Copy-Trading platforms and turnkey bots

We create reliable systems for copying top traders' trades for crypto exchanges, Telegram bots, terminals, and web platforms - with automated execution, detailed analytics, and a secure architecture.

Suitable for exchanges, brokers, investment platforms, and fintech startups.

What is Copy Trading?

Copy-Trading is a technology that automatically replicates the trades of a selected trader or model. The system receives the signal and sends it to the exchange, whereby orders are replicated in the exact sequence and with the original parameters. It's a bridge between an experienced trader and a follower, where the algorithm ensures precise execution and eliminates human error.

For investors, copy trading is a simple, convenient, and secure way to connect to professional trading, and for platforms, it's a ready-made tool for scaling their user base, helping to create new value for their audience.

Who needs a copy trading platform?

Copy-trading systems have long gone beyond simply duplicating orders. They take into account liquidity, network latency, risk parameters, and the specific features of specific exchanges, ensuring stable and accurate trading even during high volatility.

Copy trading today is more than just copying trades; it's an adaptive mechanism for automating trading and capital allocation, in demand in ecosystems where scalability, risk control, and user-friendliness are essential.

Copy-trading is especially suitable for projects:

- CEX/DEX exchanges and brokers looking to strengthen their product, increase user retention, and offer trading automation tools.

- Fintech platforms and trading terminals that need to integrate a copy-trading module, strategy subscriptions, and centralized analytics.

- DeFi and Web3 projects that need to implement automated transaction execution, smart contract integration, and on-chain signaling.

- Investment communities, private clubs, and educational projects that offer participants access to strategies and want to make the process transparent and automated.

- Startups and Telegram/Web platforms creating their own copy-trading applications, bots, or SaaS solutions with public trader ratings and a subscription system.

Copy-trading systems have become the foundation for services that value transparency, automation, and scalability of trading strategies without unnecessary complexity for users.

Cryptocurrency copy trading software can be run in two main formats:

- Built-in module inside the exchange or terminal

This solution integrates directly into the CEX/DEX infrastructure, utilizes internal APIs, provides direct access to data, and accelerates execution. This option is suitable when a module is needed on existing infrastructure. Exchanges and brokers can strengthen their product and retain users without the need for third-party services.

- A separate SaaS platform

This is a completely independent service with personal accounts, trader ratings, analytics, subscriptions, and the ability to work with multiple exchanges simultaneously. This format is suitable for startups, fintech projects, and community platforms that require flexibility, a custom architecture, and independence from a specific exchange.

Copy-trading platforms have become some of the most sought-after tools in the world of digital trading. They allow traders to scale their strategies, and investors to tap into professional models without delving into complex technical details.

CryptonisLabs creates copy-trading systems for CEX, DEX, trading terminals, Telegram bots, and web platforms - from scratch, tailored to business needs, and with full process automation. We design solutions as both built-in modules and standalone SaaS platforms, depending on the product's architecture and goals.

Our approach combines engineering precision, thoughtful architecture, and a real understanding of how modern markets work, so our solutions remain stable, fast, and secure even under high load.

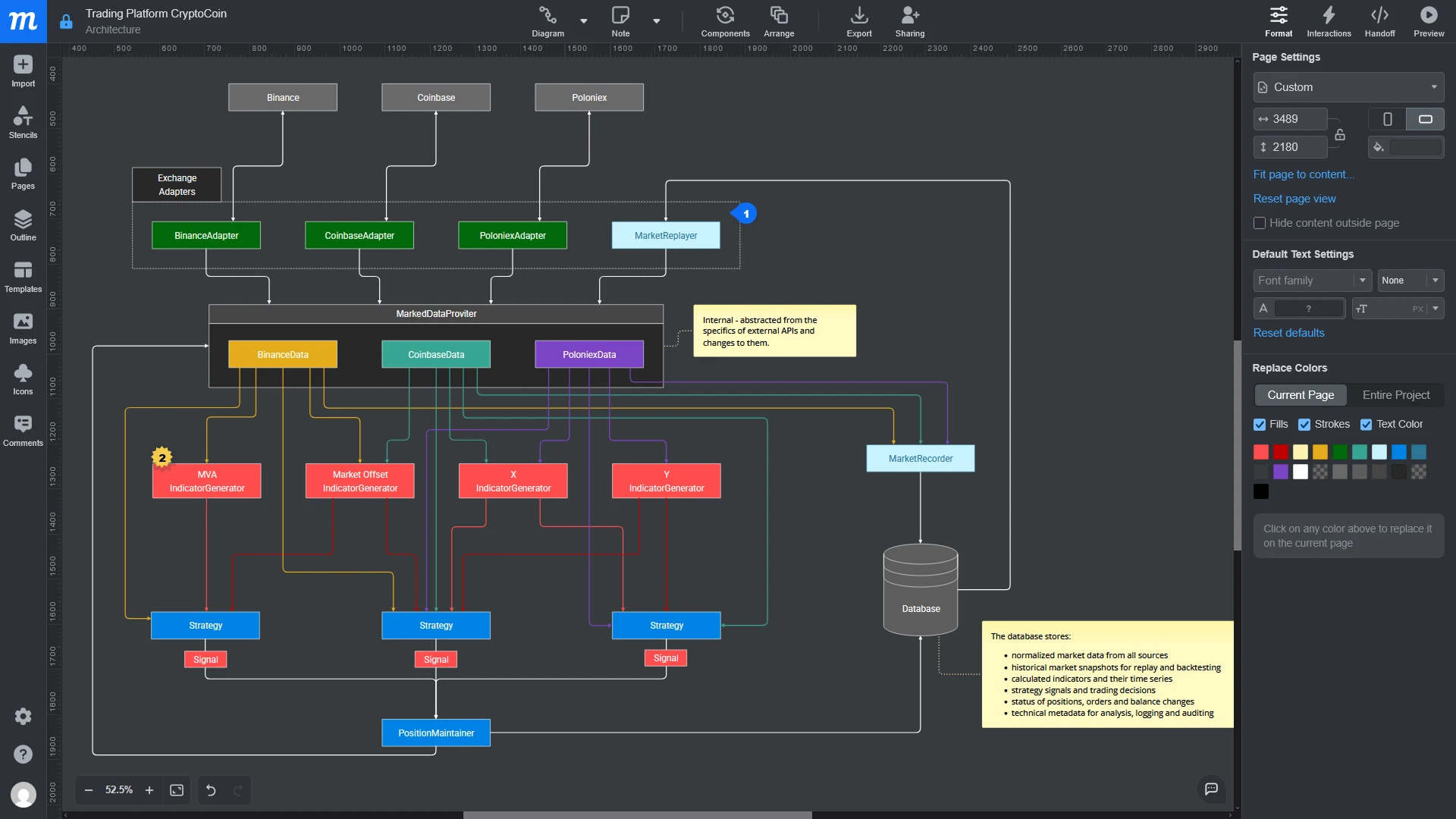

Copy-Trading System Architecture

The Copy-Trading system consists of several interconnected modules that ensure secure, uninterrupted trade execution. We create an architecture that operates quickly, accurately, and reliably in any environment.

Copy-Trading is based on a single data flow: Trader Account (Binance, OKX, WhiteBIT, etc.) → Cryptonis Copy-Core → Investor Accounts (via API) → Database, Analytics, Notifications.

This is the complete transaction path - from the moment the trader opens it to its mirror execution by subscribers. It consists of three key modules.

- Signal Source. The mirror trading system receives trading events from a master account, trading bot, trader, or external strategy via API or WebSocket, standardizes them, and sends them to the processing queue (position opening, stop order modification, partial or full trade closure).

- Cryptonis Copy-Core (copy engine). Algorithms analyze the signal, adjust the volume to the investor's deposit, take risk limits into account, and synchronize positions. Slippage is compensated for and requests are adapted to different exchanges, API limits, and market conditions.

- Order execution module. The system sends orders to investor accounts (CEX, DEX, or smart contracts), monitors statuses, retry rejected transactions, closes positions, and maintains a mirrored portfolio. All transactions are processed through a single monitoring center - recorded in the database, displayed in analytics, and transmitted via notifications. This approach creates a robust and flexible pipeline that can be deployed within an exchange, a Telegram bot, a terminal, or a separate SaaS platform.

