Scalping Crypto bots

What Is Scalping in Trading

Scalping is a strategy based on numerous short-term trades, where a bot profits from small price movements (0.1–0.5%). The main principle of scalping is speed and execution accuracy.

In crypto trading, scalping is especially effective on highly volatile pairs (BTC/USDT, ETH/USDT, SOL/USDT, TON/USDT) and requires:

- reliable API integrations (Binance, OKX, KuCoin, WhiteBIT);

- low latency;

- instant reaction to price and volume changes;

- fee control;

- risk management that responds to losses instantly before they become critical.

For scalping to deliver the desired results, it should be understood as disciplined automation of short cycles with its own rules. This is why scalping bots that consistently execute the algorithm are the most productive.

It is also important to understand the difference between scalping, Grid and Arbitrage. Scalping depends on speed, operates within a single instrument or market, uses light entries and exits, and profits from small price fluctuations. Grid earns from movements within a price range and does not always require low latency. In turn, Arbitrage logic is based on price imbalance – it seeks differences in prices between exchanges or markets.

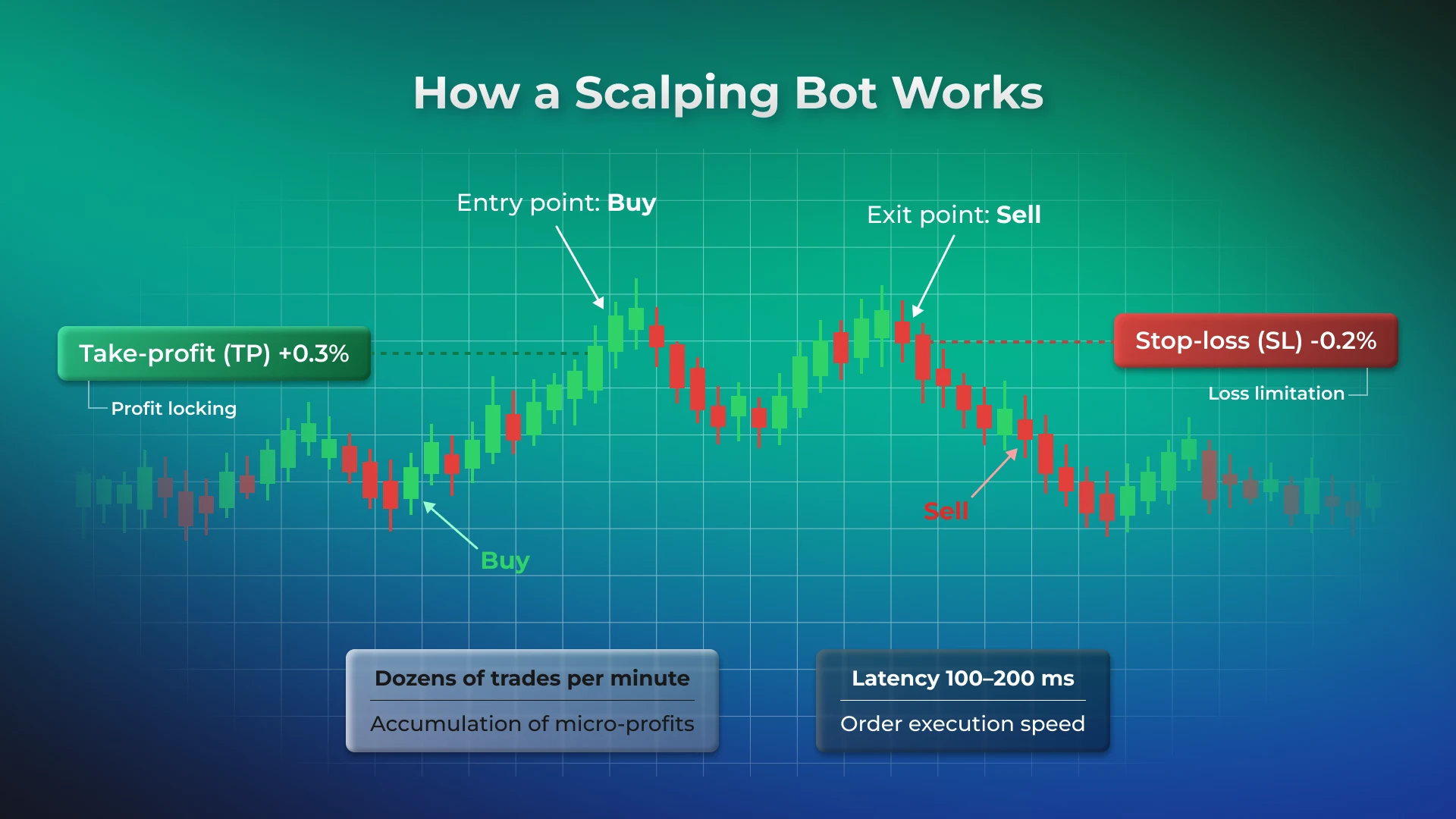

How a Scalping Bot Works

The foundation of a scalping bot is its trading algorithm. These algorithms are pre-programmed with specific rules and technical indicators that analyze vast amounts of market data. Their goal is to identify patterns or instantaneous imbalances that indicate potentially profitable trades.

