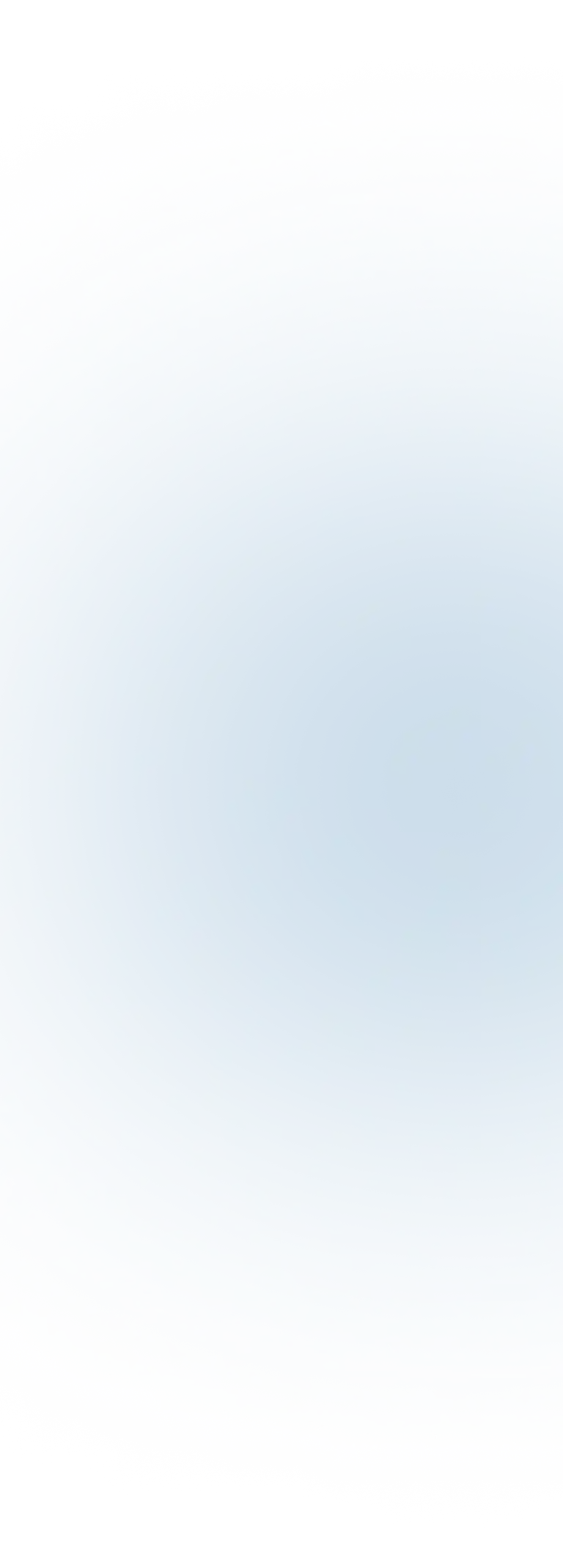

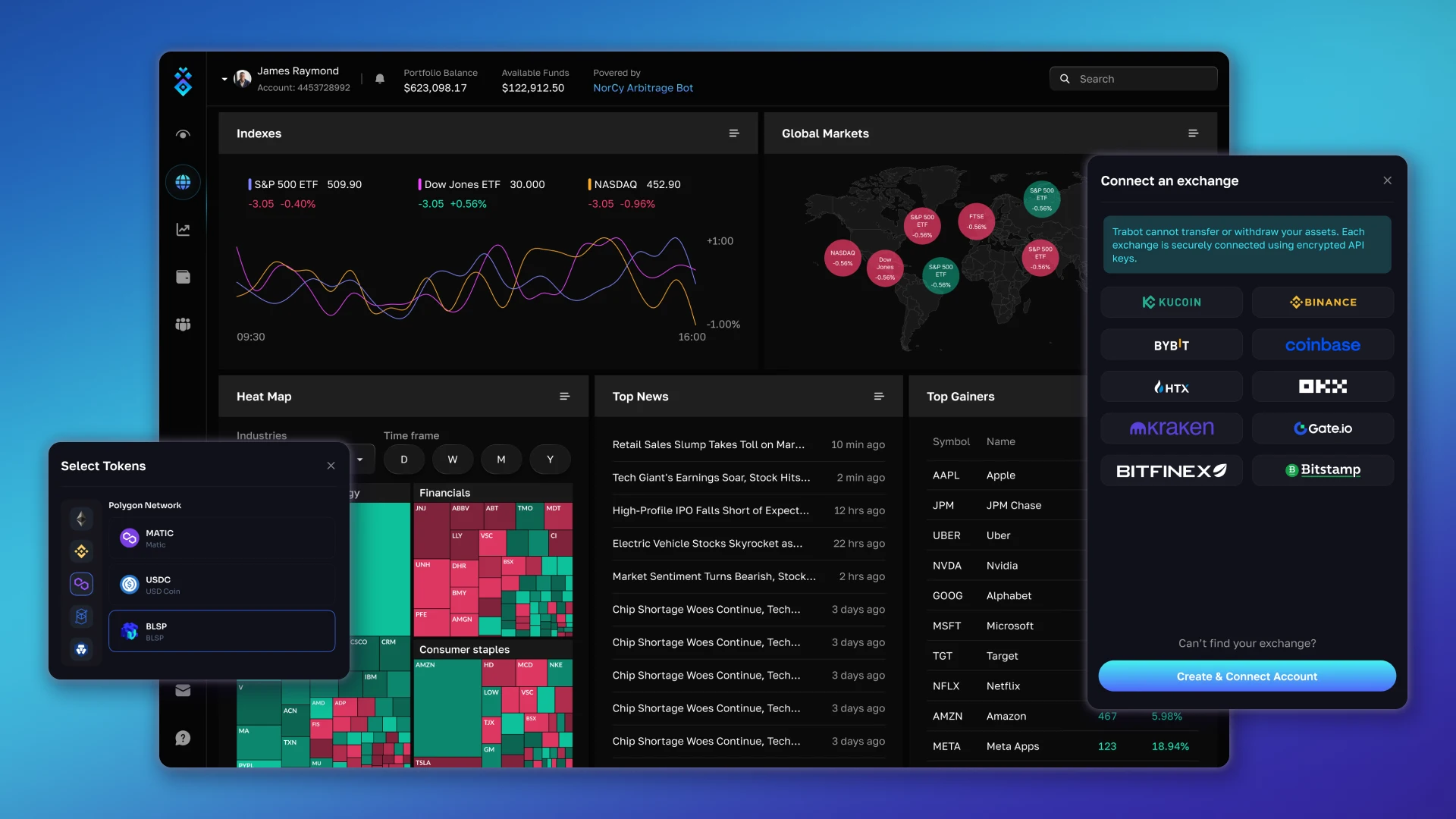

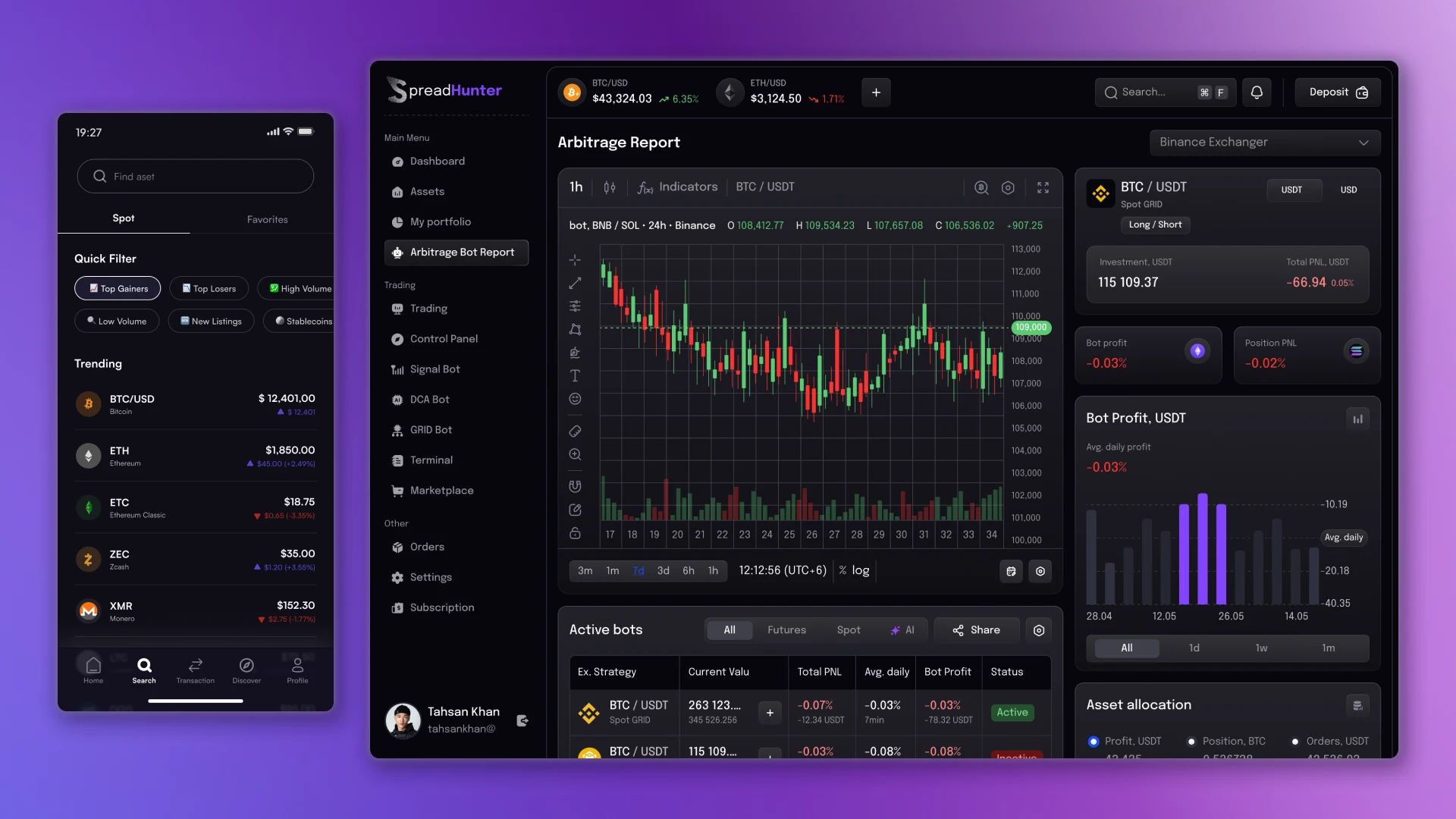

- Analytics & Dashboard

In this module, you can create profitability charts and trade distribution reports. You also receive reporting by strategy, statistics on spreads, delays, and fees, as well as Telegram and email notifications about detected opportunities. In addition, balances across all platforms can be monitored here.

Types of Implementations

CEX Arbitrage Bot

A CEX arbitrage bot is designed to work with centralized cryptocurrency exchanges, where trading occurs through intermediaries (brokers). Examples of CEX include Binance, OKX, KuCoin, WhiteBIT. Such exchanges often provide high liquidity and a wide range of trading pairs.

DEX Arbitrage Bot

A DEX arbitrage bot works with decentralized cryptocurrency exchanges such as Uniswap, SushiSwap, and PancakeSwap. Trading occurs directly between users without intermediaries. To analyze liquidity and prices, the bot uses smart contracts and Web3 integrations. It ensures high anonymity and full control over funds. It is best suited for traders and DeFi projects that want to automate complex and multi-step arbitrage operations.

Cross-chain Arbitrage System

Cross-chain arbitrage is a complex trading strategy that leverages price differences across different blockchain networks. The system analyzes multiple networks, such as Ethereum, BNB Chain, and Solana, via bridge APIs. It tracks prices, transaction statuses, and controls potential risks and delays. This solution helps identify new arbitrage opportunities, move beyond a single network, and build more sophisticated strategies.

Telegram Arbitrage Notifier

The bot is designed to send signals about potential trades that may yield profit. The system analyzes the market, records prices, and sends the necessary information via Telegram or email. This is especially convenient for traders who need to monitor trade execution, or as an additional information source for analytics.