Types of Copy Trading

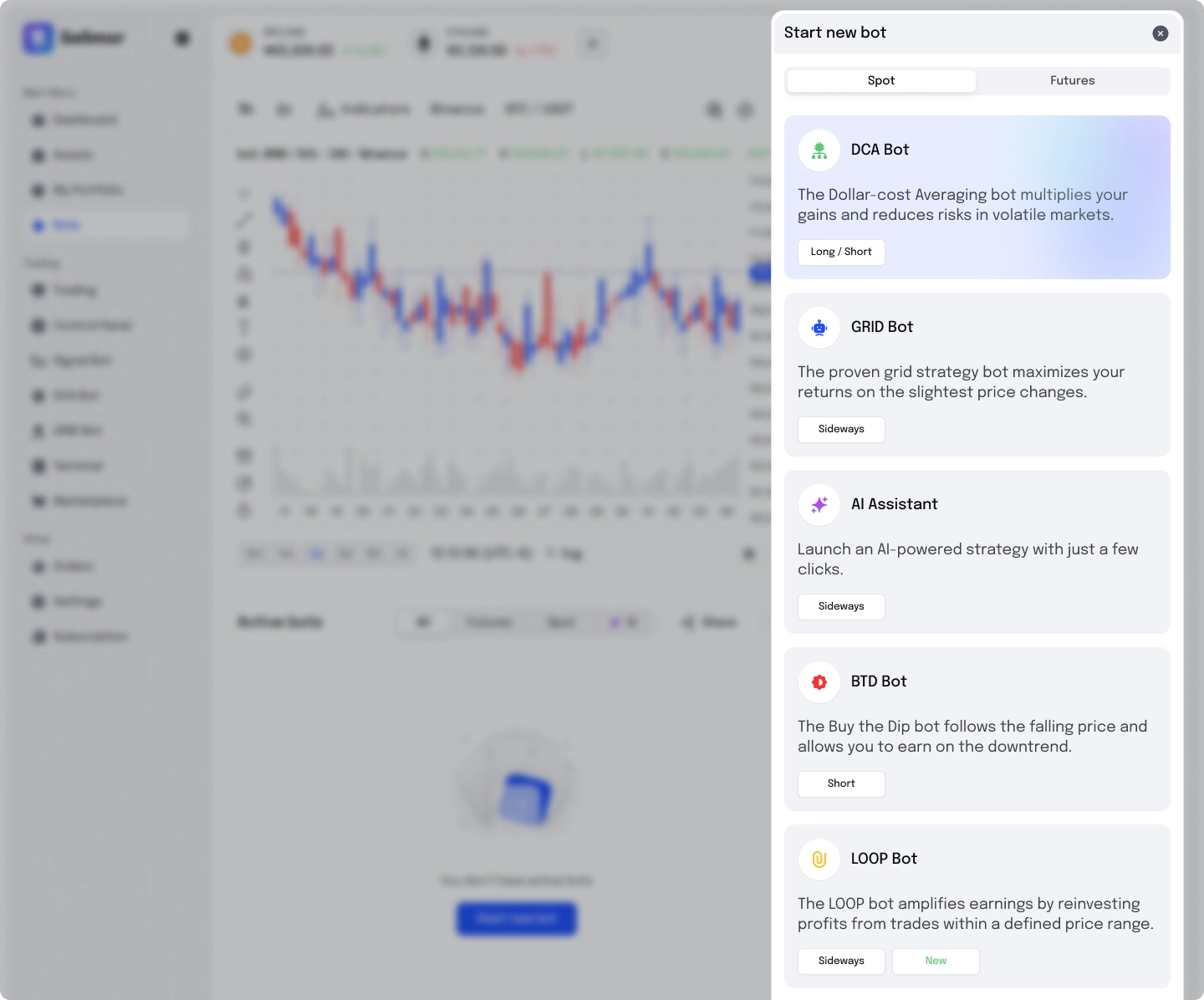

Copy-trading systems operate using various models, solving specific problems: from transparent mirror copying to scalable trading pools. At CryptonisLabs, we create platforms, modules, and Telegram bots that support all modern copying types and operate reliably on CEX, DEX, and Web3 infrastructure.

- Mirror Copying works with Binance, OKX, KuCoin, WhiteBIT, and any API that supports real-time WebSocket. This format is required by exchanges, terminals, and advanced trading platforms where accurate transmission of all trader actions without delays or distortions is essential.

- Proportional Copying is the most popular format among social trading platforms, brokers, and investment services. The system automatically scales the trade volume to the investor's deposit, preserving the structure and logic of the strategy. It is used in products like eToro and PrimeXBT, and is fully supported in our solutions.

