Trading terminals and personal trading cabinet

Services

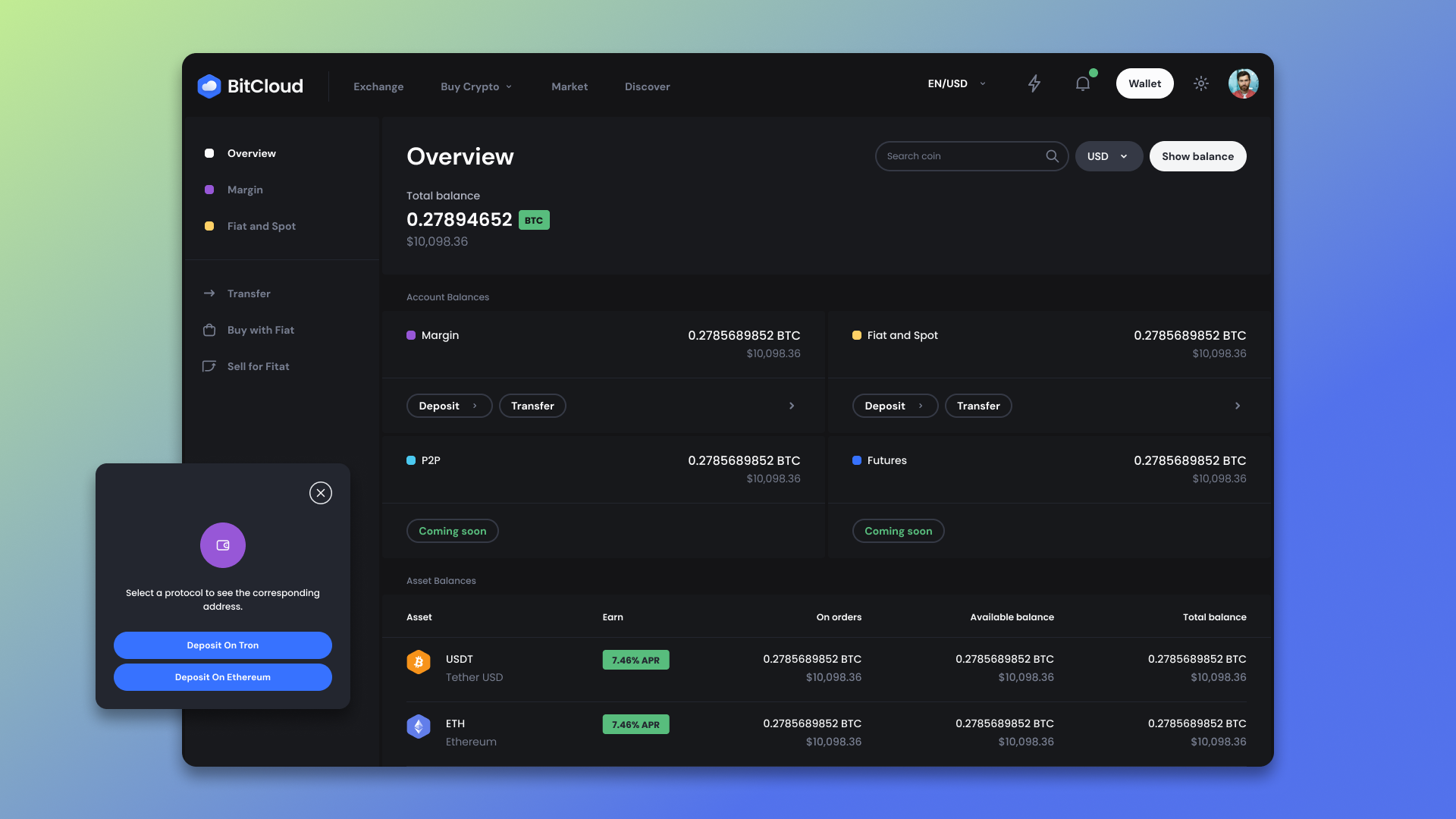

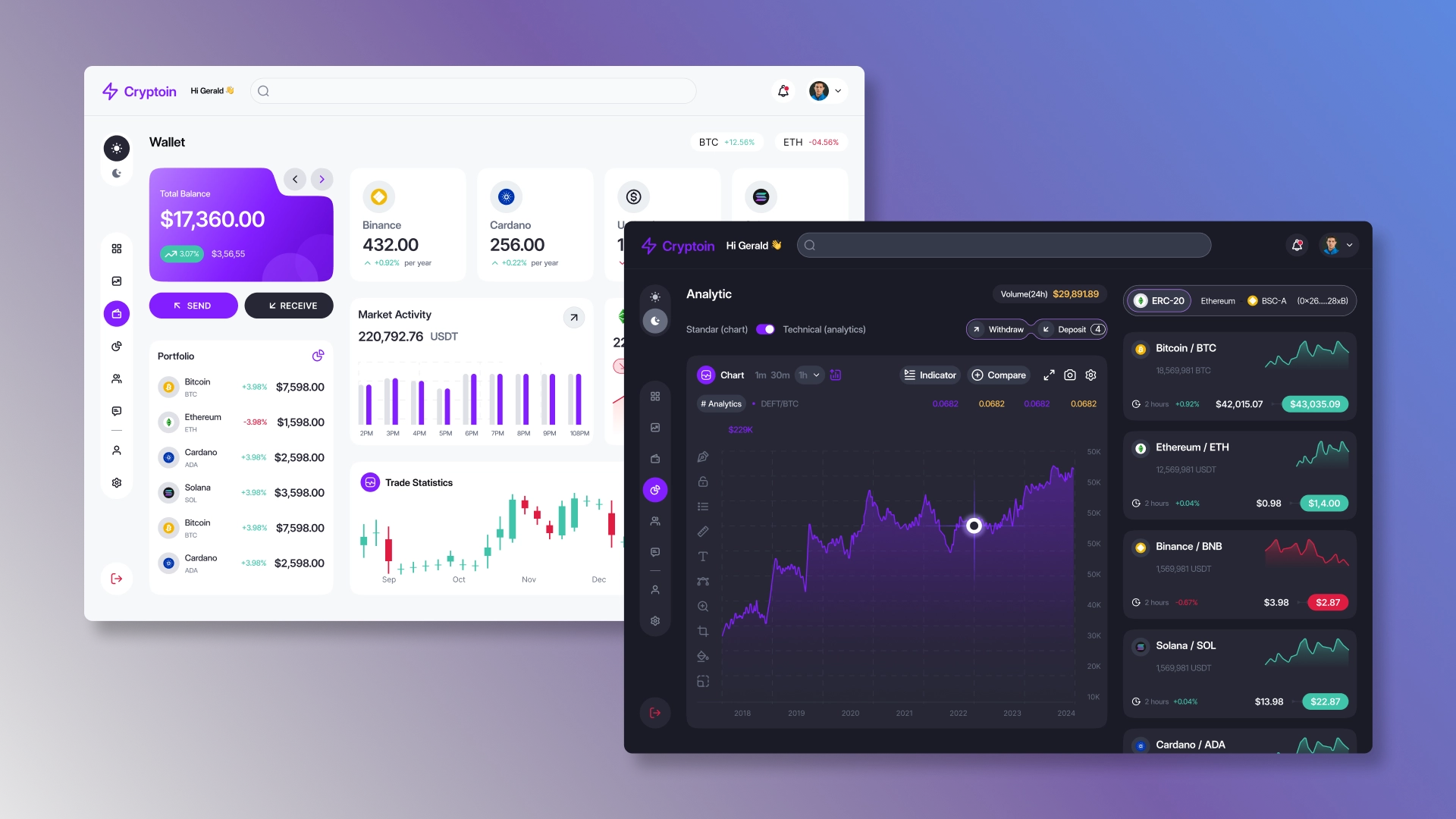

Development of trading terminals and trader and investor accounts

Developing trading terminals and trader and investor dashboards is a complex process requiring a deep understanding of financial processes, industry UX patterns, and strict security requirements. CryptonisLabs creates professional web terminals and dashboards for traders, investors, and wealth managers, featuring crypto exchange API integration, charts, analytics, and secure logins. Our interfaces are tailored to the needs of both private and professional traders: from quick trades and portfolio management to managing large assets and working with advanced metrics.

We provide a robust architecture, scalability, and seamless integration with the APIs of popular cryptocurrency and brokerage platforms to ensure your product operates reliably under heavy load and meets the expectations of even the most demanding users. Entrust your terminal development to a team that understands the specifics of financial products, high security requirements, and the importance of stable integration with exchange APIs. We will offer a solution that will strengthen your business and increase value for your users. Want to know the price and timeline? Contact us.

What we create