It is worth noting the operational speed of scalping bots. They have a significant advantage over human traders: they can analyze data and execute trades at a speed unattainable manually. This allows them to capitalize on fleeting price discrepancies. Here is how it works:

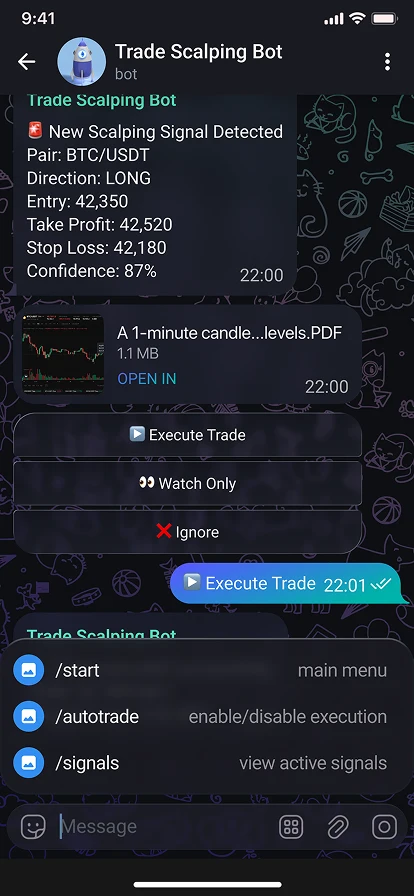

- The bot tracks a stream of quotes (every 100–300 ms). Data comes to the bot from the exchange, for example, via WebSocket. This allows it to continuously reflect prices, dynamics, spreads, and market volume.

- It analyzes microtrends and indicator signals (EMA, RSI, VWAP). A high-frequency crypto trading bot does not need detailed analytics months ahead. Short-term statistics are sufficient to detect momentum, pullbacks, or breakouts.

- It executes short entries/exits with take-profit of 0.1–0.5%. The bot’s main goal is to instantly lock in a small profit and move on to the next position.

- It uses stop losses and dynamic loss limits. Unsuccessful entries are sometimes unavoidable, even under ideal strategy conditions. That is why the bot must have protection: stop losses, loss control, and automatic suspension during sharp market fluctuations.

- It repeats the cycle hundreds of times per day. This is what drives profit accumulation: small gains from a large number of trades create a significant result.

Core Functions of Scalping Bots

🔹 1. Market Scanner (Market Analysis)

This function is the “eyes” of the bot. The Market Scanner ensures that the scalping bot sees the market, responds quickly and accurately to micro-signals, and filters out noise. The market analysis function supports tick and minute timeframes (1s, 15s, 1m, 5m). It calculates RSI, EMA, Bollinger Bands, and VWAP in real time so the bot never lags behind. The function is also responsible for pattern recognition – breakout, bounce, reversal – and includes an AI module for microtrend forecasting (optional).

🔹 2. Execution Engine (Trade Execution)

When it comes to short orders, timely execution at the optimal price is critical. The Execution Engine helps execute instant limit or market orders via WebSocket / FIX API, reducing latency. It also optimizes trades to minimize fees and handles partial fills. Thanks to this function, the bot can manage multiple assets simultaneously, for example, trading BTC, ETH, and SOL in parallel. In addition, spot, futures, and perpetual markets are supported.