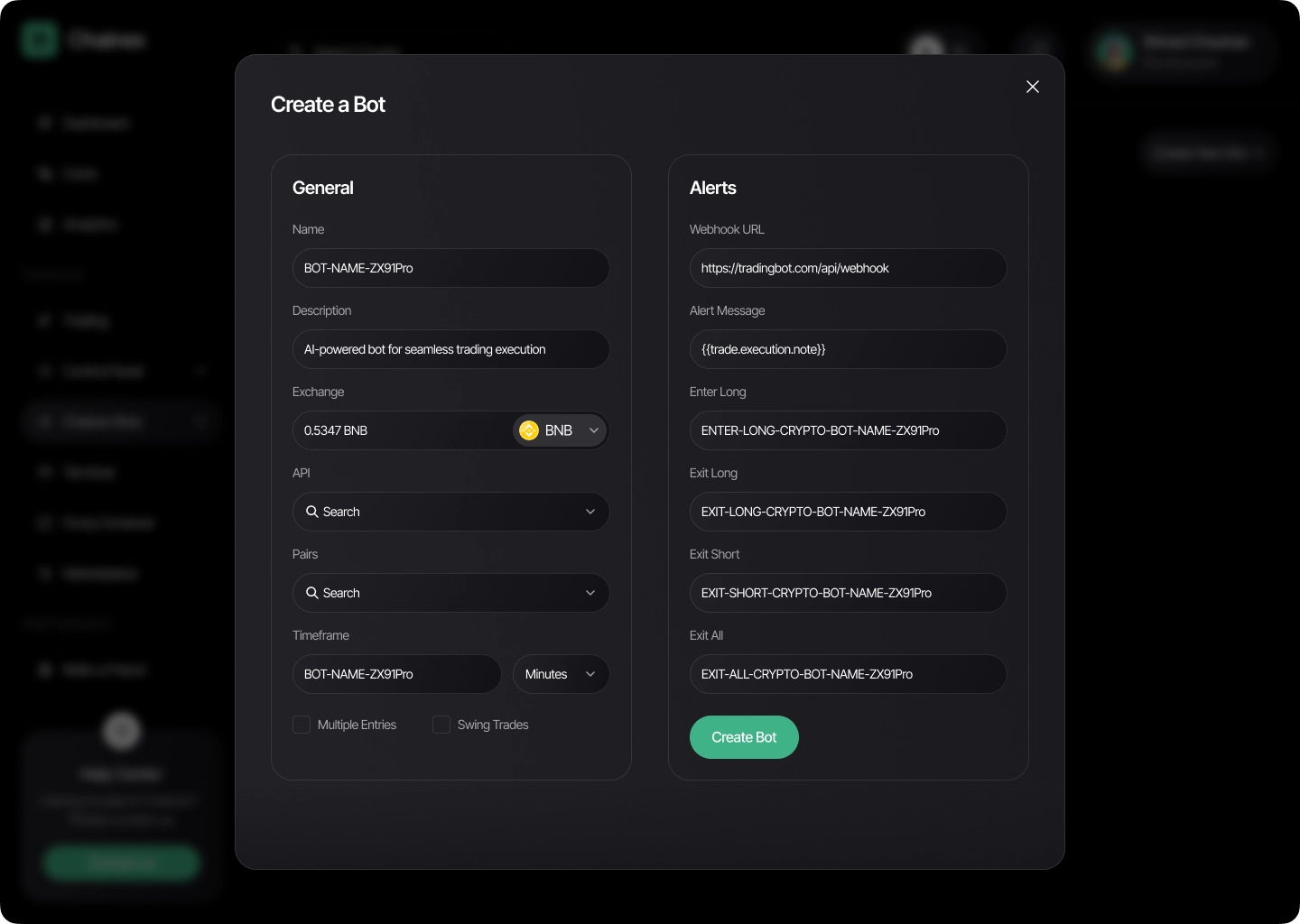

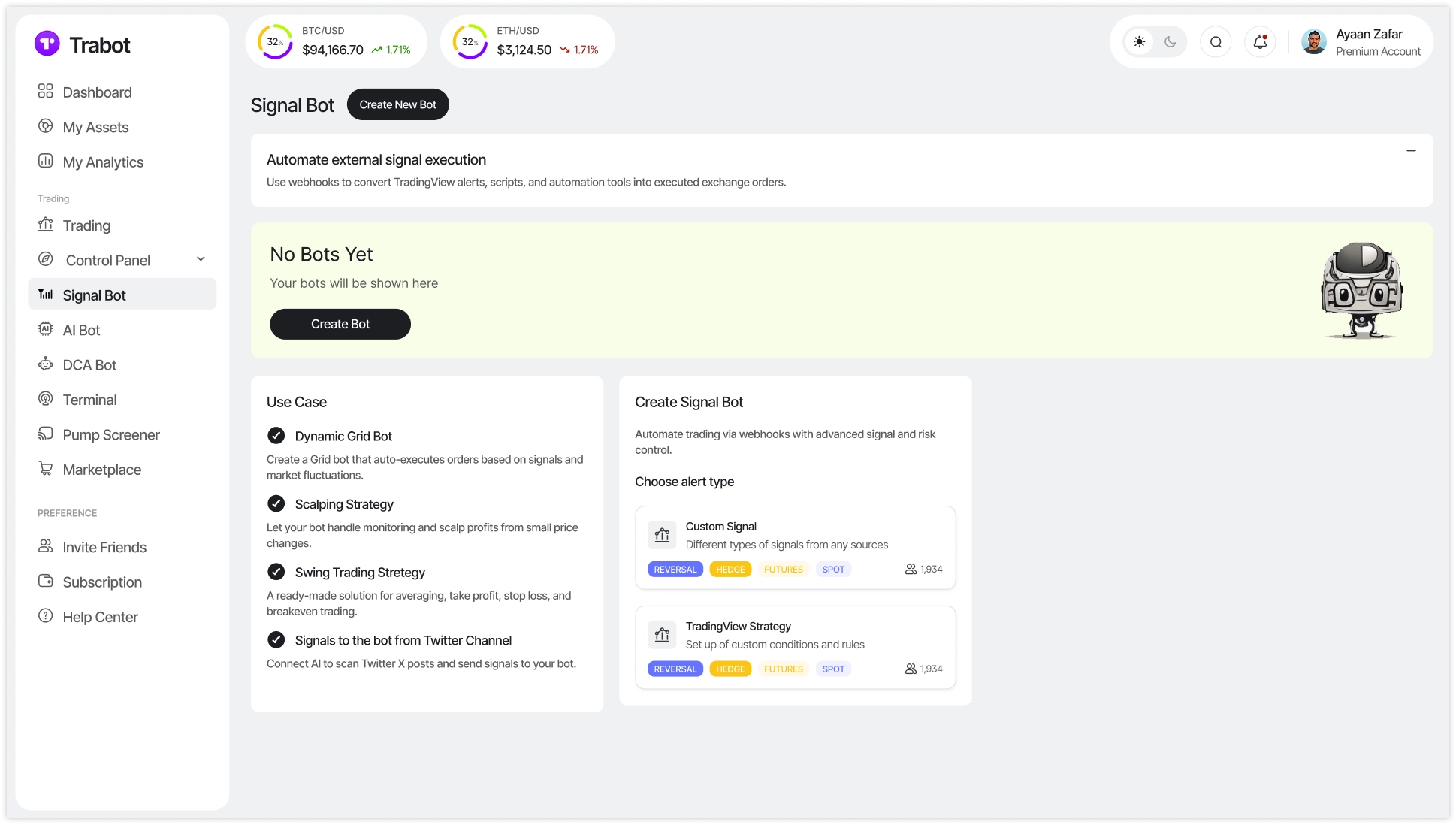

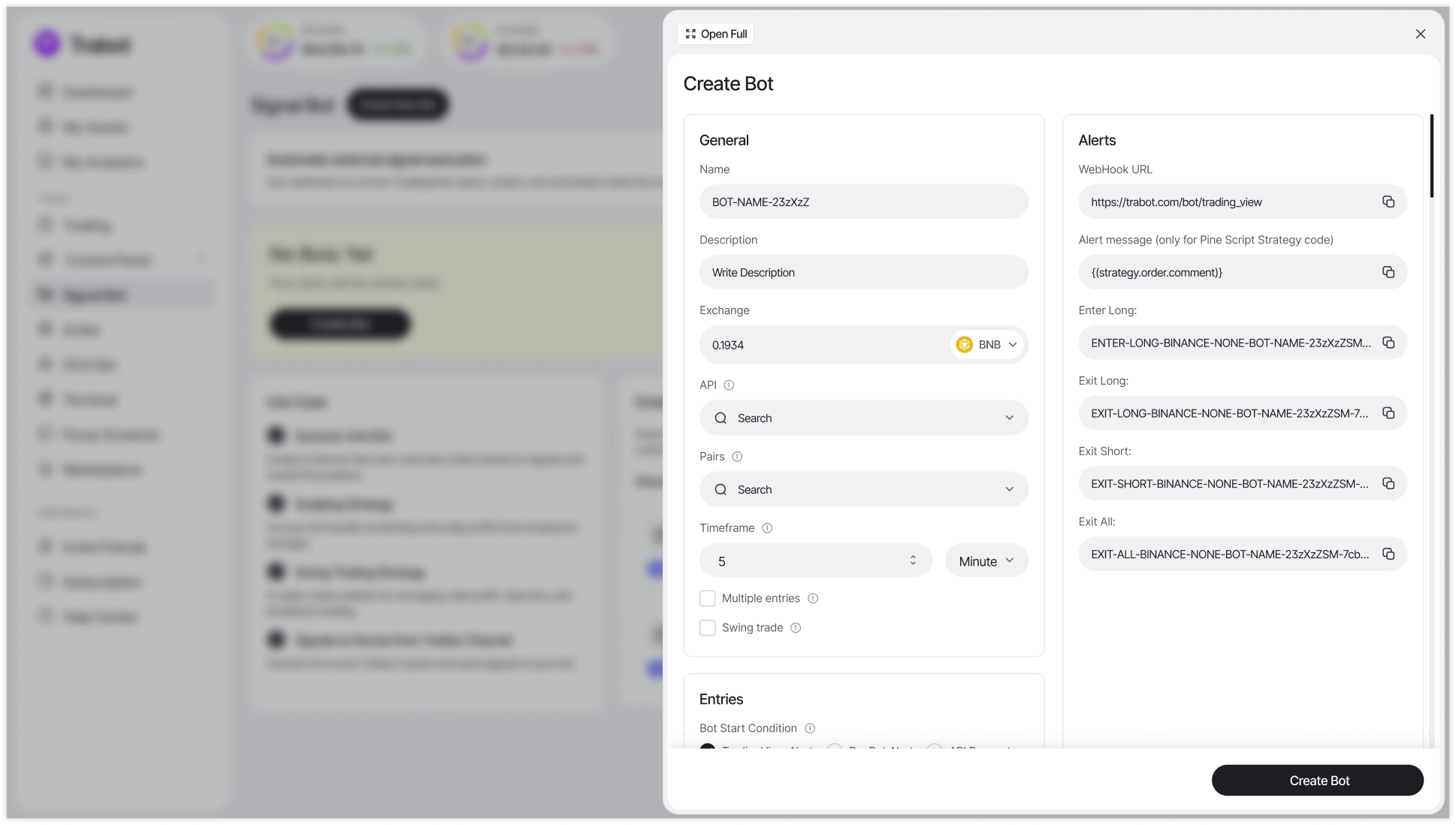

- Signal-Based Copying is suitable for AI algorithms, closed trading communities, 3Commas-like services, and Web3 projects. Trades come from bots, strategies, WebHook signals, Telegram channels, or any third-party sources. We build an infrastructure that processes signals, validates them, and executes them automatically on exchanges.

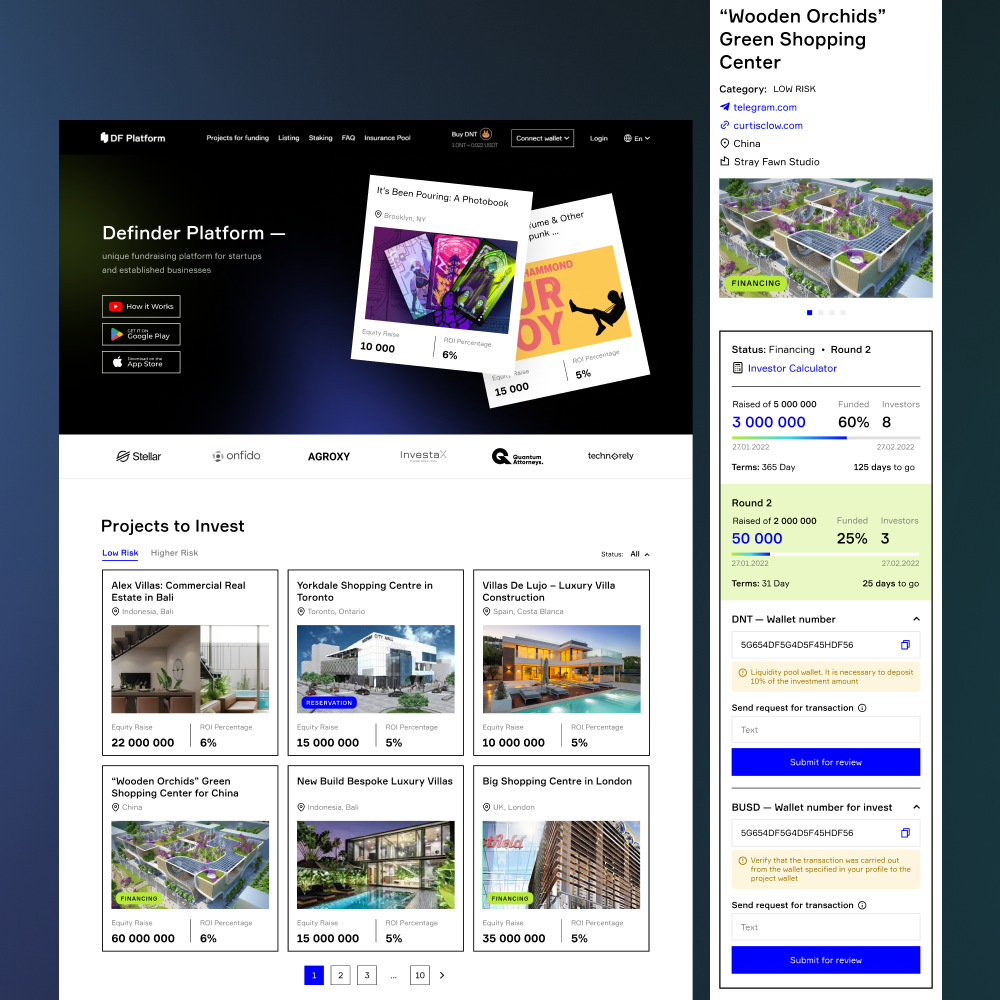

- Copy-Trading Pools (strategy and capital pools) are a format used by funds and investment products that require transparent capital management mechanisms. Several traders manage a shared pool of investors, and the system distributes trades automatically. We implement such solutions through Trading Pools, Smart Accounts, smart contracts, and off-chain architecture.

- Telegram Copy Bots (copying within Telegram) is suitable for trading communities, Web3 communities, and brands looking to launch an investment product quickly and without complex infrastructure. This full-fledged bot for copying trades in Telegram connects to exchanges via API, receives signals from channels or strategies, and automatically replicates trades on user accounts.