CryptonisLabs develops multi-exchange trading interfaces and trader dashboards that allow users to analyze the market, manage trades, connect to exchanges, and automate trading. We create comprehensive solutions for traders, investors, analysts, and capital managers—products that integrate data from multiple platforms, ensure rapid response to market changes, and create a convenient workflow within a unified ecosystem.

Our developments cover the entire user experience with financial instruments: from authorization and connecting exchange accounts to advanced analytics, trade execution, and strategy automation. We design interfaces where every detail matters—from fast chart response to a well-thought-out order structure, position display, and risk management. Our primary goal is to create tools that genuinely support decision-making and speed up the user experience, not complicate it.

The CryptonisLabs team utilizes modern data visualization technologies, robust exchange integration protocols, and an architecture capable of withstanding high loads during periods of increased volatility. This makes our products suitable for both novice traders and professionals working with large volumes and complex strategies.

Typical solutions we create:

- Web terminals for spot, futures, and margin trading —with charts, order books, order books, trade histories, and advanced execution settings.

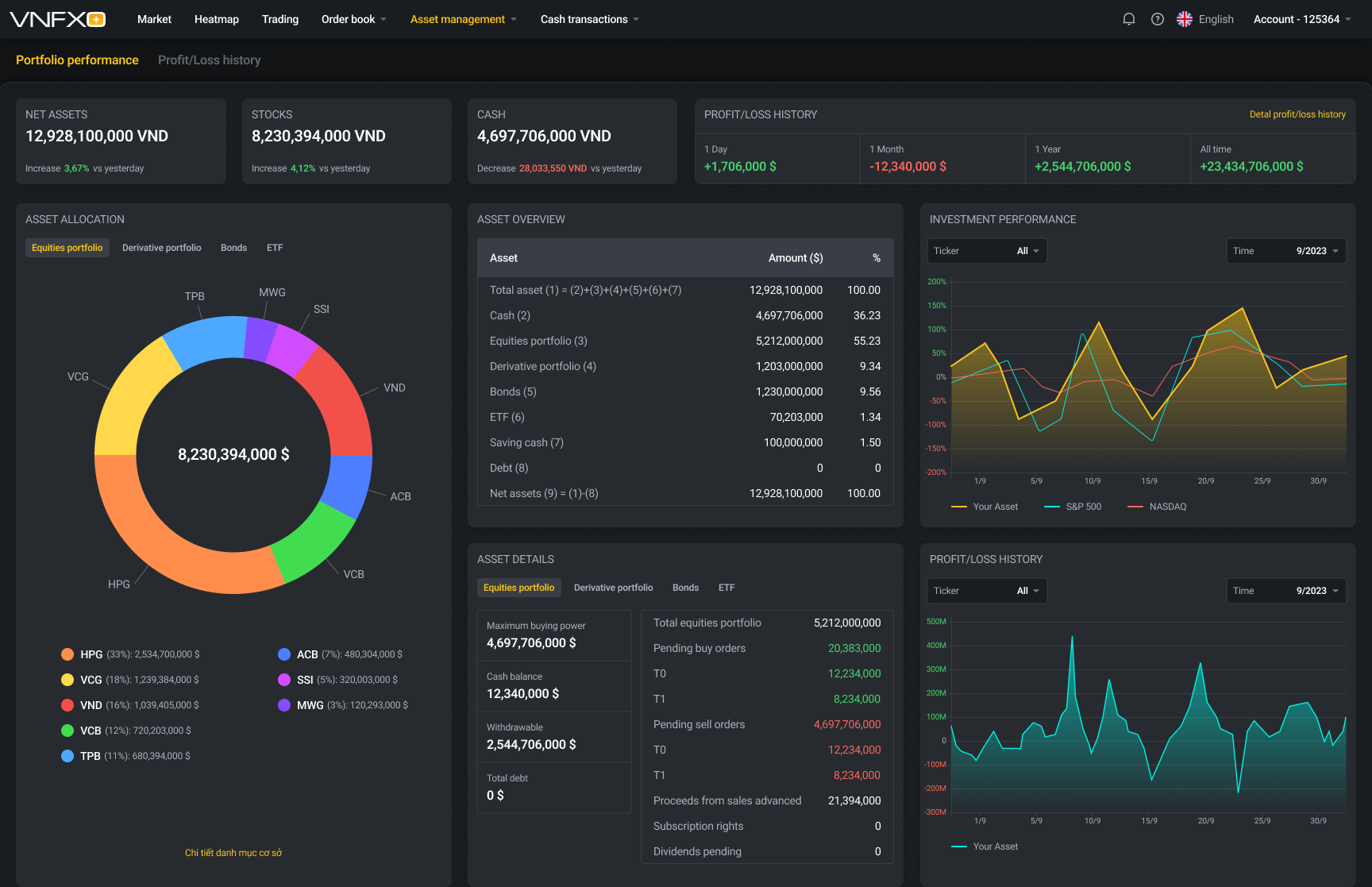

- Personal accounts for traders and investors – with asset management, portfolios, balances, and profitability analytics.