🔹 3. Risk Management

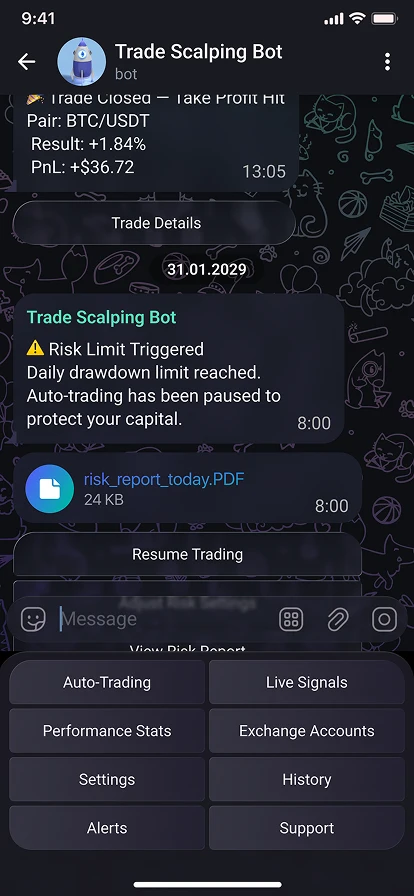

Since a scalping bot executes hundreds of trades, it must be protected from unsuccessful entries. The Risk Management function includes:

- dynamic stop-loss and take-profit to adapt to volatility, spread, and current market structure;

- daily/session loss limits (e.g., if losses exceed X%, the bot automatically stops);

- control over the maximum number of trades, as noise can cause unnecessary entries;

- automatic pause during increased volatility;

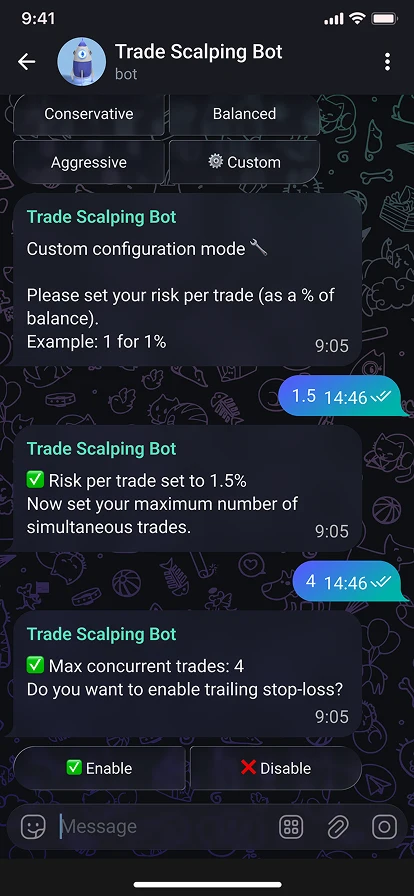

- Telegram integration for notifications to stay informed about pauses, errors, entries, or exits.

Visual scheme with price micro-graphics and entry/exit points (Buy/Sell spikes)

🔹 4. Strategies and Settings

We create scalping bots whose logic can be adapted to your needs. As a result, they can operate in different modes. Strategy parameters are diverse: you choose filters, entry thresholds, exit rules, trading hours, risk limits, etc.

Most commonly chosen strategies:

| Strategy Type | Description | Timeframe |

|---|---|---|

| Breakout Scalping | Entry on resistance break | 1m–5m |

| Reversal Scalping | Entry on pullback after momentum | 15s–1m |

| Volume Spike Scalping | Reaction to volume spikes | 5s–30s |

| Trend-Following Scalping | Following the trend direction | 1m–15m |

| Mean Reversion | Trading on mean retracement | 1m–5m |

| AI Adaptive Scalping | ML model on historical data | 1m–10m |

Bot Integrations with Other Platforms

To simplify system management, the scalping bot can be connected to your platform: exchange, analytics, payments, notifications, etc. We build reliable integrations with a focus on stability, security, and scalability:

- CEX: Binance, OKX, WhiteBIT, KuCoin, Bybit.

- DEX: Uniswap, PancakeSwap (via smart contracts).

- Data streams: Binance WebSocket, CoinGecko API.

- Analytics: TradingView integration.

- Notifications: Telegram / Discord Webhooks.

- Payments (for SaaS): Cryptomus, Binance Pay.

