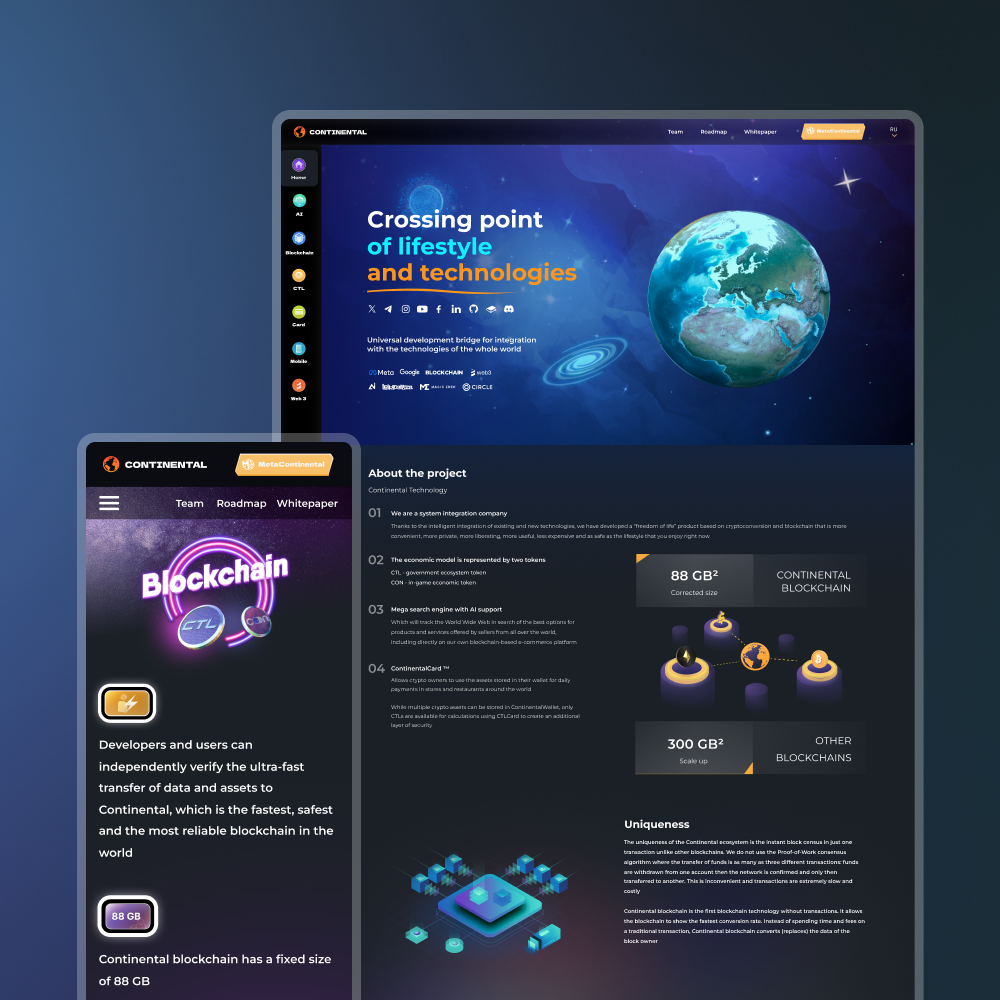

Grid Trading Bot

Grid Trading Bot is an automated trading solution designed for stable performance in volatile crypto markets by placing a grid of buy and sell orders. At CryptonisLabs, we develop scalable grid bots and platforms for specific business needs: from private trading to SaaS services and white-label solutions for crypto startups.

What is a Grid Trading Bot?