- Analytics and trade monitoring dashboards for tracking strategies, metrics, PnL, risks, and trading performance.

- Copy-trading interfaces – for connecting to leading strategies, repeating trades, and analyzing their results.

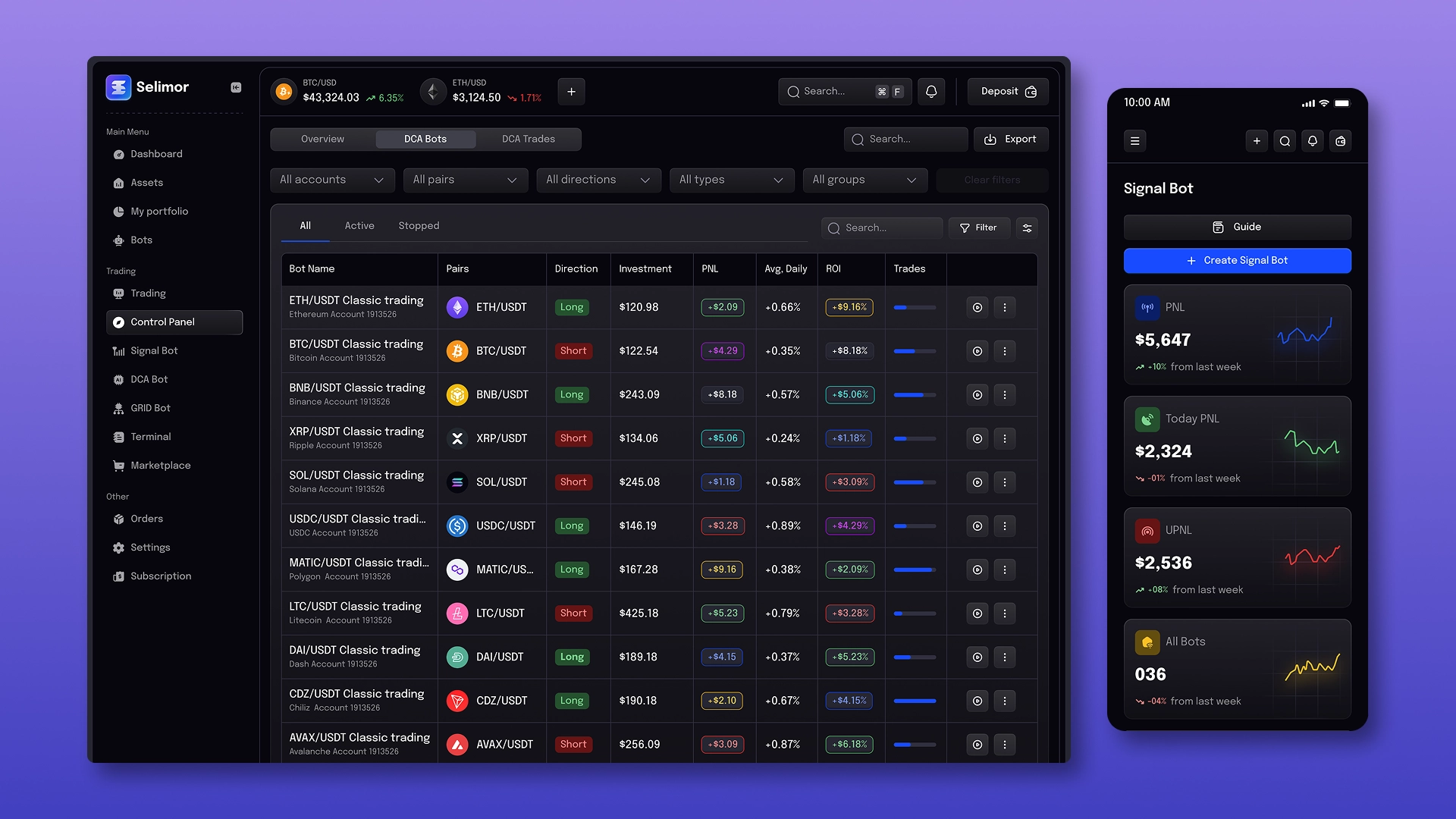

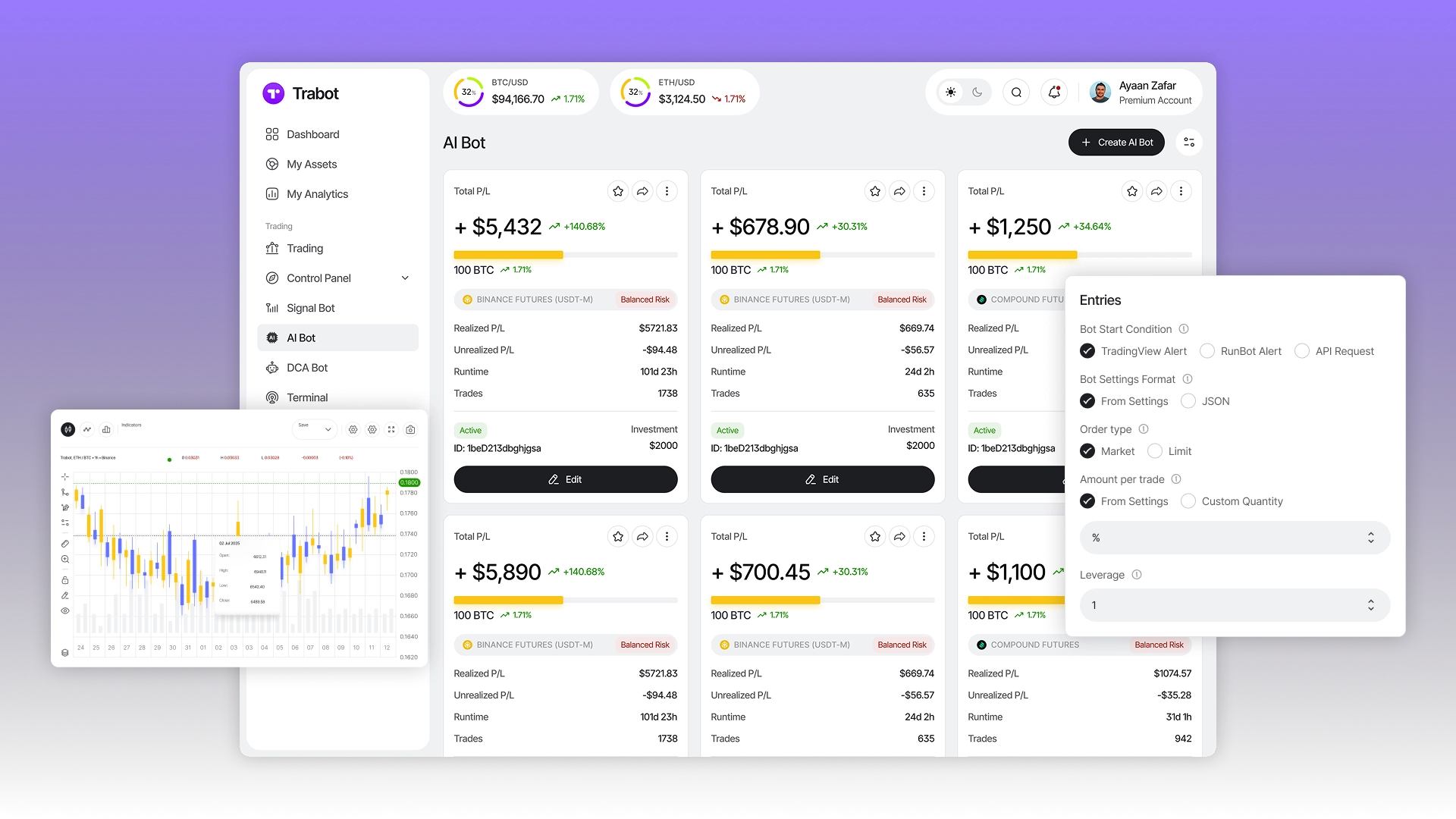