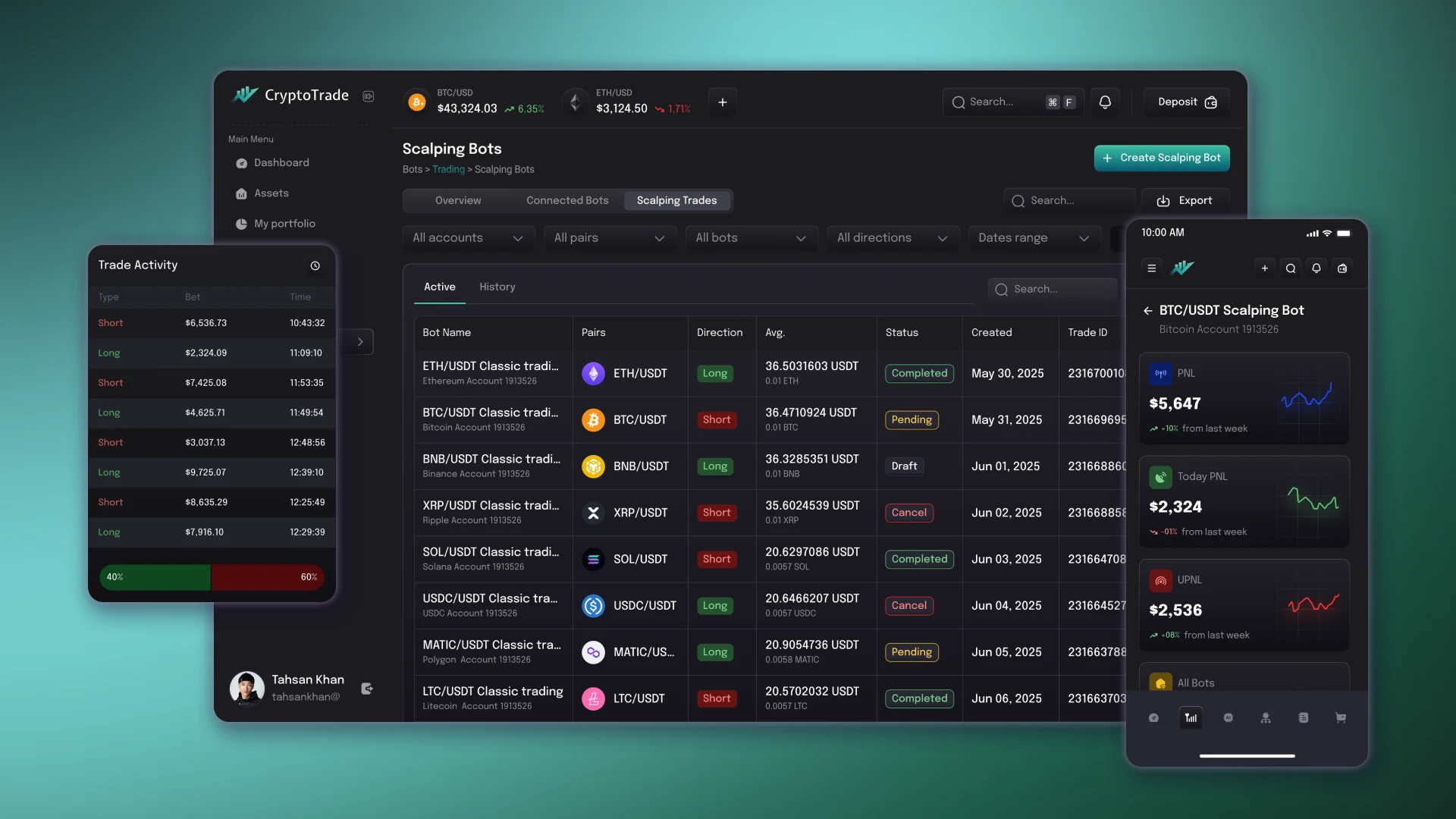

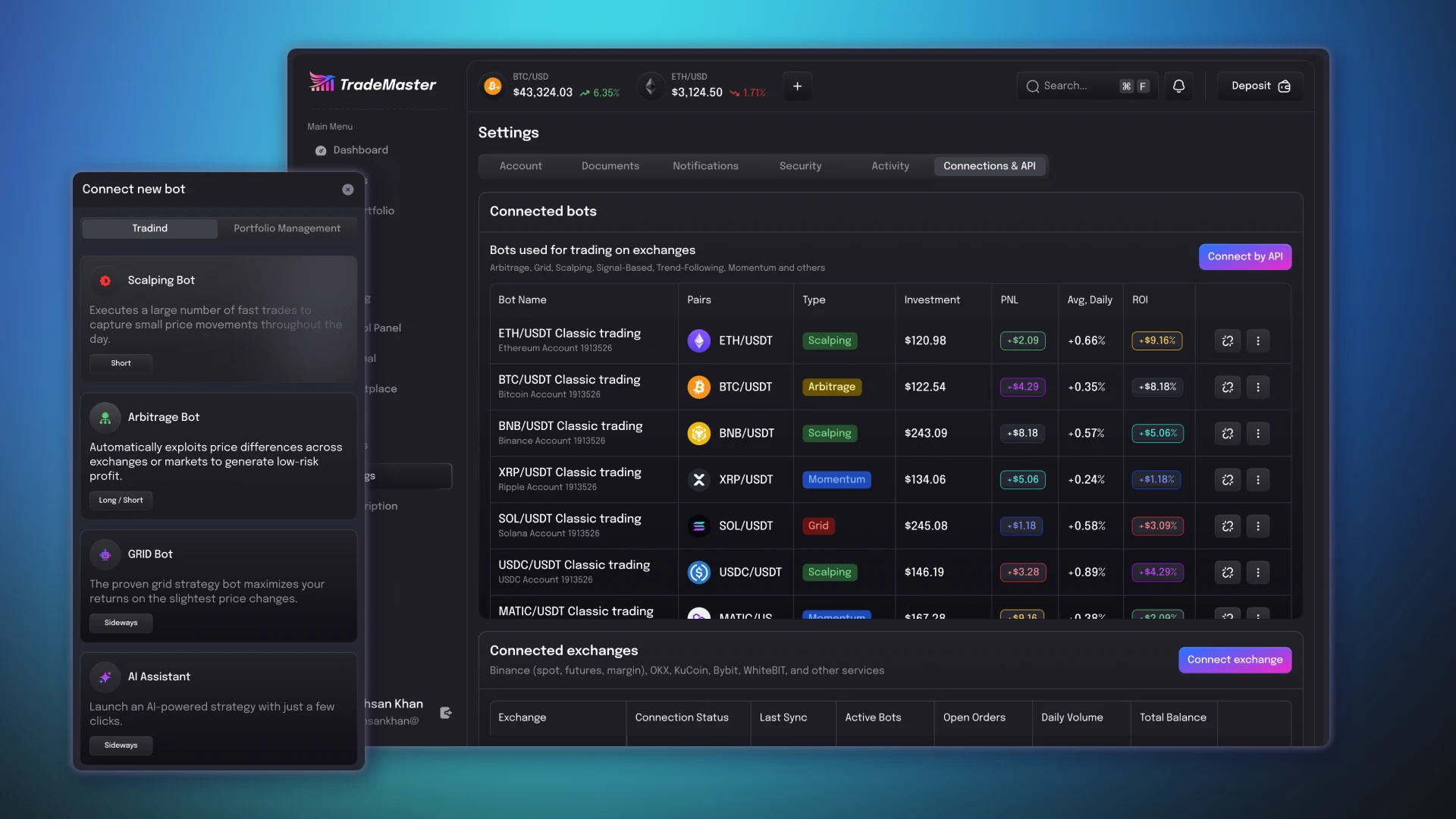

Interfaces and Analytics

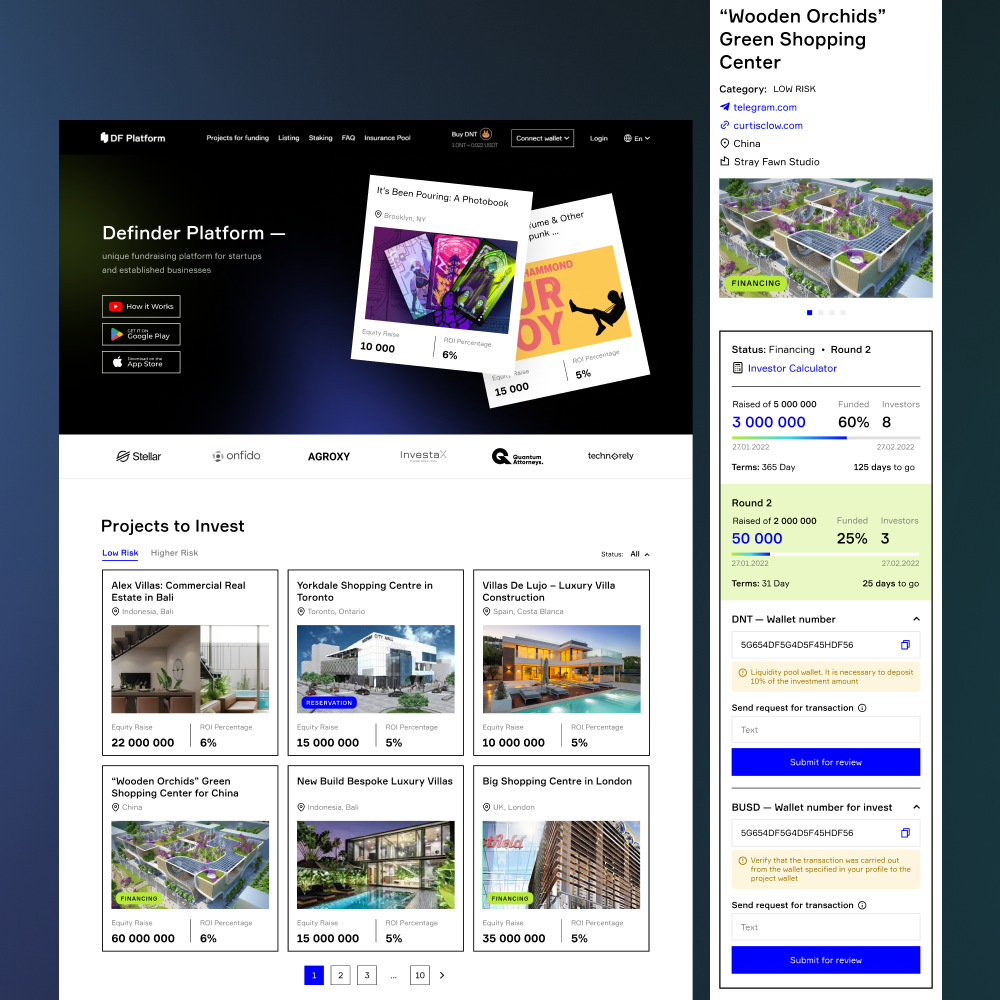

- Trader Dashboard

The trader dashboard helps control the bot’s performance: you can see how it works and which markets delivered results. The dashboard allows you to track price