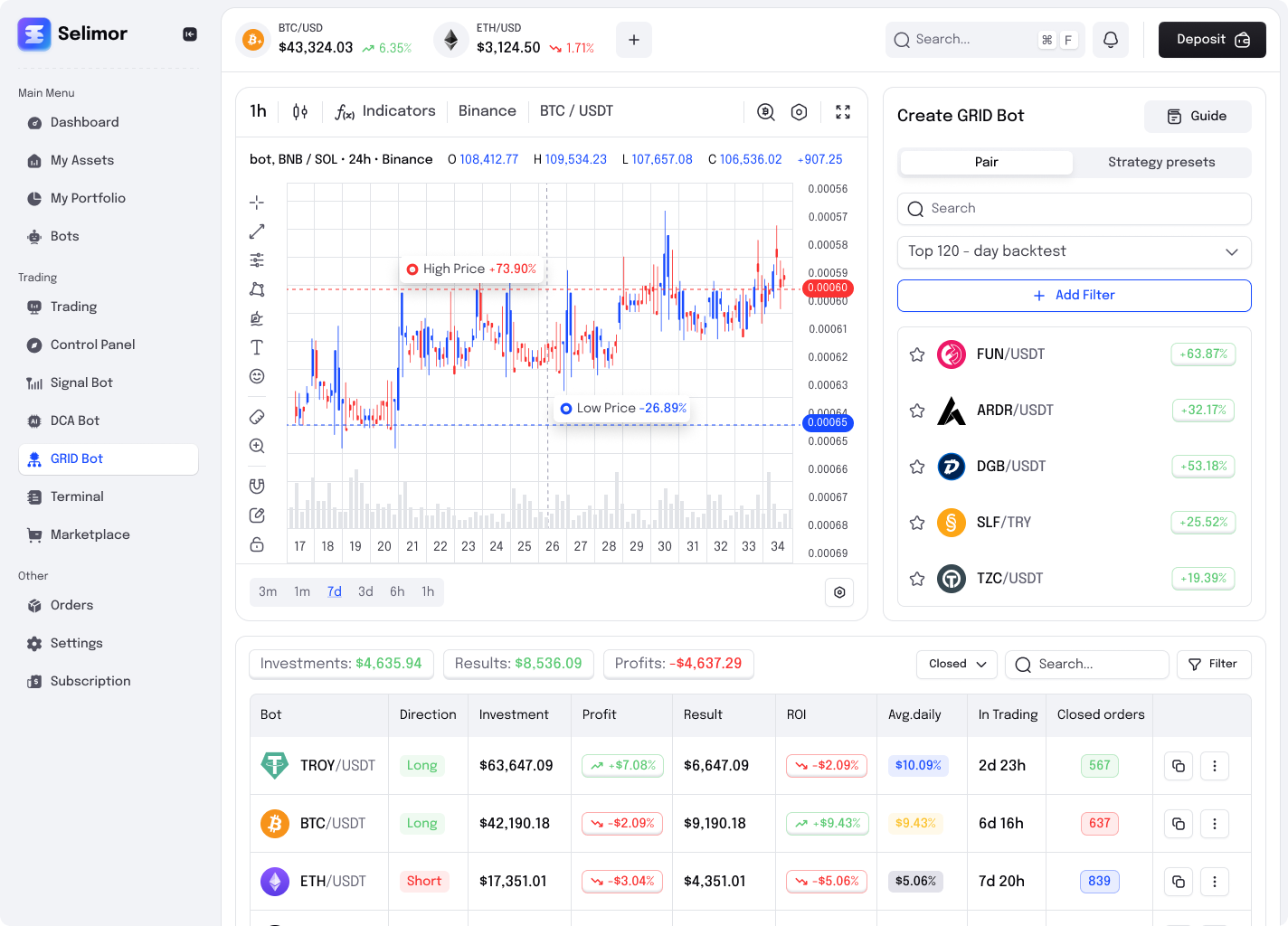

Grid Bot is an automated trading bot that breaks a selected price range into several horizontal levels and automatically buys at the lower levels and sells at the higher ones. This makes it a powerful crypto bot with a grid strategy, capable of consistently generating profits in sideways and volatile markets.

CryptonisLabs specializes in developing grid bots, creating systems that execute trades with high accuracy and remain stable in real market conditions. The bot operates as a 24/7 micro-market maker, placing multiple limit orders above and below the current price and automatically executing them via exchange APIs.

How Grid Trading Works

Sell levels (upper levels) – the bot closes profitable trades as the price rises.

Buy levels (lower levels) – the bot accumulates assets when the price decreases.

Continuous cycle – buy low, sell high, automatically and repeatedly.

The strategy forms a structured “grid” of orders:

- The bot builds a grid of orders with a precisely specified step and number of levels.

- When the price falls, buy orders are automatically opened; when the price rises, sell orders are executed.

- The result is an autonomous trading bot capable of continuously and automatically buying and selling, allowing the system to profit from market movements in both directions.

Key features of our Grid bots

We develop crypto grid bot software that adapts to market volatility, supports multiple exchanges, and integrates directly into web terminals, mobile apps, and Telegram.

1. Creating and Managing a Grid

- Flexible price ranges. Set precise upper and lower limits for the bot's activity, adapting strategies to trending, sideways, or volatile markets. Clear ranges reduce the need for constant manual adjustments and help new users confidently launch their first grid.

- Adjustable grid step (distance between levels). Determine the required price movement between order levels. A small step captures frequent micro-movements, while a larger step is targeted at major price cycles. This gives experienced traders precise control over profitability while remaining intuitive for beginners.

- Adjustable grid depth (number of levels). Choose how many buy and sell levels to place within a given range. Dense grids improve responsiveness in fast-moving markets, while sparse grids reduce capital requirements. This flexibility allows for efficient trading with assets of varying liquidity and account sizes.

- Order volume customization. Assign fixed order sizes for each level or use proportional capital allocation. This prevents overexposure in volatile areas and promotes more responsible trading – especially important for users learning risk management.

- Spot, Futures, and Margin Trading Support. Run grid bots in all major trading environments – from spot trading to leveraged futures and margin positions. This approach expands the platform's product line and gives traders the freedom to choose market conditions.

- Automatic grid restoration and self-healing. After trades are executed or market conditions change, the bot automatically rebuilds missing levels and restores the original grid structure. Even in the event of API failures or temporary market instability, the bot reliably returns to operation, reducing the need for manual monitoring.

2. Types of Grid Strategies

The system functions as an advanced crypto-grid bot, profiting from both market rises and falls through structured, rule-based execution.

Platforms without advanced strategies lose users who outgrow simple spot trading. Therefore, we offer the following types of grid strategies:

| Strategy | Description | Best suited for | Business benefit |

|---|---|---|---|

| Classic Grid | Buy lower, sell higher | Spot trading | The most popular strategy for onboarding new traders |

| Reverse Grid | Sell higher, buy lower | Short strategies | Expands product line for bear markets |

| Futures Grid | Uses leverage | Binance Futures, OKX | Increases trading volumes and platform revenue |

| Dynamic Grid | Adapts to volatility | Professional traders | Reduces bot crashes during high volatility periods |

| AI-Adaptive Grid | Uses indicators to dynamically adjust ranges | AI trading functions | Adds premium features for subscription upselling |

3. Additional functions

- Trailing Grid. The bot dynamically shifts the entire grid up or down in the direction of the market trend, allowing the strategy to remain relevant and not become stuck in outdated price zones. This is especially effective during prolonged trend movements.