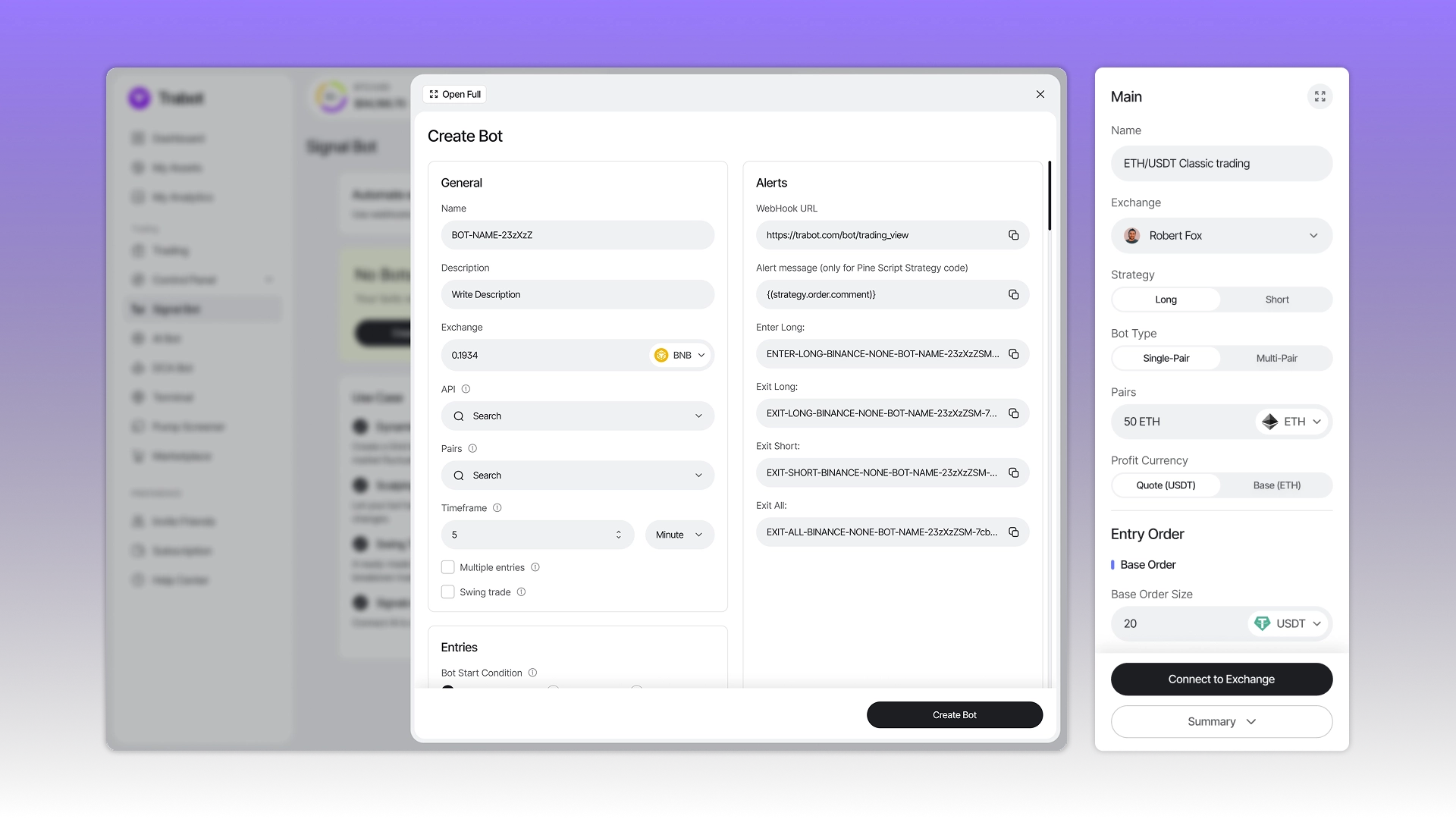

- Platforms for managing trading bots – with algorithm configuration, strategy logic, and execution control.

CryptonisLabs creates solutions that enhance products, increase user engagement, and help companies build sustainable next-generation financial services.