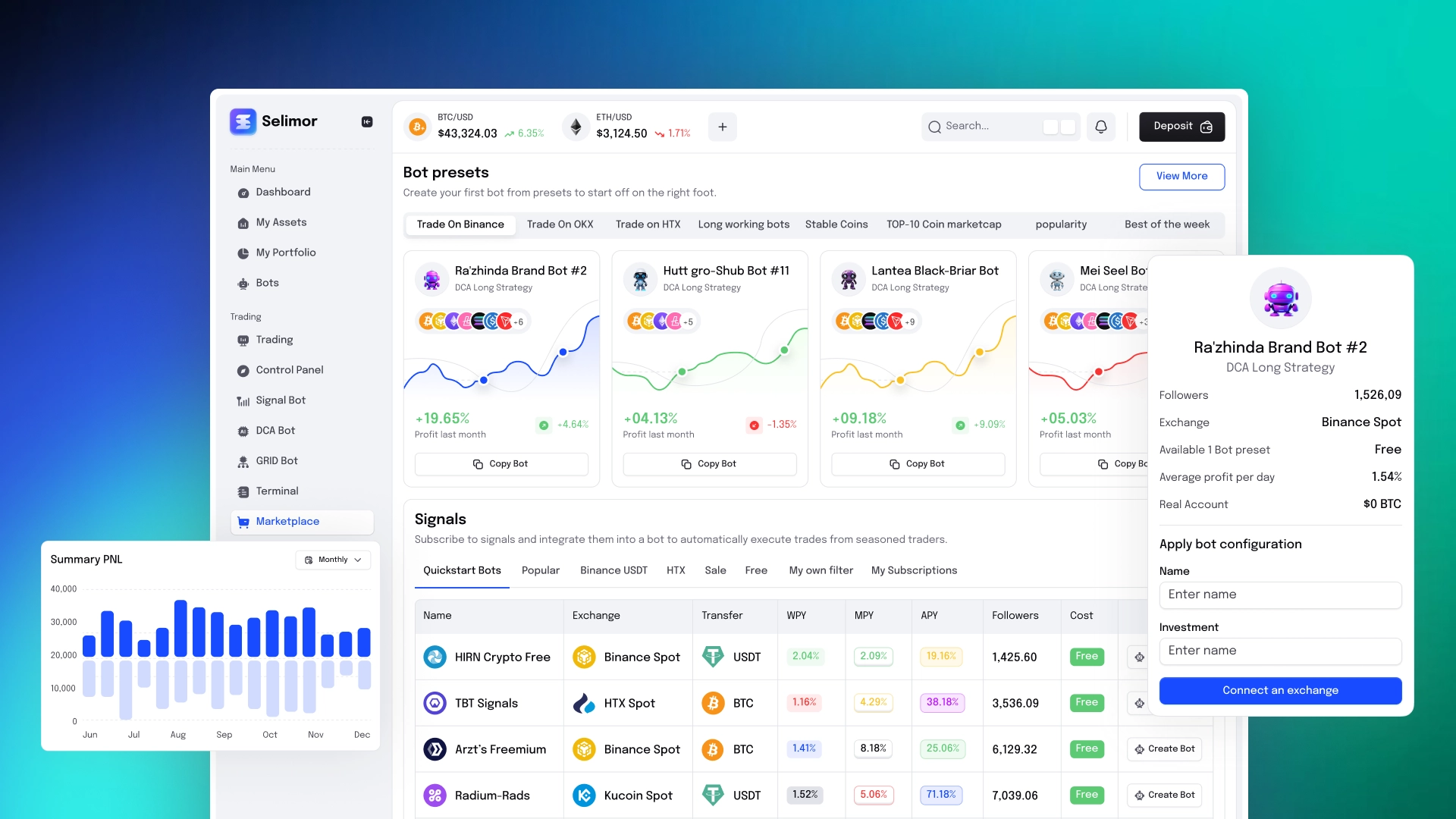

Key platform features for all participants

A modern copy-trading platform should be convenient for everyone: traders, investors, and product owners. We design systems that provide maximum benefits to all participants – from advanced automation to transparent analytics and secure API integration for copy trading.

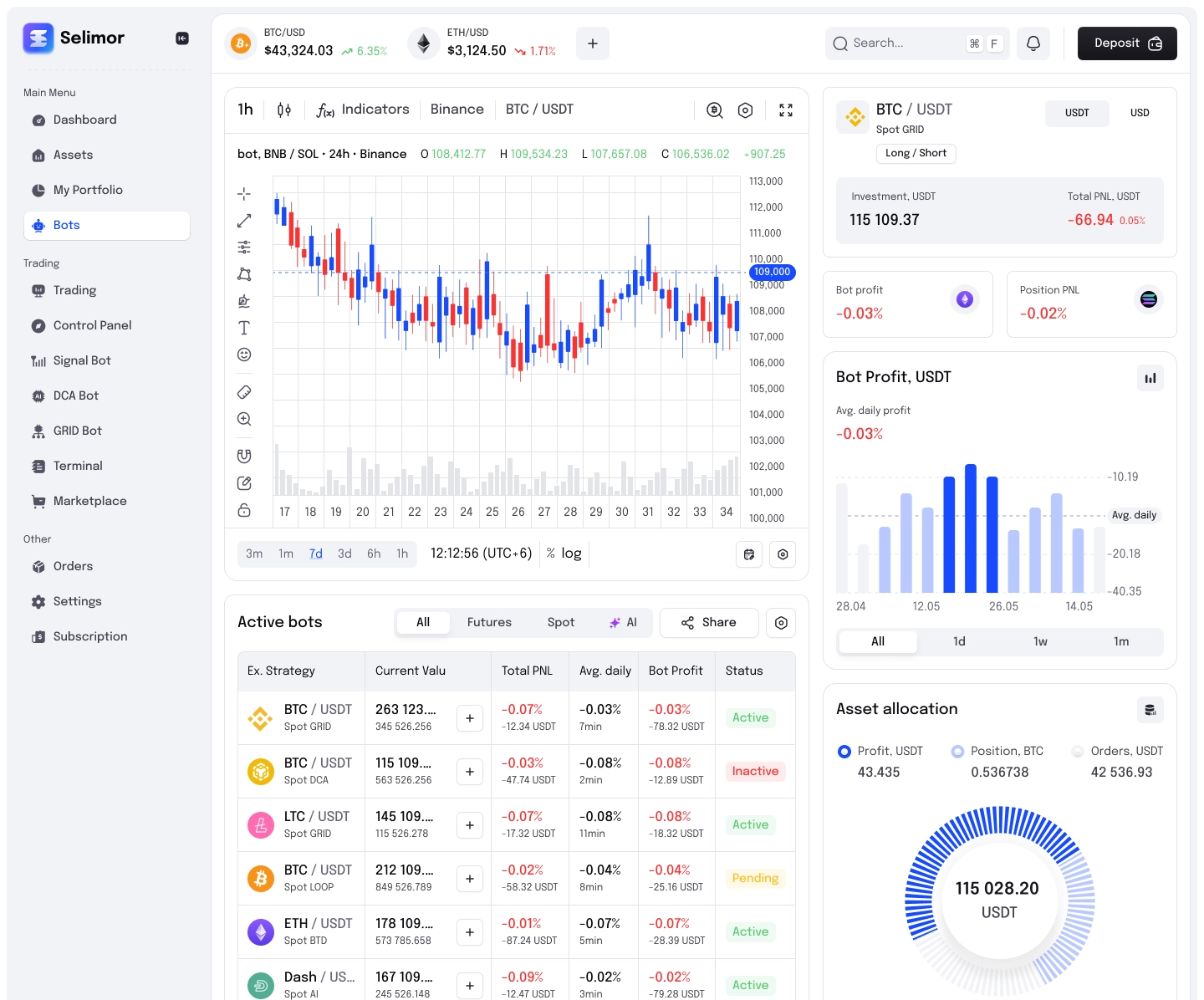

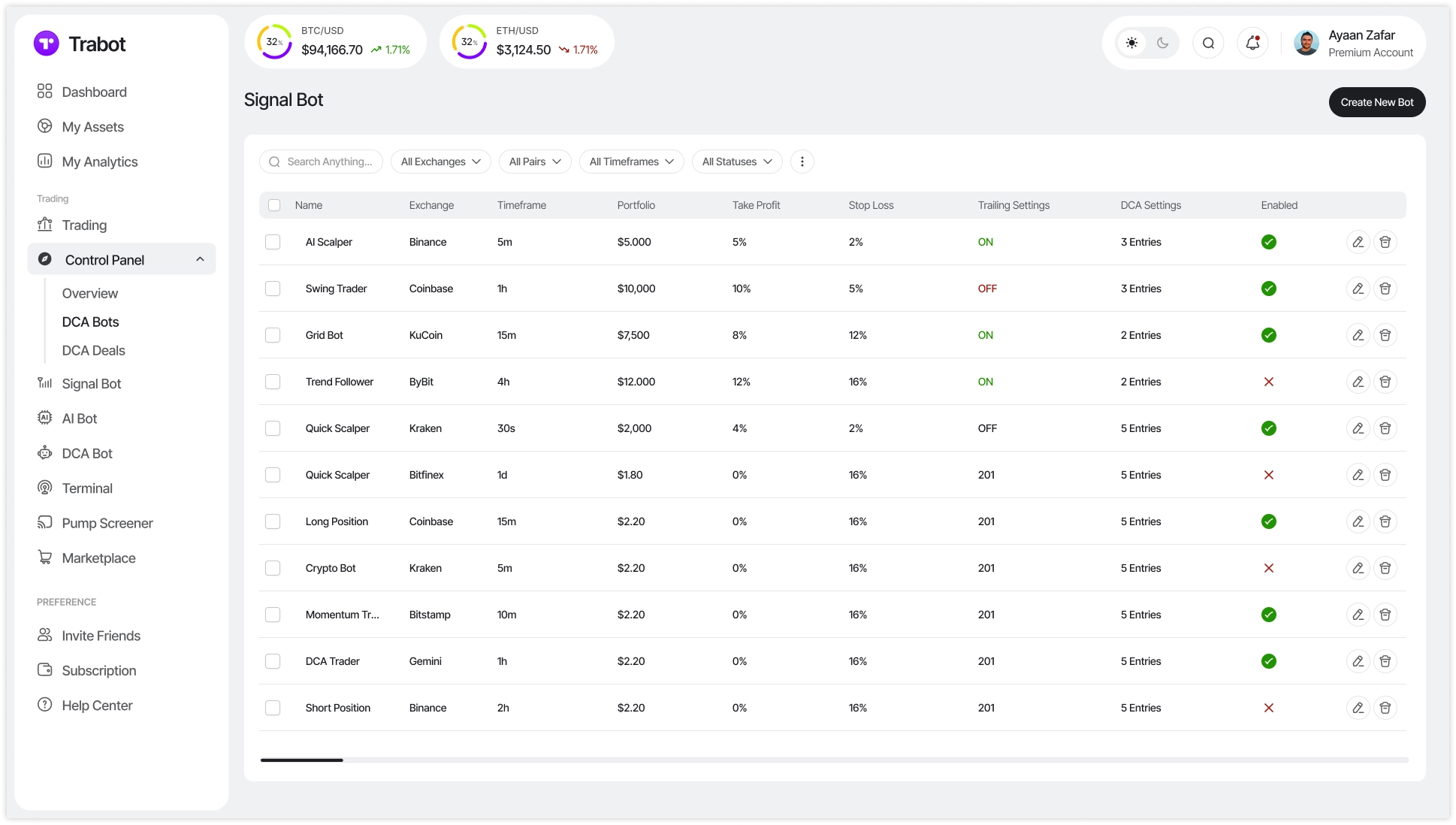

- Traders receive a full professional profile with statistics (PnL, ROI, Win Rate) and tools for scaling their strategy. They customize their trading model - spot, futures, margin, leverage - manage subscriptions and commissions, and earn ratings and badges. The platform adjusts volumes, accounts for risks, and synchronizes positions, while integrations with terminals, bots, and external signals allow for the use of any trading instruments.

- Investors select a strategy based on metrics such as return, risk, trade history, drawdown, and portfolio structure. They connect their account via API keys, and deposit limits, equity share, stop-loss parameters, and risk levels are configured in just a few clicks. All trades are executed automatically and displayed at execution, while subscription and analytics management is simple and intuitive. The platform makes connecting to professional strategies convenient, transparent, and fully automated.