- Stop-Loss and Take-Profit. Integrated risk management tools automatically close positions when preset levels are reached, protecting users' capital and reducing extreme drawdowns.

- AI optimization engine. For advanced scenarios, we implement AI optimization, transforming the system into a crypto-AI bot that adapts parameters based on volatility and market indicators. The intelligent parameter selection engine analyzes the market and recommends or automatically applies optimal grid settings.

- Backtesting module. Users can run grid strategy simulations on historical data, evaluating performance in real time before launching. This reduces the number of errors at the start and increases bot activation.

- Auto-restart and fail-safe logic. During extreme volatility, API interruptions, or partial order executions, the bot automatically restores its state and grid configuration, ensuring stable operation without manual intervention.

- Multi-pair trading support. Running multiple grid bots on different trading pairs simultaneously allows for diversifying strategies and increases overall trading activity on the platform.

Offer your users features that your competitors don't have!

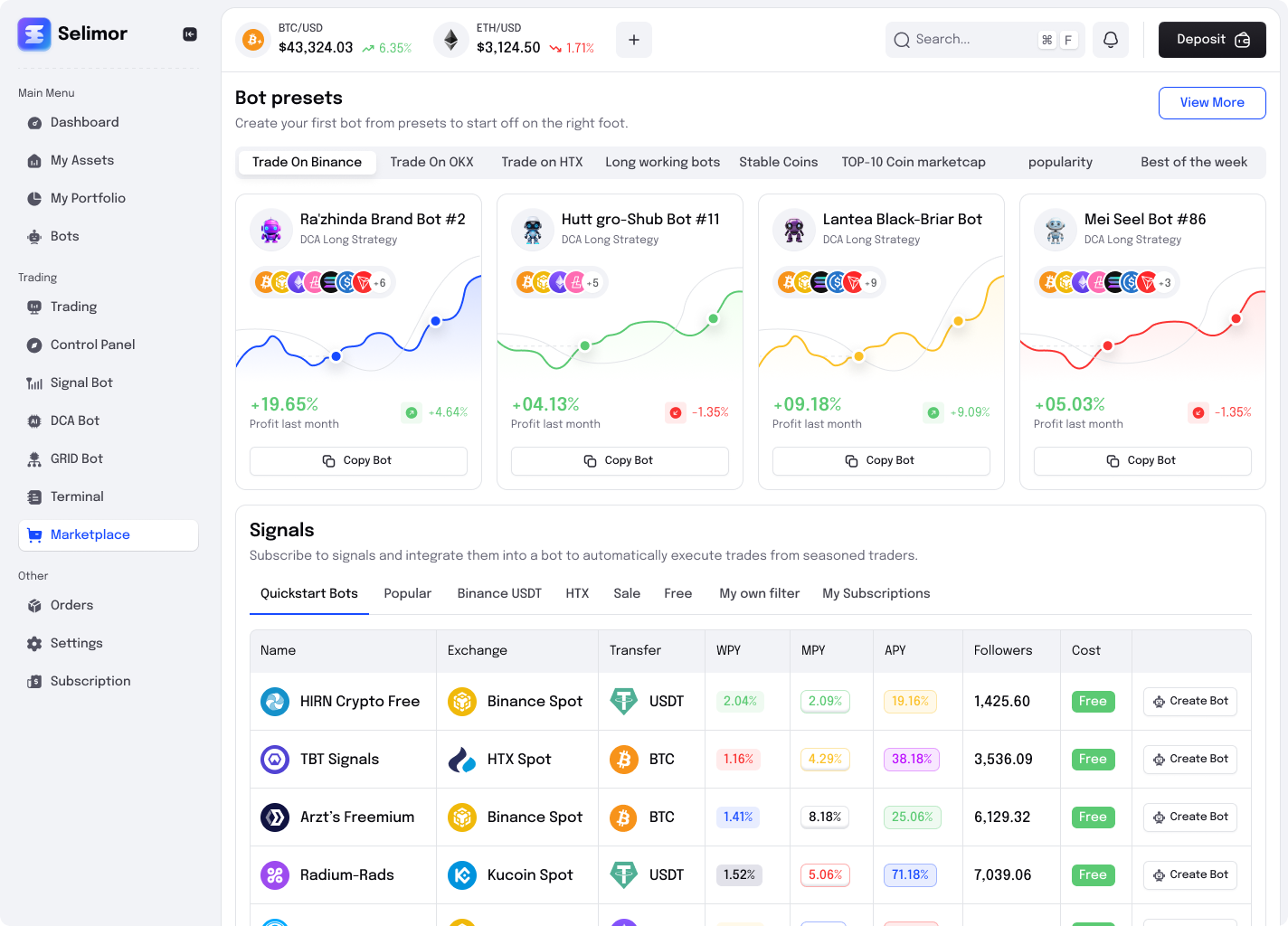

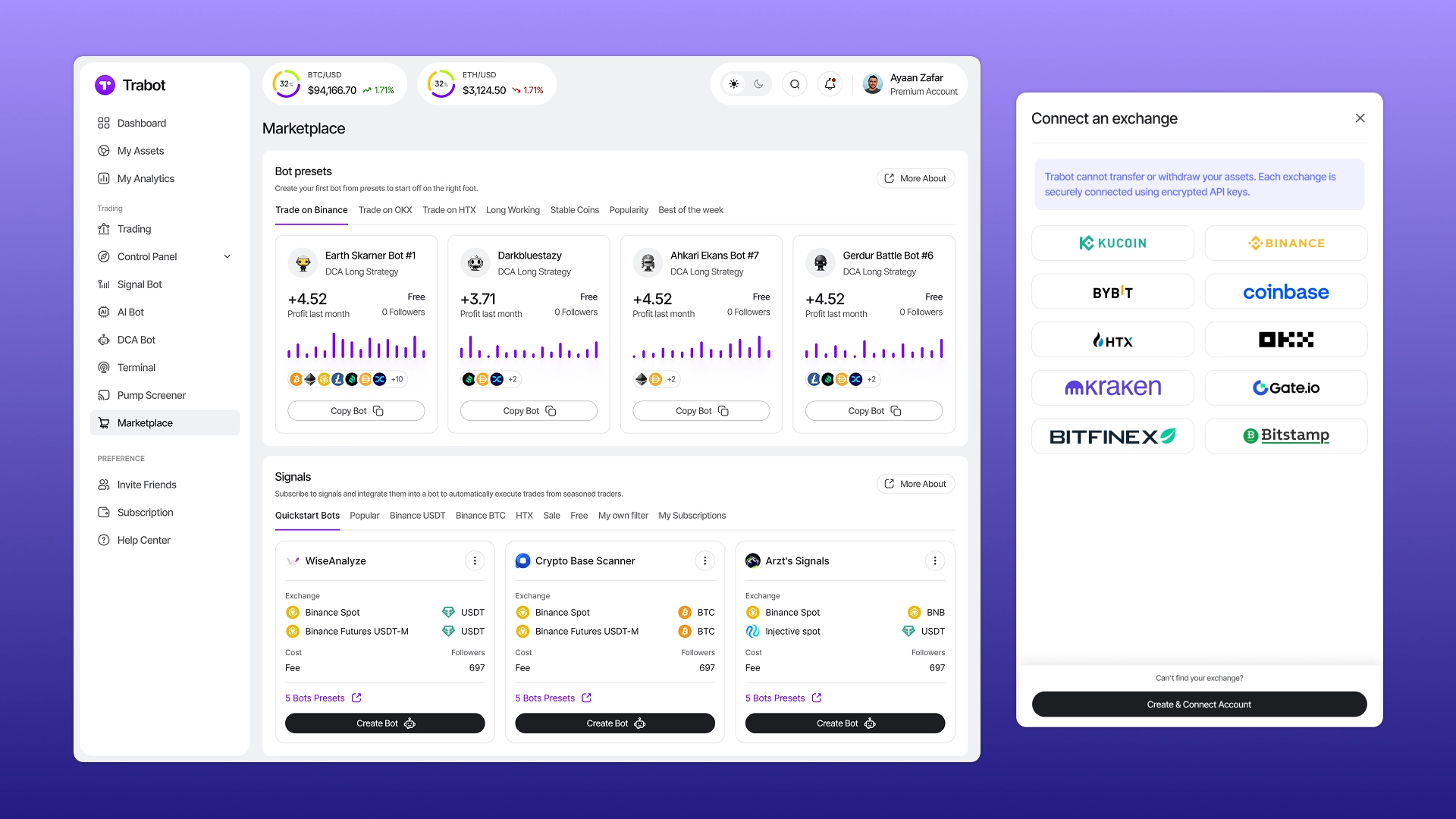

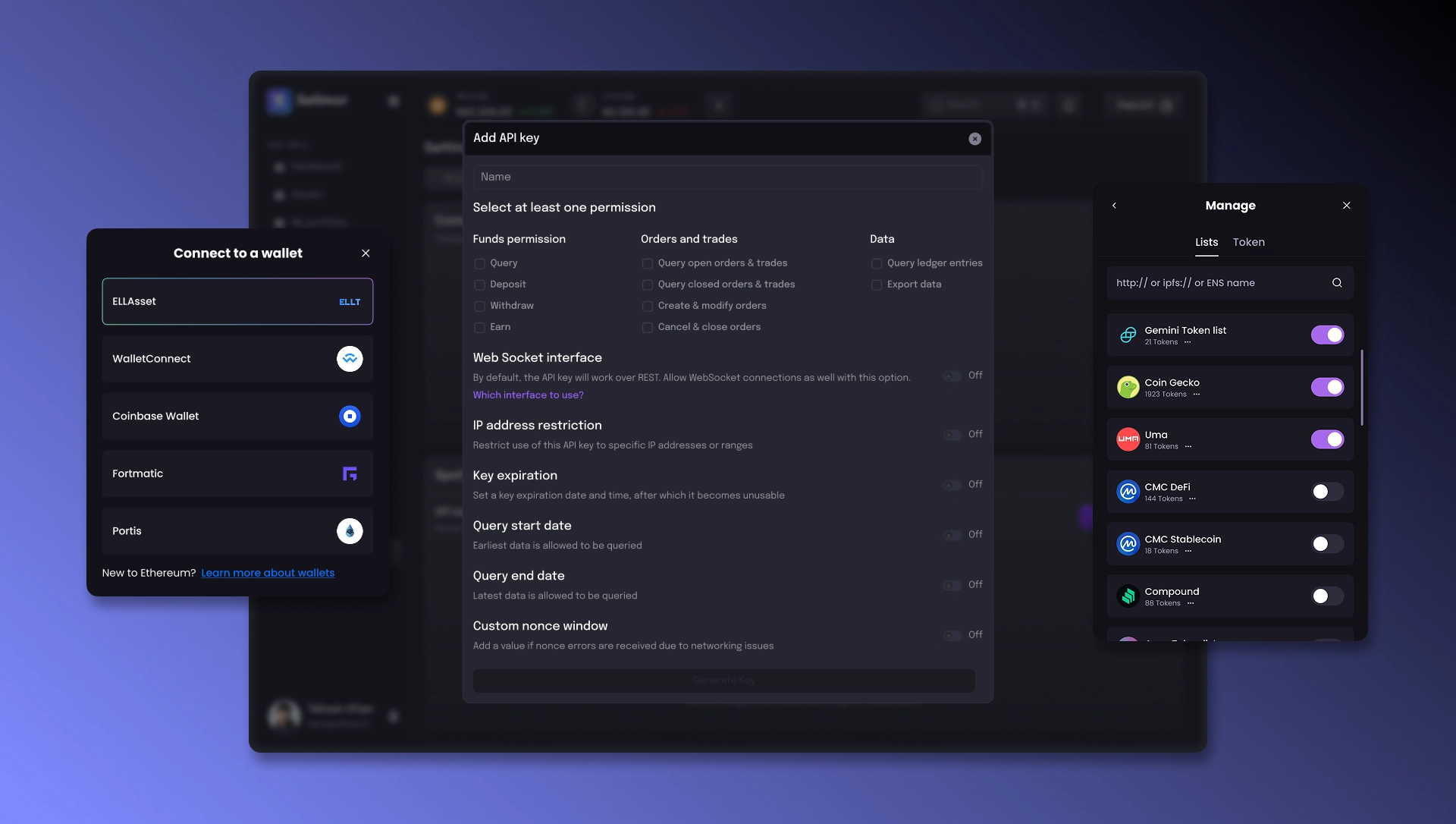

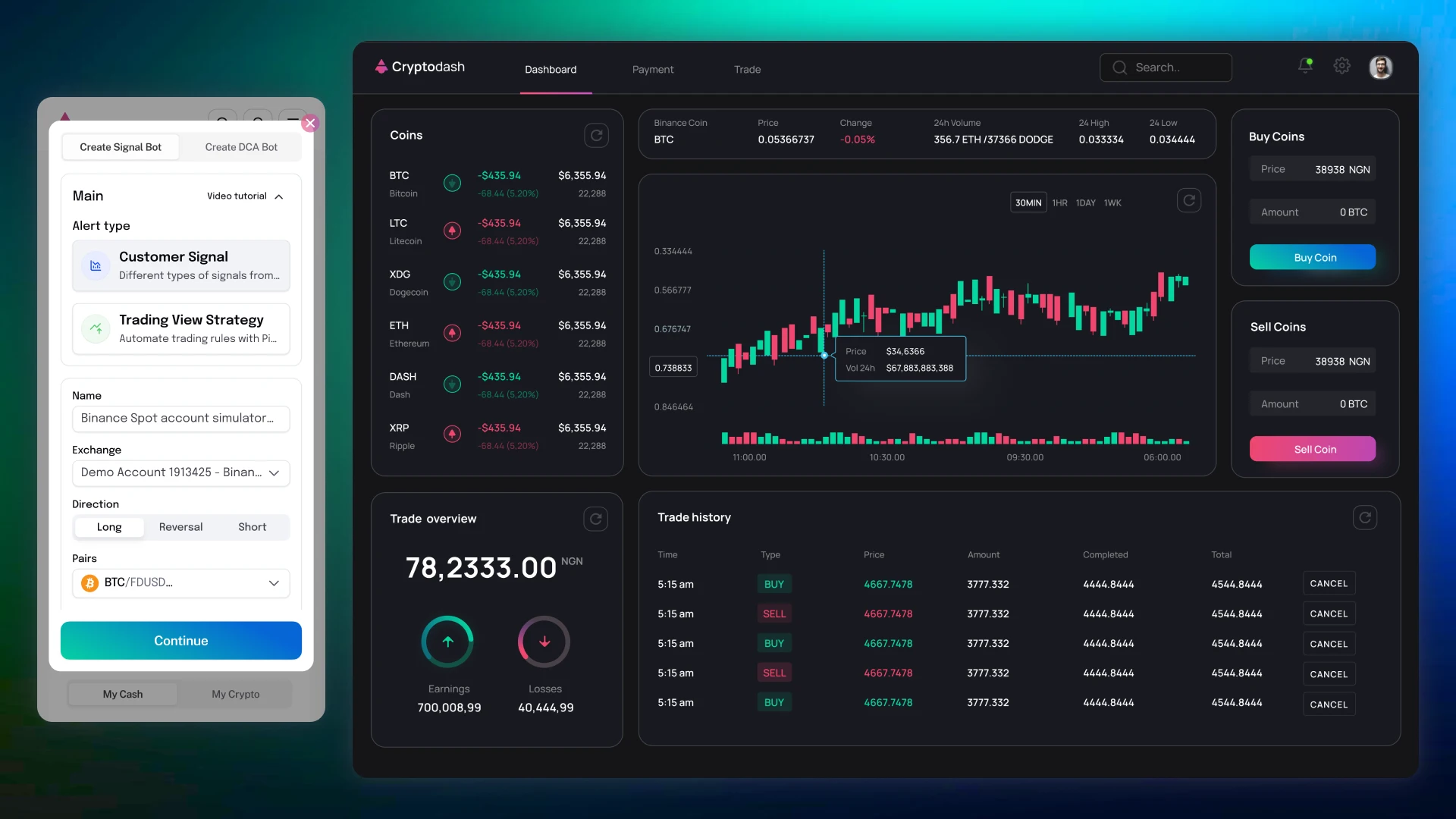

User interfaces

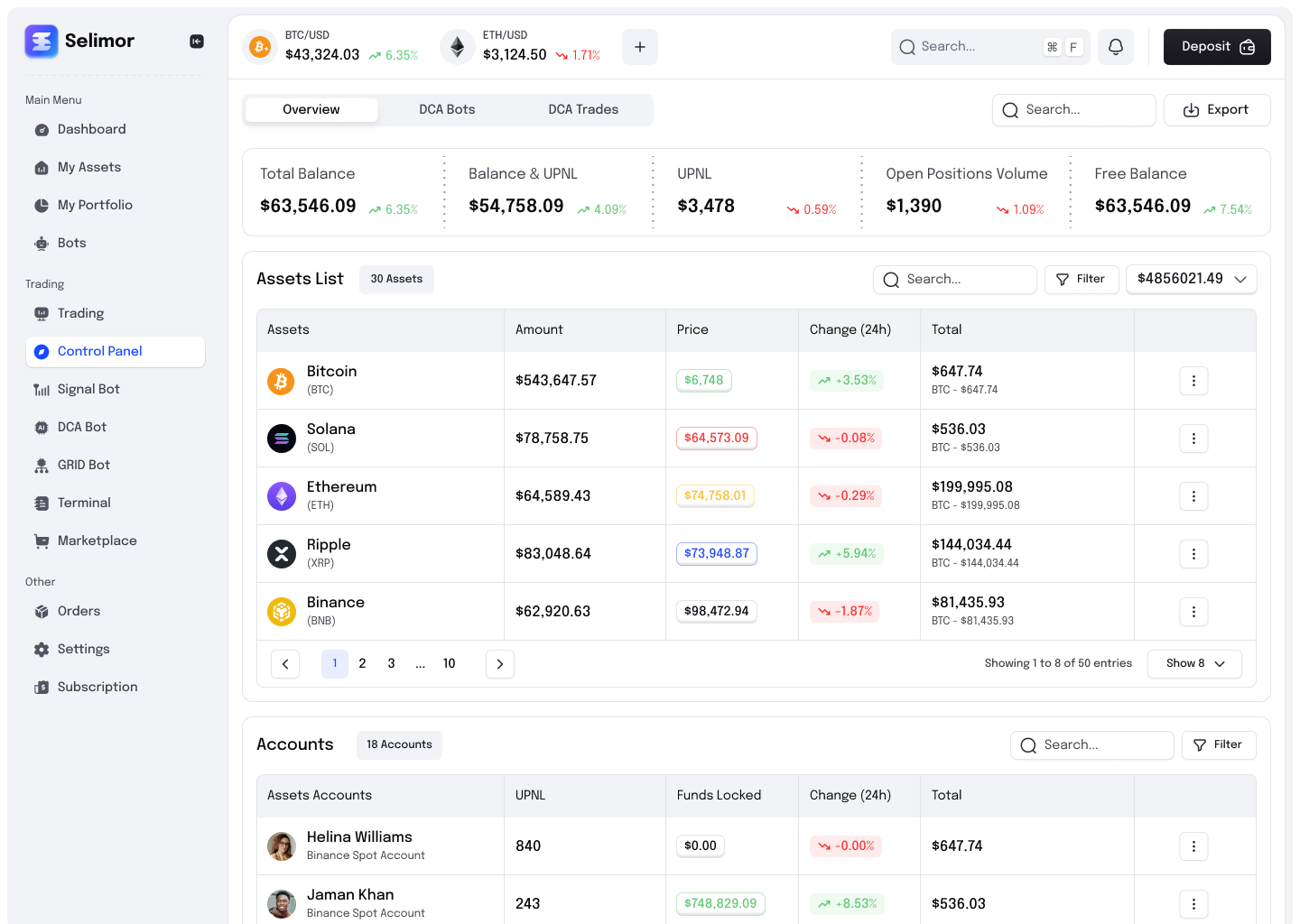

A powerful trading engine requires equally powerful interfaces, so we develop UI ecosystems that make automated trading accessible to beginners while providing advanced tools for experienced traders.

Web/Desktop terminal

- TradingView charts with grid visualization. Grid levels, active orders, and execution history are displayed directly on the chart.

- Bot Control Center. Create, edit, pause strategies, and analyze performance in a single interface.

- Real-time execution and profit metrics. Display order fills, position statuses, and total profits.

- Analytics and full transaction history. PnL, exposure, transaction sequence, and detailed reporting.