Main modules and functions

CryptonisLabs creates trading terminals and trader's dashboards that can serve as either an integrated part of your platform or a standalone SaaS product. Our solutions integrate all the key tools for professional trading: order management, portfolio monitoring, analytics, strategy automation, and secure data access. Each module is designed for scalability and flexible customization to meet specific business needs, ensuring stable operation and user convenience. Below is a detailed description of the key modules and functions that form the basis of our systems.

1. Trading interface (Web Terminal)

The trading terminal is a trader's primary tool, so its functionality must be as precise, predictable, and user-friendly as possible. The CryptonisLabs team creates interfaces that ensure speed of interaction, visual clarity, and the ability to process large amounts of market data in real time.

TradingView Chart Integration

Using TradingView allows you to integrate advanced charts, dozens of indicators, a choice of timeframes, drawing tools, and customization options into the terminal. This integration makes working with charts familiar to most traders and significantly speeds up user adoption of the platform.

Order Book, orders and transaction history

We're implementing high-performance components that display current orders in the order book, the trade flow (trade history), and order execution information. Everything is updated via WebSocket without delays or interruptions, which is critical when working in high volatility environments.

Spot/Futures/Margin Support

The terminal supports different types of markets:

- Spot - for basic asset purchase and sale transactions.

- Futures - for trading derivatives with leverage.

- Margin - with the ability to borrow assets and maintain credit positions.

Each mode has its own requirements for order logic, margin calculation, liquidation and risk display, and we carefully implement these features.

Sending and managing orders

All operations - opening a position, setting stops, modifying orders, and closing a trade—occur in real time. Using WebSockets ensures instant data transfer and synchronization of the interface with the actual state of the trading account.

Managing positions and stop orders

Users can easily manage their positions, view margins, set stop-losses, take-profits, trigger orders, and other parameters. The interface includes risk warnings, liquidation indicators, commission calculations, and automatic recalculation logic.

2. Trader and investor personal account

The personal account combines trading activity, statistics, account settings, and management of exchange API keys.

Balances, assets, order history

Users can see current balances, fund distribution, deposit/withdrawal history, and a full trading activity feed. Data is synchronized with exchanges and updated in real time.

Monitoring open positions

The trader's account displays all active trades, margin indicators, strategy results, closed position history, and additional analytical parameters.

User roles

The built-in role model allows you to separate access rights:

- Trader — Order management, portfolio monitoring, access to charts and indicators, launching trading bots, and trade history.

- Investor — Subscribe to trader strategies, view portfolios and returns, manage investments, view trader ratings, receive notifications, and receive reports.

- Admin — Managing users and roles, controlling connections to exchanges, monitoring the system, configuring the platform, general analytics, and reporting.

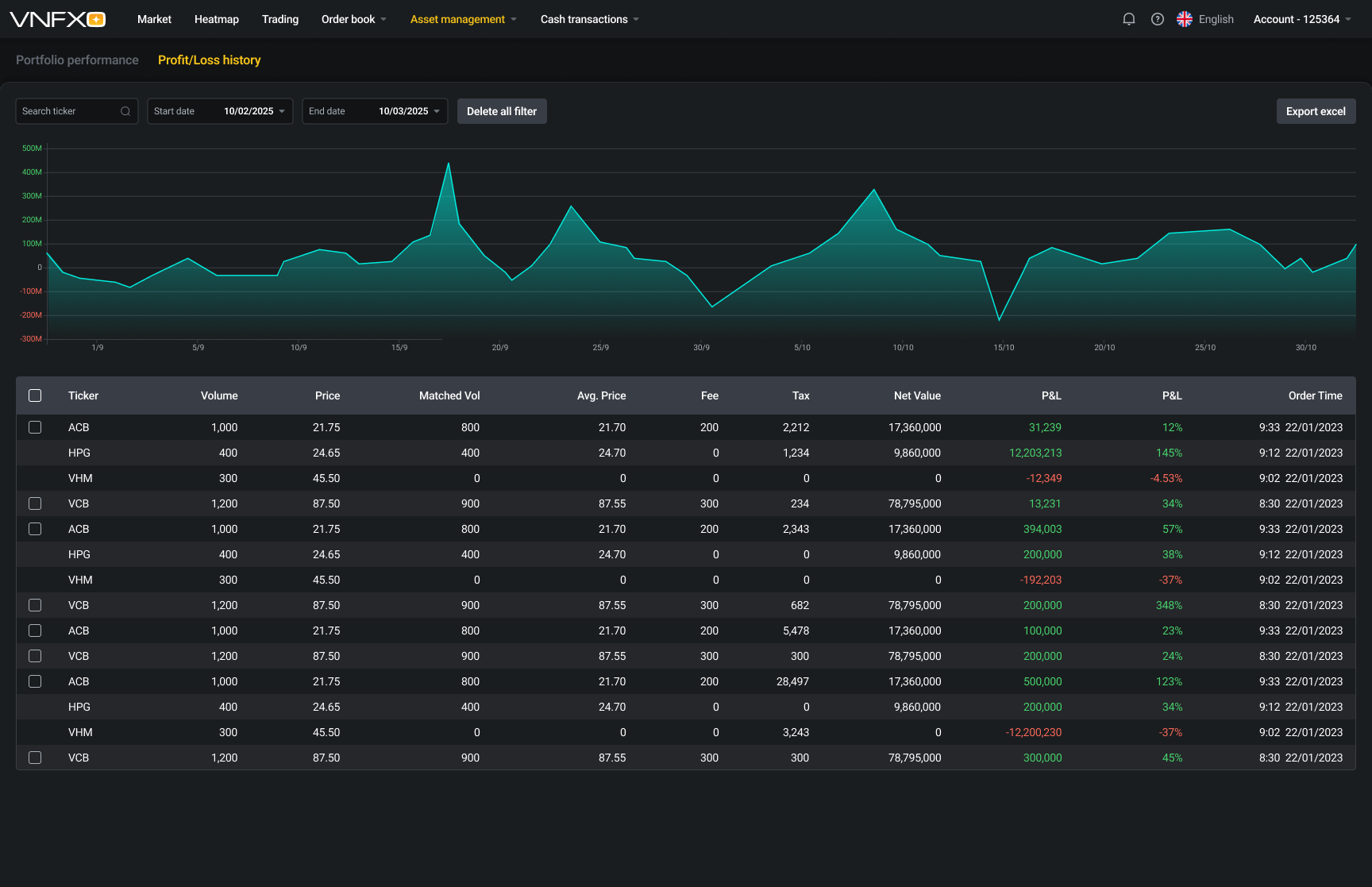

Reporting and data export

CSV and PDF reports allow you to download trade history, orders, bot activity, profit and loss, portfolio transactions, and other parameters.