- Administrators use the admin panel to manage users and traders, set commissions and limits, and control strategies, subscriptions, payouts, KYC, and API key security. Analytics, reporting, activity logs, and white-label settings for the platform's brand are also available.

For fintech companies, exchanges, and startups, we create a full-fledged SaaS infrastructure ready for scalability and high loads: from the Copy-Core engine, responsible for signal processing and routing, to billing modules, integrations with CEX/DEX exchanges, Web3 wallets, Telegram bots, and any monetization model.

The cryptocurrency investor or trader dashboard provides each participant with the exact functions they need – from a simple strategy subscription to full product management. This simplifies investor onboarding: API keys, limits, and risks are all in one window. Your copy-trading system will operate predictably and without any additional user interaction.

Integrations and APIs

Integrations are the foundation of any copy-trading system. The platform must work seamlessly with exchanges, wallets, bots, and external strategies. CryptonisLabs develops systems that connect to dozens of infrastructure services and execute trades with minimal latency.

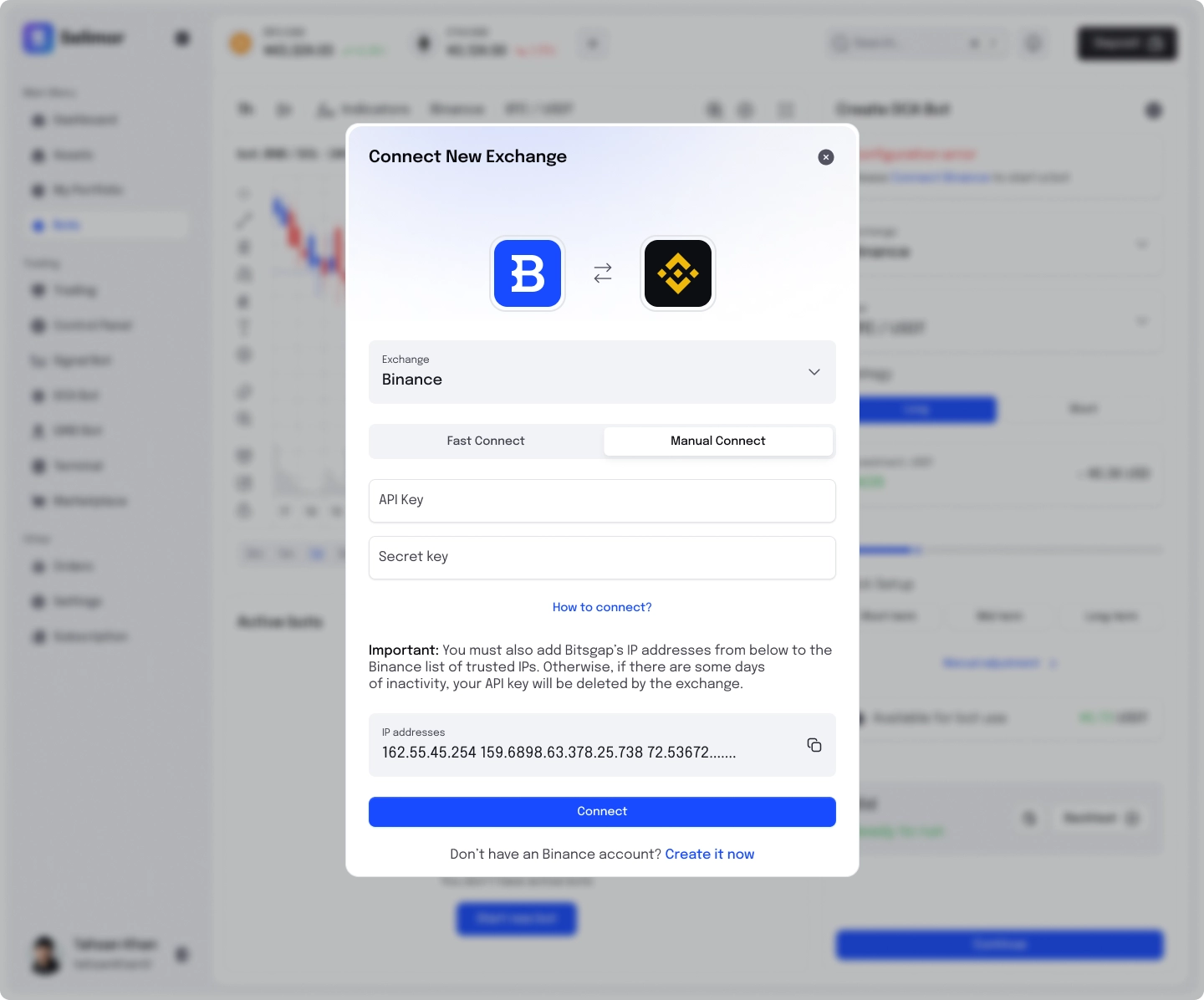

Integration with CEX exchanges

Copy trading integration with Binance, OKX, Bybit, KuCoin, WhiteBIT, and other CEXs is available. Signals are received via API/WebSocket in real time, and orders are executed automatically: the system monitors their status, replays rejected orders, and synchronizes positions. It takes into account exchange limits, slippage, and liquidity, maintaining accurate execution.

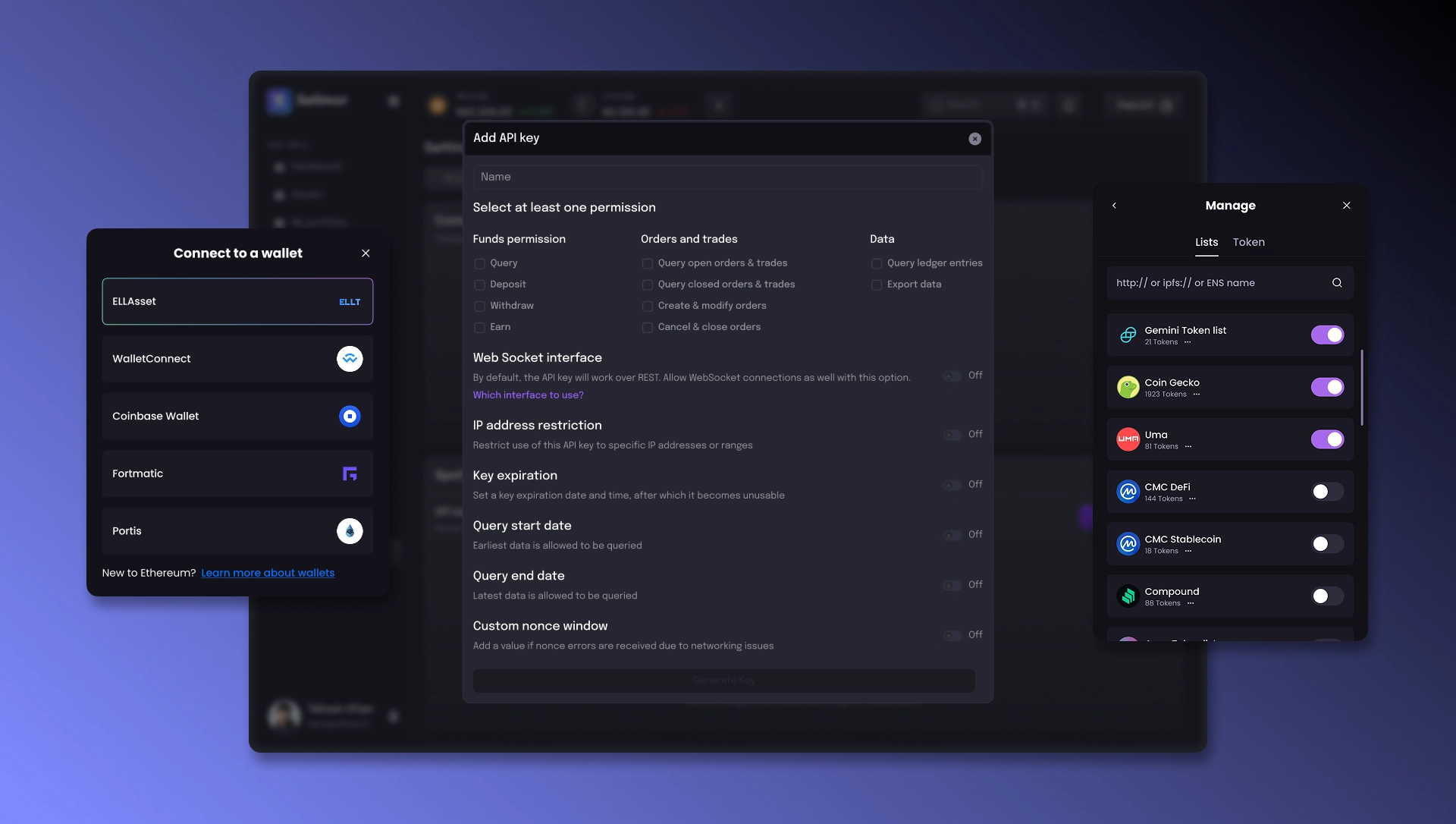

Integrations with DEX and Web3

For decentralized platforms, you can connect smart contracts or aggregators: Uniswap, PancakeSwap, 1inch API, wallets via WalletConnect, or direct RPC. The copy trading system can replicate trades in DeFi services, work with liquidity pools, strategies, and capital management on the blockchain.

Integration with Telegram bots and trading terminals

Copy trading can be integrated into a Telegram bot or an existing terminal. We configure signals from channels, WebHooks, algorithms, and bots, converting them into automated trades on exchanges. Creating a copy trading bot is ideal for social trading communities and Web3 projects.

Data and Analytics

You can connect external data sources to the platform: TradingView (Charting Library, WebHook signals), CoinGecko API, to build analytics, charts, obtain prices, indicators, and use data in strategies.

Payments and monetization

We integrate all crypto payment solutions for subscriptions, deposits, and SaaS models, including Cryptomus, NOWPayments, and Binance Pay. Our infrastructure supports subscriptions, trader commissions, automatic payouts, referral bonuses, and white-label monetization models.