and indicator charts, and a table of active positions. There is the ability to configure strategies and timeframes, track profit and loss statistics, and monitor the number of trades and entry accuracy.

- Admin Panel

The multifunctional admin panel includes:

- monitoring user activity;

- configuring fees and subscriptions;

- maintaining logs and bot reports.

This is a priority for white-label solutions where the bot is a key part of the system.

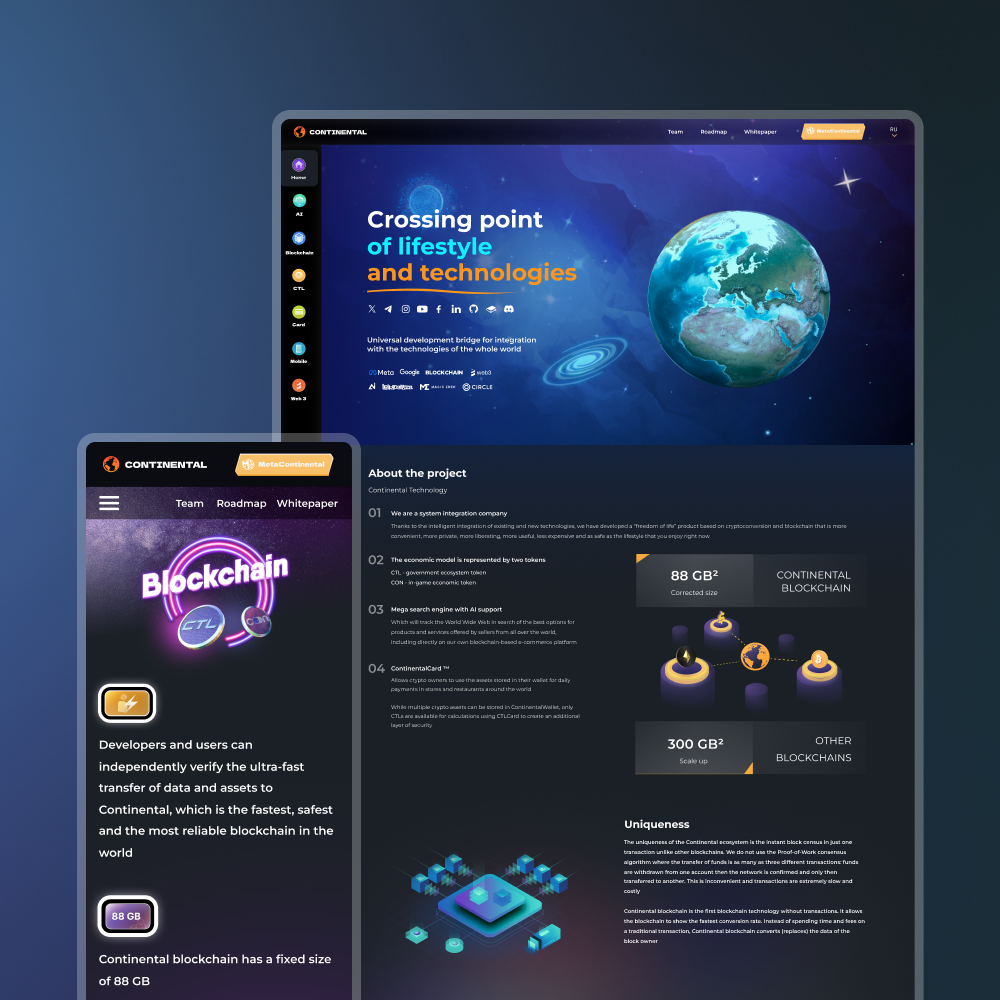

System Architecture Solution

The architecture of our scalping bots is designed to withstand high loads and operate without interruptions, with scalability in mind.