Telegram and email notifications

Notifications about transactions, asset liquidity, balance changes, strategy results, and API errors are sent via messengers or email.

3. Analytics and monitoring dashboards

Analytical dashboards are tools for evaluating trading performance and market behavior. They allow users to monitor current positions, portfolio dynamics, trade history, and key performance indicators. Below is a list of the elements we incorporate when designing analytics and monitoring:

PnL, Profitability, and Volume Charts

The user can track profits over time, analyze drawdowns, compare periodic results, and evaluate the impact of strategies.

Portfolio and Asset Allocation Display

Charts and tables allow you to evaluate diversification, risk distribution, and changes in asset value over time.

Bot and Strategy Summary

For users working with automated strategies, detailed metrics are displayed: trades, profits, risks, entry and exit points, and capital allocation.

Trader and Investor Ratings

For copy trading, a rating is formed based on profitability, stability of results, maximum drawdown, frequency of transactions, and other parameters.

Live updates via WebSocket

All charts and tables are updated in real time based on actual trader activity and market behavior.

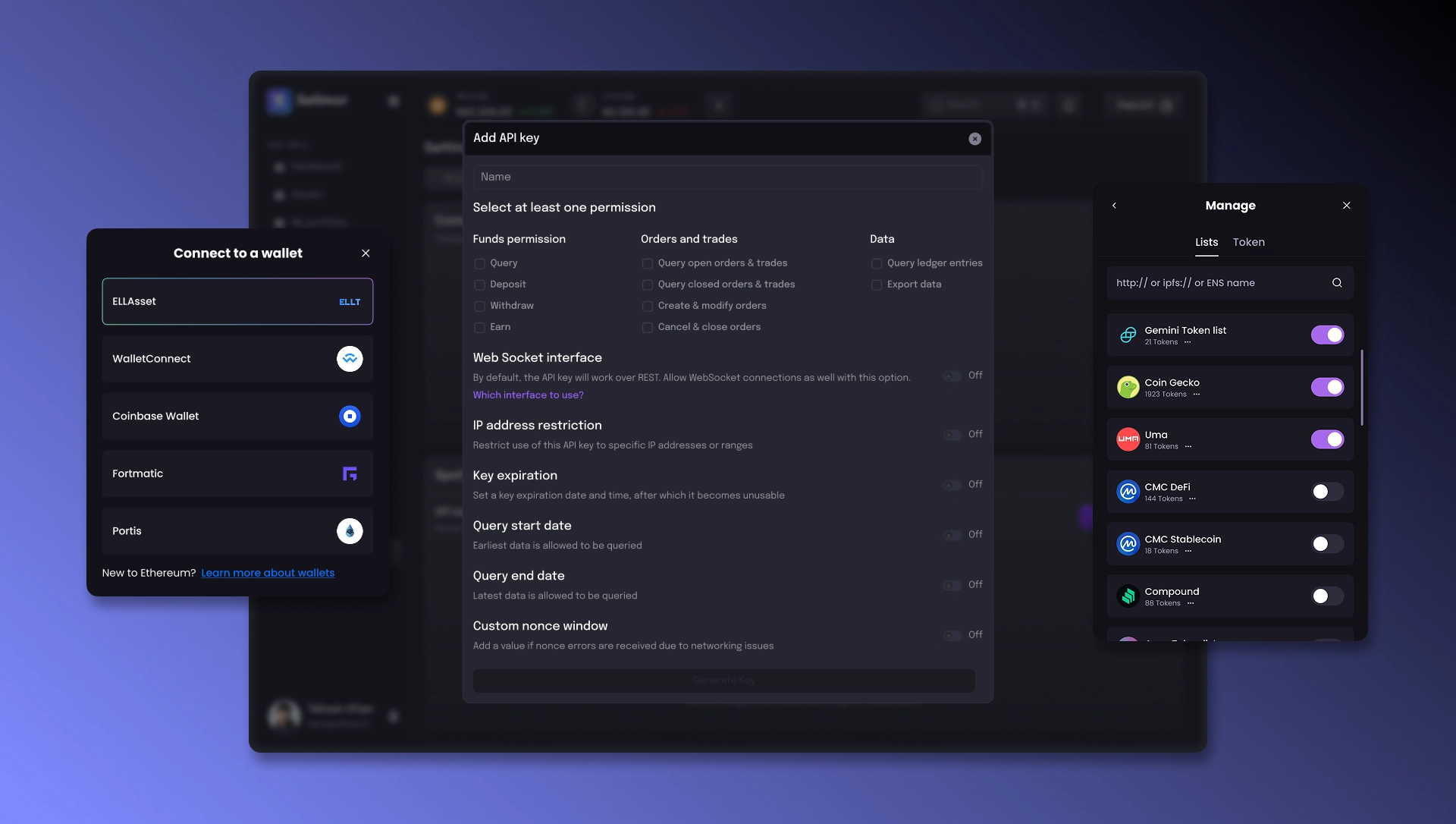

4. Integrations and APIs

Our trading terminals and trader dashboards operate via connections to crypto exchange APIs and external data sources, providing full platform functionality and access to up-to-date information.

Exchange integrations

We support Binance (spot, futures, margin), OKX, KuCoin, Bybit, WhiteBIT, and other services. We implement a unified protocol for interaction, which facilitates the connection of new providers.

Data providers

CoinGecko and Messari are used to obtain quotes, historical data, market metrics, and fundamental analytics.

Payment systems

Cryptomus and NOWPayments allow you to automate deposits, withdrawals, subscription payments, and internal service fees.

5. Security and authorization

Security is a key priority when working with exchange APIs and user data.

- JWT + Refresh Tokens. Authorization is based on secure tokens with an automatic refresh system.

- Two-factor authentication (2FA). Support for Google Authenticator and backup login codes.

- Secure storage of API keys. Keys are encrypted using the AES-256 standard and stored in secure containers.

- Leak-free WebSocket updates. Each stream has unique access keys, preventing data interception.

- Security monitoring. IP connections, failed authorization attempts, API key changes, and suspicious activity are monitored.

6. Modules and extensions

We create platforms that can be developed over the years, adding new features and integrations without the need to rewrite the architecture.

- Copy-Trading. Tools for managing strategies, subscriptions, capital allocation, and automated trades.

- Trading Bots. Support for various bot types: grid, arbitrage, market-making, trend-following

- Backtesting. Simulate strategies on historical data with visual reporting and metrics.