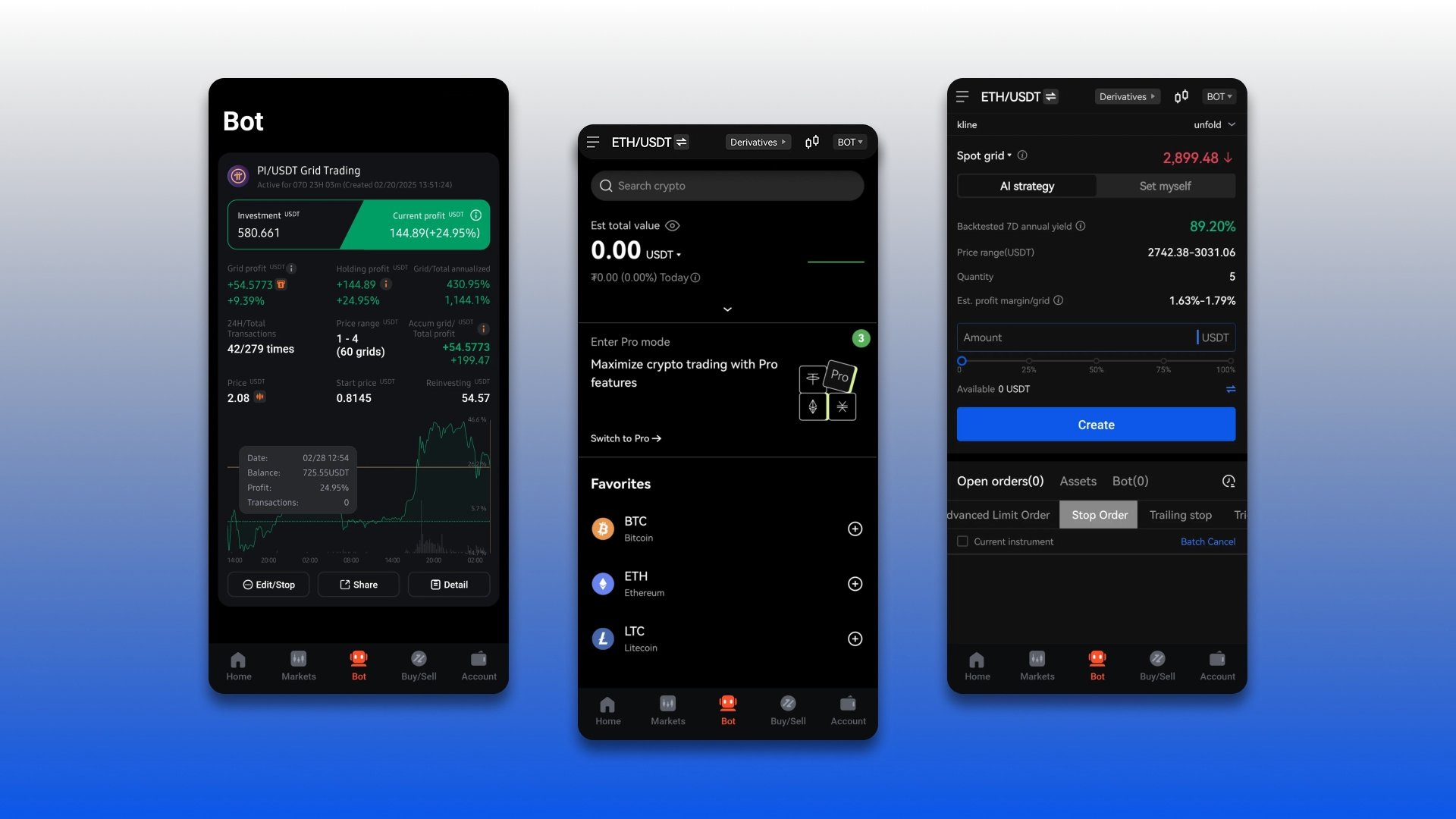

Mobile application

- Create a bot in one click. Instantly launch a fully configured grid bot.

- Push notifications. Get immediate notifications about trades and market movements.

- Quickly edit parameters. Change ranges, volumes, and grid sizes directly from your phone.

Telegram bot

- Command-based bot control. Start, stop, and configure bots using commands or buttons.

- Trade notifications. Instant notifications about order executions.

- Secure API connection. Reliable account linking via Telegram workflow.

Integrations

In developing the Grid Trading Bot, we are building a fully-fledged multi-exchange ecosystem that ensures accurate order execution and access to real-time market data. The platform supports integration with leading centralized exchanges, including Binance, OKX, WhiteBIT, KuCoin, Bybit, and Huobi, enabling trading strategies on spot and futures markets.

To obtain up-to-date quotes and analytics, we use trusted data sources: CoinGecko, Binance Market Data, and TradingView . Interaction with exchanges and data feeds is accomplished via REST and WebSocket APIs, ensuring minimal latency and high trading accuracy.

For SaaS platforms and commercial solutions, integration with payment gateways Cryptomus, Stripe and Binance Pay is provided, while user, bot, and subscription management is implemented through white-label CRM and admin panels.

Safety

Security is a key element of the Grid Trading Bot's architecture. The platform only supports API keys with limited rights (trade-only), completely disabling withdrawals. All keys and sensitive data are encrypted using AES-256 and RSA algorithms.

The system continuously monitors order execution and bot status in real time. In the event of disconnection or instability of exchange APIs, fail-safe mechanisms are automatically activated to prevent losses and incorrect strategy execution. Additionally, maximum trading volume and risk limits are configurable, and platform access is protected using 2FA, JWT and Telegram OAuth.

Solution architecture

The Grid Trading Bot's architecture is modular and easily scales to handle high loads:

- Frontend: React / Next.js

- Bot Management API: Nest.js / Python

- Exchange connectors: Binance / OKX / WhiteBIT

- Strategy Engine: Grid Controller

- Database: PostgreSQL / Redis

- Analytics and Telegram notifications

This approach allows for flexible strategy management, scaling of user numbers, and integration of new exchanges or algorithms without reworking the system core.

Modules for administrators

Platform owners and operators have access to advanced administrative functionality. The admin panel allows you to manage users and trading bots, set up commissions, tariffs, and subscriptions, as well as control API keys and trading limits.

The built-in analytics module provides detailed metrics on PnL, trading volumes, and the number of active bots , while the referral system and profitability statistics help scale your business and track monetization effectiveness.