It is built on a modular principle, allowing independent updating, testing, and expansion of individual components without stopping the entire system. This ensures high reliability, flexibility in strategy configuration, and rapid adaptation to market changes.

Special attention is paid to minimal latency, connection stability, and fault tolerance, which are critical for scalping. The system supports horizontal scaling and redundancy of key services.

We operate according to the following scheme:

Security of Scalping Bots

In high-frequency trading, security is no less critical than execution speed. That is why we implement a multi-layered approach to protecting infrastructure and client data at all levels of the system.

We apply modern cryptographic standards, strict access policies, and fault-tolerance mechanisms to minimize operational and financial risks. Every component undergoes validation for reliability, stability, and compliance with security requirements.

System security is implemented through a set of technical and infrastructural methods, including:

- work with limited API keys (Trade only);

- key encryption (AES-256 / RSA);

- request speed control (rate limiter);

- failover and reconnect when the API is interrupted;

- log of all operations and profit statistics.

Use Case Examples

Scalping bot solutions are applied both for individual trading activity and as part of complex trading platforms or infrastructural systems. The architecture allows flexible integration of bots into existing processes and adaptation to different markets, instruments, and levels of automation. Below are examples of the most popular use cases of scalping bots in commercial projects:

- A scalping bot for Binance Futures with a take-profit of 0.3%. Implemented with WebSocket operation, fast entries and exits on futures, and risk control.

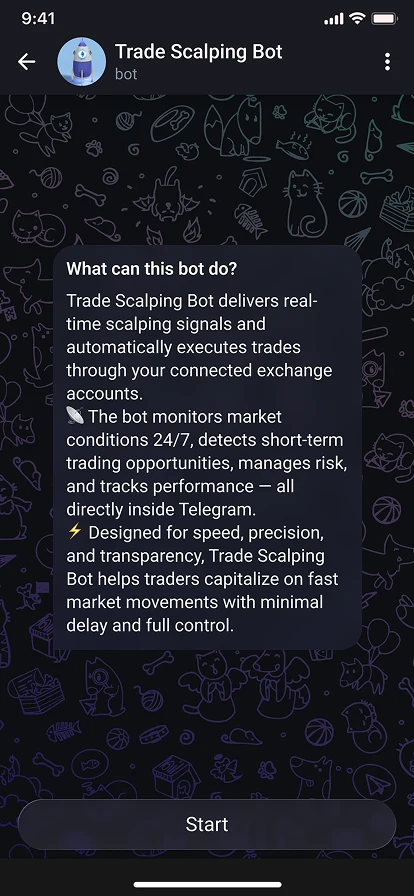

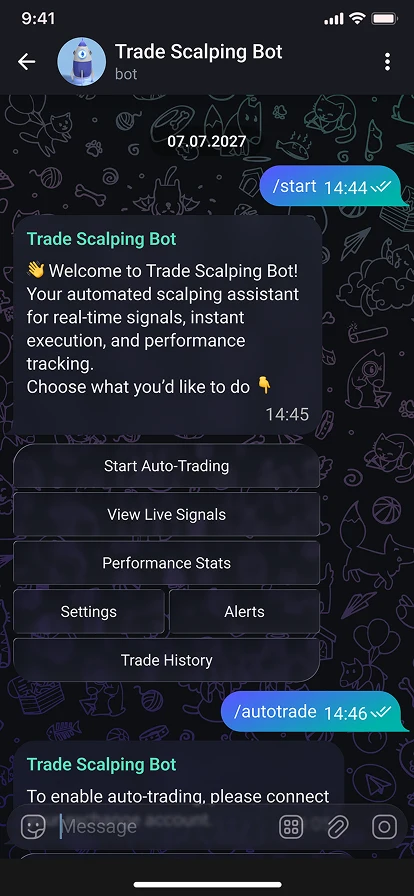

- A Telegram bot with scalping signals and automated execution. Convenient for traders as it provides a signal, automatic order placement, and limit control.

- A platform for HFT strategies with analytics and logging, allowing testing, launching, and monitoring of multiple strategies.

- A white-label panel for a prop firm or SaaS service with the ability to create roles, fees, tariffs, and a convenient admin panel supporting multi-user mode.

- An AI module for adapting strategy parameters to the market: price fluctuations, timing, liquidity.