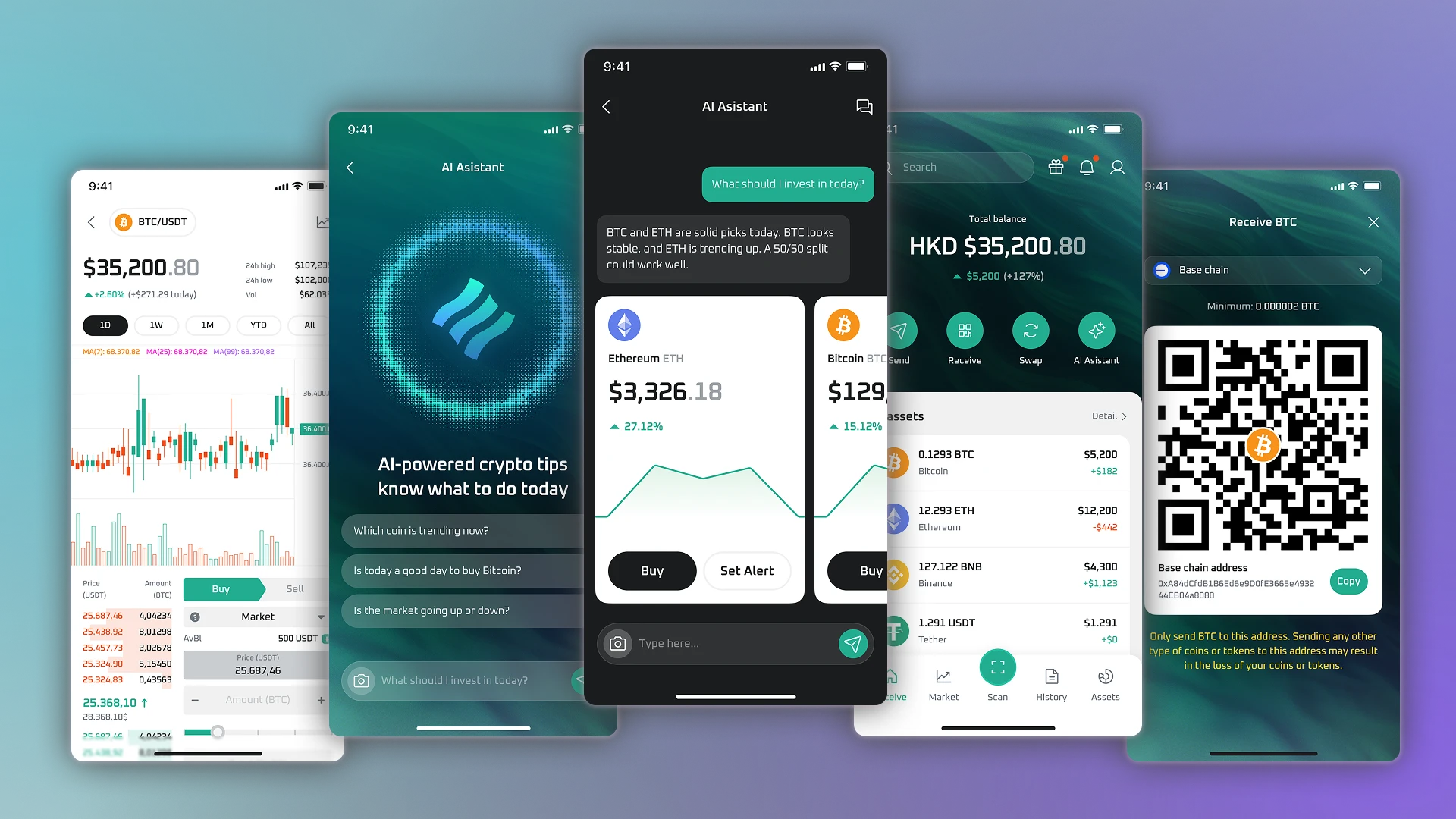

Hybrid Platform (CEX + DEX)

A hybrid exchange combines all the advantages of CEX and DEX into a single platform: high performance, speed, and secure data storage. It is a universal system with a dashboard and API, focused on maintaining user control over funds, low-latency trading, advanced order types, and reliable market infrastructure.

Security

A key aspect of an effective arbitrage system is its reliability. We work only with API keys that do not allow fund withdrawals. We isolate exchange accounts, encrypt keys (AES-256 / RSA), and verify fees before each trade.

Thanks to built-in fail-safe and rollback mechanisms, execution failures are not a concern. In addition, we implement rate-limit control and DDoS protection.

Solution Architecture

The architecture of our solution resembles a multi-layered system, where each module performs its role clearly and reliably. The Market Scanner, responsible for collecting market data, is connected to CEX APIs and DEX Web3 interfaces. This enables real-time access to prices, spreads, and liquidity parameters. The processed data is transferred to the system’s analytical core (Arbitrage Engine), where fees, potential delays, and costs are calculated. As a result, the system generates signals about arbitrage opportunities that may yield profit. These signals are sent to the Execution Layer – the trade execution layer – which independently places orders on centralized exchanges via API or interacts with smart contracts on DEX.

At the same time, the Risk Manager controls trading limits and risks. The Balance Controller monitors balances and the correct distribution of assets across exchanges and networks. All information is stored in PostgreSQL (primary database) and Redis. This enables rapid information exchange between different modules and networks. System results can be reviewed in the Monitoring Dashboard, displayed as metrics and statistics. Information about important events and new opportunities is delivered to users via Telegram.