Security and Protection of API Keys

Users trust the system with access to their trading accounts, so the architecture must eliminate any risks: key leaks, unauthorized transactions, signal spoofing, and attempts to interfere with the trading process. We build systems where API access is protected at all levels: from key storage to trade execution.

- Access to withdrawals is disabled at the integration level, completely eliminating financial risks. The platform operates only with the minimum necessary rights: reading data and trading operations.

- Keys are stored encrypted (AES-256, RSA), and requests are only made from trusted platform IP addresses. Even if a key is compromised, it cannot be used outside the system.

- Every operation is recorded : authorization, order execution, connection attempts, API errors. Any abnormal activity is automatically blocked, and the system notifies the administrator.

- Additional restrictions - maximum volume, transaction frequency, daily limits, and risk filters - protect investors from sudden volume surges or unpredictable strategy behavior.

- 2FA and JWT authentication prevent unauthorized access to personal accounts, subscriptions, and API settings. All user actions are protected by two-factor authentication and JWT tokens.

- Separate validation eliminates false signals, terminal errors, and attempted tampering. Before execution, each command is verified: signal source, master position, volume validity, price relevance, and liquidity.

This architecture allows for the launch of copy-trading products without storing funds and reduces regulatory and operational risks.

Analytics and interfaces

A copy-trading platform must be as transparent as possible for traders, investors, and administrators. We create interfaces that help participants make quick decisions:

- We develop trader profiles with advanced statistics: ROI, PnL, Sharpe ratio, Win Rate, drawdowns, trade history, and profitability dynamics on charts;

- We integrate ratings and convenient filters: sorting by profitability, risk level, trading instruments, stability, and other metrics;

- For investors, we create personal dashboards with linked accounts, profitability charts, limits, current positions, and risk analytics;

- We implement data export to CSV and PDF for reporting, analysis, and integration with external systems;

- We connect TradingView for advanced chart visualization and external market data sources – CoinGecko and CEX/DEX exchange APIs.

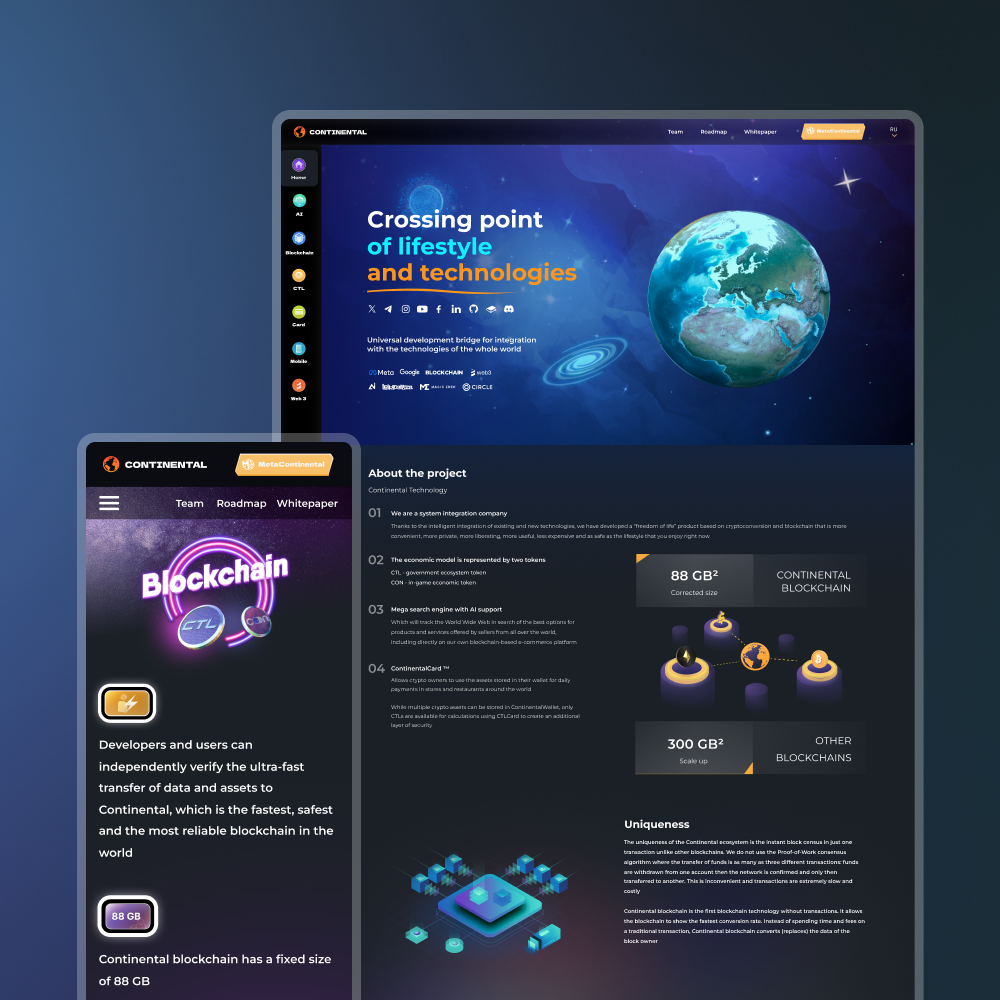

When developing white-label trade copying interfaces, we fully adapt them to the client's corporate style. They work equally reliably on the web, mobile, and in Telegram bots. All data is instantly updated via WebSocket, so trades, order statuses, and key indicators are always displayed up-to-date.