- Multi-User Access. Solutions for teams of traders, funds, and asset managers.

- Billing. Support for paid plans, subscriptions, white-label licenses, and feature limitations.

Solution architecture

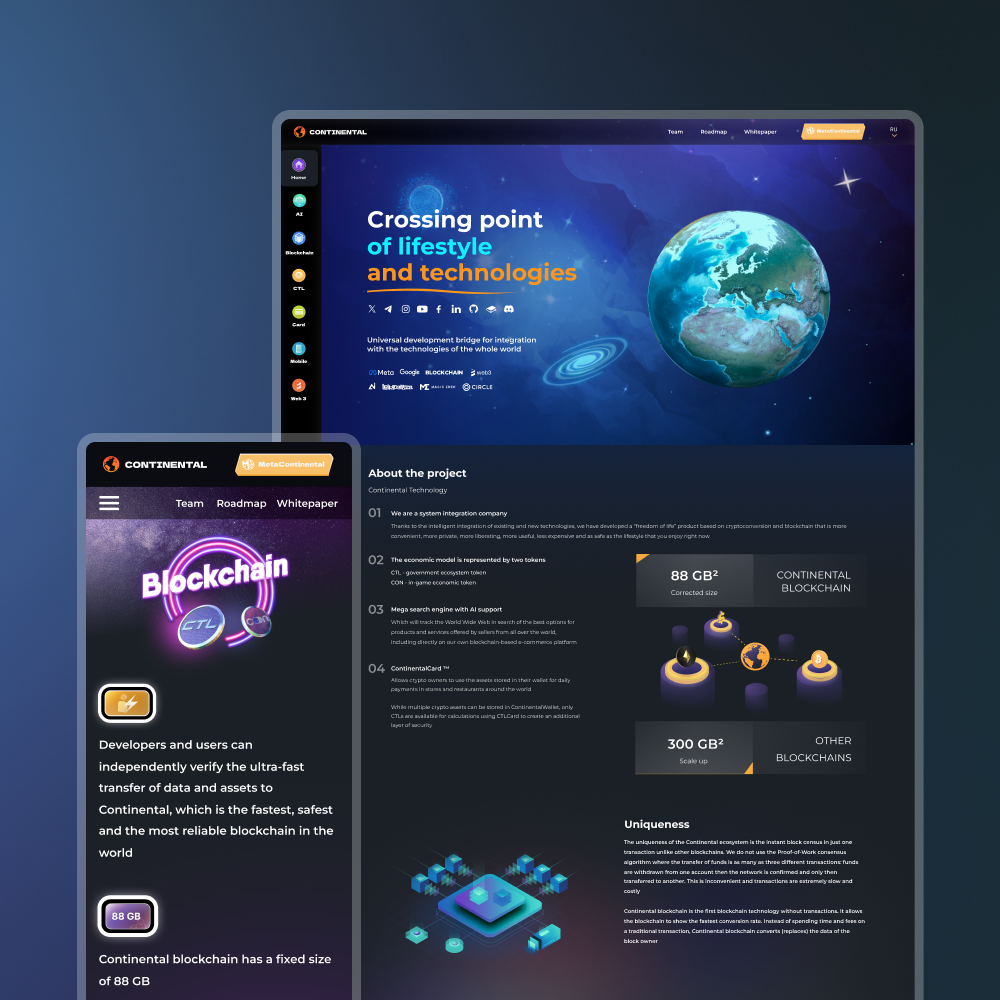

CryptonisLabs develops trading terminal architecture that can handle intense data flows, ensure low latency, and allow for the flexible addition of new features. The solution is based on proven technologies optimized for high-frequency trading and real-time operations.

Our products are built on a sophisticated architecture that combines a powerful backend, a fast frontend, and a reliable real-time layer. This approach allows us to create trading terminals and dashboards that operate smoothly, instantly respond to market events, and provide maximum user convenience.

The terminal interface is built using modern Next.js and React technologies, ensuring high performance, a smooth interface, and SEO optimization. We use TradingView to display charts, indicators, and technical analysis tools, integrating it into the system at the level of a professional terminal.

The server-side component can be implemented in Node.js using the Nest.js or Laravel frameworks, depending on the project's requirements. This architecture guarantees reliability, modularity, and high throughput when processing requests and transactions. We create direct integrations with major cryptocurrency exchanges— Binance, OKX, WhiteBIT, and KuCoin. We support trading operations, quotes, asset management, balances, orders, and trade history through a single, unified layer.

A combination of PostgreSQL and Redis is used to store data.

- PostgreSQL is the primary relational database for user entities, orders, instruments, and financial transactions.

- Redis - for caching, storing temporary data, and accelerating critical queries.

To ensure instant data updates and stable operation under high load, we use:

- WebSocket — for streaming quotes, order books, transaction data, and terminal operation in real time.

- Kafka – for asynchronous event processing, scaling, and building a fault-tolerant microservice architecture.

The Python + FastAPI stack is used to automate trading strategies, develop trading bots, and analyze data in depth. This allows for the following:

- signaling systems

- Machine learning in trading

- indicators and custom strategies

- Managing bots via the terminal interface or API

The admin panel is built using React and interacts with services via a REST API. It provides convenient tools for managing users, logs, settings, access rights, trading links, and platform statistics.

Example scenarios

We develop trading terminals and dashboards tailored to the specific needs and business logic of our clients. Below are examples of scenarios in which CryptonisLabs solutions help companies and traders effectively automate trading processes and improve user experience.

Corporate terminal for employees of an investment company

The internal terminal allows analysts, risk managers, and traders to work in a single interface, monitor portfolios, manage trading limits, and make decisions quickly. The system supports centralized roles, integration with internal company services, and advanced monitoring features.

Trader's office with connection to several exchanges

The multi-exchange dashboard combines data from Binance, OKX, KuCoin, WhiteBIT, and other platforms, providing users with a single asset management center. Traders gain access to a responsive terminal, reports, orders, portfolios, and analytics without having to switch between exchanges.