Additional Features

In addition to core arbitrage logic, we enrich the system with additional features that positively impact control and scalability and make strategy management simpler and more convenient:

- support cross-account synchronization;

- integrate the system with PnL, ROI, and volume analytics;

- configure fees, limits, and stop algorithms according to your needs;

- implement a visual strategy configurator;

- connect API support for bot management (for SaaS);

- offer the possibility to develop a white-label solution.

Development Cost of Arbitrage Bots and Platforms

The price of developing an arbitrage system is determined individually and depends on the type of strategy, the number of exchanges and networks, execution speed requirements, level of automation, and security. Below is an approximate price list for typical solutions – it will help estimate the budget and understand the difference between basic, professional, and high-load arbitrage systems.

| Solution Type | Strategies / Purpose | Timeline | Approximate Cost |

|---|---|---|---|

| Telegram Arbitrage Notifier | Signals without auto-trading, Telegram / email notifications | 6–8 weeks | $3 000 – $4 000 |

| CEX Arbitrage Bot | Inter-exchange, Triangular (Binance, OKX, KuCoin, WhiteBIT) | 6–10 weeks | $6 000 – $10 000 |

| Cross-market Arbitrage | Spot ↔ Futures, hedging, margin control | 8–12 weeks | $8 000 – $14 000 |

| DEX Arbitrage Bot | AMM pools, DeFi, Web3, gas/slippage, MEV protection | 8–14 weeks | $9 000 – $16 000 |

| Statistical Arbitrage Bot | Correlation models, AI analysis, historical data | 10–16 weeks | $12 000 – $20 000 |

| Cross-chain Arbitrage System | Ethereum ↔ BNB Chain ↔ Solana, bridge API | 12–20 weeks | $15 000 – $30 000+ |

| Latency / HFT Arbitrage | Low-latency, FIX/API, HFT infrastructure | 4–6 months | $20 000 – $40 000+ |

| Hybrid Platform (CEX + DEX) | Unified platform with dashboard and API | 4–7 months | $25 000 – $50 000+ |

| White-label / SaaS Arbitrage Platform | Bot management, client API, scaling | 5–8 months | $30 000 – $60 000+ |

Note: The final cost depends on the number of exchanges, strategy types, speed requirements, and levels of automation and security.

Use Case Examples

The system can be used for inter-exchange arbitrage between Binance ↔ WhiteBIT, as well as DEX arbitrage via Uniswap ↔ PancakeSwap. It can be applied as a cross-chain bot between Ethereum ↔ BNB Chain ↔ Solana, a Telegram service for arbitrage notifications, or a SaaS platform with a bot management dashboard.

Why Choose CryptonisLabs

We are valued for our extensive experience in developing HFT and arbitrage systems with minimal latency, as well as support for 10+ CEX and DEX APIs. We build well-designed architectures with parallel processing and advanced risk management. Our solutions easily integrate with AI forecasting modules and statistical arbitrage. We support both CEX and DEX / cross-chain arbitrage. We are ready to implement white-label solutions and SaaS platforms.

Want to launch an arbitrage bot or a platform for automated trade discovery? We will create a system that works faster than the market – with CEX, DEX, and real-time analytics integration.

FAQ

-

What is the minimum capital required to launch an arbitrage bot?

The minimum capital depends on the selected strategy. For CEX arbitrage and triangular strategies, $3,000–5,000 is sufficient. For cross-market, DEX, or cross-chain solutions, a larger amount is usually required due to fees, gas costs, and liquidity requirements.

-

Does an arbitrage bot guarantee profit?

Arbitrage does not depend on market direction, but profit cannot be guaranteed. Results depend on market conditions, execution speed, fees, liquidity, and risk management settings. We build systems with a focus on risk control and stability rather than promises of fixed returns.

-

Can one bot be used on multiple exchanges simultaneously?

Yes. Arbitrage systems support parallel operation across multiple CEX, DEX, and networks. Balances can be distributed in advance, allowing you to avoid delays and on-chain transfers during trade execution.

-

How safe is it to connect exchange accounts to the bot?

We use API keys without withdrawal permissions, encryption (AES-256 / RSA), rate-limit control, and fail-safe mechanisms. Even in the event of a failure, the bot has no access to withdraw assets from the exchange.

-

Can the system be scaled or new strategies added over time?

Yes. The architecture is built modularly, allowing the addition of new exchanges, strategies, AI modules, cross-chain, or SaaS functionality without a complete system redesign.