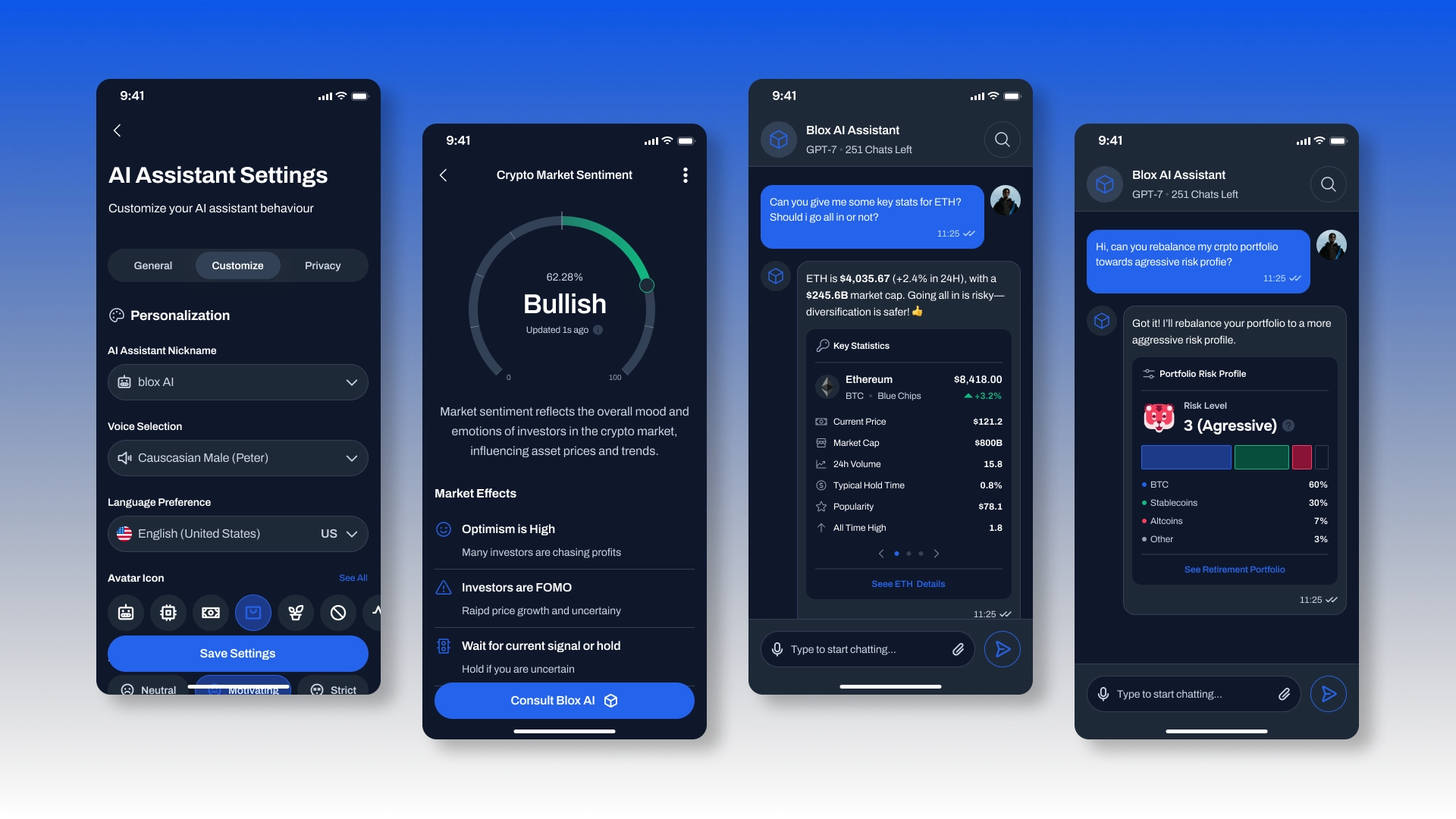

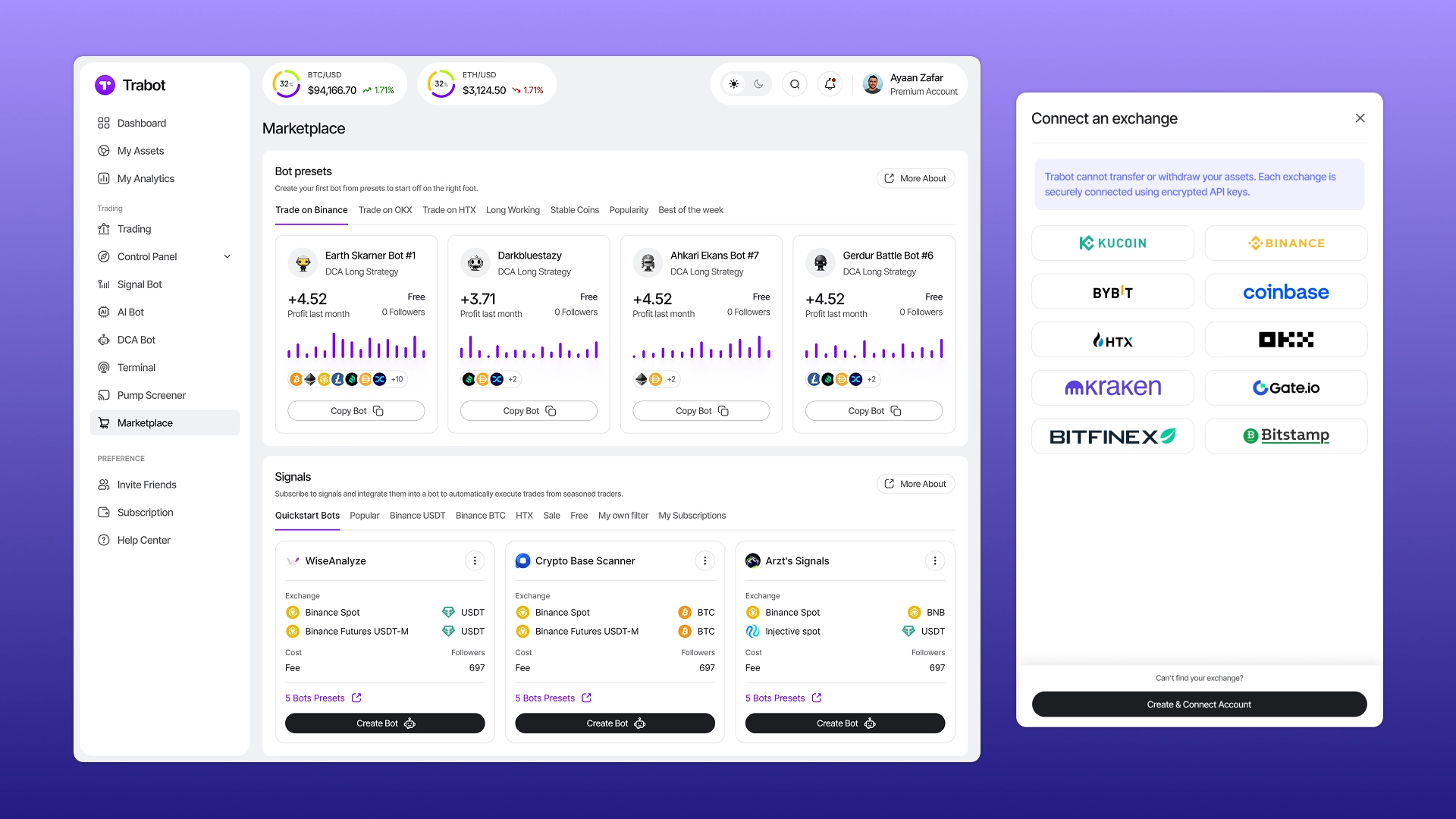

Supported interface formats

We create interfaces for copy-trading systems in the formats your users prefer. Each format is tailored to the client's product, use cases, and brand.

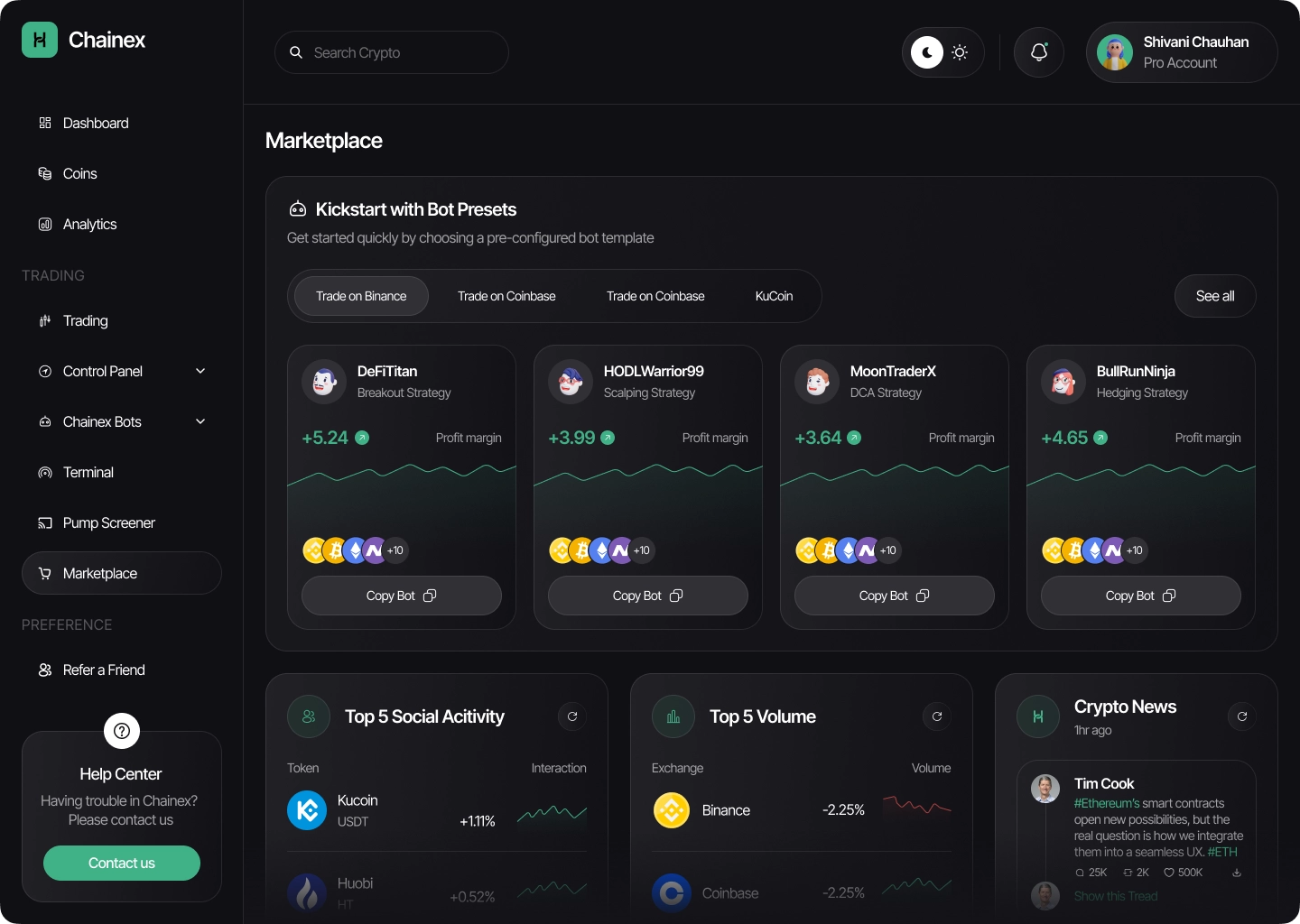

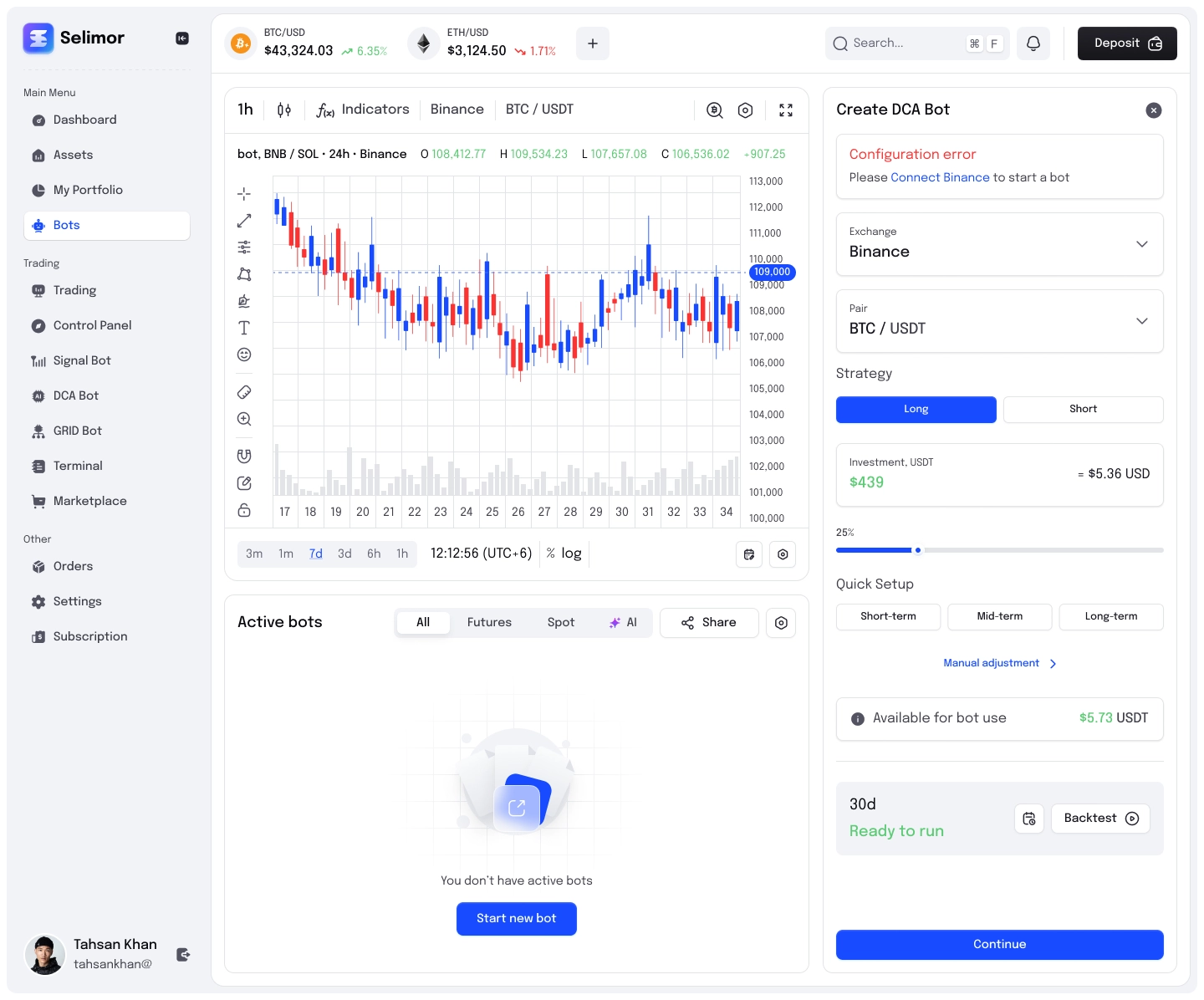

- Web platforms with trader and investor dashboards are fully functional dashboards with strategies, profitability charts, analytics, trades, limits, and copy management. This format is suitable for SaaS solutions, exchanges, and investment services.