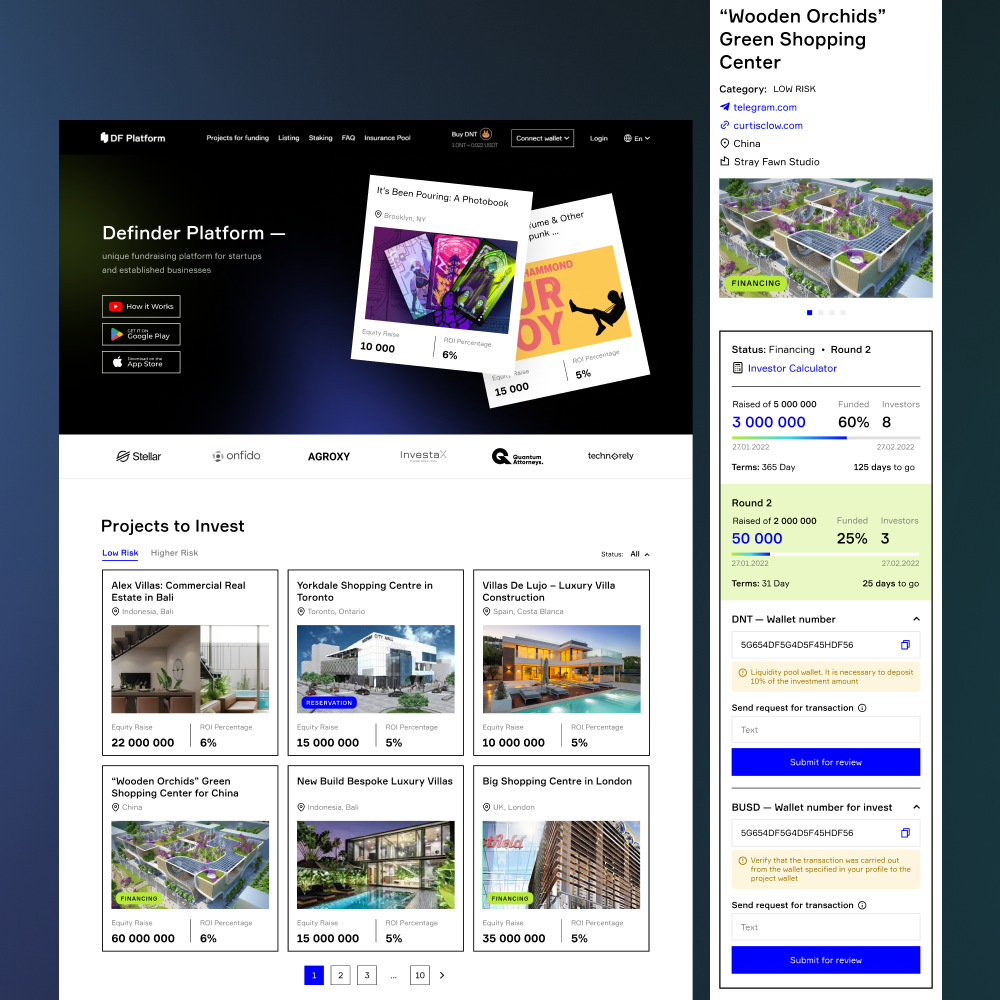

Copy-trading platform with a role-based and ratings system

The platform allows experienced traders to publish their strategies, and subscribers to automatically copy their trades. A role system defines access levels, while ratings and metrics help users choose reliable strategy providers. The solution is suitable for brokers, crypto platforms, and fintech startups.

White-label SaaS for providing clients with access to API trading

This ready-made SaaS solution allows companies to launch their own trading service under their own brand. Clients receive accounts, tokens, and flexible API access settings, including key management, limits, logs, and activity statistics. Suitable for businesses providing trading tools to B2B or B2C segments.

Web terminal with analytics panel and bot manager

The solution combines a web terminal, an advanced analytics dashboard, and tools for managing trading bots. Users can launch, configure, and monitor bots, track key metrics, and study the market through convenient charts and reports. It is suitable for platforms focused on active trading and automation.

Why choose CryptonisLabs

Clients trust us to develop trading terminals and dashboards because we create solutions that meet the most stringent requirements of the crypto trading market and fintech sector.

- We develop terminals and dashboards for any crypto exchange API. We flexibly integrate with any exchange or broker's API, ensuring the correct operation of orders, quotes, portfolios, data feeds, and all supporting services.

- Experienced integration with Binance, OKX, KuCoin, and WhiteBIT. The CryptonisLabs team has hands-on experience working with the largest cryptocurrency platforms, allowing us to quickly, securely, and correctly integrate them into your products.

- We utilize modern technologies (React, Nest.js, WebSocket, TradingView). We rely on a cutting-edge technology stack that ensures high performance and ease of use. Real-time data, a responsive interface, and powerful charts are integral parts of our solutions.

- We support white-label models and custom designs. The platform can be fully customized to suit your brand. We adapt the interface, logic, and functionality to specific business processes while maintaining system scalability.

- Bank-level security (2FA, JWT, key encryption). We place special emphasis on data protection. We implement two-factor authentication, secure authorization protocols, and reliable key encryption to ensure your platform complies with fintech standards.

- Ready-made backend modules for orders, P&L, and analytics. With ready-made modules for trading, profit and loss calculations, and analytics, we significantly reduce development time and guarantee high stability of core functions.

If you're looking for a team capable of developing a professional trading terminal, trader's dashboard, or investment platform, CryptonisLabs is ready to help. Contact us to discuss your project, and we'll offer the optimal architecture, timeline, and workflow.

FAQ

-

What is a trading terminal and a trader's account?

The trading terminal is an interface for executing trades, managing positions, and analyzing the market. The Trader's Cabinet combines account management, portfolio management, exchange connectivity, and analytics functions in a single, convenient interface.

-

Which crypto exchanges do your terminals integrate with?

We support integration with major exchanges: Binance, OKX, KuCoin, Bybit, WhiteBIT , and others. Our architecture allows for connecting new exchanges through a single API.

-

What types of trading are supported?

Our solutions cover spot, futures, and margin trading. Each mode is designed with specific margin calculations, order execution, and risk management in mind.

-

Is it possible to use the platform in white-label format?

Yes, we create white-label SaaS solutions that can be fully branded for your company and customized to your business processes.

-

How is data and API keys secured?

We use two-factor authentication (2FA), JWT tokens, AES-256 API key encryption, activity monitoring, and secure data storage.

-

What analytical capabilities does the terminal provide?

The platform includes analytics and monitoring dashboards, PnL charts, asset allocation, trading bot and strategy summaries, trader rankings, and live data updates via WebSocket.

-

Is it possible to automate trading through a terminal?

Yes, our terminals support trading bots and automated strategies, including grid, arbitrage, trend-following, and other algorithms controlled via an interface or API.

-

How is integration with external data sources carried out?

We connect the platform to CoinGecko, Messari , and other services to receive quotes, historical data, and analytical metrics, ensuring up-to-date information in real time.