Examples of use cases

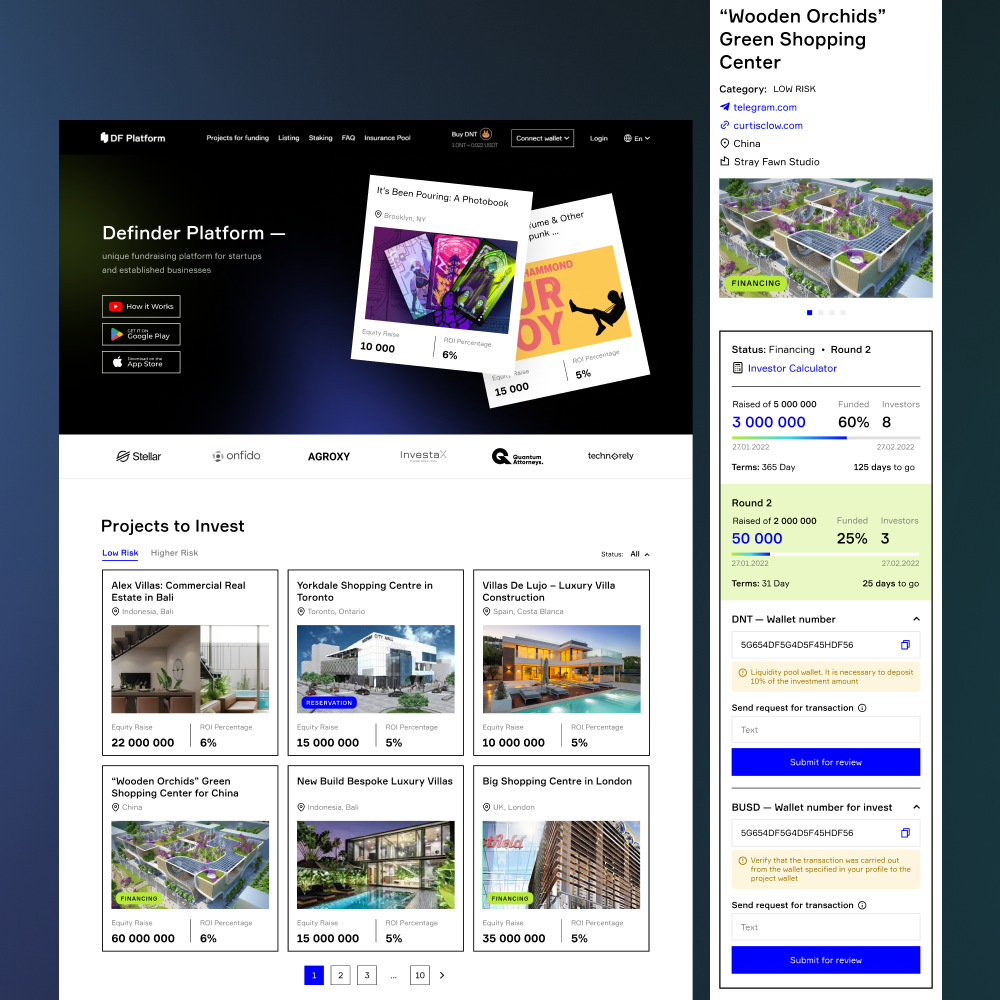

Grid Trading Bot can be used in various formats and business models: from grid bots for CEX platforms (spot and futures) to separate bot modules for web terminals or SaaS platforms.

We also offer the development of Telegram bots with grid trading and analytics, full-fledged platforms with AI-optimized grid strategies, and white-label solutions for crypto startups and brokers.

CryptonisLabs's development approach

CryptonisLabs specializes in creating professional trading solutions for the crypto market, focusing on grid strategies, arbitrage, and market making. We design scalable systems adapted to the real-world conditions of high-frequency trading and volatile markets.

Our key advantages:

- Integration with multiple crypto exchanges via secure APIs.

- Deep customization of trading logic and AI-based strategy optimization.

- White-label solutions and multi-exchange architecture.

- Full development cycle: from strategy and back-testing to deployment and support.

We create reliable, flexible, and multi-exchange grid systems with real-time analytics, high levels of security, and integration into web terminals, mobile apps, and Telegram.

👉 Contact CryptonisLabs to discuss developing a custom trading solution tailored to your goals and business scale.

FAQ

-

What is a grid trading bot and how does it work?

A grid trading bot is an automated system that places buy and sell limit orders within a predetermined price range. When the price falls, the bot buys the asset; when the price rises, it sells it, repeating the cycle automatically and continuously.

-

In what market conditions do grid strategies work best?

Grid strategies are most effective in sideways and moderately volatile markets, where prices regularly fluctuate within a range. In such conditions, the bot can repeatedly lock in small profits without having to guess the trend direction.

-

Can grid bots be used in a trending market?

Yes, when using dynamic or trailing-grid strategies. These bots can shift the grid following market movements, allowing them to adapt to uptrends or downtrends and avoid being tied to outdated price levels.

-

Which grid strategies are considered the safest?

Spot grid strategies without leverage are considered the safest. They operate only with the actual balance, are not subject to liquidation risk, and can be supplemented with capital limits, dynamic grid shifts, and protective stop-loss mechanisms to mitigate risks during changing market conditions.

-

What are the risks associated with using grid bots?

The main risks include strong unidirectional market movements, insufficient capital to support the grid, and incorrect range parameters. To mitigate these risks, stop-losses, volume limits, dynamic grid adaptation, and automatic recovery mechanisms are used.

-

How is grid bot security ensured?

Grid bots operate through API keys with limited permissions, typically without withdrawal access. Encryption, access control, and order execution monitoring are used for protection, reducing the likelihood of unauthorized activity.

-

Who are grid trading bots suitable for?

Grid bots are suitable for both novice traders seeking automation and discipline, as well as experienced users looking to systematically manage volatility, scale strategies, and manage multiple trading pairs simultaneously.