Cost of Developing Crypto Scalping Bots

The cost of developing a crypto scalping bot depends on exchanges (CEX/DEX), latency requirements, order execution architecture, risk management, and the need for a management dashboard. Below are approximate packages to help estimate the initial budget.

| Solution Type | Description | Estimated Cost | Terms |

|---|---|---|---|

| Scalping Bot MVP (CEX) | Single Market (Spot or Futures), Basic Signals, API/WebSocket Execution, Basic Risk Limits | $5,000 – $8,000 | 4–5 Weeks |

| Performance Scalping Bot | Latency Optimization, Advanced Execution Engine, Advanced Risk Manager | $8,000 – $14,000 | 6–8 Weeks |

| Multi-Exchange Scalping Bot | 2–3 Exchanges, Single Logic, Strategy Profiles, Monitoring | $14,000 – $25,000 | 2–3 Months |

| HFT Light / Pro Execution Stack | Focus on Latency Minimization, Stability, Logging, Execution Control | $25,000 – $45,000+ | 3–4 Months |

| White-label Scalping Module (SaaS/проп-фирмы) | Multi-User Mode, Subscriptions/Commissions, Admin Panel, Roles | $45,000 – $80,000+ | 4–6+ Months |

The stated prices and timelines are indicative. The final estimate depends on the selected exchanges and markets, level of automation, latency requirements, integrations, and interface format (dashboard/admin panel/Telegram).

What the Cost Depends On

Each scalping project has a unique configuration that affects implementation complexity and required resources. Below are the main parameters considered when calculating development cost:

- Exchanges and markets: spot / futures / perpetual.

- Speed requirements: 100–300 ms versus standard latency.

- Data type: WebSocket, order book, trades, funding, etc.

- Execution logic: limit/market, partial fills, algo orders.

- Risk management: daily limits, kill switch, loss streak control.

- Number of strategies and modes.

- Availability of interfaces (trader dashboard / admin panel).

- Infrastructure: VPS, containerization, monitoring, fault tolerance.

- API key security requirements and log auditing.

Why CryptonisLabs is chosen

When developing a bot, it is important to consider key technical aspects: fees, latency, stability, execution logic, error protection, and architecture. CryptonisLabs is chosen for:

- experience in developing high-frequency trading algorithms;

- latency optimization to 100–200 ms;

- support for CEX, DEX, and hybrid trading models;

- ready-made modules: signal engine, order executor, risk manager;

- ability to integrate with AI and Telegram interfaces;

- development of white-label solutions for brokers and terminals.

Want to automate scalping strategies and speed up trade execution? We will create a reliable scalping bot optimized for your strategy, API, and liquidity.

FAQ

-

How is a scalping bot different from Grid or Arbitrage?

A scalping bot profits from short price movements within a single market. It can execute many trades quickly with a small profit capture per trade. Grid focuses on trading within a defined price range, while Arbitrage targets price differences between different instruments or platforms.

-

Which exchanges and markets are supported (spot / futures / perpetual)?

We create integrations with leading CEX exchanges such as Binance, OKX, WhiteBIT, KuCoin, and Bybit. We support spot, futures, and perpetual markets.

-

Is it realistic to implement HFT light and achieve 100–200 ms latency?

Yes, in an HFT light format this is вполне achievable, provided there is proper architecture, WebSocket feeds, an optimized execution engine, and appropriate infrastructure (VPS, network, stable connections).

-

How is risk management implemented in scalping (limits, stops, kill switch)?

We implement it through a combination of dynamic stop-losses, take-profits, and loss limits.

- With stop-loss and take-profit, the bot automatically closes positions when predefined levels are reached. This reduces losses and locks in profits.

- Daily/session loss limits ensure the system disables trading if total losses exceed the set threshold.

- Kill switch (emergency shutdown) – in unstable market conditions or unexpected failures.

-

Can the bot trade multiple assets simultaneously?

Yes, provided that strategy, risk, and limits are configured separately for each asset.

-

Can a trader dashboard and admin panel be connected?

Yes. Our specialists develop a Trader Dashboard to keep track of trades, charts, and PnL. We also build an Admin Panel to monitor user actions, logs, fees, tariffs, and subscriptions. This is especially important for SaaS/white-label solutions.

-

What does the client need to provide to start development (exchange, strategy, constraints, API access)?

To start working, we need:

- selected exchange and market (spot/futures/perpetual);

- basic strategy logic or examples of entries/exits;

- risk constraints (stops, daily limit, maximum number of trades);

- latency and scalability requirements;

- API access (or test key/environment);

- interface preferences (Telegram, dashboard, admin panel).