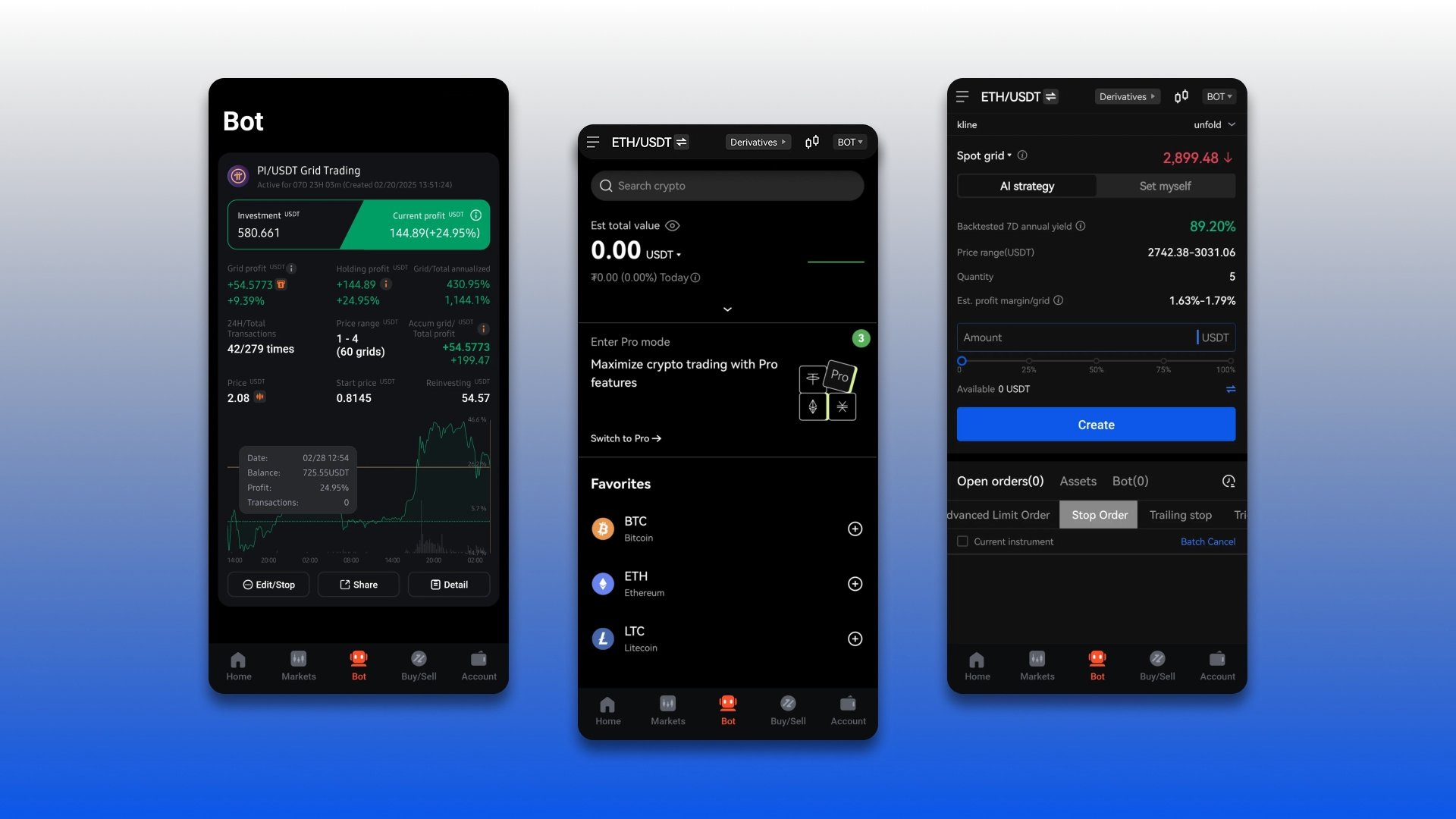

- Mobile apps for iOS and Android with exchange connectivity, statistics, strategy management, and real-time notifications are suitable for projects that prioritize mobile UX and high usage.

- Trading Terminal Plugin – a copy-trading module that is integrated directly into the client's trading terminal or platform and functions as part of the familiar workspace.

- Telegram Copy Bot is a compact yet functional solution for trading communities, Web3 projects, and more. It supports exchange connectivity, strategy analytics, limit management, strategy copying, and push notifications.

The interfaces we create work seamlessly in any environment—desktop, mobile apps, terminals, and messaging apps. Any format can be adapted to the client's brand: corporate colors, grid system, typography, logos, and UX patterns, so the system feels like the company's own product.

Additional features

The copy-trading systems we've developed can be expanded to meet any business needs. Additional modules enhance the product, open up new monetization models, and make the platform more convenient for all participants. They can be integrated in stages or integrated into the future system's architecture.

- Flexible monetization —subscriptions, trader commissions (profit-share, fixed fee), paid access levels, and hybrid schemes—allows for building a sustainable product economy.

- A referral system for attracting investors with conversion tracking, commission levels, and transparent performance analytics.

- A white-label solution allows you to release your own copy-trading product under your brand - with the desired style, interface structure, and user logic.

- KYC/AML and risk management ensure transparency and security: user verification, activity monitoring, volume and daily turnover limits, and filters for unstable strategies.

- Multi-accounting allows investors to connect multiple exchange accounts, distribute capital, and manage them from a single interface.

- Advanced trading tools include auto-synchronization of positions, pending trades (TP/SL, trailing), Smart Allocation, strategy pools, and integrations via API/WebHooks.

These modules enable the creation of solutions of any scale – from a compact Telegram bot to a fully functional investment platform for a broker.

Example scenarios

Copy trading isn't a single product, but dozens of formats that can be launched in different markets and for different audiences. We create systems that are fast, transparent, and feel like a ready-made business tool from day one.

- A copy-trading platform for an exchange or SaaS service is a new revenue stream that increases user retention and creates a competitive advantage. This isn't just a copy-trading module, but a full-fledged ecosystem with strategies, ratings, subscriptions, and advanced analytics.

- A Telegram bot for automated execution of signals for trading groups and Web3 projects where speed is critical. The bot converts signals from channels or algorithms into real trades. Exchange connection, limits, risk parameters, and trade history are all available in a single window.

- A web app for copying trades from top traders – a lightweight, fast platform with public profiles, filters, charts, and user dashboards. Investors connect with one click, and the product owner gets a tool for scaling strategies and monetizing.

- An investment dashboard for traders and investors for brokers, exchanges, and projects seeking to provide users with a professional trading experience. Charts, returns, risks, subscriptions, linked accounts, and strategy management – all in one streamlined interface.

- A white-label module for integration into an existing exchange without changing its architecture. Fully customizable to the exchange's brand, UX, and product logic - it looks like the exchange's own development, but launches much faster.

Each scenario can be adapted to specific requirements, market, and audience – from a compact MVP to a large-scale investment ecosystem.

Copy-trading platform from CryptonisLabs

CryptonisLabs has been developing copy-trading and signal-based trading solutions since 2019. Our primary focus is building a fintech infrastructure that can be securely integrated into the product and scaled as users and transaction volumes grow.

The following are usually implemented within the framework of projects:

- integration with major CEX and DEX: via API, WebSocket and smart contracts;

- ready-made backend modules: replication engine, analytics-core, ROI-calculator, risk-filters, webhook-processors;

- Any interface formats: web-accounts, mobile applications, PWA, Telegram bots and completely white-label solutions for brokers and platforms;

- A robust architecture that enables API trading without the need for funds, key encryption, IP whitelisting, and secure signal orchestration.

Our team combines a deep understanding of the market with years of experience developing trading systems. We don't just create functionality - we build the infrastructure that becomes the foundation of your investment or trading product.

Want to launch your own copy-trading platform? We can develop a copy-trading system tailored to your brand and business model, complete with trader ratings, order automation, and exchange integrations.

FAQ

-

How long does it take to develop a copy-trading platform?

Timeframes depend on the scale of the solution. An MVP with basic trade copying and integration with 1-2 exchanges typically launches in 8-12 weeks. A fully functional platform with analytics, user roles, monetization, and multiple interfaces takes 3-6 months. A phased launch is often used.

-

Is it possible to start with an MVP and develop the system later?

Yes. We design copy-trading platforms with a modular architecture. This allows us to start with a minimal set of features and gradually add new exchanges, copy types, analytics, monetization, and interfaces without reworking the core system.

-

Does the platform store funds or provide access to withdrawals?

No. The platform operates using API keys with Read + Trade permissions, without access to withdrawals. This reduces financial and regulatory risks and increases trust among users and partners.

-

What types of copy trading are supported?

The system supports all major models: mirror copying, proportional copying, signal-based copying, trading pools, and Telegram copybots. The copying type is selected based on the business model and project objectives.

-

How is the accuracy of transaction execution ensured?

The copy engine takes into account the investor's deposit, risk limits, liquidity, exchange API restrictions, and network latency. The system synchronizes positions, handles partial executions, and minimizes discrepancies between the trader and subscribers.

-

What monetization models can be implemented?

The platform supports various models: subscriptions, profit-share, fixed commissions, paid access levels, referral programs, and SaaS models. Monetization can be flexibly configured to suit your business strategy.

-

Is it possible to launch a solution under my own brand?

Yes. We develop white-label copy-trading solutions that are fully customized to your brand: interface, logic, user roles, and business processes. The platform looks and functions like your own product.